Intro—Bremer Bank Reviews & Ranking

AdvisoryHQ recently published its list and review of the top banking firms in Wisconsin, a list that included Bremer Bank.

Below we have highlighted some of the many reasons Bremer Bank was selected as one of the best banking firms in Wisconsin.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Bremer Bank Review

Bremer Financial Corporation is a $10 billion regional financial services company that was founded in 1943, named after its founder, Otto Bremer. Today, it is privately owned by the Otto Bremer Trust and Bremer employees and currently has 2,000 employees. While it is headquartered in St. Paul, Minnesota, Bremer also serves communities in Wisconsin and North Dakota.

Bremer Bank provides a wide array of banking services including wealth management, investment, trust, and insurance products. Bremer also provides services to several different industries and groups, including individuals and families, large and mid-sized corporations, small businesses, agribusinesses, nonprofits, and public and government entities.

Image Source: Bremer Bank

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our detailed review, Bremer Bank was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

Bremer Bank Review: A Focus on Non-Profits

One of Bremer Bank’s lines of business is the nonprofit sector. The firm is committed to helping nonprofit organizations meet their goals by offering unique products and services. These include:

- Endowment fund management. Bremer recognizes the unique mission and challenges of nonprofits and will create an investment strategy that is a good fit for your individual organization.

- Donor contribution programs. As a nonprofit, you want to make it simple for donors to give to your organization, whether it is by cash, debit card, credit card, check, or a direct charge right from their account. Bremer can set up convenient options to give donors a positive experience, as well as allow the nonprofit to access those funds quickly

- Private foundation establishment. Looking to set up a new foundation? Bremer Bank’s wealth management division is experienced in this area and can help you get started.

Banks do not always cater specifically to nonprofit organizations, which was a leading factor in us ranking Bremer as one of the best banks in Wisconsin. If you manage or work for a nonprofit organization, it is worth investigating what Bremer Bank has to offer.

Bremer Bank Review: Checking Accounts with Benefits

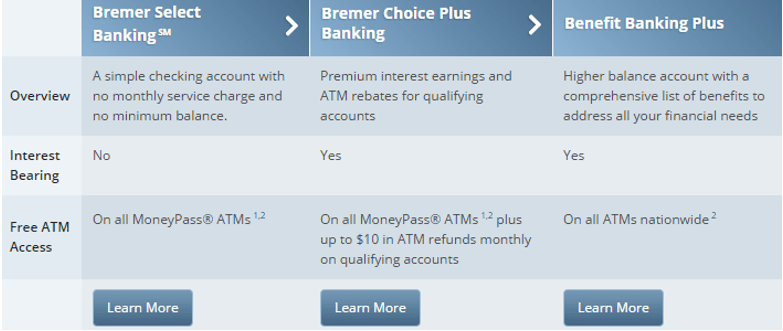

Bremer offers more than the average banks when it comes to checking accounts. Customers can choose from three different account types, each with their own benefits.

- Bremer Select Banking: This is a basic checking account. It requires a minimum $100 deposit to get started, but there is no monthly service charge, and you are not required to maintain a minimum balance.

- Bremer Choice Plus Banking: With this account, you can enjoy premium interest earnings and ATM rebates if you conduct 12 debit card transactions, have $20,000 in combined personal deposit balances, enroll in Bremer’s online banking program and sign up for e-statements, and make a minimum of one direct deposit of $500 or more to the account each month.

- Benefits Banking Plus: If you tend to maintain a high balance in your account, you can receive free products and services as well as discounted loan rates without a monthly fee with the benefits banking plus account. The account comes with perks like free mobile deposits, no transfer fees between your deposit accounts, a free safety deposit box, $750 off the costs of your first mortgage closing, and discounted loan rates.

Image Source: Bremer Bank

The best thing about all Bremer checking accounts is that, in addition to their unique characteristics mentioned above, they all come with the following attributes:

- Platinum Debit MasterCard free of charge with your account

- Online banking, mobile banking, and bill payments free of charge

- Options for overdraft protection

- Rewards-based credit card with no annual fee, provided you are approved

- Free financial plan

- Free personal trust assessment

- Free personal insurance evaluation

While the vast majority of banks offer simple checking accounts, the combination of choices for the client and value provided by the bank sets Bremer apart from the others.

In addition to reviewing the above Bremer Bank review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.