Overview: Betterment IRA Review | Read Before Rolling Over Your 401(k), ROTH or SEP IRA

There are many good reasons to consider rolling over your 401(k) plan to a Betterment IRA, Betterment Roth IRA, or Betterment SEP IRA account. However, before you take measures to do so, it is wise to assess your options and circumstances to ensure you are making the right choice.

With that idea in mind, you may want to begin by learning everything you can about Betterment LLC and by evaluating the features of their products and services.

To help you determine your next move, we have collected and studied Betterment IRA investing products, evaluated numerous Betterment IRA reviews, and analyzed a variety of other resources, including Betterment Roth IRA reviews.

Image Source: Betterment

Betterment Gets Down to Business

Betterment is a well-known, extremely large robo-advisor (automated investing service) that specializes in financial products and services that can help customers keep their funds and investments in order. CNN Money reports Betterment now serves over 168,000 customers and manages $4.8 billion in assets.

The Wall Street Journal reported in early 2015 that new funding valued it at almost $500 million, and that number has likely risen since then. In addition, Betterment is staffed by a qualified team of experienced and knowledgeable financial experts that are ready to serve customers seven days a week.

“We set out to deliver sophisticated financial products and advice to everyone, with the goal of investing made better.”

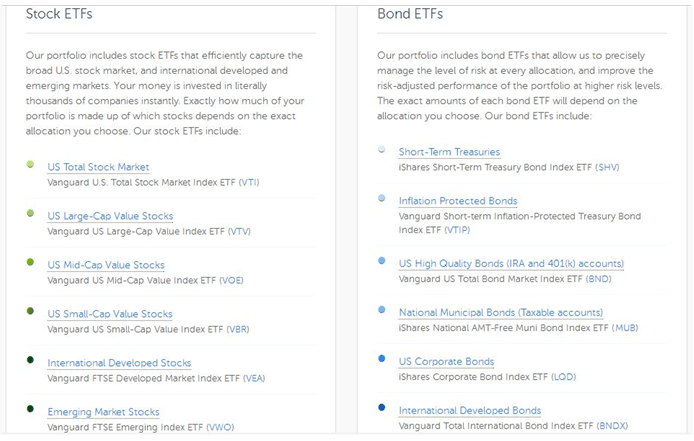

Betterment offers a diverse portfolio of index-tracking exchange-traded funds (ETFs), with services covering wealth building investments, trusts, tax-loss harvesting, and savings opportunities.

In addition, Betterment offers various types of retirement planning and management strategies, such as an easy-to-use RetireGuide™, one of their retirement planning tools.

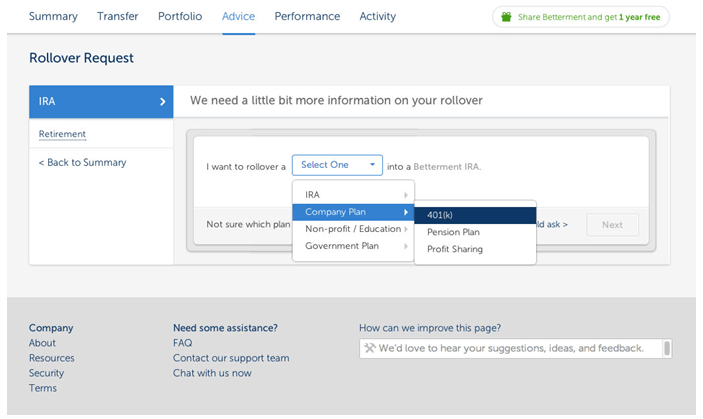

Customers can also customize retirement accounts and roll over existing 401(k) plans for wealth-building savings plans, such as traditional Betterment IRAs, Betterment Roth IRAs, and Betterment SEP IRAs.

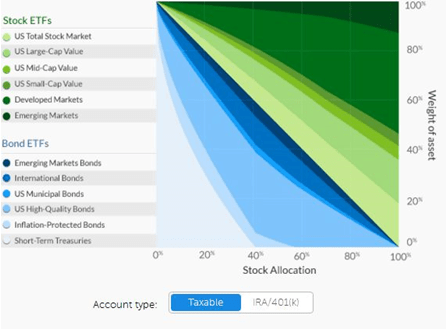

Image Source: Betterment

Betterment IRA Reviews

Betterment IRA reviews and Betterment Roth IRA reviews can be found in many financial hot spots across the internet.

For instance, InvestorJunkie.com gives Betterment a 5-star rating, citing goal setting features as helpful. They also mention that the low-cost and simplicity make it great for new investors and young people.

The website CashCowCouple.com echoes that theme by stating, “If you don’t want to manage your own portfolio, or hire a financial advisor, Betterment is tough to beat for the very low price.”

But what about those who actually use Betterment? Look no further than Mr. Money Mustache, who actually posts how his Betterment account is faring and updates it regularly. He has strong feelings about his reasons for choosing Betterment, too:

“In two words, technology and psychology are what attracted me to this company. At the core, Betterment is just a fancy frontend for Vanguard funds – when you invest with Betterment, you end up owning Vanguard funds just like a wise person would already do. But they add value by automating two things that actually allow you to earn and keep more money: automatic portfolio rebalancing, and tax loss harvesting.”

Whether you are considering a Betterment Roth IRA, want to know more about Betterment SEP IRAs or are interested in Betterment IRA investing, many of these reviews may be worth exploring.

“Betterment’s end-to-end investing experience means faster cash transfers and 60-second rollovers.”

Don’t Miss: WiseBanyan Review | Robo Comparison (Wisebanyan vs Betterment)

Questions to Ask

If you currently maintain an IRA or 401(k) account that you’ve owned for quite some time, here are several questions that Betterment suggests you should be able to answer:

- Does my existing account support my goals and aspirations?

- Has my account been routinely rebalanced and maintained to meet my needs?

- Have I been required to pay unusually high fees or have some fees buried?

If you can’t fully answer those questions or if the answers do not satisfy all of your overall financial objectives, do not feel bad. Many people have had a similar experience.

Fortunately, the Betterment support team can work with your existing 401(k) or IRA administrator to help you find answers to those types of questions.

If needed, they can also accomplish an easy transition of assets to improved programs, such as traditional Betterment IRAs, Betterment Roth IRAs, and Betterment SEP IRAs. “Betterment provides a dedicated rollover concierge to each customer rolling over retirement assets.”

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Determining Your Needs

It’s not always easy to figure out which type of IRA you need. It can depend on existing retirement accounts that you already have in place, whether or not you are married, your age, and what you think your income bracket might be down the road.

To ensure their customer decision-making process is successful, Betterment offers a step-by-step Betterment IRA calculator on their website that helps customers to verify what sort of account they need. The calculator takes into account IRA income eligibility, employer plan matching benefits, and current and future tax rates.

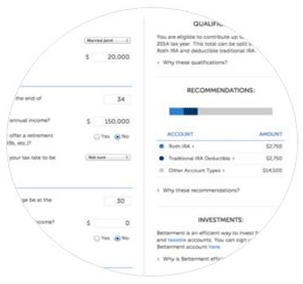

Image Source: Betterment

Although individuals may possess many IRAs at the same time, the yearly contribution for all accounts cannot exceed $5,550 for individuals under 50 years old, and $6,500 for individuals over 50 years old.

You may, in fact, meet the criteria for many types of retirement accounts, and you may find it advantageous to do so. It just depends on how much money you earn, your age, and the amount of money you place in each of your accounts.

Tax Advantages

According to the Internal Revenue Service (IRS), should you decide to roll over pre-retirement payments from an IRA account, you typically aren’t required to pay taxes on funds the account contains until you decide to withdraw it. The IRS further states that existing and qualifying IRAs can be rolled over by depositing the payment into another IRA account.

Typically, this should be done within 60 days. Your IRA plan administrator or a financial institution (such as Betterment) can directly transfer the payment to a new plan, such as a Betterment IRA or Betterment Roth IRA. The IRS notes that not only can this practice save money for your future, but your money will still be tax-deferred until it’s withdrawn.

Choosing or switching to the right Betterment IRA, Betterment Roth IRA, or Betterment SEP IRA plans can often create additional tax advantages. To select the best IRA type for your needs, Betterment created a Betterment IRA calculator, which will walk you through the process.

You may also find it helpful to thoroughly review tax rules and regulations offered in IRS publications, including those for traditional IRAs and Roth IRAs and SEP IRAs. In addition, it may also be beneficial to explore plans sponsored by employers or request advice from tax experts.

Image Source: Betterment IRA Review

Depending on your situation, these examples show the primary tax advantages and caveats you can expect:

- Traditional Betterment IRAs — Contributions can be tax-deductible, and growth is tax-deferred. Taxes are paid when withdrawn in retirement. (Since Betterment does not offer tax advice, it’s a good idea to speak with tax experts and review IRS publications for traditional IRAs and Roth IRAs.)

- Betterment Roth IRAs — Contributions are not tax-deductible; however, eligible withdrawals and growth are not taxed at all. (As a rule, funds that are converted from traditional Betterment IRAs to Betterment Roth IRAs that were previously deducted will be subject to income tax. Betterment avoids withholding your taxes since it reduces the amount of money that can grow tax-free in your Betterment Roth IRA. Since Betterment does not offer tax advice, it’s a good idea to speak with tax experts and review IRS publications for traditional IRAs and Roth IRAs.)

- Betterment SEP IRA — If they are not in excess, contributions are not included in an employee’s gross income, and there are no negative tax consequences for a direct transfer. (Since Betterment does not offer tax advice, it’s a good idea to speak with tax experts and review IRS publications for SEP IRAs.)

Related: Are Robo Advisors Worth It? Want Help Managing Risk? (Investment News & Strategies)

Beneficial and Easy Rollovers

There are several benefits to rolling over an existing 401(k) plan to a Betterment IRA. For example, most customers find they receive lucrative Betterment IRA investing options.

“Betterment makes rollovers simple and efficient — minimizing your time and keeping costs low so we can maximize your money’s growth.”

When customers roll over to Betterment IRAs, they need not bother with a large quantity of aggravating paperwork, and they can be invested in just a few days. In addition, the fees associated with Betterment IRAs are often remarkably lower than those associated with former 401(k) plans.

The Wall Street Journal states that, in the past, investment management fees often hovered at approximately 1.0% per year. However, Betterment’s intelligent technology strategies allows them to offer customers substantially reduced fee schedules, which leaves the operation with more money for investment opportunities.

Best of all, the organization offers a one-minute Betterment rollover request tool. Rendered results include products such as Betterment IRAs and Betterment Roth IRAs that typically include features such as:

- Diverse portfolio of ETFs

- Low fees

- Smart rebalancing

- Personalized advice

- Extreme tax efficiency

- Tax loss harvesting

Image Source: Betterment

Popular Article: Robo-Investing – What You Should Know! (Automated Stock Trading & Overview)

Increasing Your Investment Options

Unlike other financial products, Betterment IRAs offer a plethora of investing opportunities.

For instance, traditionally when employees continually contribute to their company’s 401(k) retirement plan, they may only have a limited selection of investment options, especially when employers choose company stocks that do not perform or invest in expensive mutual funds that do not yield expected results.

They can end up with investments that cannot help them further their financial goals.

Rolling over to Betterment IRA investing accounts offers a solution to inadequate or outdated 401(k) plans. Betterment IRA investing accounts provide customers with abundant opportunities to achieve expansive financial goals.

Because Betterment IRAs are individual accounts, they can lead to a broader range of investment prospects, including cash, bonds, stocks, and other assets. Customer deposits at Betterment are invested in assets that have been optimized for greater asset allocation.

Image Source: Betterment

Betterment carefully selects stock and bond ETFs that are favorably weighted to offer progressively increased amounts of risk and significant potential returns. Low-risk portfolios can have more short-range government-secured bonds and are sometimes coupled with stocks that do not dramatically fluctuate.

When customers prefer to move up the allocation range, Betterment establishes bonds and stocks with higher risk; however, they also offer a greater chance for higher returns.

The Right Choice

When assessing their financial needs, including the option to roll over 401(k) plans, many customers report that Betterment successfully meets their goals.

But is it right for you? Study up and compare reviews and options offered by financial intuitions, including Betterment and its competitors, to make the best decision you can for your specific needs. And don’t be afraid to seek out expert advice from a tax accountant or financial advisor.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.