Overview: CFP Exam Pass Rate & Score

If you thought passing the CFP exam would be a walk in the park, think again.

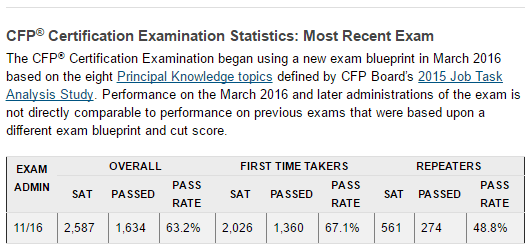

According to a recent report by the CFP board, only 65% of the candidates who sit for the exam make it to the next level. Board CEO Kevin Keller admits that they make the test as engaging as possible to ensure that only the determined receive their certification.

The low CFP pass rate and the rigorous process of attaining the accreditation have been termed as one of the reasons many financial planning students shy away from the exam.

Image Source: CFP exam pass rate

See Also: Top Project Management Keywords You Must Have on Your Resume

CFP exam overview

While the CFP exam pass rates may look discouraging, the rewards of the certification are immense. The course not only opens roads to financial freedom but enables the holders to make an impact on other people’s lives by helping them plan financially for their future. For an average student, the course takes a study time of at least 1,000 hours for the six-hour of exam. The test includes a financial planning case study, supervised client meetings, a multiple choice test, and a detailed experience analysis. It covers key areas such as:

- Risk management and insurance planning

- General financial planning principles

- Professional conduct and regulation

- Investment planning

- Tax planning

- Retirement saving and income planning

- Estate planning

The student is expected to demonstrate crystallized knowledge in these areas to be able pass the CFP exam.

For a lot of students, the financial planning case study part is the nightmare. Nevertheless, the CFP Board insists that this part, which assesses the ability of the student to apply financial planning knowledge in real life situations, is the most valuable in the course.

The case study questions account for 20% of the exam, with 50 to 55 questions distributed across different units, making it an important determinant in passing the CFP exam.

To be eligible to sit for the exam, you must complete a college or university level course of study through a CFP Board-registered program. The course work should address all the key areas of personal financial planning as specified in the recent CFP Board job analysis study.

Don’t Miss: Tips on Passing the Certified Financial Planner (CFP) Exam

Do you have what it takes to pass the exam?

Did you know that the chance of passing the CFP exam for repeaters is much lower than for first timers? According to the Certified Financial Planner Board of Standards, the repeat test takers have a 30 to 50 percent chance of passing the exam, compared to first-time test takers’ 55 to 68 percent.

Even when the available data suggests a low CFP pass rate and a high dropout rate, there is evidence that with proper preparation, no one should fail the exam. Richard Cutler, a statistician and associate professor at Utah State University, points a high CFP exam pass rate among students who use the self-study textbooks review. These students have a 62.6% likelihood of passing the CFP exam, which is the highest of all the categories of test takers.

The level of commitment and determination required in attaining a mark above the set CFP passing score is quite high. But it can be done! Take the following tips to heart:

- Use the proven CFP review materials

The self-study review materials are prepared by industry experts to help candidates gain familiarity with the CFP exam format and prepare them for the best approach to passing the CFP exam. They include textbooks with questions and explanations, video lectures, and, in some instances, online tutoring. These self-study materials improve the student’s ability to reason through scenario-based questions and case studies, which is the secret to passing the CFP exam.

When asked how to pass the CFP exam, Vickie Hampton, an associate professor of personal financial planning at Texas Tech University, recommends Kaplan Financial Education as the best source of study tools. A high CFP pass rate has been reported for students who use the Kaplan resources in preparation for the exam.

In a 2013 study, the CFP Board recognized Kaplan for the outstanding performance of its student in the accelerated certificate program. According to the Board, the performance was better than the national CFP pass rate since the November 2006 exam. Students can assess their readiness toward the actual CFP exam and identify the areas in which they must improve.

Also available on their website are free materials on how to prepare a study plan and a guide to approaching case studies and multiple choice questions. There are also free tips on how to pass the CFP exam. Apart from Kaplan, many other self-study resources can guide you on the road to passing the CFP exam, but your first step should be to understand what type of learning works best for you, no matter what materials you use in passing the CFP exam.

Image Source: Passing the CFP Exam

- Take the exam soon after graduation

In a study of success determinants on the CFP exam, Vance Grange, director of Tax and Personal Financial Planning programs at Utah State University, identifies the time that elapses between graduation and taking the CFP exam as very influential on an individual’s CFP score. According to the study, individuals who take the exam within six months of graduation are more likely to pass the CFP exam than those who wait. Recent studies by the CFP Board show that the majority of students opt to skip the exam for fear that their inexperience will prevent them attaining a CFP exam passing score.

However, even with extensive field experience, the ability to integrate the course concepts on the presented case studies is the only key to passing the CFP exam. This means that experience in financial planning is not required to pass the CFP exam. The longer you wait before taking the exam, the higher the chances that you forget the key concepts and risk getting marks below the CFP passing score.

Related: How to Become a Financial Advisor

- Your motivation will affect your performance

When it comes to selecting and undertaking any professional accreditation course, people have different motivations. In CFP, previous studies have identified a relationship between the student’s source of motivation and their success in passing the CFP exam. These studies show that students who undertake the CFP certification exam for financial incentives do not perform better compared to those who undertake it to gain professionalism and help people.

The more dedicated a candidate is to the learning process, the higher their chances of passing the CFP. In the study by Vance Grange, individuals who are motivated by personal achievements like financial gain had a lower CFP pass rate than those who were driven by acquiring the ability to serve their clients better. The majority of the best performers in the CFP exam were those who listed personal marketability and peer recognition as their primary motivators to passing the CFP exam.

From this study, it is evident that your chance of failure is high if your primary motivation is a greater salary or promotion. On the other hand, if you have an inner drive toward gaining the knowledge and expertise in personal financial planning, then you should not be worried about passing the CFP exam.

Popular Article: How to Become a Mortgage Broker (Completed Guide: Requirements, Income, Broker Licence…).

- Get familiar with the CFP grading process

When preparing for your CFP exam, you should have a clear understanding of the grading process to help you to know the areas you should study most. According to the CFP Board, the cognitive levels required to pass the CFP exam include knowledge, application, analysis, and evaluation. The exam tests the candidate’s ability to apply and integrate knowledge from its specified core topics. Note that the CFP passing score is determined based on overall performance in the test.

The exam content contains eight principal subject categories with three key areas carrying 51% of the total grade:

- Investment planning

- Retirement savings and income planning

- General financial planning principles

Both the tax and risk management and insurance planning account for 24% of the grade, while education planning takes 6% only. Under each category is a list of topics to be covered. The comprehensive coverage of these topics puts you in a better position to

In your study plan, ensure that you assign more time to the areas with more marks and use the available tools to test your preparedness for the exam. The secret of how to pass the CFP exam lies not only in hard work but on your strategy and vision. As a financial planner, you should be able to develop an excellent and well-calculated approach to ensure that you pass the CFP exam.

For more updates on the CFP exam guidelines and grading process, visit their website here.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Last Minute Tips

If you strategized from the beginning, there is no need to panic during the exam period. You have what it takes to hit the CFP passing score. During the last minutes of study, do not exhaust yourself with cramming; it won’t help you on the exam. Even when the CFP passing score may be worrying, there is evidence of a high CFP passing rate in students who are fully dedicated to learning.

Instead, take time and relax before you begin. Focus on success and visualize yourself opening the results letter to find the word “Congratulations!” on top. Remember that passing the CFP exam requires you to apply the knowledge you have gained in real life cases.

You can read more tips to effective last minute study to help you pass the CFP exams here.

Read More: How To Roll Over 401k – Everything You Need to Know! (Should I Rollover My 401K & Advice)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.