2017 RANKING & REVIEWS

TOP RANKING BEST SHORT DURATION BOND FUNDS

Learn About the Best Short-Term Bond Funds for 2017 Investment Plans

Whether you are an investment newbie or an old pro, learning more about the options available to you is helpful in making your decisions. When it comes to investing in short-term bond funds, we are here to help with this guide.

To help you with short-term bond funds specifically, we have created your 2017 rankings for the top 6 short duration bond funds.

Award Emblem: Top 6 Best Short-Term Bond Funds

You will find the following information on best short-term bonds as you read below:

- A definition of a bond

- A definite of a short-term bond fund (versus longer-term bonds and ETFs)

- A list of the best short-term bond funds for you to consider in 2017

Some of these short-term bond funds have low minimum investments; others have high minimums. Some of these short-term bonds have high risk; others have low risk.

No matter what – you will be able to learn about some of the best short-term bond fund options in 2017.

Of course, you should always consult your financial advisor before any investment choices – including short duration bond funds. This way, you can move forward with confidence about your decision.

See Also: Top Credit Card Deals and Best Credit Card Offers | Ranking & Reviews

AdvisoryHQ’s List of the Top 6 Best Short-Term Bond Funds

List is sorted alphabetically (click any of the short-term bond fund names below to go directly to the detailed review section for that short-term bond fund):

- DFA Short-Term Extended Quality I

- Fidelity® Short-Term Bond

- Frost Total Return Bond Inst

- USAA Short-Term Bond

- Vanguard Short-Term Investment-Grade Inv

- Weitz Short Duration Income Instl

Top 6 Best Short Duration Bond Funds | Brief Comparison & Ranking

Short Duration Bond Funds | TTM (Trailing Twelve Months) | Expense Ratio |

| DFA Short-Term Extended Quality

| 1.78% | 0.22% |

| Fidelity® Short-Term Bond

| 0.98% | 0.45% |

| Frost Total Return Bond Inst

| 3.90% | 0.52% |

| USAA Short-Term Bond

| 1.86% | 0.61% |

| Vanguard Short-Term Investment-Grade Inv

| 1.94% | 0.20% |

| Weitz Short Duration Income Instl

| 2.13% | 0.62% |

Short Duration Bond Funds | Minimum Investment Amount | Total Assets |

| DFA Short-Term Extended Quality

| NA | $4.9 billion |

| Fidelity® Short-Term Bond

| $2,500 | $6.3 billion |

| Frost Total Return Bond Inst

| $1.0 million | $1.9 billion |

| USAA Short-Term Bond

| $3,000 | $3.2 billion |

| Vanguard Short-Term Investment-Grade Inv

| $3,000 | $57.8 billion |

| Weitz Short Duration Income Instl

| $1.0 million | $1.2 billion |

Table: Top 6 Best Short-Term Bond Funds | Above list is sorted alphabetically

What Is a Bond?

A bond is a unique type of debt that does not include equity in the company. It has an investor and a borrower. In many ways, the investor acts like a bank for the borrower to turn to.

The bond is a certain amount of money an investor gives to the borrower. The borrower pays back that bond completely with interest payments at agreed upon variables. Interest can be fixed or variable.

Image source: Pixabay

Bonds are typically considered safer investments. This is because they are fixed-income. You know what money you will get back due to the previously agreed-upon interest rate.

When a company or government entity needs money, they can open up a bond option at a certain price. Multiple investors can buy up these bonds.

What Are Short-Term Bonds (Mutual Funds)?

Short-term bonds mature quickly, often between one and four years. This means you will get your initial investment (the principal) and your interest in a short amount of time. This typically means the best short-term bonds are less of a risk with credit and interest rates.

As CNN Money explains, “A longer-term bond carries greater risk that higher inflation could reduce the value of payments, as well as greater risk that higher overall interest rates could cause the bond’s price to fall.”

In return for having a lower risk, short duration bond funds tend to offer a much lower yield than other longer-term bonds.

Note that we will be discussing only short-term bond funds, not short-term bonds in ETF form. Differences include:

- Method of payment: The best-short term bond funds are often purchased from the company itself.

- Costs: The best short-term bond funds often have a slightly higher expense ratio.

- Performance: The best short-term bond funds will many times out-perform ETFs.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Don’t Miss: Cloud Computing Examples – Get What You Need! (PaaS, SaaS, & IaaS Example)

Detailed Review – Top Ranking Best Short-Term Bond Funds

Below, please find a detailed review of each best-short term bond fund on our list of short-term bond funds. We have highlighted some of the factors that allowed these best short-term bonds to score so highly in our selection ranking.

DFA Short-Term Extended Quality I Review

The first short-term bond fund we will look at from our list of short-term bond funds is the DFA Short-Term Extended Quality I. In January 2017, the net asset value of each share was $10.78.

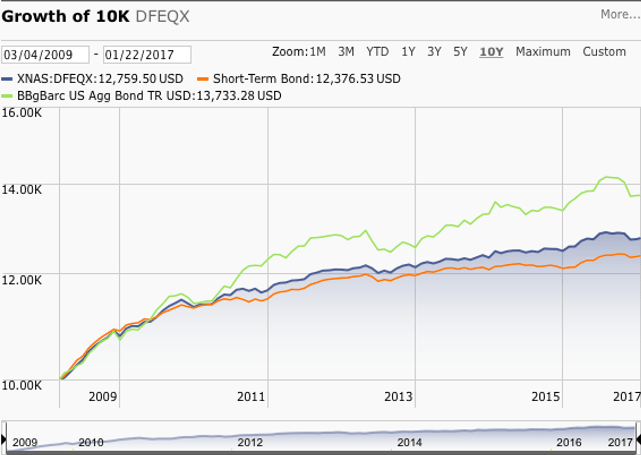

Image Source: Morningstar

The chart above shows that these short-term bonds have had a high yield over the past year, while managing to keep one of the lowest expense ratios on our list.

These short duration bond funds have had the following growth of $10,000:

- 1 month: $10,019

- 1 year: $10,056

- 3 years: $10,478

- 5 years: $10,902

The average effective maturity time is 2.89 years for these short-term bonds. Morningstar rates this bond as an “above average” risk at the 3-year mark and an “average” risk at the 5-year mark.

The top three sectors of these best short-term bond funds are:

Fidelity® Short-Term Bond Review

Next up on our list of top short duration bond funds is the Fidelity® Short-Term Bond. In January 2017, the net asset value of each share was $8.59.

As you can see from the chart above, this Fidelity short-term bond fund has the lowest trailing twelve months (TTM) yield. However, it also has the lowest minimum investment among our list of best short-term bond funds.

This means this fidelity short-term bond fund is a great option for those who do not have much money available for an initial investment.

These short duration bond funds have had the following growth of $10,000:

- 1 month: $10,026

- 1 year: $10,122

- 3 years: $10,297

- 5 years: $10,588

The average effective duration time is 1.66 years for these best short-term bond funds. Morningstar rates this bond as a “below average” risk.

The top three sectors of this Fidelity short-term bond fund are:

- Corporate Bond (49.09%)

- U.S. Treasury (19.77%)

- Asset-Backed (15.93%)

Related: US Small Businesses – Why Are Small Businesses Important? (How Many, Statistics & Importance)

Frost Total Return Bond Inst Review

Now, let’s take a look at the highest-yielding of these short duration bond funds: Frost Total Return Bond Inst. In January 2017, the net asset value of each share was $10.40.

With a 3.90% yield over the past 12 months, these short-term bond funds are offering exceptionally high payouts compared to many best short-term bonds. This reward comes only with a large investment.

Note that these short duration bond funds require a 1 million dollar investment at minimum.

These best short-term bond funds have had the following growth of $10,000:

- 1 month: $10,084

- 1 year: $10,625

- 3 years: $10,991

- 5 years: $12,578

The average effective maturity time is 5.96 years for this short-term bond fund. Morningstar rates this bond at a “high” risk.

The top three sectors of these best short-term bond funds are:

USAA Short-Term Bond Review

The next best short-term bond fund we will look at is the USAA Short-Term Bond. In January 2017, the net asset value of each share was $9.13.

These short-term bonds have a low minimum investment at $3,000 and a nice TTM yield at 1.86%. It is important to note, though, that these best short-term bond funds have the highest expense ratio on the list.

Image Source: USAA

These short duration bond funds have had the following growth of $10,000:

- 1 month: $10,038

- 1 year: $10,303

- 3 years: $10,440

- 5 years: $10,994

The average effective maturity time is 2.28 years for these best short-term bonds. Morningstar rates this bond at an “average” risk.

The top three sectors of these best short-term bond funds are:

Popular Article: How to Start a Cleaning Business This Year

Vanguard Short-Term Investment-Grade Inv Review

Next up on our list of top short-term bonds is the Vanguard Short-Term Investment-Grade Inv. In January 2017, the net asset value of each share was $10.64.

As one of the best short-term bond funds on our list, this short-term bond fund has the lowest expense ratio. Combine this feature with the low minimum investment, and this best short-term bond fund can be a great option for those only desiring to invest a small amount.

These short duration bond funds have had the following growth of $10,000:

- 1 month: $10,054

- 1 year: $10,253

- 3 years: $10,541

- 5 years: $11,110

The average effective maturity time is 3.10 years for these best short-term bond funds. Morningstar rates this bond at an “above average” risk.

The top three sectors of these short duration bond funds are:

Free Wealth & Finance Software - Get Yours Now ►

Weitz Short Duration Income Instl Review

The last on our list of best short-term bond funds is the Weitz Short Duration Income Instl. In January 2017, the net asset value of each share was $12.30.

These short-term bond funds have the second highest TTM yield at 2.13%. It has a higher expense ratio than the other high-yielding short-term bond fund, Frost. Both require a minimum 1 million dollar investment.

These short duration bond funds have had the following growth of $10,000:

- 1 month: $10,048

- 1 year: $10,362

- 3 years: $10,503

- 5 years: $11,022

The average effective maturity time is 2.34 years for these short-term bond funds. Morningstar rates this bond at an “average” risk.

The top three sectors of these best short-term bond funds are:

- Corporate Bond (45.41%)

- U.S. Treasury (22.39%)

- Agency MBS Pass-Through (14.10%)

Read More: Starting a Business in Florida (Checklist to Help You Get Started)

Conclusion – Top 6 Short Duration Bond Funds

Now that you have more information about some of the best short-term bond funds in 2017, you can start the process of choosing the best short-term bonds for you and your finances.

A great place to start is meeting with a financial advisor before delving into short duration bond funds for the following important reasons:

- They can help you take stock of your finances to see which short duration bond funds you can afford

- They can help point to the right best short-term bond fund

- They can help you understand the ups and downs of the market at the current time

- They can help you gain confidence in your choice

- They can help you with decisions in the future

Perhaps 2017 will be your year to dive into the world of short-term bonds with one of these best short-term bond funds.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.