Comparison Reviews: Chase Checking Account vs. Bank of America Checking Account

When comparing national banks like Chase and Bank of America, a first glance may display little difference. However, once we take a deeper look, it’s obvious that they are actually quite different, such as having their own checking account promotions, special offers, and more.

In order to determine which company came out on top, we examined checking account promotions, like Bank of America and Chase Checking Account bonus, savings and money market accounts, CDs, overall customer experience, and any additional fees that may be charged for various reasons.

Since these banks will often promote things such as Chase checking account bonus or Bank of America promotions, it’s important to dive a little deeper in order to discover what Chase checking account offers or Bank of America offers really mean.

See Also: The Best Checking Accounts | Tips to Finding the Best Bank for a Checking Account

Chase Checking Account Offers vs. Bank of America Offers

It doesn’t matter if you flip burgers or flip houses; you should have a checking account. It’s the bank account that can be used for groceries, gas, cash deposits, or ATM withdrawals. Checking account promotions differ with each company, so read on to figure out which one has the features you need and the bonuses you want.

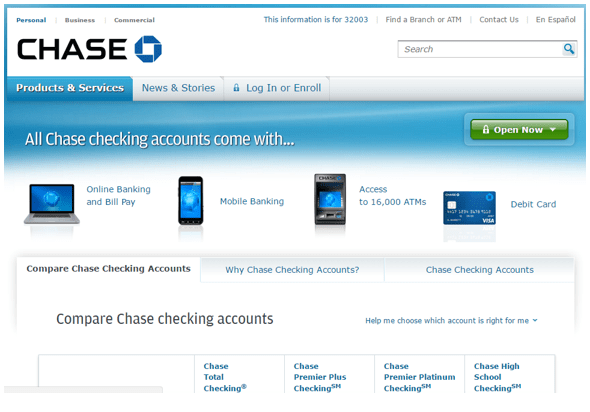

Image Source: Chase Checking

Bank of America promotions begin with a minimum deposit of $25 to open an account. Normally, there is a $12 fee charged to the account each month. However, for students under 23, or for accounts with direct deposits of $250 each month, that fee will be waived.

In addition, rather than the student discount or direct deposit, if you have an average balance of $1,500 or more, or if you are a Bank of America Preferred Rewards client, the fee is also waived. These are fairly standard limitations and come with a Bank of America new account offer.

Similar to Bank of America promotions, the Chase checking account offer includes the same $12 monthly fee after a minimal opening deposit of $25. In contrast, the fee will be waived if there is a direct deposit of $500 each month (twice BoA’s direct deposit amount) or with a balance of $1,500 in the account.

One difference with the Chase checking account offer is that individuals must maintain a balance of at least $5,000 overall, which can be split between checking and savings. While this amount seems high upfront, there are other offers that may begin to put Chase in the lead between the two.

Neither the Chase checking account offers and Bank of America offers extend interest bearing on their checking accounts, but both have over 16,000 free ATMs. Outside of those options, the fee for using another ATM is only $2.50 domestically and $5.00 internationally for out-of-network transactions.

All in all, Chase checking account offers and Bank of America promotions have low opening deposits and minimal monthly fees, though there are multiple ways to avoid even these few fees. One Chase checking account bonus would be advanced options, which are Premier PlusSM and Premier PlatinumSM Accounts, which carry additional requirements.

Bank of America offers a similar type of account for balances over $50,000 and a separate program called Preferred Rewards Clients.

Don’t Miss: What Is Credit Counseling? This Is a Service Designed to Help People …

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Premium Checking Requirements

Everyone needs a checking account, but for those who qualify for a premium account, there are certainly some perks to consider. Whether you choose Bank of America or Chase, there are several options to consider when searching for checking account promotions.

Generally speaking, you would need about $10,000 in order to qualify for a premier checking account, such as the ones featured in Chase or Bank of America promotions. Some perks will include additional interest, free or discounted financial advice, discounts, and even waived fees.

According to Nerdwallet, the nation’s five largest banks include Chase, Bank of America, Citibank, Wells Fargo, and U.S. Bank. For this evaluation, we will be diagnosing Chase checking account offers and Bank of America promotions for premium checking accounts.

Chase checking account bonus options include Premier Plus CheckingSM and Premier Platinum CheckingSM. Each has their own fees and requirements to waive those fees. Premier Plus CheckingSM requires a $25 monthly fee, but it can waived if the investor qualifies for the Chase checking account bonus by holding a balance of $15,000.

With the Premier Platinum CheckingSM account promotions, there is also a $25 fee, which can be up to $35 in Connecticut, Net Jersey, and New York. In order to have this fee waived, investors need to have at least $75,000 in linked accounts.

For Bank of America promotions, there is a $25 fee on checking unless $10,000 is linked to your Bank of America or Merrill Lynch account. There is also a Preferred Rewards Bank of America checking account bonus offer that waives fees with at least $20,000 in linked accounts.

Related: Definition: Credit Rating is Defined as a Professional Analysis of the …

Premium Checking Account Promotions & Waived Fees

Also known as relationship banking, premium checking accounts promotions include additional checking account promotions and services, such as checking and savings, investments, mortgages, credit cards, as well as home, auto, and personal loans. This all factors into Chase checking account bonuses and others.

When searching for the best checking account promotions on premium accounts, make sure to look for waived fees on out-of-network ATMs, customer services, discounted mortgages or loan interest rates, low international travel fees or exchange rate discounts, and the coveted, strong interest rates.

Chase Premium Checking Account Promotions

With Chase Premier Plus CheckingSM Account promotions, fees are waived on out-of-network ATMs four at a time, meaning that in every transaction period, the first four out-of-network transactions are waived, but the following transactions will feature $2.50 each, or $5.00 for international ATMs.

In addition, Chase Premier PlusSM features an additional Chase checking account coupon, in the form of bonus waived fees. These include zero fees on check orders, annual fees for a small safe or deposit box, monthly fees on 1-2 checking accounts, and monthly fees on a Chase Plus SavingsSM account.

Finally, Chase Premier PlusSM also features an APY of 0.01%, with free incoming domestic wire transfers (when sent from another Chase account) and free cashier’s checks or money orders as additional sorts of Chase checking account coupons.

The second option from Chase, known as the Premier Platinum CheckingSM, offers its own incentives, which include waived out-of-network fees, free check orders, overdraft protection on four occurrences during a 1-year term, along with waived monthly services and waived stop-payment fees.

Bank of America Premium Checking Account Options

With Bank of America’s checking account bonus, known as Interest Checking®, perks include interest rates that are tiered on the account’s balance and an APY of 0.01% if the balance is below $10,000 and an APY of 0.02% for accounts between $10,000 and $99,000. The Bank of America checking account bonus for accounts over $100,000 is 0.03% APY.

Waived charges include a waive on stop-payments, free cashier’s checks, waives on incoming or domestic transfers of any kind, and the first month’s fees are waived for up to three different Bank of America Checking accounts or four savings accounts. These are great Bank of America new account offers.

In addition to the Interest Checking®, there is also the Preferred Rewards option for Bank of America new account offers. This offer includes a free withdrawal per cycle, and all out-of-network ATM transactions are also waived for those with accounts greater than $100,000 or more.

Other waived fees for Preferred Rewards include check orders, incoming domestic wire transfers, monthly fees on four or less savings or checking accounts, and free incoming international wire transfers for those with balances above $50,000 or more.

Other Bank of America new account offers for Preferred Rewards members include discounts on mortgage fees or auto loan rates, along with rate bonuses for money market accounts and credit card rewards. Other benefits increase with higher balances, generally with interest.

Popular Article: Debt Service Ratio – What is It? It is Defined as …

Savings Accounts to Link with Checking Account Promotions

Since many of the options within checking for Bank of America and Chase include linked accounts, it’s a good idea to check out the pros and cons with their savings accounts. In order to receive the most from your checking account promotions, let’s breakdown the linked accounts.

Bank of America Savings Account Information

Bank of America promotions include a $5 checking fee unless there is a balance of $300, automatic transfer of $25 each month, or if the account is linked with another checking account or with a Preferred Rewards client. Essentially, having the two accounts could save you this small fee within savings.

The interest on this Bank of America offers is 0.01% APY as long as the minimal opening deposit is $25 or more. When linking with a checking account, it’s as easy as going online, using an ATM or simply calling your local branch to change money between accounts.

Chase Savings Account Information

When linking a Chase savings account with this Chase checking account offer, there are several factors to consider. Like the Bank of America offers, Chase Savings includes a $5 fee, which can be waived if the balance is $300, or if a reoccurring deposit is $25 or more. Additionally, those under the age of 18 have their fees waived, regardless of which savings account they hold.

Image Source: Bank of America Checking Account

Other ways to avoid the fee would be to link the Chase Savings account with a Chase checking account offer, such as Chase Premier Plus CheckingSM, Chase Premier PlatinumSM, or Chase Private Client CheckingSM Account.

Interest on this account is 0.01% APY at the moment, as long as a $25 minimum has been met to open the account. In addition, when linking with a Chase Checking Account offer, it’s easy to transfer money between accounts for emergencies.

Savings accounts between Chase and Bank of America are nearly identical. The APYs are below the national average, which is currently 0.06% APY. The benefit of these being so similar is that is allows for more research to be done on the checking side, to determine the best checking account promotions.

Free Wealth & Finance Software - Get Yours Now ►

Customer Experience with Chase and Bank of America Offers

Bank of America offers a phenomenal FAQ section that gives most of the information any customer would ever need. On their website, their Checking Clarity Statements provide an overview of each option, along with any fees or interest that may accumulate.

Both Chase and Bank of America offer budgeting and savings programs in addition to reliable money transfer services. Like Progressive Auto Insurance, they both also offer side-by-side comparisons so customers can quickly examine fee comparisons and see if and when changes may arise.

Bank of America promotions include an online chat portal that even includes estimated wait times when traffic to the site is heavy. While Chase has no chat portal, both sites can answer questions for customers on Twitter, and Bank of America is in 35 states, while Chase is currently in 25.

Perhaps the only item we haven’t discussed are those pesky overdraft fees. Both companies have them and neither one is too friendly. Bank of America offers a hefty $35 fee and may charge customers four times per day; Chase has a $34 fee and will stop after three charges.

Read More: What is Credit Card Consolidation?

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Conclusion – Choosing Bank of America or Chase Checking Account Bonus

Chase and Bank of America promotions offer several convenient options for checking account promotions. While the majority of these two offers are quite similar, the differences will often depend on the customer.

Whether you should choose Bank of America promotions or Chase Checking Account bonus really depends on how much money you have to tie up into accounts.

While it’s ideal to save, not everyone can do so in every season. For those who are unable to keep money in an account at a higher level, the premium checking or linked multiple accounts may not be an option.

Finding the best checking account promotions will often depend on income, savings, and emergency expenses.

When searching for the best Chase checking account bonus or Bank of America checking account bonus, there are many factors to consider, so do your homework to find out which plan fits you best. Remember, there is always a possibility for change, so pay attention to any updates from your bank.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.