Intro: Betterment Tax loss Harvesting

Betterment’s Tax Loss Harvesting service is offered as a free service for those who have an account with the company. Due to this service becoming highly popular, an in-depth Betterment Tax Loss Harvesting review is needed so that investors can make informed decisions.

Image Source: Betterment Tax Loss Harvesting

See Also: Are Robo Advisors Worth It? Want Help Managing Risk? (Investment News & Strategies)

How Betterment Tax Loss Harvesting Works?

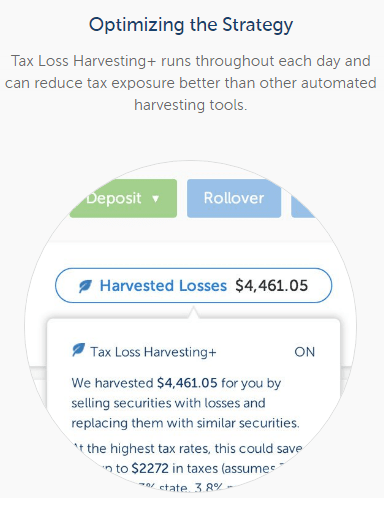

Betterment’s tax loss harvesting is the practice of selling a security (stock, bond, ETF, etc.) that has experienced a loss. By “harvesting” this loss, you are able to offset taxes on both the gains and income that you make on other securities. The sold security is replaced by a similar one, maintaining the optimal asset allocation and expected returns in your Betterment managed portfolio.

In the end, utilizing a Betterment Tax Loss Harvesting strategy results in a more balanced investment portfolio.

Robo-investment firms like Wealthfront also use a tax loss harvesting process for their clients.

Image Source: Betterment Tax Program

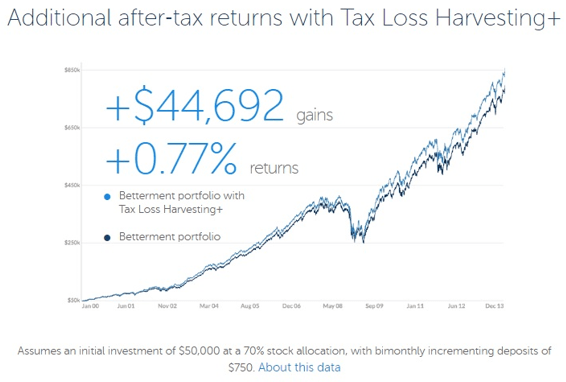

Betterment Tax Loss Harvesting is not a new idea. However, the automated approach that this program takes claims that it can offer fewer losses and lower taxes for investors.

Thus, it has become a topic of discussion within the financial community. Betterment research shows that, through utilizing the Betterment tax loss program, a person can increase his/her returns by 0.77% each year. This data was configured utilizing the last ten years of data the company had:

Image Source: Betterment Tax Loss Harvesting

Image Source: Betterment Tax Loss Harvesting

The Goals and Benefits of Betterment Tax Loss Harvesting

In its white paper on the Betterment tax loss harvesting program, Betterment goes into detail about many issues surrounding ETF investments and how its program works better than an individual or other computer programs on the market.

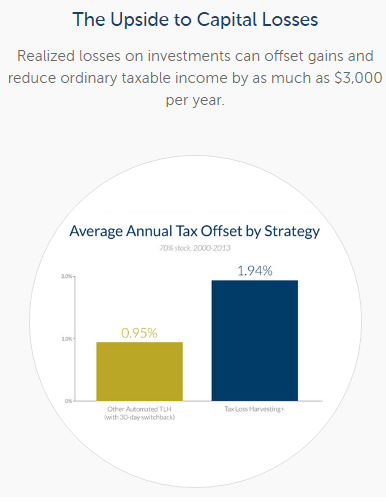

In highlighting the Betterment tax loss harvesting program, the company points out:

- This service is performed daily on those who have accounts with Betterment.

- It is fully automated, meaning you do not have to go into your account to do this or ask for this to be performed.

- It can be used to offset up to $3,000 of your ordinary income through the year.

- If the losses are still present after this $3,000 milestone, you can carry balances forward indefinitely with current tax laws in place.

Don’t Miss: Betterment vs. Wealthfront – Rankings & Review

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Methods Used to Lower the Tax Bill

While many believe that the Betterment tax program utilizes tax deferral, the program instead offers numerous methods for lowering the tax bills of investors. The four methods stated include:

1. Tax deferral – with this method, the taxes that you would normally incur are put off indefinitely. Tax deferral is a legal method and the most often-used method of lowering your tax bill.

2. Pushing capital gains into a lower tax rate.

3. Converting ordinary income into a long-term capital gain as the long-term capital gain is often taxed at the current rate for gain.

4. Permanent tax avoidance through using these gains as a charitable donation or bequeathing this to an heir(s).

These methods have been shown to work. Betterment Tax Loss Harvesting is simply the company putting its own spin on a practice that has been going on for decades within the investment world.

Image Source: Betterment Tax Loss Harvesting

The Wash Sale Rule: Is This a Consideration?

When trading on investments, the wash sale rule is one that has to be considered. The IRS defines a wash sale as the selling or trading of a stock or security at a loss, then following this up by purchasing an identical stock or security within 30 days of selling the original stock. If this happens, no loss can be deducted, thus you are getting no tax benefits.

The Betterment Tax Loss Harvesting program does take into consideration the wash sale rule. This is why when an ETF is sold, it is replaced with a similar investment, but not similar enough so that the IRS could state it as a wash sale. Immediately upon selling an ETF, a new one replaces it to avoid having money simply sitting in your account.

After the 30-day period has passed and the EFT is performing better, it is legal for this to be re-purchased.

Ultimately, the wash sale rule is a part of the algorithm for the Betterment tax program. Thus, users can feel confident in the new ETF purchased.

Image Source: Betterment Tax Loss Harvesting

Working with Betterment Tax Loss

For individuals who have investments with the company, they will receive Betterment tax forms during January or early February that will categorize their losses and gains. In addition, they can receive various forms throughout the year that are going to categorize what types of changes were made to investment portfolios due to the use of the tax harvesting program.

Along with receiving Betterment tax forms that are needed, Betterment offers customer service via:

- Live chat

- By phone

Users of its service will also find details about their accounts via their personal dashboards. Betterment does seem to be easy to contact and connect with, which gives the company a higher approval rating in the Betterment Tax Loss Harvesting reviews being seen online.

The Benefits of the Betterment Loss Harvesting Program

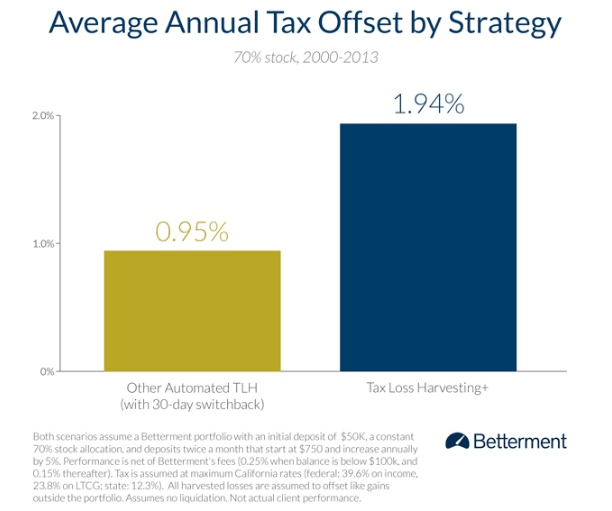

With the understanding of what the Betterment Tax Loss Harvesting program can do for you, the question to ask is whether or not this is the best product for you. Betterment states that its program runs two times better than the competition:

Image Source: Betterment Tax Loss Harvesting

These results were a test between the Betterment tax program and the 30-day switchback program that most companies utilize.

In addition to these statistics, Betterment claims:

- No client is ever exposed to short-term capital gains in order to harvest losses.

- There is zero cash drag at any time.

- The investment portfolios with the company remain balanced at all times.

- The program runs effectively with those who are also having IRA activity to avoid an overlap in losses.

Related: Betterment Review – Returns, Fees, and All You Need to Know

Is Tax Harvesting for You?

Tax harvesting is better-suited to certain investors on the market. For example, those who are investing on a short-term scale will find that tax harvesting is meant for long-term investors. For those who are at the age of retirement, tax loss harvesting would likely serve no benefit to them as they may be pulling these investments out for their retirement.

Betterment Tax Loss Harvesting is going to work best for those who make frequent deposits. The more money in which is being invested, the more harvesting that can happen, and ultimately the more money a person will be able to withdraw without incurring high taxes.

You must ask yourself if you are ready to invest for the long term and if you are willing to make deposits into your accounts frequently. For those who are not, tax loss harvesting could become a waste of time and effort. However, for those who do want to go this route, this could be a great program.

Overall, what differentiates Betterment tax programs from others on the market is the fact that it is included for free for anyone who invests with the company. In addition, regarding the statistics discovered through research, it seems to be a program that works better than the other computer programs being used by the competing companies.

Is Betterment the Best Company for You?

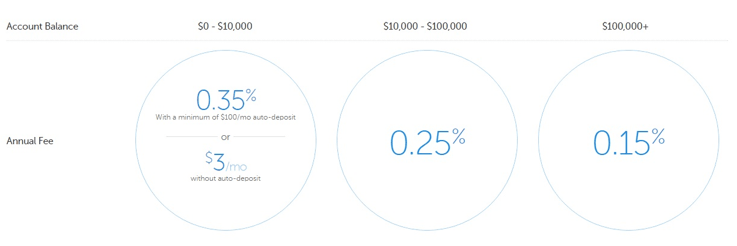

Before diving into the tax harvesting program offered, you must take into consideration the fees associated with Betterment. While the Betterment Tax Loss Harvesting program is offered at no cost to current investors, you must take into consideration the cost of investing with the firm:

Image Source: Betterment Tax Loss Harvesting

Betterment offers a pricing schedule in which the more you invest, the smaller your fee for maintaining these investments with the company are. Do note that the $3 per month is with auto deposit. A few other fee related items to consider:

- It does not charge a trade fee

- No transaction fee is charged if your withdraw or deposit into your account

- If the account has a zero balance, there is no fee charged

- The minimal deposit for opening an account is $10

The company is considered one of the top 10 online wealth management services on the market to choose from, showcasing why many people are recommending the company to others.

If you are deciding on where to invest and looking for the opportunity to have tax loss harvesting performed, then the Betterment Tax Loss Harvesting program can offer you an automated approach to what once required having a financial degree. We do hope that this Betterment Tax Loss Harvesting review has given you a better understanding of what tax harvesting is and who Betterment is as an investment company. With this information, you can now make the best decision for your financial future.

Popular Article: WiseBanyan vs. Betterment – Rankings & Review

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.