Student Loan Debt and Federal Loan Servicing

Student loan debt is increasingly on the rise in the United States with the average 2016 graduate having $37,172 in debt upon graduation. With statistics like this rising year after year, it’s no wonder that the Department of Education allows separate federal loan servicing companies to help handle the workload.

Consumers are working hard to untangle the web of their debt, but it helps to have a thorough understanding of how the Fedloan student loans work. If you originally took out your student loans with the Department of Education, why are you now required to make a Fedloan payment?

Image source: Freeimages

Is dealing with Fedloan Servicing a scam?

Not all of the Fedloan Servicing reviews are resoundingly positive. A few of the same customer complaints seem to crop up time and time again. The frequency of negative reviews is enough to make consumers wonder if there is a Fedloan Servicing scam.

In this article, we will be exploring the details on MyFedloan Servicing from making a payment to utilizing the Fedloan Servicing app. If you’ve been wondering how to handle your current predicament with your federal loan servicing, you’ll want to join us as we take a look at a potential Fedloan Servicing scam.

See Also: Top U.S. Bank Credit Card Offers | Ranking | U.S. Bank Cash Back, Travel, Rewards Cards Reviews

What Is Fedloan Servicing?

With all the hype over repaying Fedloan student loans, many consumers are a little confused over why MyFedloans is handling their debt. Sometimes referenced as their parent company, the Pennsylvania Higher Education Assistance Agency (PHEAA), Fedloan Servicing has come under scrutiny in the recent past. We’ll take a closer look at the Fedloan Servicing reviews after we gain a thorough understanding of what they do.

Consolidating, repaying, and postponing payments can be tricky endeavors but Fedloan Servicing is designed to aid in the process. As of December 2015, they are the largest company set up for federal loan servicing.

Federal loan servicing companies were created to handle the day-to-day operations for student loan borrowers required by the Department of Education. Many of these companies exist, including Fedloan Servicing. Consumers are assigned to specific federal loan servicing companies with no preference or option in their appointed company.

Fedloan Servicing is one of several possible federal loan servicing agencies consumers could be assigned to. They are approved by the Department of Education, and Fedloan Servicing maintains a staff of dedicated loan counselors.

Fedloan Servicing and the Fedloan Servicing app come alongside consumers struggling with their student loan debt. They offer assistance in multiple ways, ranging from special programs to arranging special monthly payments.

For a full list of services provided by Fedloan loan servicing, take a look at our list below:

- Educate yourself on debt and estimate monthly payments while in school

- Generate a repayment strategy

- Come up with realistic monthly payments based on income

- Organize all of your debt in one convenient location

- Consolidate your loans

- View information quickly with the MyFedloan app

In theory, the MyFedloan Servicing does offer a handful of programs that are useful to college students and recent grads alike. However, many consumers are finding that there are a lot of difficulties regarding dealing with their Fedloan student loans.

For a closer look at what real consumers and other companies are sharing regarding their federal loan servicing, you don’t have to look far.

Don’t Miss: Compare Credit Cards | Ranking | Top Credit Cards (Comparison & Reviews)

Customer Service Complaints

When it comes to Fedloan Servicing reviews, it’s difficult to find many that feature a positive spin on their offerings. The idea behind their federal loan servicing seems solid enough, but they appear to be lacking on follow through.

One consumer referred to them as “consistently and embarrassingly awful” in their Fedloan services reviews. This attorney’s docket for the previous year demonstrated at least one major issue with Fedloan Servicing for more than 64% of his clients.

Lengthy Wait Times

The complaints about the customer service associated with Fedloan Servicing are numerous. Consumers are perhaps most concerned with the lengthy wait time associated with new income-driven pay as you earn plans.

In an exposé written by the Washington Post, many advocates for the Revised Pay As you Earn (REPAYE) program estimate that it typically takes two to three weeks to be enrolled. In many cases, the time increased to thirty days or more. With Fedloan Servicing, they found that the cases were even further backlogged.

The Consumer Financial Protection Bureau did some investigating to find out why so many consumers fail to enroll in the income-driven plans offered through federal loan servicing.

They found that Fedloan Servicing (along with the other top companies) have a history of complaints when it comes to giving consumers inaccurate information.

The top student loan official from the Consumer Financial Protection Bureau cited “detours and dead-ends” when it came to keeping payments affordable. When they reached out to Fedloan Servicing on their own, they did not offer comments on the situation and consumer complaints at hand.

For many, the lag between filling out the appropriate paperwork and receiving the opportunity to enroll in the repayment plans leads them to believe that the Fedloan Servicing scam could be real.

Consumers who reach this point are desperate to make their Fedloan Servicing payment more affordable based on their income.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Misinformation

However, it is increasingly difficult to do that with such an influx of consumers complaining of lengthy wait times and misinformation. Attorney Adam Minsky wrote for the Boston Student Loan Lawyer that two of the top complaints he encounters in the field are misinformation and confusing or erroneous documentation.

His suggestion to receiving misinformation or erroneous documentation is to call the company directly. Instead of assuming that the letter you received in the mail is accurate, it is important to have an actual conversation with a customer service representative regarding the status of your Fedloan payment, consolidation, or anything else pertaining to your Fedloan account.

Many consumers are also complaining that their time working toward public service loan forgiveness is not counted appropriately. Misinformation from customer service representatives regarding this program is costing borrowers more money than they had planned.

Not only are they struggling to pass along correct information, but many recommend hiring friendlier and more personable staff to take care of clients who call. It is more than just the misinformation that is off-putting to consumers and borrowers who utilize Fedloan Servicing.

In reviews everywhere, there are comments regarding the unfriendly demeanors and uncaring attitudes of those who are on the front lines of the customer service department.

Related: Top Gas Credit Cards for Bad Credit, Poor, Fair, & No Credit | Ranking & Reviews

Making a Fedloan Servicing Payment

One of the benefits to federal loan servicing through this company is that you can gain an interest rate reduction by enrolling in direct debit. Rate reductions are minimal (0.25%) but can still offset the overall cost of tremendous student loan debt.

While this is a helpful feature, some consumers point out that the enrollment is not as automatic and seamless as you might think. You won’t want to mistakenly believe that you are signed up immediately because it takes up to two billing cycles to take effect. During this time, you must continue to make your Fedloan payment through another method, including the MyFedloan app, or risk penalization.

NerdWallet recommends making the switch to direct debit for the additional savings as well as the convenience. However, they also tell consumers to be cautious. Ensure that your application has been processed through the Fedloan Servicing app before you discontinue any other payment methods.

Another helpful tip to help you pay off your Fedloan services faster is to make additional contributions. Enrollment in direct debit through MyFedloans allows you to automatically contribute extra money to pay down high-interest loans faster.

Be warned that you have to be very specific about any extra contributions you intend to make. If you don’t specify which loan you want the money to go toward, it allocates those funds to all your loans. Situations like these are marked as “paid ahead” bills, meaning it goes toward your payment for the following month.

The best way to target your high interest student loans through Fedloan Servicing is to put your request in writing. Provide standing instructions to your federal loan servicing agency through one of the three recommended methods:

- Fax

Consolidating Loans with the Fedloan Servicing App

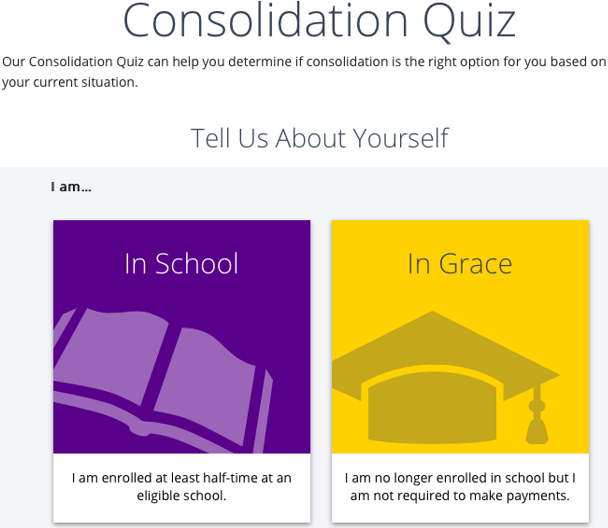

Another area where Fedloan Servicing could use some improvement is their loan consolidation program. Not all student loan debt can be consolidated through your Fedloan account, and you must meet certain eligibility criteria. You can see whether your Fedloan services account would benefit from consolidation using their quiz.

Image Source: MyFedloan

When it comes to loan consolidation, Fedloan Servicing certainly provides a lot of useful information to consumers. It’s a great place to see the potential advantages and disadvantages in one convenient location. For example, you may have lower monthly payments but a longer repayment period.

The downside to consolidating your loans through federal loan servicing with MyFedloans is the continued negative experiences with their customer service department. Studentloans.net refers to their customer service as “sub-par,” “shoddy,” and “unsupportive.”

Adam Minsky again concludes that many of his clients have seen unbelievable errors with their consolidations processed through MyFedloan Servicing. There are a handful of errors he has seen on multiple occasions with consumers who are trying to consolidate their loans through the Fedloan Servicing app:

- Loans left off the consolidation even when present on the application

- Consumers set up with the wrong repayment plan

- Incorrect projected payoff consolidation loan balances

- Applications canceled without approval or knowledge

As you can see, the consumer satisfaction with consolidation through Fedloan Servicing leaves a lot to be desired. It is the same issues that were already encountered with poor customer service when it comes to making regular payments and dealing with the company as a whole.

When you do decide to consolidate loans, you may have the option of selecting your provider. This can be an excellent way to forego doing business with Fedloan Servicing if you’ve been unsatisfied with the overall service you’ve received to date.

If possible, you may want to consider opting for a private lender to consolidate your student loan debt. Many consumers who have previously used Fedloan Servicing for their consolidation and debt repayment recommend making the switch to a different provider if you have the option to do so.

Popular Article: Top Chase Bank Credit Cards | Ranking | Business, Travel, and Other Chase Rewards Cards

Fedloan Servicing App

Most consumers do the majority of their banking and bill-paying on the go these days. Every major company has developed an app to make this process simpler and more convenient. The Fedloan Servicing app is no exception.

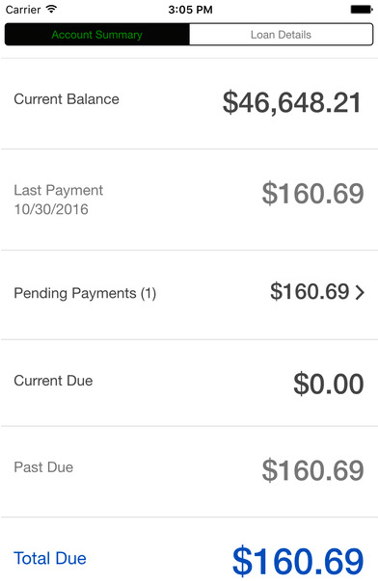

Consumers are attempting to use the Fedloan Servicing app in order to make sense of their monthly payments, consolidation, and general Fedloan account information. Available through both iTunes and the Google Play store, the Fedloan Servicing app gives you access to a number of details about your account:

- Details about your loans

- Scheduling future payments

- Viewing payment history

Image Source: iTunes

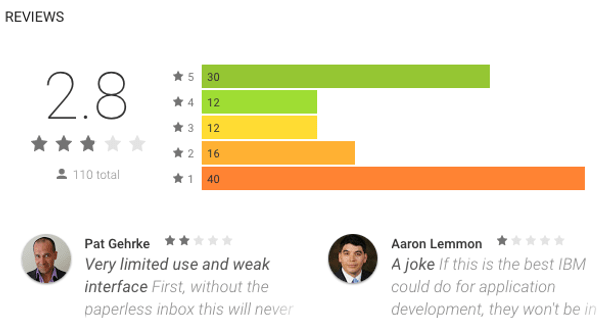

The reviews surrounding the Fedloan Servicing app are slightly more positive than those for the company as a whole. Many users are willing to rate it with a full five-star review in the iTunes store. However, it still maintains a relatively low rating overall.

Across all of the versions of the Fedloan Servicing app, there are have been 76 consumer reviews voluntarily posted. Among those reviews, it has received an average of a two-star rating. The new version is looking slightly improved with 52 consumer reviews and an overall rating of 2.5 stars.

The Google Play store ranks it higher than iTunes for an overall score of just under three stars. They have collected more consumer reviews (110) in comparison to iTunes, but it has still allowed the Fedloan Servicing app to score low overall.

When you take a close look at the breakdown of reviews for the Fedloan Servicing app, you will find that the majority of them fall into the lowest possible category. There are forty 1-star reviews compared to just thirty 5-star reviews. Negative reviews claim that the system is a “joke” and has “very limited use and weak interface.”

Google Play Store Rating

Read More: Top Credit Cards in Australia | Ranking | Best Aussie & Australian Credit Cards

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Overall Fedloan Servicing Review

In general, it seems that consumers have a lot more negative things to say about Fedloan Servicing and their Fedloan account than positive things. A Fedloan Servicing scam may be slightly farfetched, but their customer service certainly leaves a lot to be desired.

When it comes to your federal loan servicing, you may not have many options apart from figuring out how to make the best of your time with the Fedloan Servicing app and program. Unfortunately, you need to be prepared now to spend much of your time battling customer service and the misinformation they have a tendency to give.

Consumer review organizations, such as the Better Business Bureau, have extensive complaints lodged against the company. While MyFedloans is not a Better Business Bureau–accredited organization, it does still have close to 400 closed complaints lodged against it in the last three years.

The vast majority of these complaints are related to billing or collection issues. The runner-up offense pertained to problems with the product or service offered.

Rest assured that there is no Fedloan Servicing scam waiting to take advantage of your hard-earned money. However, you should be conscious of where your funds are going when you make a Fedloan Servicing payment and stay on top of your documentation. Being proactive when dealing with their federal loan servicing and the MyFedloan app has the potential to make your experience more positive.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.