Intro—Town Bank Reviews & Ranking

AdvisoryHQ recently published its list and review of the top banking firms in Wisconsin, a list that included Town Bank.

Below we have highlighted some of the many reasons Town Bank was selected as one of the best banking firms in Wisconsin.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Town Bank Review

Town Bank is a community bank where decisions are made locally, and its bank staff resides in the community in order to provide efficient and timely care to its customers. Since it is locally managed, Town Bank is able to offer more customized services and products to fit the needs of its residents within the area. It does not have the large overhead that some other banks do, so it’s able to pass on savings to its customers in the form of better rates.

Town Bank is a Wisconsin bank with 19 locations throughout the state. It can be found in Wisconsin’s smaller towns such as Wind Lake, WI, as well as among banks in Madison, WI, one of the state’s bigger cities.

Regardless of location, Town Bank prides itself on its commitment to understanding and meeting the needs of its customers.

Image Source: Town Bank

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our detailed review, Town Bank was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

Town Bank Review: Locally Owned, Locally Managed

Town Bank identifies itself as a real community bank. Since it is locally owned and locally managed, a far-off corporate office is not responsible for decisions that affect Wisconsin bankers. Instead, “there is on-site control over all services, products, loan approvals, and interest rates.” This means that, as a Town Bank customer, your needs are taken into consideration. Town Bank cares about the financial well-being of its customers, making it one of the best banks in Wisconsin.

Town Bank Review: Money Smart

We hear time and again how important managing one’s finances is, yet putting sound money management tactics into practice is easier said than done for many of us. Money Smart at Town Bank is a suite of products and programs to help you do just that.

- Money Smart for Adults: If you’re an adult looking for tips and insights on achieving your financial goals, this program could be right for you. This training program is led by an experienced instructor and covers 11 modules. As outlined on Town Bank’s website, topics include a description of deposit and credit services offered by financial institutions, choosing and maintaining a checking account, spending plans, the importance of saving, how to obtain and use credit effectively, and the basics of building or repairing credit.

- Money Smart for Young Adults: We’ve said it before and we’ll say it again—you’re never too young to start learning about money management. With that in mind, Town Bank’s Money Smart for Young Adults program is designed for young people between the ages of 12 and 20. It reviews the basics of handling money and finances, as well as how to create positive relationships with financial institutions. Money Smart for Young Adults is a wise step for yourself or your child to take in order to become familiar with managing finances early in life.

- Money Smart for Small Businesses: Jointly developed by the FDIC and SBA, this instructor-led, 10-module program will teach you the basics of organizing and managing a small business.

In addition to its Money Smart training programs, participants can benefit from Town Bank’s Money Smart Checking account. After attending at least one Money Smart session, you can benefit from:

- No minimum deposit to get started

- ATM Card with up to 6 free out-of-network ATM reimbursements each month

- Dollar-A-Day Savings Service, which automatically transfers $1 (or more) each day from your checking account to your savings account

It’s clear that Town Bank is one of the Wisconsin financial institutions that cares about the well-being of its customers, and the bank can help improve your financial know-how.

Town Bank Review: Everyday Loan

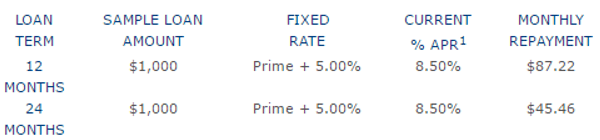

This bank in Wisconsin conveniently offers Everyday Loans, which are ideal for covering unexpected costs that inevitably pop up from time to time. The fixed-rate loan is available in amounts up to $2,500 and can be paid off in terms up to 24 months. The approval decision will be made quickly, giving you faster access to your funds.

Image Source: Town Bank

Because the interest rates are not exceptionally low, it is wise to exercise discretion when taking out these loans. However, it’s nice to know that this Wisconsin bank has you covered should the need for an everyday loan arise.

In addition to reviewing the above Town Bank review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top-rated banking firms & credit unions:

Top Rated Banks

Top Banking firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.