2017 RANKING & REVIEWS

TOP RATED DEPARTMENT STORE CREDIT CARDS

Are Department Store Credit Cards a Good Value? (Top 10 Best Store Credit Cards)

Does it seem like every time you’re at a register ready to pay for your purchases in a store you’re being asked if you’d like to apply for the store’s signature credit card? If you frequently shop online, you’ve probably also noticed many retailers are now offering store credit cards promising you great discounts and rewards.

So, are these department store credit cards and general retail store credit cards a good value?

The short answer? It depends.

Some of the top store credit cards do offer some pretty generous discounts, opportunities to earn points and rewards, and other perks. However, while there are benefits, there are also downsides to even some of the best store credit cards.

Award Emblem: Top 10 Best Store Credit Cards

One of the biggest problems is that store credit cards tend to have very high interest rates. If you simply want the card to earn the perks, and you shop at that retailer frequently, you may plan on paying off your balance quickly, so interest rates may not be a concern for you.

Another possible conflict is when store credit cards can only be used or only offer rewards for shopping with that particular brand. If you shop at that store frequently, again, that’s not going to be a significant problem, but if you’re looking for a store credit card that can be broadly used, it’s something to keep in mind.

The following list of the best department store credit cards and leading overall store credit cards feature some of the most generous sign-up bonuses and rewards programs, and many also boast other benefits such as introductory interest rate specials.

See Also: Top Credit Cards to Rebuild Credit | Ranking & Reviews | Best Cards for Rebuilding Credit

AdvisoryHQ’s List of the Top 10 Best Store Credit Cards

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- Amazon Prime Store Card

- BJ’s Perks Elite® MasterCard®

- Costco Anywhere Visa® Card by Citi

- GapCard

- Kohl’s Charge

- Lowe’s Consumer Credit

- Nordstrom Visa Signature®

- Target REDcard™

- TJX Rewards® Credit Card

- Walmart MasterCard

Top 10 Best Store Credit Cards | Brief Comparison

Credit Card Name | Rewards/Discounts | Annual Fee | Average APR |

| Amazon Prime Store Card | 5% Back | $0 | 26.24% |

| BJ’s Perks® Elite MasterCard® | 5% Back | $100 | 14.99% |

| Costco Anywhere Visa®Card by Citi | 4% Back | $0 | 15.49% |

| GapCard | 5 Points for Every $1 Spent on Gap Brands | $0 | 24.99% |

| Kohl’s Charge | Extra Discounts | $0 | 23.99% |

| Lowe’s Consumer Credit | 5% Off Purchases | $0 | 24.99% |

| Nordstrom Visa Signature® | 2 Points on Nordstrom Purchases | $0 | 16.90% |

| Target REDcard™ | 5% off | $0 | 22.9% |

| TJX Rewards® Credit Card | 5 Points on Company Purchases | $0 | 26.99% |

| Walmart MasterCard | 1% for Ever $1 | None | 22.90% |

Table: Top 10 Best Store Credit Cards | Above list is sorted alphabetically

Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Retail Store Credit Cards and Department Store Cards

Below, please find the detailed review of each card on our list of top store credit cards. We have highlighted some of the factors that allowed these clothing store credit cards and retail store credit cards to score so well in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Amazon Prime Store Card Review

Amazon.com is one of the largest and most recognizable online retailers and marketplaces in the world, so it’s only natural they would be one of the stores that offer credit cards. Headquartered in Seattle, Amazon is the largest Internet-based retailer in the world based on total sales and market capitalization.

In addition to being a top online retailer, the company also produces consumer electronics and provides cloud infrastructure services. The Amazon Prime Store Card is just one of their card offerings that’s ranked on this list of the best store cards.

Key Factors That Led to Our Ranking of This as One of the Top Store Cards

Unique features of the Amazon Prime Store Card that led to its inclusion this list of the best store credit cards are listed below.

5% Back

The Amazon Prime Store Card has no annual fee, and quite a few other benefits and perks, particularly in terms of the rewards program. To begin, cardholders get 5% back as a statement credit every day on all of their Amazon.com purchases.

This program is particularly valuable among stores with credit cards because there are no category restrictions or limits.

That means overall, cardholders with this best store credit card get the benefit of 5% savings on all of their purchases they make on the site. That can be particularly advantageous with a company like Amazon because it’s such a massive online retailer that you can buy almost anything through the site. It gives you a lot of flexibility to go with this store credit card.

Promotional Financing

Another feature that comes with the Amazon Prime card is the ability to have access to promotional financing. When a shopper’s cart is over $149, cardholders have the option to choose promotional financing instead of earning 5% back, giving them a sense of flexibility.

Currently, there is 6-month financing on purchases of $149 or more and 12-month financing on purchases of $500 or more. There are also options for 24-month financing on certain Amazon-sold items.

That means the cardholder pays over time using promotional financing, and if they pay in full, they don’t have to pay interest within the promotional period. If the promotional balance isn’t paid in full within the promotional period, then interest is charged to the account.

Limited-Time Offers

Another advantage of the Amazon Prime Store Card and one of the reasons it was included in this ranking of the best store cards is the fact that Amazon frequently offers special limited-time offers in addition to their rewards program, promotional financing, and no annual fee.

For example, the current offer is a free $40 Amazon gift card that is instantly loaded into an applicant’s Amazon.com account when their credit card application is approved.

These offers are common with the Amazon Prime Store Card, so it can be valuable for customers considering this offer to keep an eye on what they’re featuring at any given time.

Fast Shipping

As compared to other stores that offer credit cards and department store cards, the Amazon card is great if you value fast, free shipping. This card is available only to Amazon Prime members, so along with the benefits of the card itself, you’re also going to get the choice of free 2-day shipping on eligible Prime purchases, which is just one more benefit of this store credit card.

There are a few things to note about this card, however. While it is one of the best store credit cards, if you don’t take advantage of promotional financing the card does have a high ongoing APR.

It’s also a closed-loop card, so it can only be used on Amazon.com, but as mentioned at the start of the review for this best store credit card, since there are so many items available on the site, this isn’t often a big issue like it might be with other limited store credit cards.

Don’t Miss: Top Business Credit Cards | Ranking | Best Small Business Credit Card Offers (Reviews)

BJ’s Perks Elite® MasterCard® Review

BJ’s is a popular wholesale club that requires membership and also offers different retail store credit cards. This leading membership warehouse club has more than 210 clubs in 15 states on the East Coast, primarily. BJ’s strives to excel in the delivery of top brands, a wide selection of fresh foods, great savings opportunities, and they are the only membership club that accepts manufacturer’s credit cards.

The BJ’s Perks Elite® Credit Card does carry a $100 yearly fee, which isn’t the case with most of the retail store credit cards and clothing store credit cards on this list, but it is also a high-level card with premium offerings, so many consumers may find that balances out the annual fee.

Key Factors That Led to Our Ranking of This As One of the Top Store Credit Cards

As compared to clothing stores with credit cards and department store credit cards, the following are key reasons this particular card is included in this ranking of the best store credit cards.

5% Earnings

Among other department store cards and retail store credit cards, the BJ’s Perks Elite™ Credit Card offers some of the best opportunities to earn rewards.

It’s the high level of rewards earning capabilities that led to the inclusion of this on this ranking of the best department store credit cards.

When shoppers upgrade to this Elite-level store credit card, they earn 5% per $1 spent on their purchases made not only in person at BJ’s but also when they shop online at BJ’s.com.

Other Rewards

One of the most unique elements of this particular store credit card not seen with many other stores with credit cards is the ability to earn rewards and cash back not just for purchases made with the store itself, but on other purchases outside of BJ’s as well.

For example, cardholders can earn 2% cash back on eligible purchases made at dining and gas stations outside of BJ’s Clubs. The card also features 1% earnings on all other purchases made at any eligible store, and the card includes gas benefits.

When a customer is buying fuel at BJ’s, the purchases they make earn rewards which include $0.10 off every gallon. The gas discount is instant at the pump with the Elite card is used to pay.

There is a lot of flexibility with this card, which makes it appealing to consumers searching for the best store credit cards that don’t limit them to rewards or only shopping in one particular store.

Sign-Up Bonus

When you decide to open this particular store credit card, you are first eligible to receive a sign-up bonus. For example, the current offer with the BJ’s Elite card is $50 in rewards for making a first purchase outside of BJ’s.

Additionally, this card is unique because while there is an annual fee for the card, it can be paid in lieu of the $50 BJ’s Membership Card. The BJ’s Membership Card doesn’t have to be paid for separately and is included as part of the package when you get the BJ’s Perks Elite™ Credit Card.

The annual fee also goes down to $75 when a cardholder sets up an auto-renewal for their club membership.

MasterCard Advantages

Since this card is a MasterCard, it is one of the store credit cards on this list of the best department store credit cards that comes with MasterCard benefits and perks. Some of these include:

- Zero Liability Protection in the event the card is used fraudulently without the approval of the cardholder

- MasterCard Global Service which is 24-hour emergency assistance for lost or stolen cards

- Identity Theft Resolution services

- The Extended Warranty program covers things purchased with the card. It doubles the original manufacturer’s warranty on certain items.

- Price Protection offers cardholders the possibility for reimbursement for the difference in price for two items if they find the item at a lower price somewhere else within 60 days of making the purchase

Related: Best 0 Interest Credit Cards | Ranking | Top No-Interest, 0% Purchase, 0 Percent Credit Cards (Reviews)

Costco Anywhere Visa® Cards by Citi Review

Costco is a membership wholesale retailer with operations around the world. The goal of Costco is to bring members top-quality, brand-name items at competitive pricing. They also feature not only merchandise and departments for groceries but also specialty departments and extensive member services, such as travel planning and packages.

The first Costco opened in 1976, and since that time has grown significantly to become one of the leading global brands. Available exclusively to Costco members is the Costco Anywhere Visa® Card by Citi, featuring rewards and other benefits for members.

Source: Costco Anywhere Visa® Card by Citi

Key Factors That Led to Our Ranking of This as One of the Top Store Credit Cards

Reasons the Costco Anywhere Visa® Cards by Citi was included in this ranking of the best department store credit cards and the best overall retail store credit cards are highlighted in the following list.

Gas Cash Back

For most consumers, one of the primary things they purchase is gas, so it can be particularly advantageous to find credit cards that offer special rewards and discounts on these purchases. The Costco Anywhere Visa® Cards by Citi is an excellent card option if you want rewards on gas and also want a good all-around store credit card.

It features a very competitive 4% cash back on eligible gas purchases not just in the U.S. but anywhere in the world. This includes the already low prices of gas at Costco.

This reward is available for the first $7,000 per year, and then it’s 1% after that threshold is reached. This benefit is available for both business and personal card purchases.

Other Cash Back Offers

The Costco Anywhere Visa® Cards by Citi isn’t just a best store credit card if you make frequent gas purchases or are looking for rewards in this category. It also offers many other valuable rewards.

For example, with this leader among the best store cards, cardholders can get 3% cash back on restaurant and eligible travel purchases worldwide, making this the perfect card for people who frequently dine out or travel.

It also includes 2% cash back on all other purchases from Costco and Costco.com. The rewards don’t stop there, however, which is why this is ranked as one of the best store credit cards.

Cardholders also get 1% cash back on all other purchases.

Introductory APR

As mentioned at the start of this review of the best department store credit cards, clothing store credit cards, and overall stores that offer credit cards, interest rates can be an issue with these products. Interest rates on department store credit cards tend to be on the high side, and they don’t often include introductory APR offers. This is not the case with the Costco Anywhere Visa® Cards by Citi, however.

First, this best store credit card features an introductory offer of 0% APR for 7 months on purchases. After that, the variable APR remains very low not only compared to retail store credit cards but credit cards in general. Currently, the variable APR is 15.49%.

Other Benefits

Along with offering one of the most competitive rewards and cash back structures of all stores that offer credit cards, there are other advantages to using the Costco Anywhere Visa® Cards by Citi. First, shoppers have the flexibility to earn Costco cash rewards anywhere Visa is accepted. With this flexible card, they’re not restricted to shopping or only earning rewards at Costco.

Also when cardholders have a paid Costco membership, there is no annual fee to use this leader among the best store credit cards, and the card can actually be used as the cardholder’s Costco membership ID.

Additionally, the cash back is provided in a simple, clear way. It’s an annual reward coupon included in February billing statements that can then be redeemed for cash or merchandise at US Costco warehouses.

Popular Article: Top Credit Cards with No Annual Fee | Ranking & Reviews | Best No Annual Fee Credit Cards

GapCard Review

GapCard is a leader among clothing store credit cards from the Gap and the family of companies that are part of the Gap corporation. Gap, Inc.’s first store was opened in 1969 with the idea of making it easier for customers to find a great pair of jeans. Since that time, the company has grown into a global fashion powerhouse and includes five distinctive brands.

Gap clothes are available in 90 countries around the world, and the portfolio of brands include Banana Republic, Old Navy, Athleta, and Intermix. The e-commerce business is strong, and there are thousands of stores internationally.

Key Factors That Led to Our Ranking of This as One of the Best Store Credit Cards

Features of the GapCard that led to its inclusion on this list of the best retail store credit cards and clothing store credit cards are detailed in the following list.

Rewards

Among clothing stores with credit cards, the GapCard offers excellent rewards options. Cardholders earn points for making a purchase at any of the brands that are part of the Gap Company, and this includes in-store and online purchases. Then, rewards are also redeemable at any Gap, Inc. brand. This card is very flexible regarding the rewards program.

Cardholders earn 5 points for every $1 spent on Gap brands in-store and online, and for every 500 points earned, they receive a $5 reward.

As one of the leading clothing stores with credit cards, Gap also offers rewards for shopping outside of their family of brands. Not only can this store credit card be used outside of Gap and Gap-brand stores, but cardholders are rewarded with 1 point for every $1 spent anywhere Visa is accepted.

Source: GapCard

Bonus Rewards and Promotions

The GapCard is included on this list of the best store credit cards and specifically is one of the best options for clothing stores with credit cards because the company goes out of their way to reward customers for their use of the card.

The Rewards program is just one aspect of this effort. Cardholders also gain access to exclusive discounts, events, and savings opportunities.

For example, cardholders get 15% off their first purchase when they open a new account. They also get 10% off every Tuesday at both Gap and Gap Factory. This includes in-person and online shopping.

There are regular offers to get extra points, special birthday savings, and no receipt is necessary for returns for cardholders of this leader among retail store credit cards.

Easy Tracking and Management

Sometimes one of the biggest complaints customers might have about clothing store credit cards, and really any credit card is that it’s difficult to manage the credit card, and particularly the rewards the accumulate. GapCard is simple in this aspect. Customers apply for and then activate their account.

They can then log on from anywhere to see and redeem their awards with one click. They can easily log on the card management platform to track the points they’ll need to get to the next Reward and tier status, and they can also conveniently access earned offers.

Gap Silver

If customers start with the GapCard, one of the leading clothing store credit cards, they can eventually move to the Gap Silver status, which is designed to provide an even higher level reward experience. With Gap Silver Status, cardholders gain the following benefits:

- 20% quarterly bonus Reward points

- Choose Your Own Sale Day

- Free online shipping with no minimum purchase requirement

- Free basic alterations on Banana Republic purchases

- Special access to Silver Cardmember events

- Priority access to card member hotline

To gain Gap Silver status along with this best store credit card, cardholders simply have to earn $5,000 points in a calendar year.

Read More: Best 0 Balance Transfer Credit Cards | Ranking & Reviews | 0 APR Credit Card Balance Transfer Fee

Kohl’s Charge Card Review

Kohl’s is a top department store that also offers one of the best department store credit cards, called the Kohl’s Charge Card. There are more than 1,100 Kohl’s stores around the country, and these stores include everything from women’s fashion including collaborations with top designers to home décor, jewelry, children’s clothing, and more.

Kohl’s is also known for offering valuable discounts, coupons, and promotions, and Kohl’s Charge Card holders get even more advantages, which is why it’s one of the leading clothing stores with credit cards.

Key Factors That Led to Our Ranking of This as One of the Best Department Store Credit Cards

Among clothing stores with credit cards, the Kohl’s Charge Card ranks as one of the best store cards for the reasons cited in the following list.

Discount Opportunities

While the Kohl’s Charge Card does have a relatively high interest rate, if you pay off your charges quickly and you shop the store frequently it can be very valuable, primarily in terms of the discount opportunities offered by this leader among clothing store credit cards.

This best store credit card includes an introductory discount on the first purchase made with the new card. Currently, that’s an extra 30% off the first Kohl’s Charge purchase. There’s an additional 15% discount that arrives when the new card comes in the mail.

Special Offers Throughout the Year

What’s really unique about the Kohl’s Charge, one of the best department store credit cards, is that you don’t just get special offers for signing up, or maybe once or twice a year.

The card entitles cardholders to at least 12 special offers every year, which averages out to about one special offer per month.

This is in addition to the sign-up bonus of 30% off the first Kohl’s Charge purchase. The discounts are usually 15%, 20%, or even 30%.

Source: Kohl’s Charge Card

MVC

If you apply for and receive the Kohl’s Charge Card, one of the leading department store credit cards, and find that you like it, there are options to further expand the benefits you receive. One option is participation in the Most Valued Customer (MVC) program. To become eligible for this program, cardholders only have to spend $600 a year on their Kohl’s Charge.

Once a cardholder becomes an MVC, they receive 18 discounts annually at a minimum.

What should be noted about the Kohl’s Charge Card when comparing it to other best store cards is that it’s ideal for frequent Kohl’s shoppers, but if you’re not a regular customer at the store, you might be better off choosing one of the more flexible options on this list of stores with credit cards. Unless you frequently shop Kohl’s, you would likely want a card that can be used anywhere and isn’t just limited to one store.

Yes2You Rewards

Yes2You is the Kohl’s Rewards program for customer loyalty. The reason this rewards program is mentioned on this list of the leading stores that offer credit cards and the best department store credit cards is because Yes2You rewards can be combined with Kohl’s Charge discounts so cardholders can save even more.

The Yes2You program includes three primary elements which are Save, Share, and Surprise. Shoppers earn one point for every dollar they spend no matter how they pay, and they get a $5 reward for every 100 points. There are eight saving offers given every year, guaranteed, a special birthday gift, and opportunities to earn bonus points.

Credit card offers from this best store credit card can also be combined with Kohl’s Cash, which is just one more special savings program offered by Kohl’s.

Related: Top Cash Rewards Credit Card Offers | Ranking | Best Cash Back Rewards & Money Back Credit Cards

Lowe’s Consumer Credit Card Review

Lowe’s is one of the nation’s top home improvement stores, and they also feature home improvement services, décor, outdoor and garden items, electronics, and appliances. Lowe’s has been delivering home improvement solutions for more than 60 years. Along with being one of the best home-related stores, Lowe’s also features a valuable credit card option in the form of the Lowe’s Consumer Credit Card.

The Lowe’s Card is included in this ranking of the best store credit cards for many reasons, including the excellent exclusive discount and financing options cardholders have access to.

Key Factors That Led to Our Ranking of This as One of the Top Store Credit Cards

Lowe’s is one of the top stores that offer credit cards, and the following are specific reasons this card was chosen as one of the best store credit cards.

5% Off

The Lowe’s Card is unique from many of the other store credit cards included in this ranking of the best store cards because the cardholder has a lot of choice and flexibility regarding how they use the card. There is one option that allows cardholders to choose 5% off purchases every day.

This is a current special offer, and it does have an ending date, but there are similar offers frequently available with this card. When cardholders pay with their Lowe’s Consumer Credit Card, they receive 5% off their order or purchase. The 5% discount is applied after all other applicable discounts.

In addition to the 5% off everyday option, some consumers can also select 18 months special financing, the details of which are listed below.

Special Financing

Another promotional offer currently available to Lowe’s cardholders is special financing. The Lowe’s Card very frequently includes special financing offers, so this isn’t out of the ordinary.

Rather than choosing the 5% off discount, when paying for a purchase cardholders can select instead to have up to 18 months special financing with a minimum purchase.

Under the current promotion available with this best store credit card, the cardholder would receive special financing for 12 months on an order or purchase ranging from $299 to $998.99. For purchases or orders of more than $999, the special financing terms would be extended to 18 months.

This offer gives cardholders a great opportunity to start a complete a larger project and have up to 18 months of special financing.

Project Financing

Another exclusive option available to Lowe’s cardholders, one of the leading retail store credit cards, is Project Financing. These options include 36, 60, or 84 months’ special financing.

Cardholders have the opportunity to select the payment plan that will work best for them, which is ideal for big projects. For example, with the 36-month plan, cardholders with this leader among the best store cards would have 36 fixed monthly payments at 3.99% APR until paid in full.

There is also the option to take 60 fixed monthly payments at 5.99%, or 84 fixed monthly payments at 7.99%. It’s important to note, however, that these offers aren’t automatic, and they have to be requested at the time of purchase. It applies to in-store purchases or orders of $2,000 or more made on a Lowe’s Consumer Credit Card.

No Annual Fee

Another benefit of the Lowe’s Consumer Card that led to its ranking on this list of store credit cards that rank as the best store cards is that there is no fee to use this card, and it carries regular promotions that are very valuable to customers.

In saying that, however, it’s also important to note a few other things about this store credit card.

The first is that when you do take advantage of various special financing offers such as the ones used as examples above, if the special financing isn’t paid by the deadline, you’ll owe deferred interest on the balance, and the card does have a high ongoing interest rate.

At the same time, this store credit card offers some of the best discounts and rewards, so if you can make the payments in the time agreed upon, it can be one of the best store credit cards overall.

Free Wealth & Finance Software - Get Yours Now ►

Nordstrom Visa Signature® Review

Nordstrom is a luxury fashion retailer with a history spanning more than 100 years. Nordstrom has been a leading specialty fashion retailer since 1901 for men, women, and children. In addition to clothing, the retailer has shoes and accessories. There are 347 Nordstrom store locations in the U.S. and Canada, and they also operate the outlet Nordstrom Rack, with discounted designer items.

In terms of being one of the leading clothing stores with credit cards, consumers have several options including the Nordstrom Visa Signature®, the Nordstrom Retail Card, and the Nordstrom Debit Card.

Key Factors That Led to Our Ranking of This as One of the Top Store Credit Cards

The Nordstrom Visa Signature® is one of the store credit cards included on this list of the best store credit cards for reasons like the ones listed below.

Nordstrom Rewards

If you’re a frequent Nordstrom shopper, this card can carry with it some excellent rewards and exclusive benefit opportunities, and it’s for these reasons this card is part of this ranking of the best department store credit cards and clothing store credit cards.

The rewards system for Nordstrom cardholders is tiered. So all customers begin at level one, and then there are three other levels they can achieve, depending on how much they spend.

As cardholders who have this leader among the top store credit cards spend more, they start earning what’s called Nordstrom Notes. Nordstrom Notes can be used in exchange for cash back and other benefits.

Bonus Points Events

The Nordstrom card is one of the best store credit cards for many reasons, including how easy it is to earn points and move to the next rewards level if you’re a frequent shopper.

Then, on top the already existing straightforward nature of the program that comes with this best store credit card, cardholders have frequent opportunities to earn bonus points throughout the year.

During these regularly held bonus points events, cardholders can earn up to six points per dollar.

As an example, this would mean a cardholder who spent $334 during a Triple Points event when then be eligible to receive a $20 Nordstrom note.

Exclusive Events

Another perk that comes with the Nordstrom card, ranked as one of the leading clothing store credit cards and overall retail store credit cards, is exclusive and first access to various sales and events held by the store throughout the year.

For example, the Nordstrom Anniversary Sale is one of the biggest events of the year featuring excellent deals on designer items, and cardholders get to view the sale items and have access to them before the sale starts for the general public.

Also, certain cardholders that have reached level 2, 3, or 4 of the rewards program get to attend a special private holiday shopping party, only open to Nordstrom cardholders.

Competitive APRs

As has been mentioned throughout the entirety of this ranking of the leading department store credit cards and the best clothing stores with credit cards, it’s important for consumers to be careful and make sure they know what the interest rates will be before selecting a card. Store credit cards tend to have comparatively high interest rates, but this isn’t the case with the Nordstrom Visa Signature Card.

The APR for this card ranges from 11.15% to 23.15%, and it’s one of the few department store credit cards or general store credit cards with a tiered interest rate level based on creditworthiness.

This card can also be used for non-Nordstrom purchases, although the APR is slightly higher than what it is for Nordstrom purchases.

Nordstrom is also one of the clothing stores with credit cards that doesn’t have an annual fee.

Don’t Miss: Best Commerce Bank Credit Cards | Reviews | Commerce Bank Rewards, Secured, Business Cards

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Target REDcard™ Review

The Target REDcard™ is one of the leading department store cards available from national retailer, Target. While Target is considered a discount retailer, the company has worked to bring customers partnerships with high-end designers and brands to offer exclusive lines and products. Target is the second-largest discount retailer in the U.S, behind only Walmart.

It’s headquartered in Minneapolis, and it’s a favorite among shoppers, which is why their store credit card can be a great option for many consumers searching for stores that offer credit cards boasting excellent deals and value.

Key Factors That Led to Our Ranking of This as One of the Best Department Store Credit Cards

The Target REDCard is included in this ranking of department store cards and the top store credit cards for factors listed below.

5% Back on Everything

Typically when you’re comparing department store credit cards and looking at stores with credit cards, there’s a common theme. You’ll get a discount or reward for signing up for the card, but then after that first day, there aren’t more rewards.

The Target REDCard stands out from many other stores with credit cards because it features 5% back, all the time. This is a high amount of cash back, particularly considering even some of the best rewards cards offer only around 2 percent cash back.

If you’re a frequent Target shopper and plan to pay off your balance quickly, this leader among the best store cards is an excellent option.

Source: Target REDcard™

Shipping

What’s great about the Target REDCard, as compared to other stores that offer credit cards and department store cards, is that the benefits and features of the card are valuable in real world situations and are realistic for a variety of people who do a lot of shopping at this store.

For example, REDcard holders get free shipping on most of their orders they place at Target.com.

They also have the opportunity to take advantage of an extra 30 days to make returns.

Additionally, it’s important to note that this card doesn’t have an annual fee.

Extra Discounts

Perhaps the biggest reason the Target REDCard is included on this list of the best department store credit cards and retail store credit cards is because of the significant 5% discount on most purchases. Aside from that, this card represents an excellent value in other ways too.

For example, the card can be used along with Cartwheel discounts to maximize savings. The Cartwheel app is a Target exclusive featuring weekly specials and discount coupons within the app that help people save on everything from home décor and groceries.

The card can also be used with many coupons and other store promotions offered by Target. With such a wide variety of products, including clothing, household supplies, and fresh and packaged groceries, this card can be really versatile and useful.

That sense of versatility is one of the reasons it’s ranked as one of the best store cards on this ranking of the top store credit cards.

Simple to Use

Another reason the REDCard ranks well among stores with credit cards and the best department store credit cards is that it’s just easy to use. The rewards program is very straightforward, since you’re just getting a straight 5% discount, and you don’t have to worry about tiered rewards or anything similar.

Also, it’s easy to activate and manage the card once you have it.

Target has an online platform for easy card management.

Additionally, this leader among store credit cards features chip and PIN security mechanisms for peace of mind.

Free Wealth Management for AdvisoryHQ Readers

TJX Rewards® Credit Card Review

The TJX family of companies is one of the most popular retail groups in the U.S. TJX companies include T.J. Maxx, which was founded in 1976 and is one of the largest off-price retailers in the U.S. There are more than 1,100 T.J. Maxx Stores across 49 states, and there is also a T.J. Maxx e-commerce site.

Also part of TJX Companies are Marshalls, HomeGoods, and Sierra Trading Post in the U.S. The TJX Rewards® Credit Card represents one of the excellent department store cards with flexibility and opportunities to gain benefits from using the card.

Key Factors That Led to Our Ranking of This as One of the Top Store Credit Cards

When looking at stores with credit cards and clothing store credit cards, the following are specifics of why the TJX Rewards card was included on this list of the top store credit cards.

Rewards

If you’re a frequent shopper at the TJX family of companies, you’re likely to find the rewards program that comes with this store credit card particularly appealing. The rewards program is an essential reason it was named as one of the leading department store credit cards.

The rewards program with this best store credit card includes 5 points per dollar spent at any of the stores that are part of the TJX Companies. This includes shopping at T.J. Maxx, Marshalls, HomeGoods, and Sierra Trading Post.

What’s unique about the TJX Rewards card, as compared to many other department store cards, is that cardholders can also earn points for shopping at other stores. Points can be redeemed for 1 cent each as a certificate at T.J. Maxx and partner stores.

Bonus Rewards

The TJX Rewards card is a leader among retail store cards for a number of reasons, including the availability of bonus rewards and discounts on top of the standard rewards program that’s attached to this card.

First, cardholders receive $10 in rewards certificates for every $200 they spend, which can be redeemed at stores and online. Also, there is a bonus of 10% on a cardholder’s first in-store purchase one they open their new account.

This card has no limit to the amount of TJX Rewards a cardholder can earn, either.

If you frequently shop at the included family of stores, this can be a great option for you.

MasterCard Benefits

When looking at store credit cards and comparing the best department store credit cards, it can be good to choose a card with flexibility and offerings that are of value outside of one particular store or even a family of stores. As one of the top store credit cards, the TJX Rewards MasterCard can be attractive in this sense.

First, as mentioned above, this card includes the ability to earn rewards for spending outside of the TJX stores.

Also, it’s a MasterCard, so it has widespread acceptance most places.

The card also includes standard MasterCard benefits including 0% Fraud Liability, Price Protection, Extended Warranty Coverage, and Identity Theft Resolution.

Store Options

What’s unique about this best store credit card as compared to many other department store credit cards is that it gives you a lot of shopping options. The high-level rewards earnings opportunities are available not just at one store, but four stores, so you have a lot of choices and flexibility when it comes to how you’re earning rewards.

These stores are also found in most cities throughout the country.

This store credit card also features other unique perks such as the ability to access cash at ATMs where MasterCard is accepted.

While the interest rate is relatively high, as is the case with so many stores with credit cards, there is a lot of flexibility and other valuable features that can make it appealing to certain consumers.

Popular Article: Best Credit Cards for People with No Credit History | Ranking and Reviews

Free Money Management Software

Walmart Credit Card Review

Walmart is the largest retailer in the world and has seen tremendous growth in the past 50 years. There are more than 260 million customers that visit the more than 11,500 Walmart stores. Walmart is unique because it’s not only a retailer on a massive scale, but it’s also a discount store that works to provide the best prices possible on a broad range of items.

It’s the vast selection of already well-priced items in Walmart stores that makes their store credit card one of the most popular department store cards.

Key Factors That Led to Our Ranking of This as One of the Top Store Credit Cards

When looking at department store credit cards and the overall best store credit cards, the following details highlight why the Walmart Credit Card is part of this list.

Discounts

Like so many of the retail store credit cards on this list of the top stores that offer credit cards, the Walmart card features great discounts that make it appealing to consumers who want to save money on the items they’re already purchasing.

To begin, this selection for a best store credit card includes 3% savings every day on Walmart purchases. The savings and reward program included with the Walmart card, one of the best department store credit cards is called 3-2-1.

In addition to the 3% everyday savings when shopping at Walmart and on Walmart.com, consumers get 2% on eligible fuel purchases and 1% back on other purchases everywhere the card is accepted.

Credit Score

One of the things that can be appealing about the Walmart Credit Card as compared to many other retail store credit cards and options from stores that offer credit cards is the fact that it’s relatively easy to qualify for. It’s a good store credit card for someone who frequently spends money at Walmart and might not have a credit score that would allow them to qualify for a card elsewhere.

Even though store credit cards can have certain negative things associated with their usage, this card can be a good option for someone who wants to establish or rebuild their credit, while saving money on everyday purchases at the same time.

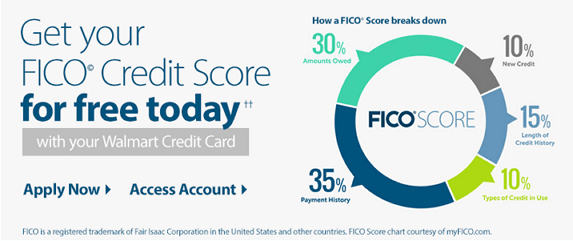

It can be a good choice for someone who has a FICO score of less than 630, and they will have the benefit of not only saving on Walmart purchases but also the cost of gas.

Free Credit Score

One of the most unique features of this card that makes it stand out from the other best store credit cards and best department store credit cards in this ranking is the inclusion of a free FICO Credit Score.

Cardholders can enroll in electronic statements that will show them their credit score.

The FICO Score that comes with their electronic statement will include a breakdown of why they have the score they do and what’s negatively impacting their score. This can help cardholders not just have a unique opportunity to save money with one of the best store credit cards, but also to see how they can improve their credit and monitor it over time.

Source: Walmart

Promotions and Special Events

The Walmart Card, one of the best store cards for people looking for an option if they have low or average credit and want to save money, also includes regular promotional deals that can add extra value to the card.

As one of the top store credit cards, customers will frequently find promotions such as the one happening right now that allows new cardholders to save up to $50 after opening a card and using it to make purchases at Walmart.

There’s also another simultaneous offer available from the Walmart Card, one of the best store cards, which includes a $10 eGift Card when a new cardholder makes their first Walmart Pay purchase with their Walmart Credit Card.

Conclusion—Top Store Credit Cards

Store credit cards can be a mixed bag from the perspective of the consumer. Before choosing clothing store credit cards, department store credit cards, or general retail store credit cards, it’s important for consumers to think about some things.

The first is the overall cost of store credit cards. Many of even the best department store credit cards and top store credit cards have high interest rates, so they’re frequently best for consumers who are going to pay their balance quickly.

When looking at top store credit cards, it’s also important to think about how much use you would actually get from the card, and whether or not it would be worth it to you in terms of the features and rewards that come with the store credit card.

Finally, before deciding on even the best store credit cards, think about whether or not you might get better value from using a card not affiliated with a retail store.

Once you’ve considered these issues, you can start thinking specifically about the stores that offer credit cards that would be of the most value to you. The above names on this list of the best store cards and the top store credit cards include good rewards, cash back, and discount programs, as well as other features such as acceptance at other retailers and bonus offers.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.