Guide: Understanding and Harnessing Credit Card Utilization

Maintaining a healthy credit score is a crucial part of building solid finances. To maintain the highest credit score possible, it is important to grasp how it is calculated and the individual factors that are used to measure creditworthiness.

Credit card utilization is one of these important factors. Understanding how credit utilization works and how it can affect your credit score allows individuals the opportunity to steer their credit usage in a productive direction. Effective credit utilization can allow cardholders to use their credit mindfully and improve their credit score with each billing cycle.

Some common questions regarding this subject include:

- What is credit utilization?

- How does credit utilization affect my credit score?

- What is an ideal credit utilization rate?

To answer these questions and more, AdvisoryHQ has compiled an exhaustive guide to help users understand credit card utilization. Each aspect has been broken down to its simplest parts to help users master how credit utilization works and how they can use it to better control their own credit score.

See Also: Important Differences between Debit and Credit Cards | Guide

What Is Credit Utilization?

Credit utilization is the measurement of how much a cardholder borrows from their credit card company each month. It is designed to show how much of their credit is actually used in proportion to their credit limit.

Credit card companies calculate utilization as a debt-to-credit ratio that shows the difference between an account’s credit balance and credit limit.

What is Credit Utilization?

This debt-to-credit ratio accounts for a huge part of an individual’s credit score. Lending companies generally operate under the assumption that these utilization ratios can indicate whether or not a cardholder handles debt responsibly.

Don’t Miss: Best Credit Card Debt Consolidation Companies | Ranking & Reviews

Credit Utilization and Your Credit Score

Many cardholders might ask: What is credit utilization capable of doing to my credit score? Quite a bit. Though there are many different systems used to measure credit scores, credit card utilization generally accounts for about 30% of a credit score calculation.

In its most basic form, a credit score is designed to judge how likely a borrower is to repay their future debts. It is a number calculated to represent an individual’s creditworthiness based on how they have handled debt and credit in the past.

A credit score is generally based on credit reports filed by lenders and is reported by credit bureaus. A high credit score indicates that the individual in question has demonstrated financial habits and behaviors that would make them a quality borrower and unlikely to default on a loan.

Each method used to measure credit scores is unique and may offer slightly different results for the same cardholder. Though they each take into account a number of different factors, they generally include:

- Payment history

- Credit utilization

- Age of credit

- Mix of credit

- Credit inquiries

Each aspect of a credit score measures how likely an individual is to repay their debts in a different way. Companies calculate utilization to judge how high a cardholder’s credit usage is in proportion to how high it could be, which begs the question: should cardholders aim for higher or low credit utilization ratios?

High Utilization Ratios

Debt-to-credit ratios that are higher can negatively affect a credit score. High utilization ratios indicate to a potential lender that a cardholder is a higher risk. This is because larger debts, particularly in proportion to debt limits, are generally less affordable. Debts that are less affordable are more likely to result in late or missed payments. This can result in losses for the lender, which is undesirable.

Credit utilization is significant because each credit limit is predetermined based on each cardholder’s likelihood and ability to repay charges made to the card.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

For example, a person with a $400 credit limit was already deemed likely to be able to repay $400 a month and no more. The closer this person comes to the limit on their card, the less likely, or more difficult, it will be for them to repay their debt. Because a $300 balance is a much higher utilization ratio for them than it would be for a person with a $2,500 limit, it is riskier and less desirable.

High credit utilization ratios indicate to prospective lenders that this person maintains high balances in proportion to their credit limit. This indicates that they may be more likely to spread themselves financially thin in regards to future debt repayment.

Low Utilization Ratios

Low ratios are considered to be the best credit utilization ratios. Using a smaller portion of the available credit makes an individual less likely to default on a payment. This makes them a less risky, more attractive customer to lenders. Those who are more attractive are given higher credit scores to make it easy for lenders to choose the best borrowers.

Related: BMO World Elite MasterCard vs. MBNA Rewards vs. Scotiabank Gold Amex vs. TD

The Best Credit Utilization Ratios

Since high credit utilization rates can wreak havoc on a credit score, lower rates are the best credit utilization ratios. Low credit utilization ratios can be achieved by maintaining low credit card balances. Most experts recommend a credit card utilization target of 30% or less.

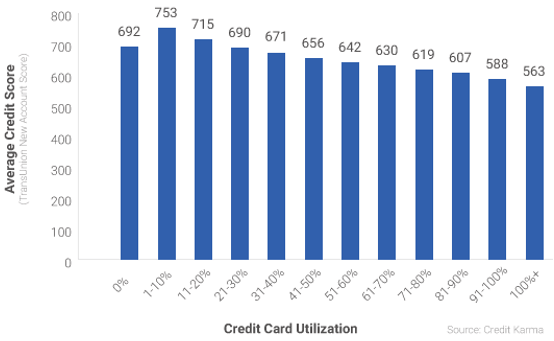

If low credit utilization rates result in better credit scores, it would not be ridiculous to assume that a 0% ratio would be idea. However, a study conducted by Credit Karma in 2014 found that cardholders with extremely low debt-to-credit ratios, between 0% and 1%, actually had lower average credit scores than cardholders with slightly higher credit card utilization ratios.

Credit Card Utilization Ratio

Though 30% is the standard recommendation for credit utilization rates, this study also found that cardholders with utilization factors between 1% and 20% had the highest average credit scores between 753 and 715. This goes to show that there is no magic number for the best credit utilization ratios. Lower might be better, but it is always best to have at least some card activity.

Lower credit rates can result is higher interest rates on credit cards and loans like mortgages. For example, individuals with credit scores of 650 can end up with mortgage interest rates up to 1% higher than those with credit scores around 760. This can add up to thousands of extra dollars over the lifetime of the mortgage. Keeping your credit card utilization low is one way of boosting your credit score and saving money.

Popular Article: Capital One® Quicksilver® vs. Barclaycard Rewards MasterCard® vs. Citi Thankyou® vs. HSBC Platinum Card (Reviews)

Credit Cards with High Limits

Credit utilization can change how you might approach the idea of credit as a whole. Sometimes, people will avoid credit cards with high limits that they feel they could never afford to pay back if they were maxed out. However, credit cards with high limits can make it that much easier to maintain a low credit utilization ratio.

Since credit utilization ratios are directly proportional to credit card limits, having a credit card with high limits offers an easy opportunity for a lower credit card utilization ratio. Even a credit card with a limit that would be completely unrealistic for your finances can offer you the chance to improve your credit score through responsible use.

Having a credit card with high limits or requesting that your credit card company raise credit limits on your account can allow you to maintain a low balance and reap the benefits of low credit card utilization without changing spending or card usage habits.

How Is a Credit Utilization Ratio Calculated?

Calculating a credit utilization ratio for a single credit card is relatively simple. Cardholders can calculate utilization by dividing their credit balance by the credit limit. This number just needs to be multiplied by 100 to find their credit utilization ratio.

For example, if a credit balance is $200 for a card with a credit limit of $1,000, the credit utilization ratio for that particular account is 20%.

Using this formula to calculate utilization for one credit card account may not account for a person’s entire debt-to-credit ratio. This is because many credit bureaus calculate credit card utilization ratios in two ways. First, they will do individual debt-to-credit ratios, as exampled above, for each card. However, they will also calculate an individual’s entire debt-to-credit ratio over all of their active credit card accounts.

For this reason, it is important to approach credit utilization holistically. It is important to maintain a low credit utilization ratio on each individual card so that the overall credit utilization ratio remains low as well. Because credit bureaus examine accounts individually and together, keeping one account low to compensate for another may not end up being helpful.

A high utilization factor will not affect your credit score in the same way as a late payment. A late payment can lower your credit score for a significant period of time. A high debt-to-credit ratio, on the other hand, can change from month to month.

Both your credit score and credit utilization is calculated based on your credit report. Because credit reports are based on monthly updates when your credit cycle ends, your score and ratio may not be completely up to date. This is because they will not reflect your most recent purchases, credit usages, or limit increases.

Read More: Best Discover Credit Cards | Ranking

Ways to Keep Your Credit Utilization Low

Maintaining a low rate of credit card utilization is a major component of a healthy credit score. There are a number of different tricks and methods that can help any cardholder keep their debt-to-credit ratio in check.

A good place to start is with keeping a close eye on each credit card balance throughout the month. Frequently check each balance and plan spending to ensure that each card stays below the 30% mark. Many accounts come with the option to set up automatic alerts. These can easily be set to activate when a balance creeps too close to a high credit utilization rate.

Another easy way to keep credit utilization reasonable is to practice responsible spending habits. Affordable charges and low balances will help keep utilization factors low under most circumstances.

Using multiple credit cards is a good way to keep utilization factors low without limiting spending power. Multiple cards allow users to spread out their spending without pushing any one rate of credit card utilization too high.

Frequent Payments

Frequent credit card payments can also help keep credit card utilization rates at desirable levels. If one card begins to approach the 30% level, making a mid-cycle payment can allow the cardholder to continue using the card without increasing the credit card utilization rate.

Setting an automatic mid-cycle payment along with the regular end of cycle payment can help keep credit card utilization low without requiring such close attention to the account. However, be sure to keep your card usage reasonable to avoid charges that would be difficult to pay back.

Card Limits

Credit card limits are a huge factor in maintaining good rates of credit card utilization. Cards with lower limits are more difficult to use properly because they restrict the amount of money that can be borrowed. For example, a card with a credit limit of $400 has a 30% debt to credit ratio of about $130, a relatively small amount of money.

Inversely, you can decrease your utilization factor quickly by requesting that your credit card company raise credit limits for your account. If an account does raise credit limits, maintaining the same spending patterns will automatically give that account a lower debt-to-credit ratio.

Keep Credit Cycles in Mind

Most credit card companies issue credit reports on a regular cycle. However, this cycle may not line up perfectly with individual billing cycles. This means that it is possible for credit reports to go out in the middle of a cycle or right before a payment is normally made. This can make it seem like a cardholder often maintains a high ratio even if that is not the case.

For this reason, it may be worthwhile to investigate the individual reporting cycles for each credit card account. This is not as difficult as it sounds; a phone call or email to the customer service team should be all it takes to find out what kind of reporting cycle is normal. This can help cardholders know the best times to have their credit utilization as low as possible.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Understanding Credit Card Utilization

Maintaining a low credit card utilization ratio is a great way to help improve your credit score. Understanding how this ratio is measured, how it affects your credit score, and how to optimize it is key to achieving your optimal financial life.

Keep some of our larger points in mind:

- A low credit utilization ratio can improve your credit score

- The best credit utilization ratios are below 30%

- Responsible spending is crucial to maintaining a low debt-to-credit ratio

- Credit bureaus look at both individual and overall credit card utilization ratios

- Raised credit limits can automatically improve utilization ratios

It is important to remember that a credit utilization ratio, high or low, is only one of many factors that make up a complete credit score. The 30% recommendation and findings of the Credit Karma study are only averages and should be treated as such. It is possible for an individual cardholder to have a higher ratio score and still achieve a good credit score depending on their unique financial factors.

Image Sources:

- https://pixabay.com/photos/credit-card-master-card-visa-card-1520400/

- https://www.creditkarma.com/credit-cards/i/credit-card-utilization-and-your-credit-score

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.