Discover Bank Reviews – Online Banking Rates, Savings/CD Rates, and Locations

This “Discover Bank reviews” article is a follow-up to AdvisoryHQ News’ comparison ranking of the top online banking firms with the best CDs and savings rates.

Based on the high interest yield offered on Discover Bank’s high yield savings account, combined with the bank’s high yield CDs (3 months–10 years) and money market accounts, Discover Bank was selected as one of this year’s best online banking firms.

In this Discover Bank review article, we present a more detailed overview of the bank and also answer frequently asked questions about Discover Bank CDs, Discover Bank high interest savings accounts, and Discover Bank locations. Discover Bank provides a wide range of online banking accounts and products to meet most (if not all) of your banking needs.

Image Source: Discover

Image Source: Discover

Are you looking for a Discover Bank location? If so, click here: Discover Bank Locations and Address.

Discover Bank Reviews – Intro

As a banking institution, Discover Bank offers services and products that are similar to those provided by most brick-and-mortar banks like Bank of America, Citi, Bank of the West, and Wells Fargo.

However, as an online banking firm, Discover Bank does not operate a lot of physical bank locations and relies heavily on online banking tools. Based on these factors, the bank is able to pass along “overhead cost savings” in the form of additional savings and high yields to its depositors.

How Safe Is Discover Bank?

Questions that are frequently asked by potential new customers include “Is Discover Bank safe?” and “Is the bank FDIC-insured?” Yes, Discover Bank is FDIC-insured. What this means is that your funds are FDIC-insured up to the maximum allowed by law (FDIC deposit insurance is $250,000 per depositor).

In addition, Discover has a “$0 Liability Protection,” which means that you will never be responsible for any unauthorized use of your Discover bank debit card nor would you be responsible for any fraudulent online/mobile banking transaction that is made on your account.

Overall, Discover Bank is safe (relative to other online banks) in that it provides the below free protection and insurance services:

- Free Proactive Fraud Monitoring service

- $0 Liability Protection service

- Free Bill Pay Protection services

- Military grade encryption protocol

- Enhanced online protections__

Discover Bank Locations

For general correspondence, below are the three Discover Bank address locations for sending your mail. Also see “Discover Bank Locations – 60,000+ Free ATMs.”

Discover Bank Locations for General Correspondence:

Checking & Savings Accounts – Discover Bank address location:

- Discover Bank

- PO Box 30416

- Salt Lake City, UT 84130

New Accounts & Deposits – Discover Bank address location:

- Discover Bank

- PO Box 30417

- Salt Lake City, UT 84130

Discover Bank Address Location for all IRA/retirement account-related correspondence:

- Discover Bank

- PO Box 30418

- Salt Lake City, UT 84130

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Discover Bank Savings Account Review

Opening a Discover savings account can be done online or by calling the firm’s toll-free number. You’ll need at least $500 to open your account. As with most savings accounts, you are allowed 6 withdrawals a month.

Discover Bank’s saving account has no monthly maintenance fees. In addition, there are no monthly balance requirements.

You can deposit checks using the bank’s mobile app or transfer money between your accounts with ease.

Discover Bank Checking Account Review

Discover Bank’s checking account is what is known as a “cashback” account. With this account, you can earn 10 cents for each transaction (up to 100 transactions per month).

The 10 cents per transaction is applicable to debit card purchases, online bill payments, and check payments. In total, you can earn up to $120 in cashback income from your Discover checking account. Similarly to the bank’s savings account, there are no monthly balance requirements or monthly maintenance fees.

Best of all, you can open this account with as low as $25.

Discover Money Market Account Review

Discover Bank’s money market account is a high yielding interest paying account. A $2,500 deposit is required to open the account. In addition, a $2,500 monthly balance is required to avoid a monthly maintenance fee.

Click here to open a Discover Bank money market account: Discover Bank Money Market.

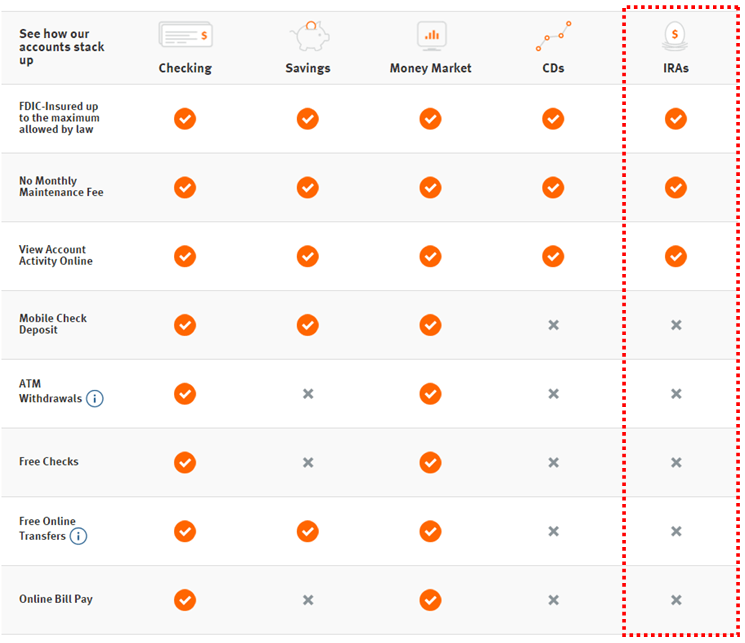

Discover Bank IRAs Reviews

Are you interested in a Discover Bank IRA? Similarly to its high yielding CD accounts, Discover also offers very high rates on its IRA accounts.

Image Source: Discover__

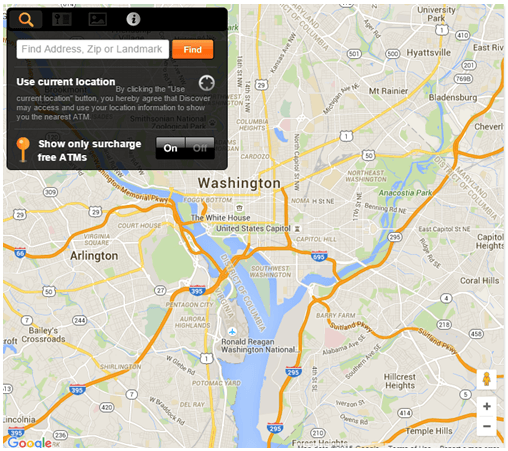

Discover Bank Locations – 60,000+ Free ATMs

Being an online bank, Discover does not maintain physical branch locations, which allows it to keep its expenses down and offer these high yielding accounts.

As a customer of the bank, you are provided with easy access to your funds and deposits at over 60,000 free ATM Discover Bank locations. See below for how you can find one of these 60,000+ free ATM Discover Bank locations.

Finding a Discover Bank ATM Location

To find a Discover Bank location to withdraw funds, follow the instructions below:

1. Click here: https://www.discover.com/cash-atm-locator/

2. Enter your zip code.

3. Discover Bank ATM locations in your area will be represented by orange map pins.

Image Source: Discover

Withdrawing Money from Your Discover Credit Card

What if you want to withdraw money from your Discover credit card account instead of your Discover checking or savings account? Are there any ATM fees?

No, there are no ATM fees if you take a cash advance with your Discover credit card at one of these locations.

However, Discover will charge you a cash advance APR (and possibly additional fees) for taking cash out of your credit card (this is not isolated to Discover. All credit card companies do this).

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.