2017 RANKING & REVIEWS

TOP RANKING BANKS IN WISCONSIN

Finding the Top Banks in Wisconsin

Banks may not be the first thing that come to mind when you think of Wisconsin’s economy. Instead of Wisconsin bankers you likely think of Wisconsin cheese-makers. If you fall into that category of people, you’ll be surprised to learn that Wisconsin’s financial services industry actually makes up about 10% of the midwestern state’s gross domestic product.

Like banks anywhere, banks in Wisconsin provide traditional personal and business products and services, including checking and savings accounts, loans, and investment products.

The following institutions were ranked among the best banks in Wisconsin because they have unique characteristics or offer innovative products, in addition to the usual checking and savings accounts, loans, and investment vehicles. No matter your needs, you are sure to find a Wisconsin bank that will help you reach your financial goals.

Award Emblem: Top 15 Best Banks in Wisconsin

AdvisoryHQ’s List of the Top 15 Best Banks in Wisconsin

List is sorted alphabetically (click any of the below names to go directly to the detailed review for that bank)

- Associated Bank

- Bank Mutual

- Bremer Bank

- FirstMerit Bank

- Johnson Bank

- National Exchange Bank and Trust

- Nicolet National Bank

- North Shore Bank, FSB

- Old National Bank

- Peoples State Bank

- TCF Bank

- Town Bank

- Tri City National Bank

- WaterStone Bank, SSB

- Wisconsin Bank & Trust

Top Banks in Wisconsin | Brief Comparison

Banks in Wisconsin | Highlighted Features |

| Associated Bank | Health Savings Account |

| Bank Mutual | Bank of Knowledge |

| Bremer Bank | Endowment Fund Management |

| FirstMerit Bank | The Voice Credit Card |

| Johnson Bank | Merchant Card Processing |

| National Exchange Bank and Trust | Golden Years Club |

| Nicolet National Bank | Cashback Checking |

| North Shore Bank, FSB | 70/7 Video Tellers |

| Old National Bank | CheckCash Express |

| Peoples State Bank | Scholarship Program |

| TCF Bank | TCF Power Savings |

| Town Bank | Everyday Loan |

| Tri City National Bank | Remote Deposit |

| WaterStone Banks, SSB | Military Valor Program |

| Wisconsin Bank & Trust | Sustainable Responsible Impact Investing |

Table: Top 15 Best Banks in Wisconsin | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Banks in Wisconsin

Below, please find the detailed review of each firm on our list of the best banks in Wisconsin. We have highlighted some of the factors that allowed these Chicago banks to score so high in our selection ranking.

See Also: Top Banks in Massachusetts | A Comparison of the Best Massachusetts Banks

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Bank Mutual Review

Bank Mutual was founded in Milwaukee in 1982 by several men who worked together at a local newspaper. Their goal was to help each other achieve homeownership by setting up a small building and loan association. At the time, many mutual building societies were popping up across the eastern United States, which inspired the men to get into the business.

Thus, the Mutual Building and Savings Association was established. Because money borrowed at that time was meant to be paid back relatively quickly—unlike the 30-year home loans we are familiar with today—the members were able to take turns borrowing to buy their respective homes.

After being renamed and restructured several times in the years that followed, the institution became Bank Mutual in 2003. Today, its 60 branches allow the bank in Wisconsin to serve more than 100,000 households throughout the state, as well as in Minnesota.

Source: Bank Mutual

Key Factors That Enabled This Firm to Rank as a Top Wisconsin Bank

Several factors helped Bank Mutual rank among the top Wisconsin financial institutions. Keep reading to find out the reasons behind the high ranking.

Education Resources

Innovative technology is important for banks to remain competitive in today’s world, in which banking transactions are increasingly being conducted online. However, not everyone is technologically savvy enough to be comfortable making the transition to online banking.

For those customers who are nervous about making the transition to online banking, Bank Mutual’s education resource center is the perfect place to start.

The resource center is a Web page that can easily be found on Bank Mutual’s home page. It houses a number of tutorials to help customers learn how to conduct various banking functions on their own.

You can see how to set up online bill payments, access mobile banking, and prevent ID theft while working online, among other popular banking functions. With Bank Mutual’s descriptive resource center, you’ll be up to date in no time.

Popmoney

Popmoney allows Bank Mutual customers to send and receive money electronically. While this is a common feature among banks, including banks in Wisconsin, in the digital age, Popmoney is unique in several ways.

Source: Bank Mutual

First, money can be sent and received without the need to share your private account information. Instead, you can securely transfer between accounts using email addresses or mobile phone numbers.

Second, Popmoney’s “Request Money” feature allows you to ask for money from your friends and acquaintances simply by inputting their email address or phone number. Senders and recipients can then send a fixed amount of money or choose how much to pay.

Bank of Knowledge

The importance of sound financial management shouldn’t be underestimated. This is something that this bank in Wisconsin recognizes. Its Bank of Knowledge is an online resource that features insights and news from Bank Mutual’s industry experts. You can find blog posts and other information about a number of banking topics, from business loans to savings tips to selling your home. This online resource sets this bank in Wisconsin apart.

Don’t Miss: Best Banks in California | Ranking | Review of the Top California Banks

Johnson Bank Review

Johnson Bank is one of the newer institutions on our list of the best banks in Wisconsin. It was founded in 1970 by Samuel C. Johnson, famous for being a fourth-generation leader of one of the world’s most successful private companies, SC Johnson.

It has more than 40 locations across Wisconsin and Arizona. More specifically, Johnson Bank can be found among banks in Appleton and Madison, WI.

Key Factors That Enabled This Firm to Rank as a Top Wisconsin Bank

Johnson Bank is one of the best banks in Wisconsin in this year’s ranking for the following reasons.

Umbrella Insurance

Sometimes auto and home insurance doesn’t cover life’s unexpected events. Johnson Bank recognizes this and offers umbrella insurance.

Essentially, umbrella insurance provides additional coverage for unpredictable life events. As outlined on Johnson Bank’s website, “If you own a house and have a retirement account or other investments, an umbrella policy should be a part of your financial plan and a step toward protecting your wealth”.

You can choose from $1 million to $10 million in liability coverage to protect your assets, be it your home, your vehicle, your income, or other investments that you hold. Opting for umbrella insurance can give you peace of mind knowing you are covered should something unexpected happen.

Private Banking

Some individuals require services that go beyond traditional retail banking offerings. This top bank in Wisconsin offers private banking to address the more complex financial needs of some of its customers. This Wisconsin bank offers personalized and customized services for these sorts of customers and can help them with comprehensive financial management and an assessment of their risk tolerance. They are also happy to liaise with other professionals relevant to your financial needs including attorneys, accountants, and more.

Merchant Card Processing

Businesses in Wisconsin in need of payment processing solutions will be happy to learn that this top Wisconsin bank offers merchant card processing. This service can help business increase their cash flow while also reducing their operating costs.

Since more and more customers are using debit cards and credit cards to make purchases, it will be extremely important for businesses to offer corresponding payment methods in order to retain current customers and bring in new ones.

The benefits of using this Wisconsin banks payments processing solution include:

- Local representation

- 24/7 support

- On-site training

- Competitive pricing

- Online access to your account

Related: Top Missouri Banks | Finding The Best Bank in Missouri

National Exchange Bank and Trust Review

Having been in business since 1933, the National Exchange Bank and Trust is a reputable Wisconsin financial institution. The independent, family-owned business is headquartered in Font du Lac, WI, and has several locations statewide. True to its name, its mission is to build relationships its customers can trust.

Image Source: Top Wisconsin Banks

Key Factors That Enabled This Firm to Rank as a Top Wisconsin Bank

We ranked the National Exchange Bank and Trust among the best banks in Wisconsin this year for the following reasons.

Seniors Program

The National Exchange Bank and Trust operates a banking program exclusively for seniors. Called the Golden Years Club (GYC), it is open to customers 55 years of age and older. Or as the bank puts it, “people age 55 and better”. If you’re eligible, you can benefit from exclusive discounts, informative seminars, and travel rewards.

Source: National Exchange Bank & Trust

Specific benefits of the GYC program include:

- No minimum balance or maintenance fees on checking accounts

- Check safekeeping (this includes three free copies per month)

- Access to National Exchange’s Travel Club

Additionally, GYC members receive the following products and services free of charge:

- Printed checks (limit of two boxes per the calendar year)

- Bi-monthly newsletters

- Informational seminars to make the most of finances

- Money orders

- Cashier checks

- Direct deposit of social security or payroll checks

- Membership card

If you’re a senior aged 55 or older, you can certainly save by banking with National Exchange.

Step-Up Checking Account

The Step-Up checking account with National Exchange helps young adults learn to manage their finances responsibly. Young people between the ages of 18 and 25 can open a Step-Up checking account, and they are rewarded for making sound financial choices. This includes:

- ATM fee refunds allow users to withdraw cash wherever they are without worrying about hefty ATM fees. ATM fee refunds will be credited to their account within two business of each ATM transaction.

- Interest rate bonuses on eligible savings, money market, or CD accounts.

The Step-Up checking account is a way to help young adults start out on the right foot financially, making the National Exchange Bank and Trust one of the best banks in Wisconsin.

Popular Article: Best Banks in Colorado | Best Colorado Banks in Denver, Colorado Springs, etc.

Nicolet National Bank Review

Founded in 2000, Nicolet National Bank is one of the newer banks in Wisconsin. Nevertheless, it has over 30 locations, from smaller communities to the state’s larger centers.

Just like Wisconsin banks that have been around for years, Nicolet offers a wide range of products to meet your individual needs, whether it’s a multimillion-dollar commercial loan or a simple personal checking account.

Key Factors That Enabled This Firm to Rank as a Top Wisconsin Bank

Keep reading to find out why Nicolet National Bank topped this year’s this of the best banks in Wisconsin.

Cash Back Checking

With Nicolet’s Cash Back checking account, you’ll benefit from your purchases. You’ll receive 3% cash back on all purchases made with your debit card, as long as the following stipulations are met:

- You are signed up for e-statements

- You have the direct deposit function set up

- You have made 10 successful debit transactions per qualification cycle

As a bonus, the Cash Back checking account also offers unlimited checks, free of charge.

The Vault

Like many of the other banks in Wisconsin that have been reviewed in this ranking, Nicolet offers a section of its website dedicated to educating its customers.

The Vault contains insights, news, loan calculators, and overviews of financial regulations, among other tools, to help you understand banking products and the broader financial landscape in one convenient online location.

You can read current blog posts or search by topic to find more specific information. It’s a great resource to stay up-to-date on financial news.

Source: Nicolet National Bank

Checking Options

Nicolet National Bank offers four different checking account options: an account in which you earn cash back on purchases, a rewards checking account, a simple value checking account, and an account for customers with a high deposit balance.

Offering these different types of checking accounts gives the customer the opportunity to choose the a perfectly suited checking account from this bank in Wisconsin.

Below are a few details on the checking accounts offered by this Wisconsin bank:

- Real Cash Back Checking: 3% cash back on all purchases made by debit card, up to $300 (qualifications must be met), ATM surcharge reimbursement ($10 per account), free online banking and bill pay, e-statements, debit card, and unlimited checking.

- Real Rewards Checking: 3% APY on balances between $0.01 and $15,000, 0.10% APY on balances more than $15,000, 0.02% APY on balances if qualifications are not met during the qualification cycle, ATM surcharge reimbursement ($10 per account), free online banking and bill pay, e-statements, debit card, and unlimited checking.

- Value Checking: No Qualifications, free online banking and bill pay, e-statements, debit card, and 30 checks per month ($0.25 after 30).

- Platinum Checking: free online banking and bill pay, e-statements, debit card, and 40 checks per month ($0.25 after 40), and interest earned (see website for qualifications).

Read More: Best Banks in Wisconsin | Ranking | Review of the Best Wisconsin Banks

North Shore Bank, FSB Review

The North Shore Bank was founded by several teachers in Shorewood, Wisconsin in 1923. It began in the backroom of a local hardware store as the North Shore Building & Loan Association.

The first branch was opened in Milwaukee in 1972, and the bank was renamed the North Shore Bank in 1989. Since its inception, the bank has grown from $22,000 to more than $1.7 billion in assets. Today, you can find 45 branches across eastern Wisconsin and northern Illinois.

The motto of this bank in Wisconsin is “The Bank of You,” a testament to its commitment to helping its customers and communities in which it operates thrive.

Key Factors That Enabled This Firm to Rank as a Top Wisconsin Bank

Below are key factors that contributed to this year’s ranking of the North Shore Bank to rank as one of the best banks in Wisconsin.

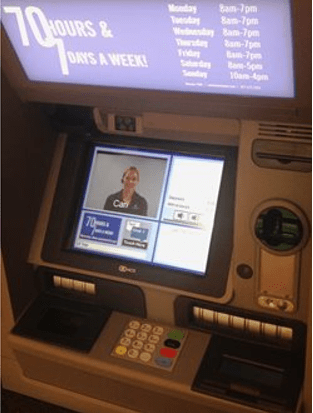

70/7 Video Tellers

Let’s face it: banking is an integral element of our lives and our financial well-being, yet it’s not always easy to get to a branch during regular banking hours. The solution? North Shore Bank’s video tellers, which are available 7 days a week for a total of 70 hours in nine locations.

Simply visit one of the interactive video teller kiosks and touch the screen to begin speaking with a representative. Remember, you’ll need your North Shore Bank debit card or your driver’s license to use this service.

Source: North Shore Bank

You can speak with a teller via video during the following hours:

- Monday–Friday, 8 a.m. to 7 p.m.

- Saturday, 8 a.m. to 5 p.m.

- Sunday, 10 a.m.–4 p.m.

Enhanced Online Security

This Wisconsin bank takes security seriously. With North Shore Bank’s Enhanced Online Security platform, you can rest assured that your money and accounts are secure. You can sign up and log in online, without the hassle of downloading any software.

The authentication system for online banking then uses multiple layers of security to prevent identity theft, fraud, and any unauthorized persons from accessing your accounts.

The process is threefold. Each time you log in to North Shore Bank’s online banking platform, the system verifies the following three items:

1. Your log in credentials: This means that in order to access your accounts online, your Access ID and password must match exactly the records in North Shore Bank’s system.

2. Your device: North Shore Bank also monitors the devices you use. If it doesn’t recognize a computer, tablet, or smartphone as one you use regularly, you will be asked a security question to verify your identity.

3. Your location: If you are trying to access your accounts online from an unusual location from which you have not logged on in the past, you may be required to answer a security question.

To browse exclusive reviews of all top-rated banks in Wisconsin, please click on any of the links below.

- Associated Bank

- Bank Mutual

- Bremer Bank

- FirstMerit Bank

- Johnson Bank

- National Exchange Bank and Trust

- Nicolet National Bank

- North Shore Bank, FSB

- Old National Bank

- Peoples State Bank

- TCF Bank

- Town Bank

- Tri City National Bank

- WaterStone Bank, SSB

- Wisconsin Bank & Trust

Related: Best Private Banks | Top Private Wealth Mangement Firms & Best Wealth Management Services

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Top 15 Banks in Wisconsin

By the end of this review, you’ve likely identified several banks with features that fit into your needs. Perhaps a great rewards card is what you’re looking for or maybe you want convenient options like video banking.

Wisconsin banks are conveniently located throughout the state, from small towns to larger financial centers. For example, top firms can be found among banks in Madison, Wisconsin and banks in Appleton, Wisconsin, as well as communities with populations of less than 5,000. This means that you won’t have to travel far to access one of the best banks in Wisconsin, no matter your location.

Each Wisconsin bank offers traditional personal and business products and services, including checking and savings accounts, loans, and investment products. However, leading Wisconsin financial institutions have additional qualities that make them stand out.

It’s impossible to pick just one institution as the best bank in Wisconsin, as banking needs vary greatly among consumers, but this list is a good place to start. A common thread among many of our top Wisconsin banks is that, in addition to everyday banking products and services, they also offer financial education resources in the form of blogs, news updates, or training programs.

This emphasis on helping customers become financially savvy is one of the leading attributes of banks in Wisconsin. Coupled with community involvement, social media savviness, exclusive discounts for customers, and, of course, top-notch banking products, you’ll be sure to find a Wisconsin bank that meets your needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.