2017 RANKING & REVIEWS

TOP RANKING BEST SITES TO COMPARE PROFESSIONAL INDEMNITY INSURANCE

2017 Guide to Professional Indemnity Insurance Explained

Certain careers naturally come with a greater risk than others. Depending on what field you work in, that risk could come with serious ramifications for the life, success, and happiness of the clientele you serve. What do you do when things go awry, against even your best laid plans?

Professional indemnity insurance can offer some protection for scenarios such as these. Unfortunately, too few consumers really understand the intricacies of what professional indemnity insurance actually is and how it works.

Award Emblem: Top 6 Best Sites to Compare Professional Indemnity Insurance Quote

Knowing that this information could be invaluable to a number of consumers, AdvisoryHQ prepared this ranking of the best sites to compare professional indemnity insurance. We will be answering key questions that are at the forefront of consumers’ minds, such as:

- What is the professional indemnity insurance definition?

- Who needs professional indemnity insurance?

- What does professional indemnity insurance cover?

- Where can you go for cheap professional indemnity insurance?

With answers to these questions and more, we’ll be sure that you have a thorough knowledge of professional indemnity insurance explained to you. Afterward, you’ll be able to gather up professional indemnity insurance quotes to benefit you and ultimately benefit the long-term financial success of your business.

See Also: Top Credit Cards for Excellent & Good Credit | Ranking & Reviews | Top-Rated Best Credit Cards

AdvisoryHQ’s List of the Top 6 Best Sites to Compare Professional Indemnity Insurance

List is sorted alphabetically (click any of the sites below to go directly to the detailed review section for that professional indemnity insurance comparison):

Top 6 Best Sites to Compare Professional Indemnity Insurance | Brief Comparison & Ranking

Websites to Compare Professional Indemnity Insurance | Coverage Areas | Highlights |

| BizInsure.com | United States | -All A-rated businesses -Short application |

| Compare the Market | United Kingdom | -Frequently cheaper than purchasing direct -Personalized advice upon intake from customer service |

| GoCompare.com | United Kingdom | -Good for simple or complicated situations -Ability to call into customer service for a fee |

| Isure | Australia | -Automatically displays quote without entering personal information |

| MoneySuperMarket | United Kingdom | -Good educational resources -Short application |

| Simply Business | United Kingdom | -Wide range in coverage amounts -Simple application |

Table: Top 6 Best Sites for Professional Indemnity Insurance Quotes | Above list is sorted alphabetically

Professional Indemnity Insurance Definition

While many people are aware that professional indemnity insurance is a requirement or recommendation for many careers, several still don’t understand the professional indemnity insurance definition.

Before we get too far into the best places to look when you want to compare professional indemnity insurance, we want to cover the basics. What is the professional indemnity definition?

In essence, the professional indemnity definition is relatively simple: it is a form of coverage to protect businesses and owners from errors in judgment. Malpractice is a form of professional indemnity insurance that most people are aware of. However, the professional indemnity insurance definition expands even beyond this basic type of coverage.

Image Source: Pixabay

What does professional indemnity insurance cover, beyond just malpractice? Some of these policies for professional indemnity insurance can help to cover professionals who are negligent or offer unsound advice as well.

Who needs professional indemnity insurance? In short, there are a few careers that require you to carry some form of coverage. You will want to have a professional indemnity insurance policy if you work in the medical field, legal field, or financial field. Popular occupations that make good use of a professional indemnity insurance policy are:

- Doctors

- Lawyers

- Financial advisers

- Mortgage brokers

- Accountants

Once you understand the professional indemnity definition, it’s easy to understand why coverage would be critical to these careers. When advice turns out against your better judgment or a client sues for a mistake that resulted from your negligence, this type of insurance can offer protection.

Having professional indemnity insurance explained helps make it clearer what you should be looking for in a good policy. What will you need protection from in order to make the best use of your insurance? Are you someone who needs professional indemnity insurance?

From here, you can begin to compare the professional indemnity insurance cost to be certain you are getting the best possible rates for the coverage you need.

Don’t Miss: Top Gas Credit Cards | Ranking | Best Credit Cards for Gas Rewards & Points

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Sites to Compare Professional Indemnity Insurance

Below, please find the detailed review of each website on our list of sites to compare professional indemnity insurance quotes. We have highlighted some of the factors that allowed these professional indemnity insurance sites to score so high in our selection ranking.

BizInsure.com Review

Specializing solely in various types of business insurance coverage, Bizinsure.com offers quotes to protect various types of professionals. Their quotes come from popular and well-rated insurance companies for a thorough professional indemnity insurance comparison.

Professional indemnity insurance quotes from Bizinsure.com fall into several different categories. Depending on what type of profession you’re in, you can receive professional indemnity quotes for:

- Professional liability

- Errors and omission

- General liability

- Business owner’s policy

The companies that are available to compare professional indemnity insurance must be A-rated or better. BizInsure.com works with well-known brands including CNA, Liberty, Philadelphia Insurance Company, and more.

Process

In order to get professional indemnity insurance quotes, the only thing you need to do is fill out a short application. This frequently has only ten questions or so, depending on your answers.

As you go through the process, BizInsure.com makes recommendations about what type of coverage is right for your profession. You can opt to select the type they recommend or move on with your own ideas.

You can compare professional indemnity insurance policies side by side to see where each one stands. This is especially helpful if there are certain categories that are more significant to you than others.

It’s important to note that BizInsure.com only offers professional indemnity insurance quotes for those who practice within the United States.

Compare the Market Review

Compare the Market is one of several websites that specialize in offering quotes on all types of insurance products. From life insurance and auto insurance to professional indemnity insurance, Compare the Market is a great place to compare quotes from third-party companies.

One of the best parts of Compare the Market’s website is their detailed description. What does professional indemnity insurance cover? Their article on the finer details of this type of coverage can help clarify some of the main questions you may have on coverage they can offer.

Quotes from Compare the Market are offered from more than 390 different providers across the board. They claim that their quotes are cheaper than buying directly from a company approximately 80% of the time.

Coverage for their products appears to only be available within the United Kingdom. Though it is not specifically addressed on their website, the BGL Group (the company behind this website for professional indemnity insurance comparison) is based out of the United Kingdom. Their Australian offshoot does not offer professional indemnity insurance quotes.

Process

Unfortunately, Compare the Market will not allow you to compare professional indemnity insurance strictly through their website. However, you can request for a representative to give you a call regarding potential professional indemnity insurance quotes.

You will need to enter your personal information and details into their form to give representatives the ability to contact you. The website promises not to sell your information to anyone else. In terms of contact from a representative, you are even able to select a preferred date and time for your phone meeting.

Related: Top Navy Federal Credit Cards | Ranking | Best NFCU Secured, Rewards, Cash Back Credit Cards

GoCompare.com Review

The ability to compare professional indemnity insurance on GoCompare.com is made possible through their partnership with other companies. This website has a broad base, featuring coverage in various areas instead of focusing solely on professional indemnity insurance quotes.

Partnering with Simply Business, GoCompare.com can offer all types of insurance quotes, including:

- Public or product liability

- Building insurance

- Business interruption or revenue protection

- Professional indemnity insurance

Most situations will allow you to receive an online quote so you can compare professional indemnity insurance instantly. When complicated situations arise, the company requests for a customer service representative to contact you directly before offering rates and pricing. Customer service representatives are guaranteed to be from the United Kingdom.

Process

For those who can make use of the online application page, you’ll receive quotes from top insurers: Axa, Zurich, Hiscox, Groupama, and Brit. The application itself makes short work being able to compare public indemnity insurance.

It will walk you through five screens worth of questions regarding your information and what you will need before allowing you to compare professional indemnity insurance policies.

You should be aware that there is a cost to calling into their customer service department. Because they outsource their professional indemnity insurance quotes to Simply Business, you must call Simply Business in order to discuss details. You will be charged 7p per minute as well as your phone company’s access charge.

Isure Review

Representing Australia-based businesses, Isure offers professional indemnity insurance quotes with low rates. Their cheap professional indemnity insurance features policies only from top-rated providers who receive an A+ or higher through the Standard and Poor’s financial strength rating agency.

They offer coverage of up to $5 million under a number of categories to offer you the ultimate level of protection. What does professional indemnity insurance cover? Areas that can be covered under their professional indemnity insurance quotes include:

- Defamation

- Negligence

- Errors and omission

- Breach of laws or confidentiality

- Loss of documents

- Dishonest employees

- Infringement of intellectual property

Of course, this coverage does not apply if you willfully and knowingly engaged in practices such as these. Their professional indemnity insurance cost can provide you with some peace of mind against the potential for these situations though.

Process

Isure touts that their process is extremely fast, allowing you access to a professional indemnity insurance quote in just seconds. Coverage will take slightly longer, with new policies taking a few minutes to bring to completion. In the end, your new professional indemnity insurance policy will even include retroactive coverage if necessary.

One of the best parts of this site to compare professional indemnity insurance is that their initial application does not require your contact information. As you enter the details, it will automatically display a potential professional indemnity insurance policy to the right of your questionnaire.

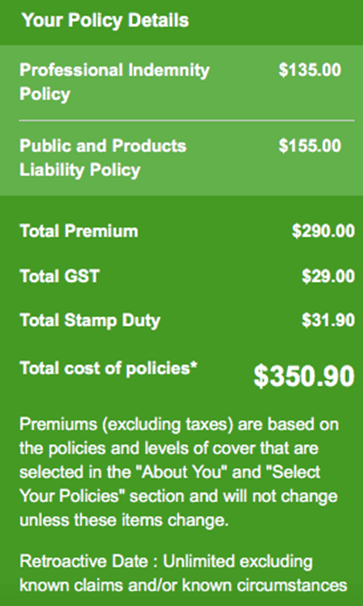

Image Source: Isure

Unlike other sites to compare professional indemnity insurance, Isure provides only one professional indemnity insurance quote for you to review.

You can modify the coverage options from your initial quote on the first screen once you make it to the section regarding your professional indemnity insurance policy details. However, you will need to enter personal information to make it to this part of the website.

Popular Article: Top HSBC Credit Card Offers | Reviews | Top HSBC Hotel, Flight, Rewards Card Offers

MoneySuperMarket.com Review

One of the top websites to compare professional indemnity insurance, MoneySuperMarket.com allows consumers to find the policy that is right for them. Allowing you to compare the professional indemnity insurance cost from various providers, you can rest assured that you’re selecting the right policy and price for your business.

You can find professional indemnity insurance quotes from leading companies including Maltings Insurance, Zurich, Axa, and Hiscox. All of the major insurers listed on your professional indemnity insurance quote will be based in the United Kingdom, as this is where Money Super Market is able to offer professional indemnity insurance quotes.

One of the major advantages of MoneySuperMarket.com is the ability to compare professional indemnity insurance types. They maintain a vast library of resources for consumers to review prior to making a decision or requesting professional indemnity insurance quotes.

Process

The application for receiving professional indemnity insurance quotes is relatively simple and straightforward. You’ll complete several screens worth of information, beginning with a general overview of what type of business you operate. From there, you’ll provide information about your employees and the type of professional indemnity insurance quote you need.

More information on how to evaluate the professional indemnity insurance cost is available in their articles about getting the most out of your money. You want to be certain that you opt for coverage that will give you the full payout in the event that you need to file a claim.

You’ll see the professional indemnity insurance quote at the very end, once all of your information has been entered into their system.

Free Wealth & Finance Software - Get Yours Now ►

Simply Business Review

Simply Business offers an extremely wide variety of coverage options for consumers and business owners searching for professional indemnity insurance quotes. Available as a standalone policy or simultaneously with public liability insurance, you can compare professional indemnity insurance policies in just minutes.

Coverage is offered through Simply Business in amounts ranging from £50,000 to £5 million. Their professional indemnity insurance quotes can cover your business in the event of:

- Professional negligence

- Unintentional breaches of copyright of confidentiality

- Defamation

- Loss of documents

You can compare professional indemnity insurance from the most well-known brands in the industry. If you’re searching for a quote, it is likely to come from companies such as Zurich, Axa, Hiscox, or AIG. They feature numerous options to allow you to compare professional indemnity insurance in-depth from all possible sources.

Image Source: Simply Business

Process

Filling out the application through Simply Business is relatively easy and fairly fast. You’ll answer questions regarding your specific trade and location, time in business, and employees. From there, you’ll have the opportunity to tweak any types of coverage you would want included in your professional indemnity insurance quotes.

If you’re uncertain how much coverage you need, be sure to read through some of the articles in their knowledge center before you compare professional indemnity insurance. This allows you to enter into the process with as much education as possible. The more you know, the more likely you are to make business savvy decisions instead of those based solely on the professional indemnity insurance cost.

Read More: Compare Credit Cards | Ranking | Top Credit Cards (Comparison & Reviews)

Conclusion—Top 6 Best Sites to Compare Professional Indemnity Insurance

Being able to compare professional indemnity insurance allows you to see all of the options available on today’s marketplace in one convenient location. Whether you think you need the bare minimum when it comes to coverage or something more extensive, you can find the resources you need to compare professional indemnity insurance all in one place.

Take advantage of the many resources available through these websites for professional indemnity insurance quotes. You can learn the ins and outs of coverage details and better evaluate the professional indemnity insurance cost prior to signing up for a brand-new policy. Know the advantages and disadvantages of opting for cheap professional indemnity insurance.

Evaluate what your business could benefit from and how risky of an operation your employees are running. Are you more likely to face lawsuits over errors and omissions or for breach of confidentiality? These types of questions can help to lead you to the proper professional indemnity insurance quotes in your comparisons.

Don’t rush into a new policy that is going to need to protect your business under the very worst of circumstances. Take your time to thoroughly compare professional indemnity insurance in advance of signing on the dotted line.

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.