What Is Credit Karma? The Importance of Your Credit Score

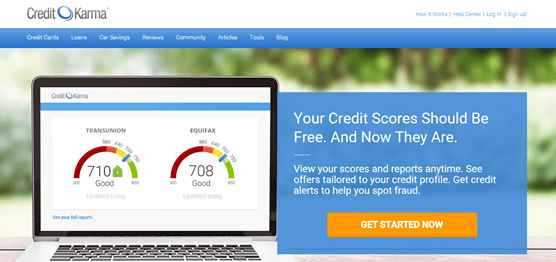

What is Credit Karma? Credit Karma is an online financial management platform that allows users to access detailed information about their credit as well as receive a free credit score. Your credit score determines whether you can get a competitive interest rate, be approved for a credit card, secure a car loan, etc. Therefore, a bad credit score could severely limit your personal financial options.

While your credit report and credit score both serve similar functions – demonstrating whether or not you are a reliable creditor – they illustrate different things. Your credit report is a detailed account of your credit history, types of credit, and payment history.

Banks and other institutions that extend credit will report your payment history to credit reporting agencies, and this information is recorded in your report. Sites like Credit Karma review your credit history to give you your credit score.

Image Source: Credit Karma Reviews

The most popular credit score used by financial institutions is the FICO credit score. While the exact formula is not public knowledge, consumers should be aware that their credit score is calculated based on their credit history, diversity of credit, and length of credit history, among other factors.

Additionally, consumers can receive different FICO scores based on which credit reporting agency is used as a reference. The three main credit reporting agencies – Equifax, TransUnion, and Experian – may have access to different pieces of information.

Since your credit score is determined by your credit report, which is a reflection of the information that’s been reported, it’s important to double-check your credit report to ensure that nothing has been misreported. Incorrect information on a credit report can have an impact on a person’s credit score. Also important to note is that everybody is entitled to one free credit report from each of the three major credit reporting agencies each year.

See Also: Quizzle Reviews – What Is Quizzle? (Is Quizzle Safe & How Accurate)

Credit Karma Reviews: Is Credit Karma Free?

Although online credit score generators have rocketed in popularity, they elicit some skepticism. Often advertised as free, attracted consumers will sign up only to learn that in the fine print, “free” is described a little differently.

During the sign-up process, some sites may ask users to provide their credit card information in order to receive their free credit score. Later, consumers learn that this “free offer” was only valid for a month, and they are then subsequently charged for the following months. So, considering all of this, is Credit Karma free? The answer is yes.

Credit Karma does not require users to provide their credit card information – and it does not plan on adding this requirement. However, hearing a “yes” to the question “Is Credit Karma free?” may do little to reassure you. If Credit Karma is 100 percent free, then how exactly does the site make its money?

The site generates revenue through ads, but not through the traditional bombardment of pop-ups as you use the site. Instead, Credit Karma offers personalized solutions to each of its users so that its ads and recommendations are useful instead of random offerings.

What is included in Credit Karma’s free service? Credit Karma packs many useful features into its service. It provides users with its Vantage 3.0 credit scores derived from TransUnion and Equifax. How accurate is Credit Karma exactly? It updates these scores weekly – each time its users log in – to ensure they have the latest numbers.

Credit Karma also provides you with complete credit reports from Equifax and TransUnion. Credit Karma reviews users’ TransUnion credit reports and informs them of any noteworthy changes through a free credit-monitoring tool. Users can also look at all of their loans and credit in one easy-to-review place.

Credit Karma is not a service where you will be surprised by unexpected charges.

Don’t Miss: 2-10 Home Warranty Reviews – What Is a 2-10 Home Warranty? (Complaints & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Is Credit Karma Accurate? (Credit Report & Credit Scores)

One concern for people hoping to use Credit Karma is whether the information provided by Credit Karma is correct. Banks typically look at a person’s FICO score when assessing that individual’s creditworthiness.

In one Credit Karma review, an individual conducted a comparison between the score provided by Credit Karma and her FICO score. The user found that the Credit Karma Vantage 3.0 score had a 1–2 point difference from her FICO score – a variation that would make no difference for a lender deciding whether to extend credit.

Additionally, credit scores are derived from the three major credit rating agencies – Equifax, TransUnion, and Experian – and these are the agencies that Credit Karma reviews and uses.

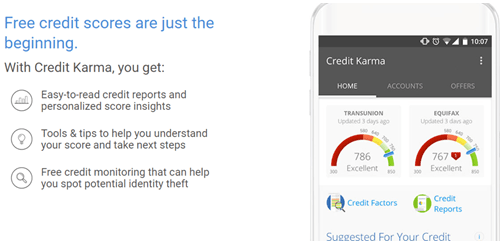

Image Source: Credit Karma

Keep in mind though that if your credit score is significantly different, it is not due to issues with Credit Karma accuracy. It is simply a matter of Credit Karma deriving a credit score from a different model. The issue simply lies in the fact that FICO has become the go-to score.

As a result, users should consider their Credit Karma scores in the context of this information. While the scores may not be spot on – and may be more than a few points off from the FICO scores – it is still a helpful way to track changes in your credit reports. Since Credit Karma is using the same credit reports that FICO uses, if you notice a drastic change, you can take action.

Is Credit Karma Legit? (How Safe Is Your Information on Credit Karma)

It’s only expected that one would wonder, “IS Credit Karma legit?” Identity theft is a common crime, especially with all of the information digitally available nowadays. As consumers become more aware of the dangers of identity theft, they are more hesitant about the information that they hand over when signing up for different services.

So, is Credit Karma legit? Absolutely. It has been around since 2007 and has sustained itself through its business model that gains revenue through targeted offers and advertisements. Credit Karma takes a number of steps to safeguard its users’ personal information.

The transmission of Credit Karma user data is protected through the use of 128-bit encryption. In addition, there is round-the-clock monitoring of the company’s servers.

Credit Karma reviews its security measures and practices regularly by enlisting the help of third-party industry experts to check for any vulnerability and confirm that the site’s security is solid. Credit Karma uses firewalls to protect users’ identities.

Additionally, the company has read-only access to your account. Therefore, Credit Karma cannot carry out transactions on the site the same way that you can’t either.

It also uses industry-standard security features. Remember that all information, whether in a traditional bank or on an app, is technically vulnerable (a determined hacker or a company error are a couple of things that could compromise a company’s security), so you have to make an educated decision about the value of the service versus the potential risk.

Another big concern for people wondering if Credit Karma is legit is whether the credit score they are receiving is the right one. Most financial institutions use FICO whereas Credit Karma uses Vantage 3.0 credit scores.

As shown above in CreditScore.com reviews, your Vantage score through Credit Karma differs because of a different scoring model, so even if there is a variation, there is still significant value to be derived from Credit Karma.

Related: What Is a Home Warranty? – What Does It Cover Complaints & Review)

CreditKarma.com Reviews: What Users Have to Say About the Service

Many financially-savvy individuals and bloggers expressed trepidation at the idea that Credit Karma could actually be free but were quickly pleased to learn that it means exactly what it says. In fact, CreditKarma.com reviews express ample praise for not only its cost-effectiveness but the quality of its service as well.

Image Source: Credit Karma

Finance Gourmet writes: “I have gotten six free credit scores from CreditKarma.com without paying a cent, without buying anything, and without clicking on any advertisements… No matter how it turns out down the road, for now, Credit Karma is a great deal for people managing their money.”

David Weliver, at MoneyUnderThirty, writes in his Credit Karma review: “I was impressed with how easy—and fast—getting my credit score was with Credit Karma. I’ve now been using Credit Karma for over five years.”

He states that it also provides the following:

- A graph that displays your credit score over time

- A comparison of your credit score to others by age, state, and income

- A report that reveals how some factors — such as payment history and debt utilization — can influence your credit score

- Tools which allow you to simulate how paying off debt or applying for credit would alter your score

- Ability to check your free credit report with updates on a weekly basis

Credit Karma Review: Best Uses of Credit Karma

While Credit Karma does not use FICO scores, it offers a lot of useful information for users. It’s a great way to frequently monitor fluctuations in your credit situation for free. It can also give you a reflection of what your FICO score is probably doing.

Constantly paying for your FICO score is pricey and since it constantly undergoes changes, getting your credit score when you are not actively applying for credit is inefficient. Credit Karma is a free alternative for more general monitoring. Users can also understand what specific actions affect their credit score.

Credit Karma also provides a helpful community for members to access financial knowledge and support for users. There, you can access Credit Karma reviews and recommendations for loans and credit cards.

Credit Karma is only available to U.S. residents with a Social Security number. Providing this number is necessary in order for Credit Karma to retrieve your credit report from one of the credit reporting agencies. In some cases, Credit Karma may only need the last four digits of your Social Security number (in addition to your name and other information) to find a match to your credit report with one of the agencies.

For those who do not live in the United States, Credit Karma reviews, helpful articles, and forums can still provide a wealth of financial information.

Popular Article: NASA Federal Credit Union Reviews – What You Should Know (Credit Card, Mortgage & FCU Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.