How Much Does a CPA Cost? | Guide to CPA Fees & CPA Fee Schedule

Taking care of your personal and business accounting needs is a serious matter. This is why most individuals prefer to entrust their finances to a certified public accountant (CPA).

However, while many consumers and businesses could benefit from the services of a CPA, several are scared off by the potential cost of a CPA and the related accounting fees they’d have to pay.

Handling your accounting or taxes yourself might seem like a great way to save money in the short-term, but it could cost you more in extra taxes or penalties down the road than the initial CPA or tax accountant fee.

At AdvisoryHQ, we’ve noticed a heightened interest regarding CPA fees and the average CPA hourly rate. To help our readers better understand the cost, we’ve put together this review to address key questions consumers are asking:

- How much does a CPA cost?

- How much does a CPA charge per hour?

- How much does a CPA charge to do taxes?

The CPA fees associated with the services provided are of great interest to both individuals interested in hiring a CPA and to professionals who work in the industry wondering what they should charge.

How Much Do Accountants Charge?

To help aspiring CPAs understand what their services are worth, we will review examples of a typical CPA cost and a CPA fee schedule to help your business pricing align with the market.

If you’ve been wondering, “How much does an accountant cost?”, you’ll get the facts and figures you need in this review and can plan your financial needs accordingly.

No matter why you might be interested in the cost of a CPA, our review will give you the information you need to know to avoid being overcharged.

See Also: Top Accounting Certifications to Become an Accountant

How Much Does a CPA Cost?

This question is one of the most pressing on nearly everyone’s mind at one time or another: how much does a CPA cost? Unfortunately, this question cannot be answered simply and takes a bit of research on accounting fees and how they vary.

The cost of a CPA depends largely on the CPA fee schedule, which each individual certified public accountant will determine for themselves.

To answer the question, “How much do accountants charge?”, we are going to take a closer look at the two primary payment methods used by CPAs to determine exactly how much a CPA costs.

Most commonly, CPA fees are determined on an hourly basis, but fixed fee billing has become more popular. Surveys conducted by Intuit (the company behind the popular accounting software, QuickBooks) showed that currently 57% of accounting professionals bill by the hour, that’s down from 66% just three years earlier.

In their most recent survey that addresses the question, “How much do accountants charge?”, 50% of financial professionals use a fixed-rate schedule for accounting fees.

While other types of accounting professionals were also included in their survey (tax accountants, CMAs, certified ProAdvisors, and bookkeepers), 27% of respondents were labeled as CPAs, and 35% were accountants, but not CPAs.

Keep in mind that the CPA rates per hour can vary pretty drastically from region to region. How much do CPAs charge in specific areas? Areas with higher costs of living, such as New York or California, may see a higher CPA cost per hour than those in the Midwest or Southeast.

Additionally, the average CPA hourly rate may fluctuate depending on the level of experience and training that a certified public accountant has.

By definition, a licensed CPA already has more education than some other accountants do. While requirements can vary slightly according to state, the standard requires a minimum of a bachelor’s degree or 120 college credit hours and a passing grade on the CPA exam. They must also maintain continuing education credits to keep their license current.

How much does a CPA cost? The number will differ depending on a number of factors, but in the upcoming section, we will take a look at CPA rates per hour and examples of a possible CPA fee schedule.

Don’t Miss: What is a Chief Financial Officer? What Does a CFO Do?

All-in-One Change Management Tools Top Rated Toolkit

for Change Managers. Get Your Change Management Tool Today...

How Much Does a CPA Charge Per Hour?

How much do CPAs charge? Now that you understand exactly which factors can influence the CPA rates per hour, it’s time to take a more in-depth look at how much CPAs charge their clients around the United States.

Plan on spending anywhere from $30 to $500 per hour. Trying to figure out what the difference is between the services you receive for $30 per hour versus the $500 CPA fees? Let’s look at the breakdown of CPA rates per hour.

We’ve referenced PayScale, which provides current average CPA rates and also addresses the question, “How much does an accountant cost?” for numerous financial professionals.

The national hourly rate data provided for the average CPA hourly rate comes in just slightly under $30 per hour ($28.65).

Because of the additional education and certification that a CPA holds, they are able to command a higher rate than a general accountant, whose median hourly rate is only $20.01.

How much does CPA charge?

To give you an idea of the comparison of other professional accounting fees to that of a certified public accountant, take a look at the averages below:

- CPA Hourly Rate: $28.65

- Accountant (non-CPA) hourly rate: $20.01

- Staff Accountant hourly rate: $20.23

- Senior Accountant hourly rate: $27.54

- Tax Accountant hourly rate: $22.90

- Tax Manager hourly rate: $34.60

With accounting fees coming in a little less than CPA fees, why do people want a CPA instead?

Consumers will typically hire certified public accountants because they value the additional education and insight that the CPA title is supposed to lend to professionals. This education and experience can command a higher price than a standard accountant without their license.

How much more do CPAs charge for their experience? Within each firm, there are separate CPA rates per hour in place depending on the overall income of the firm as well as the number of employees.

Key factors that impact how much accounts charge for CPA fees:

- Experience level

- Industry (tax, audit professionals, etc.)

- Company size

- Geographic location

How much does an accountant cost? If you’re working with a CPA junior staff member, their hourly rate falls in the $60 to $120 per hour range, according to CostOwl. If you want someone with a little more experience, then accounting fees will go up by $40 to $80 per hour.

Supervisors and senior staff members tend to make on average approximately $100 to $200 per hour.

How much does a CPA cost when they’re the owner of the firm? It’s a pretty hefty price difference.

An owner’s CPA cost per hour can range from $200 to $250, however in major cities and for top talent, hourly accounting fees for CPAs can go as high as $500 per hour.

CPA owners can also make significantly more than non-CPA owners with a $20 to $100 per hour price difference between the two.

As you can see from the above examples, the CPA rates per hour vary depending on seniority within the company as well as the size of the firm itself. Smaller firms with lower gross earnings each year may charge an average CPA hourly rate between $30 and $50 per hour, depending on the tasks for which you hired them.

Related: What is a Tax Advisor? Definition and Overview

CPA Tax Preparation Fees

One of the biggest tasks for which consumers and businesses alike will seek out a certified public accountant is tax preparation. As the fiscal year comes to a close, many individuals find themselves wondering, “How much does a CPA charge to do taxes?”

This is a legitimate concern, right along with the CPA cost per hour. In our review here at AdvisoryHQ, we’re going to break down what you can expect to pay next tax season in CPA tax preparation fees.

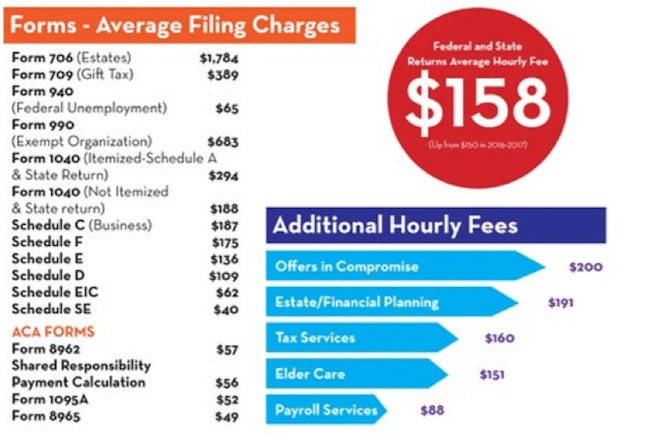

Your CPA fees will depend on the level of complexity involved in your unique tax situation. The National Society of Accountants reported the following average CPA tax preparation fees from the previous year:

- Form 1040 with state return and no itemized deductions – $188

- Form 1040 with state return and Schedule A – $294

- Form 1040 with state return, Schedule A, and Schedule C – $481

How Much Do Accountants Charge for Taxes?

How much does an accountant cost for professional tax preparation on average? Alternatively, you can opt to have your taxes filed by one of the larger, well-known companies that advertise around tax season.

The IRS assembled some of the numbers from the National Society of Accountants to give you a better idea of what you could be looking at in CPA fees.

They estimate the average cost for professional tax preparation as ranging between $152 to $261 depending upon the complexity of your taxes and whether you have additional forms beyond the 1040 to prepare.

Keep in mind that professionals hired by companies such as H&R Block or Liberty Tax Service are not always licensed CPAs and may not have extensive accounting backgrounds. While the CPA fee schedule has the potential to cost more than one of these options, you may find that you save more on your taxes by entrusting them to a certified public accountant.

How much does a CPA charge to do taxes if you have a situation that is slightly out of the norm? You might be surprised at how affordable it can be to hire a professional to prepare your taxes this year.

What other CPA fees might you incur when it comes time to prepare your taxes? Take a look at this average CPA fee schedule from CBS News featuring common occurrences that cost consumers extra money come tax time.

- Disorganized or incomplete information – $114

- Providing information later than requested – $93

- Expediting a return – $88

- Filing for an extension – $42

So, if you make some mistakes or take longer than planned by trying to do your taxes yourself before seeking out a CPA, the accounting fees can add up to more than getting them done professionally in the first place.

The cost of a CPA preparing your taxes can differ not only based on the experience, location, and size of the firm you hire, but it can also differ based on the situation you find yourself in. If you’ve been wondering how much a CPA is for when tax season rolls around, this should give you a good overall picture.

Popular Article: How to Become a Financial Advisor – Four Steps

How Much Do CPAs Charge When Work Is Not Billed Hourly?

Now that you’re armed with information regarding how much CPAs charge per hour, it’s time to take a look at instances where CPA fees may not be billed hourly.

As we mentioned earlier, flat-rate billing has become more popular in recent years, with 9% fewer firms stating they bill hourly than three years ago, so these figures will also be important for you to know.

As with accountants who specialize in routine monthly services such as bookkeeping or payroll, certified public accountants may encounter routine situations that make more sense to bill based on a fixed-fee or a flat-rate system.

Certainly, some certified public accountants can also manage the daily influx of activity with your personal or business finances. How much does a CPA cost above another accountant?

You should be paying slightly more than you would for unlicensed accounting fees, but you could expect to pay a fixed fee for payroll, making deposits, managing your accounting software, or handling your state sales tax.

Services that are rendered regularly on an ongoing basis are typically billed this way to avoid surprises each month for the clients and to provide stability since the firm will know exactly how much CPAs charge for certain items.

How should you evaluate what these fixed fee services should cost? Well, you first need to ask how much does a CPA charge per hour?

Based on the section above, you should have a good idea of what the average CPA fees should be based on the firm, location, and experience of your CPA. Inquire approximately how many hours they believe the work you enlist them for should take and see if the number is reasonable.

How much do accountants charge for monthly services? While rates vary greatly according to the services rendered, Thumbtack estimates that average monthly accounting fees can range between $75 to $175 per month.

Factors that influence the monthly CPA rate include:

- How many bank accounts need to be reconciled monthly

- How many transactions each account has

- Number of CPA consultations you want monthly

- Type of reporting you need

How much does a CPA cost for tax preparation? This is another scenario where most CPA fees will come in the form of a flat rate for each individual filing.

While you may still find CPAs who will charge an hourly fee, many will charge set rates for specific income and tax situations based on the IRS guidelines for estimated times to complete each form.

How much do CPAs charge to do taxes? Our detailed review of what you can expect to pay in CPA fees covers this exact scenario in the previous section.

Read More: What is a Financial Advisor? What do Financial Advisors Do?

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: How Much Is a CPA?

While determining CPA fees for each individual scenario isn’t an exact science, we can come up with rough approximations for the average CPA rates per hour based upon industry surveys. This can be a difficult situation to process because CPA fees do vary depending on your location, the firm you select, and the task you hire them for.

However, our average cost of a CPA should give you a starting point when it comes to answering the question, “How much does a CPA cost?” and “What can I expect to pay in accounting fees hourly or monthly?”

CPA tax preparation fees are even more difficult to delve into because of the complexity of each unique situation and filing needs. For the most basic situations, the average CPA fee schedule listed above should give you a pretty good idea if your new CPA is charging fair CPA rates per hour.

Don’t forget that while our average CPA hourly rate review can provide an excellent introduction to understanding how much a CPA is in order to get the most realistic estimate for your financial situation, you should contact a local CPA directly for their CPA fees based upon your distinct needs.

Image sources:

- https://pixabay.com/photos/computer-business-laptop-technology-3239667/

- https://pixabay.com/photos/bookkeeping-accounting-taxes-615384/

- https://mainstreetpractitioner.org/wp-content/uploads/2018/11/MSP-December-2018.pdf

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.