Intro: Definition of Portfolio

If you’re curious about the benefits of investing, or are already in the process of determining what might go into your investment portfolio, you may come across quite a few terms that seem confusing.

Perhaps you’re already asking some – or all – of the following questions:

- What is the definition of a portfolio?

- What is an investment portfolio?

- Where can I find an investment portfolio example?

- What is portfolio risk management?

- What types of investments are there?

- What are the safest investments?

- What investments carry the least or the most risk?

As you focus on developing a working knowledge of these terms and otherwise expand your knowledge base, you will be surprised at how your understanding of investment terminology expands exponentially.

Furthermore, you will become even more adept at choosing what types of investments will go into your investment portfolio.

See Also: What Is Private Equity – What Do Private Equity Firms Do? (Definition & Types)

What Is an Investment Portfolio?

While you may be familiar with the term investments, which might bring to mind an investment portfolio example of real estate purchases and rental property, you may not be aware of the basic definition of a portfolio.

According to Investopedia.com, it is a collection of financial assets that tends to include a variety of investments, such as stocks and bonds. Depending upon your expertise, you might manage your own investment portfolio or have a financial advisor, such as a broker, handle it for you.

Image Source: Definition of Portfolio

To expand this investment portfolio definition, there are conservative (less risky) as well as high-risk portfolios. According to Investopedia.com, here are some of the financial assets that might be contained in a conservative portfolio:

- Large cap value stocks

- Market index funds

- Investment-grade bonds

- Liquid cash equivalents

The types of investments that might be included in a high-risk portfolio vary. According to Investopedia.com, an investment portfolio example might include some or all of these investment types:

- Small cap value stocks

- Large cap growth stocks

- High-yield bonds

- Real estate

- International investment opportunities

When searching for types of investments to make, it goes without saying that you want — and expect —some level of financial gain. This is where the risk factor comes in, and one of the many reasons why new as well as experienced investors will diversify their portfolios so that they include a variety of investment types.

Don’t Miss: What Is a HELOC? Get All Your Info! (Definition, Tax Deduction,& Review)

What Is a Diversified Investment Portfolio?

You have probably heard the term portfolio diversification before, and you may even be aware that diversification has the potential to minimize your financial risk.

Portfolio diversification’s definition basically comes down to having a variety, or different types, of investments. These may include both short- and long-term investments as well as a combination of low- and high-risk investments.

Finding investment portfolio examples will assist you with further developing a portfolio diversification definition. To begin with, you’ll want to familiarize yourself with the range of choices.

If you’ve been investing on your own, you may want to consider working with a broker or a financial advisor to assist you with this process.

The types of investments you might have in your portfolio, according to Investopedia.com, might include some or all of the following types of assets:

- Stocks

- Government bonds

- Corporate bonds

- Treasury bills

- Real estate investment trusts

- Exchange-traded funds

- Mutual funds

- Certificates of deposit

- Options

- Warrants

- Futures

- Commodities

- Real estate

- Land

- Timber

If you’re an experienced investor with extensive knowledge of the stock market, you may want to join forces with other investors to become an institutional investor. These types of investments will generally require that you have a considerable amount of capital to invest.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The potential of receiving a high return is often commensurate with the risk. According to a short video at Investopedia.com, these investment types include the following categories:

- Insurance companies

- Banks

- Hedge funds

- Retirement funds

- Mutual funds

- National endowments

- Public sector pensions

Image Source: Investment Portfolio

You may also be interested to know that there are added incentives to other types of investments, such as being an institutional investor, which pools money from various investors to take advantage of larger investments or loan origination opportunities. In addition to fewer regulations, the Investopedia.com video cites these benefits:

- The ability to be part of daily operations

- The ability to determine whether a business remains open or is closed down

- The ability to purchase a major stake in the company

- The ability to exercise voting rights

- The ability to buy and sell company shares

It is important to remember that these benefits, in general, are accompanied byan increased responsibility to shareholders and have the potential to affect other aspects of the business or industry.

What Are Some Short- and Long-Term Investment Types?

When looking for types of investments, you will probably encounter both short- and long-terminvestment types. The Motley Fool provides several categorical options. First of all, there are short-term investment vehicles, or methods:

- Savings accounts

- Money market funds

- Certificates of deposit(CDs)

Under long-term investment vehicles, Motley Fool lists these types of investments:

- Bonds

- Stocks

- Mutual funds

If you’re investing for retirement, then The Motley Fool recommends these types of investments:

- Individual retirement accounts(IRAs)

- Roth IRAs

- 401(k)s

- 403(b)s

- Keoghs

- Simplified Employee Pensions(SEPs)

If you’re interested in knowing more about stocks and are looking for a stock portfolio definition, then NASDAQ.com is an excellent website for obtaining information.

Furthermore, given the site’’ extensive resources, you will be able to find more than one investment portfolio example. According to NASDAQ.com, there is preferred stock as well as common stock.

If you are a preferred stockholder, according to NASDAQ.com, this positionis defined by some of the following characteristics:

- Preferred stockholders participate in corporate ownership.

- Preferred stockholders have earning claims before common stockholders.

- Preferred stockholders have asset claims before common stockholders during a potential liquidation process.

- Preferred stockholders usually receive fixed dividends.

- Preferred stockholders don’t always have company voting rights.

NASDAQ.com defines common stock holders by some of the following characteristics:

- Common stockholders have company equity.

- Common stockholders may be able to vote on a variety of issues.

- Common stockholders share profits and receive dividends when securities have appreciated.

Related: What Is FCA? – What Does FCA Stand for? (Definition, Guidelines, & Meaning)

What is Portfolio Risk Management?

Once you have an investment portfolio, one of your major concerns will be portfolio risk management. According to NASDAQ.com, risk management is a process that entails the identification and evaluation of risks.

Furthermore, it entails using a variety of techniques that assist you with adapting to the situation when exposed to these risks.

In simple terms, you will be assessingthe risk factors of your various types of investments to determine what type of action, if any, you might need to take to protect your investments. There are common factors that can potentially contribute to this risk, according to NASDAQ.com:

- Market return

- Interest rates

- Inflation

- Industrial production

While you may not have control over the factors above, you can make an effort toprepare for them to the best of your ability. One way to accomplish this is to maintain an awareness of market trends and other events that have an influence on your types of investments.

This would include following local, regional, national, and international news reports from multiple, respectable sources. Even one of the seemingly safest investments possible can be affected by world events.

When assessing your financial risk and otherwise engaging in portfolio risk management, you will probably ask yourself a variety of questions regarding portfolio diversification, short- and long-term investments, and so forth.

You may also ask yourself the question, “Am I making the safest investments, or am I taking too much risk?”

You may have heard it said that it’s really a matter of making safer, or less risky, investments. This is because there is an inherent risk with most types of investments. Some investors might be more cautious, or conservative, while others may live— and love —to take risks.

Whatever type of investor you believe you are or want to become, it takes planning. As previously stated, you may want to consider working with a financial advisor, planner, or broker to assist you with making the best possible choices given your situation.

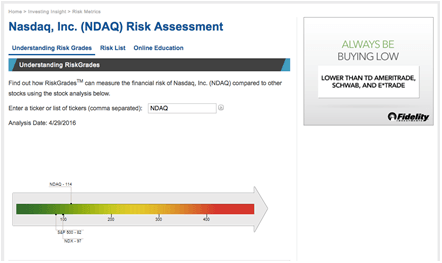

Image Source: NASDAQ.com’sRiskGrades™

If one or more of your investment types includes playing the stock market, there are tools available to assist you with understanding and determining risk assessment. One is NASDAQ.com’sRiskGrades™. This particular tool is designed to provide a comparative analysis of NASDAQ with other stocks; it may assist you in determining your portfolio’s risk management process.

Popular Article: Algorithm Trading – What Is Algorithmic Trading? (Strategies and Software Reviews)

Where Can I Obtain More Information?

To become — and remain — informed about different types of investments, you’ll want to read industry-respected publications that cover a broad, as well as narrow, range of topics. Whether you want to know about the safest investments, portfolio risk management, or an array of other topics, there are more than a few from which to choose.

It’s also important to read several different types of publications — and from different perspectives — in order to develop critical thinking skills and a firm knowledge base.

This is particularly important as a beginning investor because you’re in the process of understanding what constitutes an investment portfolio definitionas well as other important matters.

An InvestorJunkie.com article, “Top 7 Financial Magazines Smart Investors Should Read,” lists the following periodicals:

- Kiplinger’s Personal Finance

- Barron’s

- Investor’s Business Daily

- Bloomberg Businessweek

- The Economist

- Forbes

- Money

It’s a good idea to spend some quality time reviewing each publication to determine which ones relate to your interests and address your short- and long-term goals.

Once you do this, you’ll likely find several that contain information on the types of investments that interest you and that you will also enjoy reading.

Just one of these publications you might want to consider reading is Investor’s Business Daily. This publication can guide your process and provide valuable resources.

Free Wealth & Finance Software - Get Yours Now ►

For example, under the “How to Invest” pull-down menu is a broad selection of practical lessons, including “How to Read Stock Charts,”“How to Sell Stocks,” and “How to Buy Stocks.”Under the Educational Resources section is an “Investor’s Corner,” information on home study courses, live workshops, and more, including a glossary.

Over time, and with the proverbial due diligence, you will discover that the questions you ask will gain in sophistication. Where first you were attempting to find the basic definition of a portfolio or an investment portfolio example, now you may find yourself delving even deeper into more complicated issues such as what constitutes an investment portfolio analysis.

Read More: What Is Swing Trading? (Basics, How-to, & Strategies)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.