Fidelity IRA Review Overview: What You Should Know Before Selecting a Fidelity IRA

This Fidelity IRA review article gives a comprehensive overview of the services available through a Fidelity IRA.

Although there are other Fidelity IRA reviews and Fidelity Roth IRA reviews on the web, this article aims to provide you with a more detailed look at what this major financial institution has to offer.

One topic that many online reviews miss is individually outlining the primary Fidelity IRA categories: a Fidelity Roth IRA, Fidelity rollover IRA, and Fidelity traditional IRA.

This article will cover all three and provide information on the commonly queried topics:

- Fidelity Roth IRA review

- Fidelity IRA fees

- Fidelity minimum investment

- Pros & cons of a Fidelity IRA

Fidelity is known as one of the most recognized brands in the investment industry. Fidelity Investments is a global financial services corporation and the fourth largest mutual fund and financial services group in the world.

Providing investment advice, fund distribution, retirement options, and wealth management are just a handful of Fidelity’s services.

They have investor centers in over 140 locations throughout the U.S. and operate a major online discount brokerage. As one of the investment trustee giants worldwide, Fidelity offers a wide array of income and growth investments such as mutual funds, stocks, bonds, ETFs, CDs, and more.

You might wonder, “Why should I get an IRA in particular?”

In short: tax advantages, which we will explain in further detail. Subsequently, you may ask yourself if you should choose a Fidelity IRA and, if so, which Fidelity IRA is right for you.

Here we will focus on the offerings of a Fidelity IRA and try to break down the features of the three main types of IRAs in a way that’s not too difficult to digest. So, if you want to read a detailed Fidelity IRA review and are ready to find out which Fidelity IRA best suits you, let’s dive in!

See Also: Best Retirement Communities in Florida to Retire to

Fidelity Roth IRA Review

Source: Fidelity ROTH IRA

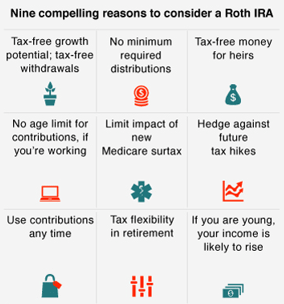

First, let’s begin with a Fidelity Roth IRA review. A Fidelity Roth IRA offers federal tax-free growth potential and tax-free withdrawals, as long as certain conditions are met. You contribute money you have already paid taxes on, so you that you don’t have to pay taxes when you withdraw funds in the future.

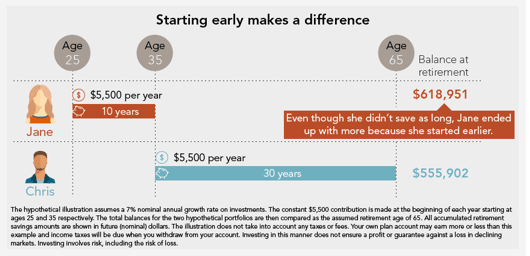

As per this Fidelity Roth IRA review on YouTube, younger people with income that is growing may find a Roth IRA more advantageous. They may prefer to pay taxes now rather than down the line at the time of withdrawal. The only age requirement is that you must be at least 18+ to open a Fidelity IRA.

Ideally, you would not need to withdraw retirement planning funds prior to retirement. But if you might need the funds early, a Roth is more flexible than other retirement accounts for accessing your contributions.

You can withdraw your contributions penalty-free under specific circumstances — for instance, for a first home purchase or funding education — provided you have had the account for at least five years.

TIME.com offers a simple explanation in their Fidelity Roth IRA review. If you anticipate being in a higher tax bracket when you retire than you are currently, a Roth IRA allows you to settle your tax bill now instead of waiting until retirement when your higher income will be taxed.

A Fidelity Roth IRA review wouldn’t be complete without mentioning the MRD details. A minimum required distribution (MRD) refers to the minimum amount you must withdraw from your account each year. There are no minimum required distributions during the lifetime of the original owner, which sets the Roth IRA apart from traditional and rollover IRAs. The IRS has a Fidelity Roth IRA review which indicates that a Roth IRA does not require withdrawals until after the death of the owner.

From an estate-planning perspective, a Roth IRA is beneficial for passing assets down to heirs tax-free. An existing traditional IRA or an old workplace plan, such as a 401(k) or 403(b), can be converted into a Roth IRA.

Don’t Miss: At What Age Can You Retire? Here is an Overview of How Soon You Can Retire

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Fidelity Roth IRA Fees

Continuing our Fidelity Roth IRA review, let’s move on to Fidelity Roth IRA fees. The following fee structure applies to Fidelity Roth IRA fees, Fidelity rollover IRAs, and Fidelity traditional IRAs:

- There is no cost or minimum investment to open an account, although certain investments such as mutual funds do require a minimum initial investment.

- There is no annual fee. Potential fees include close out, management, low balance, short-term trading, and activity assessment fees.

- Online U.S. equity trades cost a $7.95 commission. Sell orders are subject to an activity assessment fee (of between $0.01 to $0.03 per $1,000 of principal).

Image Source: Fidelity IRA Review

Fidelity Rollover IRA

If you are changing jobs or retiring and have a retirement plan from a former employer, a Fidelity rollover IRA may be for you. An IRA rollover can offer broader options than your previous workplace plan, such as mutual funds, stocks, bonds, and exchange traded funds (ETFs).

A rollover IRA can help you combine all of your retirement plan assets into a single IRA and devise a retirement income strategy. The rollover also has the option of penalty-free withdrawals for first-time home purchases and education, similar to a Fidelity Roth IRA. Most people are eligible to roll over assets into a traditional IRA or Roth IRA.

If you complete a rollover through a trustee transfer and the assets go directly from an employer-sponsored plan into a rollover or traditional IRA, there are no tax implications. Common reasons for a Fidelity Rollover IRA are leaving a current employer, attainment of age 591/2, death, or disability. Fidelity recommends contacting your current plan to determine if you are eligible for a distribution and subsequent rollover.

However, Fidelity also has rollover specialists available to answer questions, help initiate distribution, and guide you through the process. Alternatively, there is a three-step checklist available on Fidelity’s website for transferring existing IRA assets.

A Fidelity rollover IRA differs from a Roth IRA in the minimum required distributions (MRD), which start at age 701/2.

Fidelity Traditional IRA

With a traditional IRA, you make tax-deductible contributions. When you withdraw funds, you pay taxes at your current income tax level. Thus, if you withdraw the funds in retirement, you may be at a lower income bracket and be sheltered from paying higher taxes on the withdrawal. Earnings grow federally tax-deferred.

As with Fidelity Roth and rollover IRAs, you have the option of penalty-free withdrawals for first-home purchases and certain college expenses. There is no minimum to open an account, except for certain investments like mutual funds. Some investment minimums may be waived for rollovers or transfers, or if you have automatic contributions. Fidelity Roth and traditional IRAs have the same maximum contributions and catch-up contributions.

Unlike a Roth IRA, a traditional IRA has no income limits in order to make contributions. However, pre-tax contributions and any earnings are taxable once withdrawn. A 10% early withdrawal fee may apply for funds taken out prior to age 591/2.

A Traditional IRA is similar to a Rollover IRA in its minimum required distributions, which start at age 701/2. Fidelity IRAs have no set up or maintenance fees and no transaction fees when trading most Fidelity mutual funds.

Related: How Much You Should Save for Retirement by Age 30, 40, 50, and 60

Pros & Cons of a Fidelity IRA

Fidelity IRA Contribution

Advantages:

- Fidelity Investments is a large company with an established history, having been founded in 1946. It is a privately held, family-owned company currently in its third generation. This interview and Fidelity IRA review reveals information about Fidelity’s succession plan, which is in place to give customers comfort while investing in Fidelity long-term.

- Fidelity’s website is user-friendly, and they offer a variety of platforms including real-time analytics in Active Trader Pro.

- Fidelity launched a new direct-to-consumer robo-advisor called Fidelity Go. According to one Fidelity IRA review, Fidelity Go competes with the likes of Charles Schwab and Vanguard.

- Research is one of Fidelity’s strong points, and many research tools are available at no extra cost. Fidelity’s Learning Center offers free webinars, strategic guides, and more.

- Fidelity has a wide variety of mutual funds and ETFs available. NerdWallet’s Fidelity IRA review credits the company with low expense ratios.

- Customer service options include one-on-one guidance: in person, by phone or email, online chat with a representative, or online with an automated virtual assistant.

- The Fidelity minimum investment? There isn’t one, with the exception of certain investments.

Disadvantages:

- Fidelity may not be the best option for small investors. You can start an IRA with smaller amounts, but if you want your money to grow, you should reach at least $2,500, according to a Fidelity IRA review by USA Today.

- Public offerings and market-based investments come with risk, and thus may not be suitable for all investors.

- As is the case with many financial institutions, reviewers relay that Fidelity’s security measures against fraud are so extensive that they may result in users unintentionally locking themselves out of their accounts. Security regulations are in place for customers’ protection, so whether or not you consider that a disadvantage depends on your perspective.

- There have been instances where people reported difficulty leaving Fidelity for another brokerage, though many investors are wedded to Fidelity, so this may not be a problem for you. Also, take into consideration that when a company is as large as Fidelity, especially a company with a long history, the incidence of some dissatisfied customers comes with the territory.

Free Wealth & Finance Software - Get Yours Now ►

Fidelity IRA Review: Conclusion

What have we learned in this Fidelity IRA review? In the Fidelity IRA Roth review, we learned the main difference between a Fidelity Roth IRA and a Fidelity traditional IRA is whether you pay taxes upfront or in the future. Another distinguishing factor is that you can leave money in a Roth IRA to grow for as long as you choose, whereas a traditional IRA requires that you withdraw money starting at a specific age.

As far as Fidelity IRA fees: Fidelity Roth IRA fees are structured in the same way as a Fidelity traditional IRA and a Fidelity rollover IRA.

A Fidelity Roth IRA review of its offerings may be the ideal option for young people advancing in their careers or anyone interested in passing assets along to heirs tax-free. A Roth IRA has more flexibility for withdrawing assets if needed before retirement.

A Fidelity Roth IRA has income eligibility requirements but a less strict age requirement than a Fidelity traditional IRA. Of the three primary IRA categories Fidelity offers, a Roth IRA is the one that has no minimum required distributions.

Fidelity rollover IRAs are designed for those who have a retirement plan from a former employer, with the potential of more investment options than a workplace plan. A Fidelity rollover IRA is suited for those who are changing jobs, retiring, or have reached age 591/2, death, or disability.

Fidelity has a Traditional vs. Roth Evaluator wherein you can check eligibility to find out which IRAs you qualify for. You can view the Fidelity IRA review about other IRAs Fidelity offers, such as SEP IRAs and SIMPLE IRAs.

Hopefully, this Fidelity IRA review and Fidelity Roth IRA review gave you information you can use when selecting your preferred form of retirement planning.

Popular Article: Ways to Conduct Financial Planning for Retirement