FHA Mortgage Rates: An Overview of FHA Loan Rates and FHA Interest Rates

What exactly are the FHA mortgage rates? Specifically speaking, what are the FHA rates today, including FHA loan rates and FHA interest rates? The FHA mortgage loan rates that are extended to homebuyers keep the housing market thriving, but it also covers a portion of the population that has struggled to obtain mortgages with the collapse of the subprime mortgage market.

Since the FHA mortgage loan rates are extended to people with poor credit as well, potential borrowers may wonder just what kind of FHA interest rates they would have to pay. While a poor credit score does not necessarily disqualify a potential borrower from obtaining FHA mortgage rates, the FHA loan rates may differ depending on their credit score.

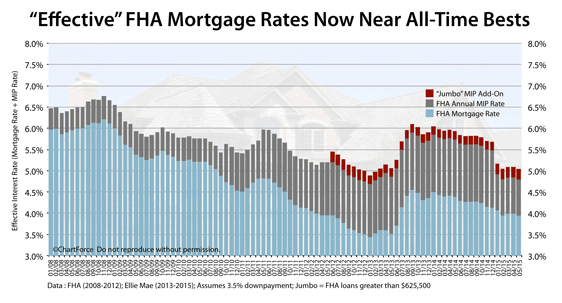

Source: The Mortgage Reports

The FHA mortgage rates requirements are determined based on your FICO score. The FICO credit score is considered the de facto credit score and is used by most lending institutions. Your FICO score is calculated based on several factors. Understanding how your FICO credit score is calculated is important for fixing your credit before applying for loans.

See Also: Apply For FHA Loan – How To Apply (Online, Home Loan & FHA Mortgage)

FHA Loan Rates: The Importance of Your Credit Score, How It Is Calculated, and How You Can Improve It

FHA Loan Rates: How Is My FICO Score Calculated?

If you are exploring FHA mortgage rates and are concerned about your credit score, a helpful first step to take is to learn how FICO scores are calculated.

The tricky part about credit scores is that each credit score company keeps their algorithm secret. This makes sense since other companies would simply replicate their methods.

Preferred credit score calculator FICO, short for Fair Isaac Corporation, does give some information regarding what is important to your credit score. This is helpful for people who are exploring lending options, particularly those looking at FHA loan rates.

The data that FICO uses is divided into five main categories of credit report information:

- Payment History (35%)

- Amounts Owed (30%)

- Length of Credit History (15%)

- New Credit (10%)

- Credit Mix (10%)

As you can see, a large part of your credit score is about how much debt you have outstanding, and how promptly and responsibly you have paid off your debt up until this point.

But that is not the entire story. How long you have held credit, the most recent credit you’ve been approved for, and the diversity of the credit you hold (i.e., credit cards, auto loans) are all variables that are accounted for in these calculations.

This is the kind of information that will determine what kind of FHA mortgage loan rates and FHA interest rates you get.

FHA Loan Rates: How Can I Improve My Credit Score Before Exploring Mortgage Rates?

Improving your credit score can be difficult, but it is not impossible. In fact, striving to improve your credit score before looking into mortgages including FHA mortgage rates is a smart course of action to take before buying a home.

One of the biggest roadblocks to improving your credit score is paying down existing debt. In most cases, people simply do not have the available funds to deal a significant blow to their debt. But if you are serious about accessing attractive FHA loan rates, perhaps there is room for drastic action.

- Cut down on your expenses.

While it sometimes feels like we have no money, we can usually find areas of our lives where it is possible to cut back. If it is manageable in your area, taking public transportation instead of driving can save dramatically on car insurance and car payments. Buying high protein foods that are cheaper than meat. Reduce how much you eat out, go to the movies, or shop for clothes. Accessing competitive FHA loan rates will require a decent credit score, and you can only get to that point by improving it. Reducing your debt is one of the best ways to do so.

- Negotiate with your lenders.

Sometimes, getting a sweet deal is as simple as picking up the phone and asking. If you are serious about improving your credit score to receive good FHA mortgage rates, you may have already started doing the above by drastically cutting your spending; this allows you to put more toward paying down debt.

Another option is to reduce the amount of debt that you owe. If you are behind on payments or owe a significant balance, some lenders may reduce the amount you owe if you are willing to pay the entire balance outright. This is not a guaranteed strategy, but it is worth trying. In some cases, you may not get what you called for, but the lender or debt collector may have some attractive alternatives for you to consider. Take a proactive approach to tackling your debt and obtaining attractive FHA mortgage rates.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

- Check your credit report.

You are entitled to one free credit report from each of the three credit reporting agencies (Equifax, Experian, and TransUnion) once a year. Do not waste this resource. It is extremely important. The FICO score that the FHA will be using to determine your FHA mortgage rates is based on your credit report. If your credit report has errors on it, your credit score will naturally be flawed as well.

(Note that you are entitled to a free credit report from these agencies each year; this free report does not include your credit score, though you can obtain your score for a fee.)

Ensure you get access to fair FHA loan rates. Double check your credit reports from all three agencies to ensure that the information they were given by financial institutions is correct. A simple correction could improve your score.

- Be prompt with your payments.

One of the worst things you can do to your credit score is make late payments. If you absolutely can’t commit to paying off huge sums of your debt, the one thing you can do is start committing to making your monthly payments (this includes minimum payments on credit cards) promptly! It is a simple and immediate way to start improving your credit score for FHA loan rates (and your financial health overall).

Don’t Miss: Best Banks for Mortgages – A Complete Guide (Best Mortgage Rates & Reviews)

FHA Mortgage Rates: The Perks of FHA Loan Rates

FHA mortgage rates are attractive for first-time homebuyers. One of the factors that make it difficult for first-time buyers to get a home is the required size of the down payment. With an FHA mortgage, buyers can get away with a smaller down payment. Recent changes, however, have made these appealing FHA loan rates a bit harder to receive for people with choppier credit scores.

Image source: Pixabay

FHA Loan Rates: FHA Mortgage Rates for Varying Credit Scores

The FHA website provides the FHA loan rates and minimum down payment required for varying credit scores:

- 580 or higher FICO score = 3.5% down payment

- Lower than 580 = 10% down payment

As you can see, a low FICO credit score does not necessarily disqualify you from FHA loan rates, but it does limit the FHA mortgage rates you do qualify for. If your credit score is lower than 580, you do not have access to the lower down payment FHA mortgage rates and will need to put down 10 percent. In this situation, potential borrowers have to consider their options. If they have the 10 percent down payment, they can either:

- Put the money down in accordance with the FHA mortgage rates and buy a home

- Use that money to pay down some of their debt, improve their credit score, and eventually benefit from the better FHA loan rates

FHA Loan Rates: FHA Rates Today Based on Lending Institution

When it comes to FHA interest rates, consumers can access real-time daily rates online that include FHA rates today. You can find FHA mortgage rates through banks that provide FHA approved mortgages. In most cases, the best indication of your potential FHA loan rates will be determined once you apply and your credit score is considered.

You can also search online to see which banks provide FHA mortgages and then see what the FHA rates today are through the individual site.

To find specific lenders in your area in order to find their FHA rates today, check out the useful search portal on the U.S. Department of Housing and Urban Development website.

FHA rates today can be a helpful way of comparing options and financial institutions. Since FHA mortgages and FHA loan rates are quite popular and actively sought out by hopeful homeowners, many financial institutions have FHA approved status.

Related: Capital One Mortgage Reviews – Get What You Need to Know! (Home Loans, Complaints & Review)

FHA Mortgage Rates: Why Are FHA Mortgages and FHA Loan Rates So Desired?

One of the most obvious reasons people desire FHA rates today and in the past is because of the lower minimum down payment. This makes homeownership more accessible to people that simply cannot put aside as much money as most financial institutions and lenders require.

Along with its FHA rates today and its FHA mortgage rates, the FHA website also provides additional reasons why FHA loan rates are so attractive to potential homeowners:

- It is easier to qualify for FHA mortgage rates.

Traditional lenders reject a lot of loan applicants who have less than stellar credit. Even with a mediocre or low credit score, an applicant is not automatically disqualified from the benefits of FHA mortgages and FHA loan rates.

- They have competitive FHA interest rates.

One of the most unsavory features to come out about the mortgage crisis was the propensity of subprime mortgage lenders to sign borrowers up for predatory interest rates. FHA interest rates are meant to make homeownership accessible to more people, not as a way to prey on dreams of homeownership. FHA loan rates are set to make monthly payments affordable.

- FHA mortgage rates are also affordable when it comes to additional fees.

FHA rates today are affordable and designed to be fair. Other additional fees associated with a mortgage (mortgage insurance, closing costs, and more) are also lower than the fees traditional lenders offer, making FHA mortgage rates even more attractive.

- Individuals who have filed for bankruptcy or gone into foreclosure in the past are not barred from FHA mortgage rates.

Life happens, and sometimes that means filing for bankruptcy or going through foreclosure. Unfortunately, this significantly (and negatively) impacts an individual’s ability to get loans later in life. The good news is that having any of these two things in your financial and credit history does not immediately exclude you from accessing FHA loan rates.

Individuals in this situation who want access to FHA mortgage rates will need to meet other requirements instead, such as re-establishing good credit, a consistent payment history, and more in order to qualify.

- Those with no credit or an insufficient credit history have alternative ways of applying for FHA rates today.

Typically, those applying for FHA rates today need to have two lines of credit, but for those who have not built up enough of a credit history, a substitute form is available.

Popular Article: Churchill Mortgage Reviews – What You Want to Know (Complaints & Review)

FHA Rates Today: FHA Loan Rates for Refinancing Your Mortgage

Refinancing is an option for people who need to find a more affordable method for their existing mortgage. Instead of completely discarding the first mortgage, it is paid off and a new loan with a different set of payment terms is entered. There are FHA loan rates available for people who would like to refinance their existing mortgage.

FHA Streamline Refinance

If you already have an FHA mortgage with the accompanying FHA loan rates, then the FHA Streamline Refinance may be the option for you. This option is only available to individuals who are currently using the home with the FHA loan as their primary residence.

It is a streamlined option because you can get the reduced FHA interest rates and, in most cases, skip the appraisal. There is also limited paperwork that needs to be completed by your lender, effectively saving you time and money. This streamlined refinance with the FHA loan rates does not include a cash back option.

FHA Regular Refinance

Conventional loans require the traditional verification methods, including employment verification, debt ratio considerations, a credit check, and more. You may also qualify for more competitive FHA loan rates, FHA interest rates, and monthly payments based on your credit history and credit score. In this case, cash back scenarios are an option.

Free Wealth & Finance Software - Get Yours Now ►

FHA Rates Today Can Make Home Ownership Possible to a Larger Portion of the Population

The Federal Housing Administration (FHA) was created in 1934 as part of the National Housing Act of 1934. Its mandate is to maintain standards for mortgage lending and interest rates in addition to improving housing conditions and stabilizing the housing market. Its FHA mortgage rates and FHA interest rates are ways to make home ownership more accessible to people. By insuring mortgages, the FHA provides more incentive for lenders to give out mortgages.

FHA mortgage rates are a great option for those who do not yet have a large enough down payment but are eager to enter homeownership. Naturally, benefiting from FHA loan rates requires borrowers to pay for mortgage insurance to mitigate some of the risk for lenders.

Additionally, if your credit is not in the best shape, you can either take the time to repair it or apply for the FHA loan rates and provide a higher down payment.

Read More: Freedom Mortgage Reviews – Get All the Facts! (Customer Service, Complaints & Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.