2017 RANKING & REVIEWS

TOP RANKING BEST VA LOAN CALCULATORS

2017 Guide: Finding the Best VA Loan Calculators

Since its inception in 1944, the Veteran’s Affairs mortgage — commonly called the VA loan — has been an integral military benefit. In fact, VA lenders have provided housing for over 20 million veterans and family members.

As the housing market slowly recovers, VA loans will continue to increase in popularity and value. With 0% down, no mortgage insurance requirements, and competitive interest rates, these mortgages are the last of their kind.

For military homebuyers, a VA loan is often a crucial lifeline, making it a crucial component of their military benefits.

Award Emblem: Top 6 Best VA Loan Calculators

Whether you are a retired service member with a current VA loan or an active duty member weighing options, a VA loan down payment calculator or a VA refinance calculator can be a valuable financial tool.

Taking out a loan can be a complicated process, and VA loan calculators provide simplified estimates of how a mortgage can fit into your financial plan.

Our review will take a close look at the top-rated VA loan calculators, highlighting the best VA calculator for veterans and active duty service members to evaluate the affordability of their mortgage.

See Also: Which Is the Best Mortgage Calculator? Zillow? Bankrate? SmartAsset? | Calculators with PMI, Taxes, & Insurance

AdvisoryHQ’s List of the Top 6 Best VA Loan Calculators

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that calculator):

- VA Funding Fee Calculator from Veterans United

- VA Home Loan Payment Calculator from Veterans United

- VA Loan Calculator from Bankrate

- VA Loan Limit Calculator from Veterans United

- VA Mortgage Calculator from VALoans.com

- VA Mortgage Calculator With Taxes by VALoans.com

Image Source: Pixabay

Top 6 Best VA Loan Payment Calculators | Brief Comparison & Ranking

VA Loan Calculators | Used for | Inputs | Best for |

| VA Funding Fee Calculator from Veterans United | Estimating one-time payment amount for VA funding fees | Loan type Military experience Purchase price Down payment Loan term | Viewing estimations on funding fee percentages |

| VA Home Loan Payment Calculator from Veterans United | Creating potential monthly payment amounts | Loan type Service type Purchase price Loan rates & terms Credit score Property taxes Home insurance | Seeing a comprehensive breakdown of total cost (purchase loans & refinancing) |

| VA Loan Calculator from Bankrate | Calculating monthly payments | Loan amount Loan rates & terms Start date Extra payments | Those who prefer to have an amortization table |

| VA Loan Limit Calculator from Veterans United | Estimating VA loan limits | State City | Finding loan limits for specific states & counties |

| VA Mortgage Calculator from VALoans.com | Determining maximum loan qualification | Income Property taxes Home insurance Car payment Credit card bills Loan terms & rates | Seeing how debt-to-income ratio affects loan eligibility |

| VA Mortgage Calculator With Taxes from VALoans.com | Estimating monthly payments with taxes & insurance | Purchase price Down payment Loan rates & terms Property taxes Home insurance | Those who want a comprehensive estimation of affordability |

Table: Top 6 Best VA Loan Calculators | Above list is sorted alphabetically

VA Loans vs. Traditional Mortgages

Before using VA loan calculators, it’s important to understand the different components of a VA loan. These types of mortgages vary from traditional mortgages, meaning that potential homebuyers should always use a VA loan calculator rather than a traditional mortgage calculator.

Compared to a traditional mortgage, a VA mortgage comes with:

- No down payment requirements- Compared to the 20% down payment that traditional mortgages typically require, this is an incredible benefit for service members.

- No private mortgage insurance- Because VA loans are backed by the government, VA lenders do not require homeowners to purchase mortgage insurance.

- Competitive interest rates- Banks see VA loans as less of a risk, as they come with government backing. As a result, interest rates are often much more affordable through VA lenders.

- Greater accessibility- With fewer requirements, no insurance requirements, and lowered interest rates, VA loans are extremely accessible and affordable for those who qualify. Thus, these loans are also popular refinancing choices, making a VA refinance calculator an important tool.

Of course, as with any loan, there are certain limitations and fees associated with a VA loan. Potential homebuyers who want to use a VA loan payment calculator should keep the following components in mind:

- Loan limits- VA lenders place limits on VA loan amounts, and these limits vary from one area of the country to the next. While most veterans qualify for up to $417,000, this can change depending upon the county.

Using a VA loan amount calculator can help determine how surrounding property values and economic health will influence loan amounts.

- Funding fees- This one-time fee is paid directly to the VA, enabling these loans to continue to be dispersed. On average, funding fees tend to range between 2.15%-3.3% of the purchase price.Using a VA percentage calculator or a VA loan rates calculator can provide an estimation on what type of funding fees your mortgage will carry.

Don’t Miss: Which Mortgage Calculator Is the Best? Yahoo? Bankrate? Dave Ramsey Mortgage Calculator?

Different Types of VA Loan Calculators

Taking out a mortgage can be a complicated process, even when using VA loans. There are multiple types of VA loan calculators that are formatted for specific financial situations.

When looking for a VA loan calculator, it’s important to find a VA calculator that fits your individual needs. While there are many calculating tools available, the most popular VA loan calculators will fall into one of these categories:

- VA loan qualification calculator- For service members who have not yet taken out a mortgage, a VA loan qualification calculator is a great way to independently determine eligibility before beginning the process.

- VA percentage calculator- This type of calculator can help determine what percentage of the purchase price will be allocated to the funding fee. Depending upon the provider, the VA calculator may also evaluate interest rates.

- VA loan payment calculator- Following traditional payment calculator models, a VA loan payment calculator can assist potential homebuyers by providing an overview of payment amounts. This type of VA loan calculator is great for those who want an estimate of monthly affordability, or who want to use a VA loan down payment calculator to find the most beneficial down payments.

- VA refinance calculator- Most VA loan calculators can also be used as a VA loan refinance calculator. With competitive rates and affordable requirements, refinancing with a VA loan is becoming incredibly popular, as we said previously.

When looking for the best VA loan calculators, the key is to choose the financial tool that fits your unique situation.

Understanding the differences between a VA loan payment calculator, a VA refinance calculator, or a VA percentage calculator can make searching for VA loan calculators into a much more streamlined process.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best VA Loan Calculators

Below, please find a detailed review of each calculator on our list of VA loan payment calculators. We have highlighted some of the factors that allowed these VA loan calculators to score so highly in our selection ranking.

VA Funding Fee Calculator from Veterans United Review

As a VA-approved lender, Veterans United offers many valuable services for military members, including their collection of VA loan calculators.

Their VA Funding Fee Calculator is a great option for those who want to use a VA loan amount calculator to see how the funding fee will factor into the loan total

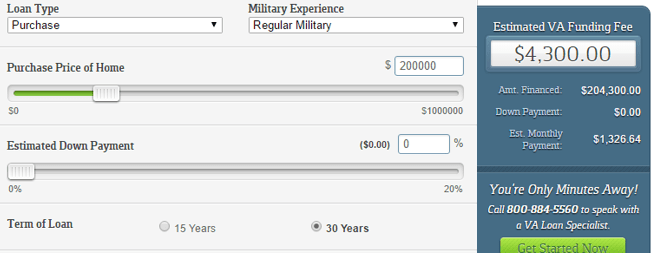

Image Source: Veterans United

How It Works

This VA loan payment calculator uses financial information to estimate the funding fee for any VA mortgage. Funding fees are estimated through the following information:

- Loan type & military experience: Choose from regular, reserves, or retired

- Purchase price: Sliding scale up to $1 million

- Estimated down payment: Sliding scale up to 20%

- Loan term: Choose between 15- or 30-year terms

Once the criteria is entered, this VA loan payment calculator will display the estimated funding fee, total loan amount, and monthly payments.

Why It Makes the Top List

Not only is this VA loan amount calculator easy to use, but it covers an aspect of VA mortgages that is often forgotten. Many VA loan calculators leave out the funding fee, which may not provide an accurate estimation.

Another great aspect of this VA loan payment calculator is that it allows for advanced estimations. Users can choose to also include property taxes, credit score, and homeowner’s insurance to see an estimated interest rate for the loan.

Additionally, there may be value in using this VA loan payment calculator as a VA refinance calculator. Simply change the loan type to create a VA loan refinance calculator.

Related: The Best Military Retirement Calculators for Active & Reserve Military Personnel

VA Home Loan Payment Calculator from Veterans United Review

For those who want to view a comprehensive estimation for monthly payments, the VA Home Loan Payment Calculator is a great place to start. This tool provides a clear financial overview for potential homebuyers to see exactly what they are paying for with their VA loan.

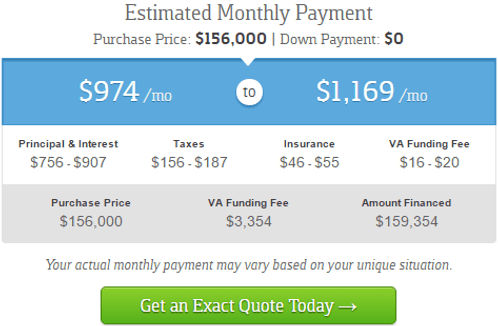

Image Source: Veterans United

How It Works

This VA loan payment calculator uses a core set of financial information to determine monthly payments, including a structured breakdown of each separate cost.

- Loan type & service type: Choose between Military, Reserves, National Guard, or Surviving Spouse

- Purchase price: Sliding scale up to $500,000

- Down payment: Sliding scale up to 20%

- Loan term: An estimated rate is provided for 15- and 30-year terms

- Credit score

- Property taxes: Sliding scale up to 2.5%

- Homeowner’s insurance: Sliding scale up to 0.5%

Once data is entered, this VA loan rates calculator will provide an estimated range for a number of monthly payments, including loan principal, interest, taxes, insurance, and funding fees.

Why It Makes the Top List

The VA Home Loan Payment Calculator provides much more than a simple estimation of monthly loan payments. Users can see a specific breakdown of what the total loan cost consists of, which can be extremely helpful in determining long-term affordability.

It’s also one of the most versatile VA loan calculators on our list, as it can also be used as a VA refinance calculator.

Those looking to use a VA loan refinance calculator can simply change the loan type to either an interest rate deduction or a cash-out refinance loan to create an efficient VA refinance calculator.

VA Loan Calculator from Bankrate Review

As a simple, straightforward VA calculator, the VA Loan Calculator is a great tool to consider using. Bankrate is well-known for providing useful financial tools, and their VA loan calculators are certainly worth a try.

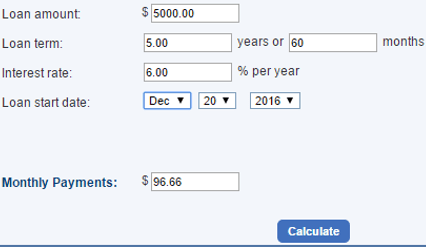

Image Source: Bankrate

How It Works

This VA loan rates calculator requires a few pieces of financial information to calculate monthly payments:

- Loan amount

- Loan term (years/months)

- Interest rate

- Loan start date

For those who want to use a VA loan payment calculator to see long-term effects of extra payments, the VA Loan Calculator from Bankrate allows for extra monthly, yearly, or one-time payments.

Why It Makes the Top List

For some users, less is more, and Bankrate provides straightforward and simple VA loan calculators.

Despite requiring a small bit of data, this VA loan payment calculator does provide a full amortization table to demonstrate how monthly payments affect the life of the loan.

For those looking for a VA refinance calculator, the ease of use and quick results from this VA calculator may be a great fit.

Popular Article: Which is the Top UK Mortgage Calculator? HSBC? Santander? NatWest? RBS?

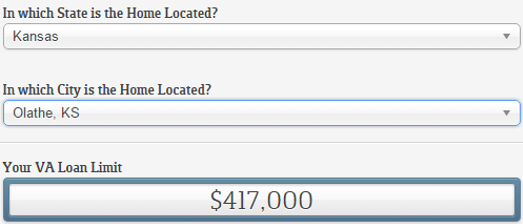

VA Loan Limit Calculator from Veterans United Review

Although it is one of the simplest VA loan calculators on our list, the VA Loan Limit Calculator from Veterans United is also one of the most useful. While most eligible loans cap off at $417,000, there are certain states and cities that allow borrowers to qualify for larger amounts.

For potential homebuyers who are nearing the standardized limit, it may be worthwhile to use this calculator.

Image Source: Veterans United

How It Works

Simply enter your state and city into the VA loan qualification calculator to find out if your area allows for larger or smaller loans.

Why It Makes the Top List

While it’s common knowledge that VA loans are eligible up to $417,000, it’s difficult to find out which cities allow for larger amounts.

Because not many sources provide this information, this tool can provide valuable insight into financial limitations or freedoms.

Potential homebuyers who are close to the standardized limit should certainly consider using the VA Loan Limit Calculator.

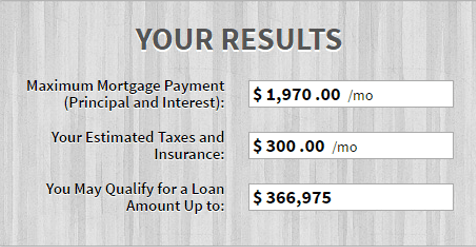

VA Mortgage Calculator from VALoans.com Review

For those who want to see what loans they are eligible for, the VA Mortgage Calculator offers a comprehensive and beneficial way to estimate loan qualification.

The calculator uses debt-to-income ratio to gage results, taking a standard rate of 41% as accepted by the VA.

Image Source: VALoans.com

How It Works

To determine what loan amount you may qualify for, simply add the following monthly figures into the VA loan payment calculator:

- Income

- Property taxes

- Insurance

- Car payments

- Credit card bills

- Loan terms

- Interest rate

After calculating, this tool will use the debt-to-income ratio to show the maximum payments that would fit into a monthly budget and estimated loan qualification.

Why It Makes the Top List

For those looking to see the affordability of a loan over time, this VA loan qualification calculator is a great option.

Using debt-to-income ratio is a very efficient method of determining whether a mortgage payment can fit into an existing budget, making it a valuable tool for any prospective homeowner.

Free Wealth & Finance Software - Get Yours Now ►

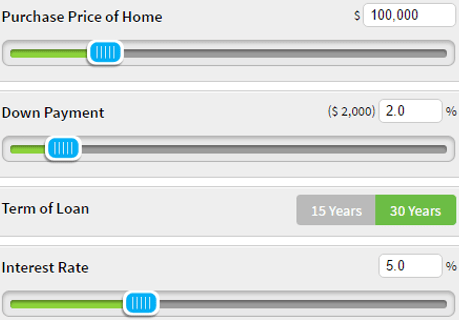

VA Mortgage Calculator With Taxes from VALoans.com Review

As a VA loan calculator with taxes, the VA Mortgage Calculator With Taxes is a good choice for those who want a complete overview of their monthly payments.

Not many VA loan calculators include tax payments, making this VA loan calculator with taxes stand out among the rest.

Image Source: VALoans.com

How It Works

This VA loan payment calculator is relatively simple, though it provides enhanced results. Users input loan and property information, including:

- Purchase price

- Down payment

- Loan rates & terms

- Property taxes

- Homeowner’s insurance

Results show an estimation for monthly payments, including taxes, insurance, and even VA funding fees.

Why It Makes the Top List

Just like the previously reviewed VA loan calculators from VALoans.com, this VA loan calculator with taxes uses debt-to-income ratio to create an accurate estimate for monthly costs. Since it includes VA funding fees, debt-to-income ratio is crucial, as it can vary from one financial situation to the next.

It can also be used as a VA loan down payment calculator, as users can easily change their input to see how down payments affect monthly payments.

Read More: Top Prepaid MasterCard Cards | Ranking | Details on MasterCard Gift, Secured, Reloadable Cards

Conclusion – Top 6 Best VA Loan Calculators

The VA loan is a great option — and often the most beneficial — for service members to purchase a home, whether active or retired. With relaxed requirements, no mortgage insurance, and competitive rates, the popularity of VA loans will likely remain.

VA loan calculators can be valuable supplements for those looking to sign up for a VA home loan. These financial tools can provide guidance for those who are unsure whether a VA loan will be affordable over time.

When looking for a VA refinance calculator or a VA loan payment calculator, keep in mind that each calculator will focus on different aspects of the loan. Choose VA loan calculators that address your specific questions about VA loans in order to get the maximum benefit from these financial tools.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.