Intro: Crowdstreet Real Estate Crowdfunding

A few decades ago, becoming an investor meant finding a financial advisor or a broker to evaluate your financial goals and facilitate the investment process for you.

Today, investing is becoming easier than ever, particularly with the rise of crowdfunding sites. With a focus on sourcing small investments from large groups of people, crowdfunding is often one of the most convenient and accessible forms of investing.

This is especially true when it comes to crowdfunding for real estate. Traditionally, real estate investments required a significant amount of capital, making these investments accessible only to large financial institutions or high net worth investors.

Before real estate crowdfunding platforms existed, investing in real estate was challenging, if not impossible, for individual investors.

As the accessibility and popularity of crowdfunding for real estate increases, many investors are finding that real estate crowdfunding sites are making the process much more accessible, affordable, and profitable.

One such real estate crowdfunding platform is Crowdstreet, offering real estate crowdfunding that is “transforming commercial real estate investing.”

But what is Crowdstreet? How does crowdfunding for real estate work? What do Crowdstreet reviews say about the platform? Most importantly, is Crowdstreet legit and safe for new investors?

In this Crowdstreet review, we’ll cover the above questions to help you determine whether Crowdstreet is the best real estate crowdfunding platform for you.

We’ll also look at the pros and cons highlighted by other Crowdstreet reviews to show what sets this real estate crowdfunding platform apart—and what to look out for when participating in crowdfunding for real estate.

See Also: Simplilearn Reviews – News Report – Financial Literacy

Crowdstreet Review | What is Crowdstreet?

Founded in 2013 and based in Oregon, Crowdstreet is a fee-free real estate crowdfunding platform that seeks to provide “institutional-quality investment opportunities” to help investors diversify portfolios and grow wealth.

As a commercial software and services company, Crowdstreet seeks to “democratize access to commercial real estate investment opportunities” by making it real estate crowdfunding easy, convenient, and rewarding.

What sets Crowdstreet apart from other real estate crowdfunding sites is that it encourages relationships between real estate operators and developers by using a direct-to-investor real estate crowdfunding platform.

This means that investors are sending their contributions directly to the sponsor—and communicating directly with them—which promotes transparency and lowers risk for both parties.

Investor Requirements for Real Estate Crowdfunding

In the past, Crowdstreet securities were only open to accredited investors, meaning they must have an annual income of at least $200,000 or a net worth of $1 million.

Today, the Crowdstreet Marketplace crowdfunding for real estate is available for both accredited and non-accredited investors alike through offerings like the Medalist Diversified REIT and the Impact Housing REIT.

It should be noted that, although these REITs allow for non-accredited investors, the vast majority of securities available through Crowdstreet are restricted to accredited investors. You can access more information on their requirements in their Terms of Service.

Don’t Miss: The Great Courses Review – What You Should Know! (Financial Literacy, Great Courses Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Crowdstreet Review | Is Crowdstreet Legit?

Before using a real estate crowdfunding platform, it’s important to consider where your money is going.

Is Crowdstreet legit? How can you tell that you’re investing with a trusted, verified company?

One good way to determine if a real estate crowdfunding site is legit is to look at what type of industry support they have. In the case of Crowdstreet, the company has brought in over $5 million in funding from investors.

This amount of funding reflects positively on Crowdstreet—investors would not contribute millions of dollars into real estate crowdfunding sites that were not legitimate or poised for success.

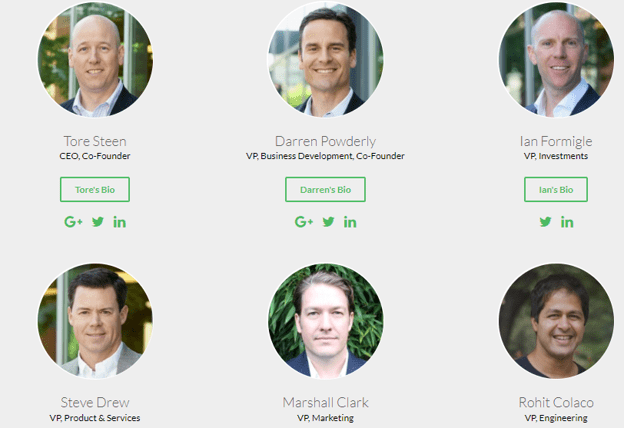

Another great way to answer the question, “Is Crowdstreet legit?” is to look at how experienced their executive team is.

In total, the team at Crowdstreet has over 120 years of combined experience in real estate, software development, online marketing, and private equity, including senior leadership and management roles.

Finally, we can also answer the question, “Is Crowdstreet legit?” by looking at how the real estate crowdfunding platform evaluates the background and track record of each sponsor.

As reported in a Crowdstreet review by Investor Junkie, any crowdfunding for real estate proposals undergo a rigorous review process across three categories, which includes:

- Emerging—Sponsors must have 2-5 years of experience, a portfolio up to $100 million, and proven experience in their given geographical region and asset class

- Seasoned—At least 5 years of experience, over $100 million in their portfolio, and proven relationships with bankers and existing investors

- Tenured—At least 10 years of experience, a portfolio of $250 million or more, multiple real estate investment cycles, and a dedicated staff for investor relations and accounting

With millions of dollars in backing from investors, over ten decades of real estate experience, and a detailed vetting process, our Crowdstreet review concludes that yes, Crowdstreet is legit.

Related: Best Identity Theft Protection Services | Rankings & Review

Crowdstreet Review | Pros & Cons from Crowdstreet Reviews

Real estate crowdfunding through Crowdstreet has been reviewed numerous times by financial experts, generating both positive and negative Crowdstreet reviews.

In the sections below, we’ll highlight the various pros and cons found in Crowdstreet reviews from various financial publications to help you determine whether this real estate crowdfunding platform is right for you.

Pros of Crowdstreet Reviews

In their Crowdstreet review, financial publication Investor Junkie praised the platform for offering comprehensive details on each project, allowing investors to “perform their own due diligence” before investing.

Additionally, all fees are paid by sponsors, making real estate crowdfunding much more affordable for investors, a point which many Crowdstreet reviews are quick to point out.

From the perspective of our Crowdstreet review, encouraging communication between investors and sponsors is a huge benefit for both parties, and should certainly be counted as a significant advantage when using Crowdstreet for real estate crowdfunding.

Not only does it help establish a positive, ongoing relationship, but it also promotes transparency and trust, two key elements of the best real estate crowdfunding sites.

Cons of Crowdstreet Reviews

Compared to other real estate crowdfunding platforms, the investments on Crowdstreet tend to be a bit pricy, a highlighted feature of many Crowdstreet reviews.

One Crowdstreet review points out that, although the average minimum investment for the real estate crowdfunding industry is $10,000, many securities on Crowdstreet start at $25,000.

Investor Junkie echoed this point in their Crowdstreet review, noting that other crowdfunding for real estate sites allow investments as low as $1,000.

The exception to this is their recent inclusion of REITs for non-accredited investors. With minimum investments of $1,000-$5,000, these securities will be much closer to the national average.

Our Crowdstreet review found that one potential downfall could be the lack of liquidity involved in crowdfunding for real estate. Because it is a private marketplace, investors cannot trade their investments, which can be restricting.

It’s also important to note that the length of time is much longer than for other types of investments. For example, current offerings from the Crowdstreet Marketplace range anywhere between 3-12 years, meaning that investors are in it for the long haul.

Popular Article: Top Gift Ideas for Women Who Have Everything (Detailed List and Guide)

Conclusion: Is Crowdstreet the Best Real Estate Crowdfunding Platform for You?

For accredited investors with larger amounts of capital to invest, Crowdstreet is a great option.

Compared to other real estate crowdfunding platforms, there is a stronger focus on communication between sponsors and investors, and investment offerings have impressive rates of return.

Crowdstreet also has the advantage of focusing entirely on commercial real estate crowdfunding, which eliminates the need to sift through single-family homes.

However, for non-accredited investors, Crowdstreet will not be the best option. While they are slowly integrating more options, a real estate crowdfunding platform like Fundrise will have a greater range of investment options with lower requirements.

As with any real estate crowdfunding platform, your best approach is to perform your own research to evaluate whether the platform suits your unique investment goals and requirements.

Read More: Udemy Review – What Is Udemy? Get all the Facts (Udemy Courses Review)

Image sources:

- https://www.crowdstreet.com/about/

- https://cdn.pixabay.com/photo/2017/10/28/09/57/venice-2896591_960_720.jpg

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.