Which Card Is Best for You? We Compare: Capital One Spark vs. Fifth Third Business vs. HSBC Business Credit Card vs. Amex Business Credit Card

If you own a business, there are a number of company-related benefits you can get with a business credit card like the Capital One® Spark Card or Amex small business card, beyond what you can get by using just a personal credit card.

But how do you know which card to choose that has the best features for you? Besides the two mentioned, there is also the Fifth Third credit card for businesses and the HSBC business MasterCard® to pick from. While you may think most business cards must have similar benefits, there are some key differences between them.

Image Source: Fifth Third Credit Card

Some business credit cards, like the Capital One® business credit card, from Capital One®, are designed to help new business owners build and strengthen their credit, while a card like the American Express Blue for Business®, from American Express, offers multiple points rewards to use toward business expenses.

Other cards, like the Fifth Third credit card, from Fifth Third Bank, feature tools to help track and monitor business spending. If you have multiple employees who use corporate credit cards, then the employee cards branded with your organization’s name offered with the HSBC business credit card from HSBC Bank USA might be of particular interest to you.

Factors to Consider When Selecting a Business Credit Card

As you read through our comparison of Spark business credit cards, HSBC business MasterCard®, Amex business credit card, and the Fifth Third credit card for business, you’ll want to consider some key factors to help you decide which card best fits your organization’s needs.

One card may be perfect for a business that has employees that travel extensively, while a different card may be the best choice for companies that don’t carry a lot of debt. Here are a few factors to consider when choosing whether the Spark credit card, Amex small business card, or one of the others is a good fit.

- Amount of debt you want to carry

- Amount of traveling done by your company employees

- Your company’s creditworthiness

- How much you need to extend cash flow

- Whether points and cash back are important

- The amount of any fees, such as the annual fee

- How much the APR increases your overall costs

- The types of spending reports you need

- Whether you need employee cards

High-Level Comparison Table

| Comparison Factors | American Express Blue Card for Business | Fifth Third Credit Card | HSBC Business Credit Card | Capital One® Spark Classic |

| Annual Fee | None | None | None, but $25 for rewards program | None |

| Points Rewards/Cash Back | 1x per $1, 2x per $1 when booking Amex travel | None | 1x per $1 | 1% unlimited cash back |

| Intro APR | 0% for 9 months | 0% for 9 months | 0% for 6 months | None |

| APR after Intro Period | 11.49%–19.49% | 10.24%–22.24% | 13.49% (or prime +9.99%) | 23.24% |

| Foreign Transaction Fee | 2.7% | 3.0% | None | None |

| Credit Building Card | No | No | No | Yes |

| Corporate Branding | Not mentioned | Not mentioned | Yes | Not mentioned |

Table: The above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Business Credit Card 2017 Comparison | Capital One® Spark Card vs. Fifth Third Credit Card vs. HSBC Business MasterCard vs. Amex Business Credit Card

While these four companies all cater to the credit card needs of businesses, not all the cards are created equal. For example, Capital One® Spark cash for business is a cash back program unique to the Spark® Classic from Capital One® credit card, and the HSBC MasterCard BusinessCard® Card looks to be the only one offering corporate branding of employee-issued cards.

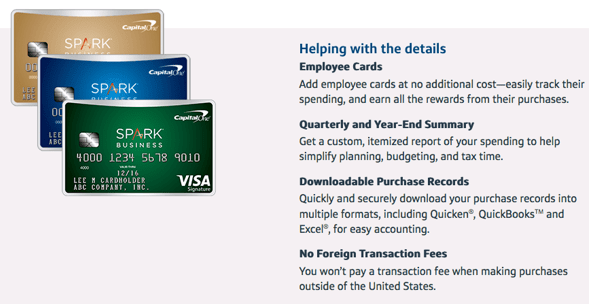

Image Source: Spark Business Credit Cards

If you’d like zero interest for the longest amount of time offered from the group, then the Fifth Third Business Card or the American Express Blue for Business® Credit Card both give you 9 months without interest.

We will next take a look at each particular benefit offered, why they may be important for a business credit card, and compare how the Spark credit card, Amex business credit card, HSBC business credit card, and Fifth Third credit card compare on each benefit.

Points Rewards and Cash Back Benefits

One benefit that can help businesses make the most of their money are points rewards and cash back bonuses offered by various business credit cards. This allows companies to stretch their spending dollar further and can positively impact their bottom line.

Image Source: Capital One Business Credit Card

Three of the credit cards in our comparison of Capital One® business credit card, Fifth Third card, HSBC business MasterCard, and Amex small business card offer money or points back for purchases. We’ll examine the offerings of each below.

Fifth Third Credit Card

No cash back or rewards points incentives are offered.

Capital One® Spark

The Capital One® Spark card is the only one that offers unlimited cash back on every purchase. You get 1% cash back on every dollar spent with your Capital One® Spark cash for business credit card. They also have no minimum limit to redeem the cash. You can redeem for credits for previous purchases, gift cards, and more.

The Spark business credit cards also have a handy feature on their website that lets you see instantly what you can earn in cash back for every dollar you spend.

Amex Business Credit Card

The American Express Blue for Business® Card rewards you with 30% more rewards points each year with an annual relationship bonus. According to their website, the “relationship bonus” means points equal to 30% of your past year’s purchases.

You earn 10,000 Membership Rewards® points after making your first purchase within your first 3 months of card ownership. You earn 1 point for each dollar you spend on eligible purchases and 2 points for each dollar spend when you book on the American Express Travel website.

HSBC Business Credit Card

The HSBC business MasterCard® credit card also allows you to earn rewards points, but if you opt into their rewards program, there is a $25 annual fee. You receive 2,500 bonus points just for enrolling in the program and can earn one point for every $1 spent up to 10,000 points per month.

You can redeem HSBC business credit card points on free air travel, ultimate sports experiences, and gift cards to restaurants, retailers, and cruises. Points can be redeemed by calling 800–952–4315 or online at rewards.us.hsbc.com.

Don’t Miss: Best First Credit Card | Guide | How to Find Good Credit Cards for First-Timers

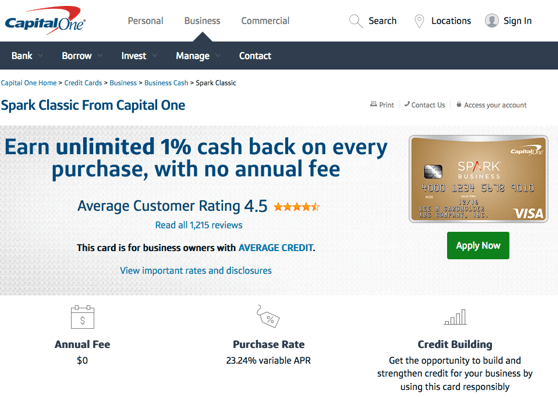

Building or Repairing Credit

It’s common when starting a new business to not yet have a credit history, and in this case it might be more difficult to get a card like the Amex business credit card, Fifth Third credit card, or HSBC business credit card. But one of these four cards was made to build or rebuild credit, the Capital One® Spark credit card.

Of these four credit cards for business only the Spark credit card by Capital One® is specifically offered to those that might have no or less-than-stellar credit. If you’re a new small business looking to build a name and credit history, then the Capital One® Spark cash for business card might be the most attractive and easiest to get.

Related: Best Credit Cards to Have | Guide | What is the Best Easy to Get Credit Card to Apply For?

Annual Percentage Rates Comparison

The amount that you pay in interest, both initially and over the long haul, can have a significant impact on your bottom line. If you secure a card that offers a period of zero interest, like the Fifth Third credit card, HSBC business MasterCard®, or the Amex small business card, it can mean an opportunity to have working capital for 6 to 9 months without paying interest, as long as you pay it off within that time.

If you need a little longer to pay off any Capital One® Spark or other credit card debt, then having a card with a long-term lower APR could be more advantageous to your business.

You also want to take notice of the balance transfer and cash advance interest rates, as they may differ from the regular purchase interest rate.

Capital One® Spark Card

The offer by Capital One® Spark doesn’t have a zero APR introductory rate like the other cards do; it has one of the higher APRs, at 23.24%. But that’s not unrealistic because they offer the card to those with none to less-than-good credit as a way to build their credit, so the APRs tend to be higher as a trade-off with this type of card.

The balance transfer APR is from 13.24% to 21.24% and the cash advance APR is the same as the one for purchases, at 23.24%.

Amex Business Credit Card

The American Express Blue for Business® Credit Card offers 9 months with 0% APR and a variable rate between 11.49% and 19.9% after that. They do not specify the APR on balance transfers other than to state in their terms that cash advances and balance transfers have interest due after the transaction date.

The APR for cash advances is 25.49% (or prime + 21.99%).

Fifth Third Credit Card

The business card offered by Fifth Third Bank also gives you 9 months with zero interest. After the intro rate, the APR is between 10.24% to 22.24% on purchases and balance transfers. If you’re doing a cash advance, then you’ll pay a 24.99% APR.

HSBC Business Credit Card

If you have a HSBC business credit card, you’ll have slightly less time than the last two for 0% APR. This card offers 6 months with no interest, and 13.49% after that, which is fairly low if you look at the high APR range of the other cards as a comparison.

The HSBC business MasterCard® offers a balance transfer and cash advance APR of 21.49%.

Popular Article: Discover vs Wells Fargo Secured Credit Card Review | Which Card Is Best?

Comparison of Business Credit Card Extras

There are many extras that you can get whether you choose a Fifth Third card, a Capital One® Spark, an Amex business credit card, or an HSBC business credit card. Extras like travel insurance, zero liability for fraudulent purchases, and detailed spending reports can mean big savings.

Here’s a breakdown of the business card extras offered by each of these four business credit cards.

Image Source: Capital One® Spark

Capital One® Spark Card Benefits

The Capital One® Spark card offers the following extra benefits to card members:

- 0$ Fraud Liability for lost/stolen cards

- Fraud Alerts

- Quarterly & Year-End Summary

- Auto Rental Collision Damage Waiver

- Purchase Security & Extended Protection

- Travel & Emergency Assistance Services

Amex Business Credit Card

The Amex small business card provides the following benefits to cardholders:

- Purchase Protection

- Baggage Insurance Plan

- Travel Accident Insurance

- Global Assist® Hotline

- Extended Warranty

- Car Rental Loss and Damage Insurance

- Roadside Assistance Hotline

- Receipt Match℠

- Account Alerts

Fifth Third Credit Card

The Fifth Third Business Card offers the following extras to card members:

- Zero Liability for Unauthorized Purchases

- MasterRental® Insurance

- Purchase Assurance

- Extended Warranty

- Master RoadAssist Roadside Services

- Save on Purchases through MasterCard® Easy Savings™

- Travel Accident Insurance

- Identity Theft Resolution

- VAT Reclaim Service

- MasterAssist Travel Assistance Services

HSBC Business Credit Card

If you have an HSBC business MasterCard® you’ll receive the following extra benefits:

- Monthly Cardholder Statements for Each User

- Individual Spending Limits

- Personal Business Relationship Manager

- Free Year-End Summary Statement

Conclusion | 2017 Comparison of Capital One® Spark Card vs. Fifth Third vs. HSBC Business Credit Card vs. Amex Business Credit Card

As you can see, each of these credit cards for business offer unique opportunities to increase your cash flow.

Whether you like the easy credit building and cash back incentives of the Capital One® Spark business card, the travel rewards bonuses from the American Express Blue for Business® Credit Card, or one of the extra features offered from Fifth Third or HSBC, you have options that can benefit your business.

If you take a careful look at your cash flow and spending needs, it can help you choose the card features that would most positively impact your organization.

Whether it is the Capital One® Spark card, Amex Business Credit Card, HSBC, or Fifth Third cards for business, the multiple options can mean a smart choice for your business credit needs.

Read More: Best Credit Cards for Bad Credit or No Credit | Guide | How to Find Bad Credit Credit Cards

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.