Introduction: Best Refinance Rates and When to Refinance

No one can look 30 years into the future and have an accurate prediction of how life will change. When you take out a thirty-year mortgage to buy a home, you are trusting that your life and financial livelihood will stay more or less stable.

However, life does throw us some curveballs at times, and making the decision to refinance a home may sometimes very well be the best (or only) option.

Learning how to refinance a mortgage is an important part of everyone’s financial education.

Even if you currently feel that you have the necessary financial stability to continue making payment on your current mortgage terms, you never know when an unexpected emergency or job loss might throw you into financial turmoil. Identifying where to find the best refinance rates and learning when to refinance and under what conditions is an important step for any homeowner.

In this brief article, AdvisoryHQ will provide a refinance definition as well as give information regarding when to refinance your home mortgage.

We will also examine some of the factors to be aware of when learning how to refinance a home. Next, we will explain, step by step, how to refinance a mortgage, as well as how to refinance a home, before going on to review the best refinance rates on the market, which include Bank of America refinance rates, Wells Fargo refinance rates, and Citibank refinance rates.

See Also: How to Find Top Subprime Mortgage Lenders for Bad Credit Borrowers

Refinance Definition

What exactly does it mean to refinance a home? When you go to a bank to ask about how to refinance a home, chances are that the bank will throw around some hard-to-understand terms about home equity, credit ratings, and the best refinance rates.

While all of those things do matter (and we’ll touch on them below), a simple refinance definition offered by Investopedia states “paying off an existing loan and replacing it with a new one.”

Image Source: Best Refinance Rates

In the specific context of mortgages, replacing your old home mortgage with a new mortgage on different (hopefully improved) terms makes for a good refinance definition. But why would anyone simply want to replace one type of debt with another type of debt? What advantages come with making the decision to refinance a home?

Knowing when to refinance and under what conditions is even more important than finding the best refinance rates.

When to Refinance Your Home Mortgage

Adding more years and debt to an already expensive and long-term mortgage needs to be done with a certain degree of caution. When done haphazardly and without understanding the implications, learning how to refinance a home can lead to debt that is close to impossible to escape from.

Below, we will look at four different situations when it may make sense to refinance a home.

Finding a Lower Interest Rate

When thinking about when to refinance, finding a lower interest rate is one of the biggest issues that homeowners take into account. If you were a first-time home buyer, chances are that you didn’t shop around enough to find the best interest rates on your original loan.

When thinking about when to refinance, finding the best refinance rates that are considerably lower than the rates on your current mortgage can be appealing.

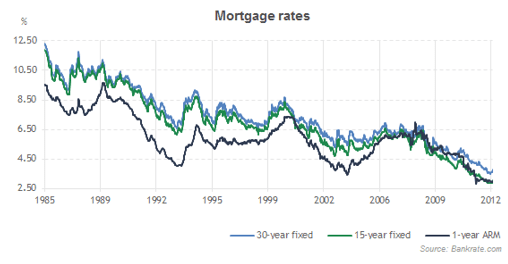

There are a number of charts on the Internet, like the one below offered by Bankrate, that show the history of mortgage rate trends.

In the chart below, you can see that mortgage rates have been following a steady downward trend for much of the past 30 years. If you took out a fixed-rate mortgage around the year 2000, you may be paying close to 8.5% APR.

The best refinance rates on the market today might be able to get you a rate closer to 4%. Even if you only have 10-15 years left on your original mortgage, you could save thousands of dollars in interest by finding the best refinance rates to substantially lower your interest rates.

Source: Bankrate.com

Investopedia warns that when considering when to refinance, “because refinancing can cost between 3% and 6% of the loan’s principal and – like taking out the original mortgage – requires appraisal, title search and application fees, it’s important for a homeowner to determine whether his or her reason for refinancing offers true benefit.”

If, however, you are able to find the best refinance rates that will lower your rate by at least 1–2%, you should easily be able to offset those extra upfront costs.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Switching to a Fixed-Rate Mortgage from a Variable-Rate Mortgage

When learning about how to refinance a mortgage, it is also important to take into account whether your original mortgage was on a fixed rate or variable rate. Variable-rate mortgages offer lower upfront interest rates but will go up with time over the course of the loan. With a thirty-year loan, your original 3.5% interest rate may jump to 7 or 8% depending on market conditions.

If the variable-interest rate on your mortgage has ballooned to several points higher than what you could obtain with the best refinance rates on the market, the time of when to refinance might be now.

Furthermore, if you and your family are thinking about selling your home sometime in the coming years, it might make sense to refinance a home to a variable-rate mortgage. Since variable-rate mortgages will give you a lower rate at the beginning of the loan term, you can benefit from lower interest payments before eventually selling your house and paying off the rest of your loan with the equity from the sale.

The best refinance rates for variable-rate mortgages are extremely low right now because of the low interest rates for mortgages across the market.

Shortening the Loan Term

When thinking about when to refinance, you may also want to consider the loan term. If you originally took out a 30-year mortgage to benefit from lower monthly payments but now have an improved financial situation that would allow you to pay a higher monthly payment, you probably would benefit from the best refinance rates of a 15-year mortgage. The best refinance rates on a shorter term mortgage are generally 1–2% percentage points lower than a comparable 30-year mortgage.

Tapping Your Home’s Equity

Sometimes, life throws an unexpected expense at you: your child may decide to go an expensive private college where tuition is above $30,000 a year or perhaps a medical emergency will have hospital bills piling up on your desk.

Tapping your home’s equity through learning how to refinance a home is one way to benefit from a low interest loan to help you cover these expenses.

The best refinance rates out there are most always lower than the terms, conditions, and rates of personal loans, educational loans or other types of loans the bank you may offer. The best refinance rates of 3-4% allow you to tap your home equity while a typical personal loan for a comparable amount might offer you an interest rate of 7-8%.

However, when considering when to refinance for tapping your home’s equity, it is important to understand that a longer mortgage term will add more debt and thus take you longer to pay off. Tapping your home’s equity through the best refinance rates may be a good idea, but it should usually only be considered as a last resort.

Related: We Buy Houses Reviews | Is This Firm Legit? Details on Companies That Buy Houses

What to Look out for When Learning How to Refinance a Home

When learning the best way for how to refinance a mortgage, it is also important to be aware of certain bank fees and charges that come along with refinancing a home. Even if the bank offers you the best refinance rates, you should also inquire about what percent of the principle the refinance will cost. Furthermore, when thinking about when to refinance, you should also search for the best banks that offer the lowest refinancing fees.

Appraisal fees, title search fees, and application fees can all add up to several thousand dollars. When considering when to refinance, by researching the best banks that offer the lowest refinance fees while still offering the best refinance rates, you can substantially lower the cost and benefit even more from the decision to refinance a home.

As you think about when to refinance, moneycrashers.com advises that “refinancing comes with nearly as many costs as the initial mortgage. You’ll need to pay closing costs, title insurance, and attorney’s fees, and you may also have to pay for an appraisal, taxes, and transfer fees.

It definitely isn’t free. Though many banks advertise ‘no-cost’ mortgages, there is really no such thing. However, you can get a no out-of-pocket cost mortgage where closing costs are either added to the loan balance (which means you’ll pay interest on the closing costs) or you’ll simply pay a higher rate to cover them.”

Popular Article: Citibank Mortgage Reviews – What You Want to Know! (CitiMortgage, Complaints & Review)

How to Refinance a Mortgage or Refinance a Home

If you feel that now is the best time to refinance your home, it is important to understand the step-by-step process so that you can potentially save money along the way. Below, we offer information on the process of how to refinance a mortgage.

1. Check your credit score to have an idea of the best refinance rates that you will qualify for. The higher your credit score, the better chance you’ll have of applying for the best refinance rates.

2. Get your paperwork in order. You will have to have your past tax forms, proof of monthly income, past mortgage statements, and other documents showing additional assets or investments you have.

3. When you’ve found a bank offering the best refinance rates and favorable terms, complete the refinance application with that bank.

4. Get an appraisal. This can cost up to $500, but it’s always best to shop around. Make sure you fix up any minor problems with your home in order to get a higher appraisal value that will help you when you choose to refinance a home.

5. Go to the underwriting review to approve your application. You may need to have extra documentation for that review.

6. Lock in your best refinance rates (so that they don’t change suddenly), sign the documents, and close on you refinance.

Obviously, the most important step when thinking about when to refinance is to find the right bank offering the best refinance rates. Almost every bank or credit union offers some sort of mortgage refinance option. Below, we offer a quick review of three of the best banks offering the best refinance rates on the market today.

Bank of America Refinance Rates

Bank of America refinance rates are some of the best refinance rates on the market today. This big name bank with a national presence offers free estimates on the best refinance rates available to you based on your zip code of residence. It also offers a toll-free number where you can schedule a free consultation with a mortgage specialist to discuss when to refinance and the best refinance rates out there.

You can find a complete guide on Bank of America refinance rates here.

Wells Fargo Refinance Rates

Wells Fargo Refinance rates are also some of the best available to homeowners looking for a reduced rate. When it comes to Wells Fargo refinance options, you can choose between a fixed rate or variable rates. Its 30-year fixed rate refinancing option is currently offered at a low 3.75% interest rate for qualifying clients while its 15-year fixed rate is just above 3%.

More information on these best refinance rates offered by Wells Fargo can be found here.

Citibank Refinance Rates

Citibank refinance rates are also highly competitive. You may be able to find a 30-year fixed rate mortgage at only 3.625%.

If you have been paying anywhere upwards of 5% on your mortgage and have been thinking about when to refinance, these Citibank refinance rates should entice you to pull the trigger on your refinance option.

You can begin your application for the best Citibank refinance rates here.

Free Wealth & Finance Software - Get Yours Now ►

How the Best Refinance Rates Can Help You Gain Control of Your Mortgage Debt

When thinking about when to refinance your home, there are a number of pros and cons to take into consideration.

If you are financially responsible and think that you can benefit from the best refinance rates or a shorter mortgage term, learning how to refinance a home can save you thousands of dollars over the years you pay off your home.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.