Overview: FCA

As you begin to explore investing your hard earned money and started to do some research, you may have asked the question, “What does FCA stand for?”

FCA stands for Financial Conduct Authority. The FCA is a United Kingdom organisation that regulates the financial services industry. The FCA guidelines set out three objectives for the organisation.

What Is FCA? – Objective to Protect Consumers

When asked what FCA is for, one answer is that it helps to protect consumers. The FCA works to make sure that consumers are being treated fairly. The FCA regulation monitors financial institutions to verify that they meet the FCA rules and standards given to the institutions.

What Is FCA? – Objective to Protect Financial Markets

The second answer as to what is the FCA is that it works to ensure that financial institutions have a strong infrastructure—as well as thorough risk management and individual accountability—that enables firms to resist financial ups and downs. The FCA meaning here is that the UK financial markets will remain strong and stable throughout the entire European Union and international financial system.

FCA Regulation

FCA Regulation

What Is FCA? – Objective to Promote Effective Competition

Another answer is that the FCA protects the financial markets by encouraging fair competition so that consumers get the best possible deal when shopping for financial service products. Through FCA regulation, financial service markets, businesses, and exchanges are verified to determine that they are in compliance with the FCA rules.

See Also: What Is Consumer Credit? – Everything You Should Know

What Is FCA? – Cooperating Organisations

The United Kingdom has created a multifaceted approach to creating a stable and thriving economy. In addition to the FCA regulation, several other organisations are involved with this responsibility. These organisations have their own objectives that work in conjunction with the FCA rules and regulations.

Whereas the FCA stands for the regulation of the financial services industry, the Prudential Regulation Authority is responsible for the regulation of banks, building societies, credit unions, insurers, and major investment firms.

The Bank of England, working alongside the FCA regulations, is charged with regulating payment, clearing and settlement systems, acting as a lender, influencing markets in times of financial stress, and facilitating the safe resolve of failing financial institutions.

The Financial Policy Committee was formed to identify, monitor, and take action to remove the risks that may be a threat to the financial stability of the United Kingdom and its financial systems.

While not directly associated with the government, the FCA guidelines mandate that the FCA reports to the HM Treasury, a government organisation. In addition, the Treasury oversees public spending, guiding the direction of UK’s economic policy and striving for a stable and growing economy.

Other agencies, government departments, and organisations that cooperate closely with the FCA to uphold what the FCA stands for include the Money Advice Service, the Department for Business Innovation and Skills, the Department of Work and Pensions, The Pensions Regulator, the Serious Fraud Office, the Financial Ombudsman Service, the Financial Services Compensation Scheme and the Serious Organised Crime Agency.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Is FCA? – History

Prior to creating the FCA in 2012, the Financial Services Authority was responsible for the regulation of the financial services industry. Formed in 1997, the FSA took over the responsibility for supervising banking from the Bank of London. It was also the listing authority for the London Stock Exchange and had the responsibility of regulating the investment services in the UK. Similar to FCA regulation, additional responsibilities given to the FSA after 1997 included regulation of the mortgage and insurance businesses and the ability to act when market abuse was evident.

After the economic and financial crisis, the United Kingdom determined there was a need to create a new set of rules and regulations that would provide stability, foster competition and prevent fraud in the financial services industry in order to reduce the risk of another financial crisis in the future. From this need, the Financial Services Act received royal assent on 19 December 2012, thus establishing what FCA stands for.

Don’t Miss: The Sarbanes Oxley Act – 2002

What Is FCA? – Legal Regulatory Powers

The new FCA rules give the organisation tremendous power to not only observe and monitor but to investigate and enforce the FCA rules and regulations. The FCA takes a three step approach to the process.

Step 1 of the FCA regulation is Authorisation. Through careful investigation, the FCA evaluates a firm or individual to determine if the firm or individual presents a risk to the overall FCA objectives. If the firm or individual does not meet specific standards set forth by FCA guidelines, the FCA will not permit that firm or individual to join the organisation.

Step 2 of the FCA regulation is Supervision. Once a firm or individual has passed the FCA guidelines and been accepted by the FCA, the FCA continues to monitor and supervise the actions of the firm or individual on an ongoing basis. This ongoing supervision assures consumers that the firms under the FCA regulation maintain a high level of standard defined by the FCA.

Step 3 of the FCA regulation is Enforcement. Where the FCA finds a firm or individual that is not maintaining the FCA guidelines, the FCA has the power of enforcement through the use of fines and criminal prosecutions.

What Is FCA? – Who the FCA Regulates

The FCA is charged with the regulation of a specific set of financial services as part of an overall program to reduce the risk and improve the strength and security of the UK economy.

Financial Advisors – Since the creation of the FCA, firms and individuals who advise on products for investments, pensions, retirement income, and financial planning are now required by FCA rules to charge a fee for such advice. Prior to the new regulations, financial advisors would collect commissions from the products they sold.

Mutual Societies – The FCA rules mandate that the FCA is responsible for registering new mutual societies as well as keeping public records and receiving annual returns from such societies.

Banks – The FCA rules indicate that the FCA will be tasked with the supervision of banks to determine that the banks ensure customers are treated fairly, that innovation and competition are encouraged, and that the banks facilitate the identification of potential risks to the economy early and often to reduce lasting consequences.

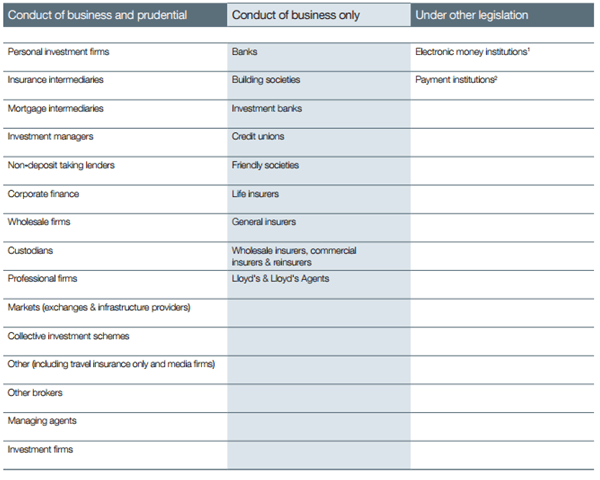

The table below is provided by AllenOvery.com and provides an extensive list of the types of firms that the FCA regulations are anticipated to be responsible for.

What is FCA?

A firm or organisation applying for authorisation to be included in the FCA will be categorised into four classes.

- FCA definition of category 1, or C1, includes banks and insurance agencies with a significantly large number of retail customers as well as those banks holding large client assets.

- FCA definition of C2 includes firms of all varieties that hold a significant number of retail customers.

- FCA definition of C3 includes firms of all varieties that hold retail customers but do not meet criteria for C2.

- FCA definition of C4 includes smaller firms and most intermediaries.

The category that a firm falls into will determine the level and style of supervision and FCA regulation. Firms falling into C1 or C2 pose the largest risk to consumers and market integrity.

Related: From Basel I to Basel III – Overview of the Journey

What is FCA? – Organisation

FCA Rules

To define FCA is to understand that it is an independent organisation, accountable to but not directly associated with the government. This independence allows for the FCA to better monitor and regulate without being encumbered by strict government regulation and oversight.

What FCA is, in part, is a foundation of transparency. In order to uphold this transparency, the FCA follows specific standards including a register of interests that provides a complete list of the directors and other positions held within firms that maintain membership and are FCA-regulated as well as those on the FCA board. In addition, the FCA rules allow for transparency through clear FCA meaning of how to deal with media, publishing internal audit reports and allowing and publishing external reviews.

As part of what defines FCA, accountability has been built into the structure of the organisation, allowing for complaints to be filed against the FCA when someone has been directly affected by what the FCA has or has not done. The FCA rules allow for a complaint to be defined as “any expression of dissatisfaction about the manner in which the regulators have carried out, or failed to carry out, their relevant functions.”

An additional part of the FCA organisation is Procurement. Due to the FCA regulations, all money spent by the FCA is required to be evaluated to ensure that the highest value is obtained. FCA contracts currently available are listed within the Tenders Electronic Daily.

Popular Article: Can Capital Reviews – Get All the Facts Before Using Can Capital

What is FCA? – How the FCA Is Funded

Funding for the FCA comes from fees charged to the firms or individuals that the FCA regulation covers. There are a variety of fees included that support the FCA and what the FCA stands for.

Application Fee – this fee is charged when a firm or individual requests authorisation from the FCA. The amount of this fee is determined by the complexity of the application and currently ranges from £1,500 to £25,000.

Change to Permissions – This fee is charged per the FCA guidelines whenever a firm requests a change to existing authorised activity. There is no fee to reduce existing permissions. A change to a firm’s permissions that maintains the existing fee block incurs a fee of £250 and a fee that puts a firm into an additional fee block will be charged 50% of the relevant authorisation application fee.

Annual – The fee for maintaining current status with the FCA. The annual fees are determined based on the type of activities, the amount of business, and the cost for FCA regulation of those activities.

Free Wealth & Finance Software - Get Yours Now ►

What Is FCA? – Benefits to Consumers

A primary goal of what the FCA stands for is consumer protection. These consumer protections allow for a stronger and more risk tolerant economy throughout the United Kingdom.

Complaints – The FCA rules outline how and when a consumer can file a complaint and receive compensation in the case of a dispute. FCA guidelines suggest a four-step process, including contacting the firm directly, making the complaint yourself, contacting the Financial Ombudsman Service, and finally, taking the matter to court.

Scams – In addition, the consumer can obtain an FCA definition of scams and provides a list of unauthorised firms and individuals and gives recommendations for how to avoid the scams and what to do if a consumer is affected by a scam. In addition, the FCA guidelines proved a way to report suspected scams.

Research Financial Service Products – The FCA stands for a well-regulated and thoroughly monitored standard of service in the financial services industry. A consumer has the ability to research the firms and the services provided by said firms that follow the FCA rules and regulations.

Consumer Protection – Because firms can only operate within the UK if they are authorised by the FCA or are exempt, this provides a level of security for the consumer, knowing that all firms following FCA regulations must uphold a high standard. This reduces the risk of unfair contracts and misleading advertisement.

Read More: CuraDebt Customer Reviews – Get all the Facts before Starting with CuraDebt

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

What Is FCA? – In Summary

Because it is still relatively new, there are often many questions about “just what is the FCA?” from consumers as well as firms looking to move into the financial services arena. What the FCA stands for is a set of rules and regulations that help to authorise, monitor, and enforce in order to provide for a strong economy that can minimize risk as much as possible. This is done through a structure of accountability, transparency, and supervision for companies that focus on investments of a financial nature. The FCA meaning holds to be one of cooperation with other organisations with a similar or complementary purpose.

Image sources:

- https://www.bigstockphoto.com/image-85852529/stock-photo-regulation-button-on-keyboard

- http://www.allenovery.com/SiteCollectionDocuments/The%20Financial%20Conduct%20Authority%20April%202013.pdf

- https://www.bigstockphoto.com/image-99199055/stock-photo-business-people-shaking-hands%2C-finishing-up-a-meeting

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.