Fintech Explosion: What Is Fintech?

In the past decade or so, an abundance of new startup companies have entered the world wide wrestling ring. An abundance of these startups have focused on a niched sector that has since been dubbed “fintech.” What is fintech?

Fintech is short for financial technology. The term encompasses a wide range of service offerings and financial technology. Fintech trends include companies developing everything from financial investing software to crowdfunding platforms.

Award Emblem: Best Fintech Startups

This ranking and review article takes a look at six of the top fintech startups. Some of these financial technology companies came up with the best new idea; others took great ideas and executed them in a better way. Regardless of how they got to where they are, they are six of the most noteworthy financial technology companies.

AdvisoryHQ’s List of the Top 6 Best Fintech Startups

List is sorted alphabetically (click any of the names below to go directly to the detailed review section for that startup):

The Breakdown

There are a number of terms that invariably come up when discussing fintech trends and the top fintech startups. We will outline a few of the most prevalent terms in this section.

- Fintech: Technology designed and used to improve financial services; also refers to the economic sector comprised of the companies that develop and use this technology.

- Startup: A young or freshly started business.

- Crowdsourcing: Obtaining (or sourcing) services, information, ideas, or other resources from a group (or crowd) of people. This most commonly takes place over the internet.

- Crowdfunding: Obtaining money, specifically, from a group of people. Also commonly takes place over the internet (thanks to ever-developing financial technologies).

Image Source: BigStock

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the firms, services, and products that are ranked on its various top rated lists?

Please click “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated firms, products, and services.

Best 6 Top Fintech Startups

StartUps | Websites |

| Betterment | https://www.betterment.com/ |

| GoFundMe | https://www.gofundme.com/ |

| Kabbage | https://www.kabbage.com/ |

| OnDeck | https://www.ondeck.com/ |

| TransferWise | https://transferwise.com |

| WePay | https://go.wepay.com/ |

Detailed Review – Top Fintech Startups

Below, please find the detailed review of each company on our list of top fintech startups. We have highlighted some of the factors that allowed these financial technology startups to score so highly in our selection ranking.

See Also: Can Capital Reviews – Get All the Facts Before Using Can Capital

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Betterment Review

Image Source: Betterment

Financial advising and the world of investing can be costly and time-consuming. Luckily, thanks to fintech trends and fintech startups, some market-savvy investors have created software that automates investing for the average, and subaverage, user. Not everyone has the know-how or the time to actively manage a portfolio. Enter Betterment.

Betterment is based out of New York, New York. Essentially, they act as your always-on-call financial advisor at just a fraction of the cost. A transparent fee structure means you’re never surprised by a bill.

Key Factors That Enabled This Company to Rank as a Top Fintech Startup

Below are primary reasons we selected Betterment to be rated as one of this year’s top financial technology companies.

Automation

There are a number of features that Betterment developers have included to make Betterment an accessible investing powerhouse:

- Weekly, biweekly, or monthly auto-deposit options

- Excess cash is promptly reinvested

- Automatic rebalancing of portfolios

- Tax loss harvesting

Already, Betterment has grown its assets under management to $5 billion dollars invested. With no minimum account balance, no withdrawal restrictions, and no transaction fees, it’s easy to see why so many people are investing with Betterment. The pricing structure is appealing as well, charging a decreasing percentage of your investment balance as your balance increases.

Fees

- Under $10,000 invested has a rate of 0.35%

- Between $10,000 and $100,000, the rate is 0.25%

- Over $100,000, the rate becomes 0.15%

When it comes to investing money, Betterment has an advanced algorithm that’s designed to maximize your portfolio’s potential based on the timeline you’re using. The experts at Betterment also offer advice on deposit amounts and frequency, all in the name of helping you reach your goal on time.

Goals

Goals are customizable, and you can set up more than one savings account for different goals. For example, you could have a two-year goal of going on a vacation, a ten-year goal of buying a house, and a 45-year goal of a retirement fund. Each goal will have a portfolio at different risk levels, customized to fit the timeline.

Unlike some other investing software startups, Betterment puts every single cent to work, reinvesting your money as you earn more in the market. Support for your account is available seven days a week by phone, email, and live chat. Betterment also shows how your investing decisions could impact your taxes.

With that much money on the line, you as the investor want to make sure it’s secure. Betterment has bank-level security. In addition, Betterment is a member of SIPC, meaning up to $500,000 worth of securities per individual account are protected.

Don’t Miss: CuraDebt Customer Reviews – Get all the Facts before Starting with CuraDebt

GoFundMe Review

Image Source: GoFundMe

GoFundMe is a startup based out of San Diego. It’s a company that launched back in 2010, and since then, it’s grown to accommodate millions of people in their quests to raise money for various goals.

In the last year alone, over 2 billion dollars has been raised. There are a number of good things to say about GoFundMe, least of which is their highly transparent business dealings. It’s no wonder that 4 million dollars are raised on average every day by its users.

Key Factors That Enabled This Firm to Rank as a Top Financial Technology Startup

Below are some of the critical reasons we were able to name GoFundMe as one of this year’s top fintech startups.

Not all campaigns are created equal, and neither are the crowdfunding websites. With GoFundMe, users get to keep every donation they receive. There are no deadlines where users are at risk of losing their funds. There are also no goal limits. This means campaigns to raise money can last as long as the creator wants or needs them to, without the fear of losing what they’ve accumulated because of a missed deadline.

Pricing:

- GoFundMe deducts 5% from each donation received

- GoFundMe charges 3% for WePay transaction

- GoFundMe charges 30 cents per transaction

In the grand scheme of crowdfunding sites, the fees at GoFundMe are some of the lowest available for comparable services.

GoFundMe can be used for personal causes and life events, meaning it’s less restrictive than some of its more targeted crowdsourcing counterparts.

Customer support is available in as little as five minutes. This ensures any questions you have are handled promptly, keeping your campaign on track.

Related: OptionsHouse Review – Fees, App, Commission, Services, Speed, Trading

Kabbage Review

Image Source: Kabbage

Kabbage is based out of Atlanta, Georgia. It was established back in 2009, but it didn’t make its first loans until 2011. It later opened offices in San Francisco, and then expanded abroad to the United Kingdom. They’ve funded over 1.6 billion dollars to help businesses grow since their founding. They have a Better Business Bureau rating of A+.

Kabbage is a company that provides loans to small businesses. This company implements a loan qualification process that is showing up as one of many fintech trends; it’s a process that takes more into account than your credit score.

Kabbage was named by Forbes as one of America’s 100 most promising companies in both 2014 and 2015. Time to take a look at why.

Key Factors That Enabled This Firm to Rank as a Top Financial Technology Company

Below we’ve compiled a list of some of our most compelling reasons Kabbage has made our list of this year’s top rated fintech startups.

Ease and Convenience

The folks at Kabbage have put a lot of thought into streamlining the loan process for businesses that need flexible access to capital as soon as possible. Here are some of the ways they do that:

- Apply in five minutes online

- No application fee

- Access cash 24/7

- Draw as frequently as once per day

- No fees, costs, or obligations to draw funds

- Only draw the capital you need as you need it

The application process for Kabbage considers more than just your credit score. You can apply online and they will have their loan verdict back to you within minutes after you submit. In order to keep submissions paperwork-free, you actually link your online business account to Kabbage for review. Whether it’s ebay, Square, Etsy, etc, you link your online business to Kabbage, and they use data to make an assessment in real time.

There are two primary qualifications to apply:

- You have to have been in business for at least one year

- Your business needs to generate over $50,000 dollars annually in revenue

As long as you meet those criteria, Kabbage will consider you quickly and determine your loan eligibility. Once you’ve qualified, how much capital will this fintech startup give you access to?

Loan Amounts and Use

Kabbage has two credit line caps:

If it turns out you do not need to use all the credit they’ve offered to you, no problem. Kabbage lets you use only what you need to use, and only when you need to use it. This means that, if you receive a $10,000 credit line offer to expand your company, but manage to do it in $8,000, you’re only on the hook for paying back the $8,000, plus the interest.

Loan Payback

Fees for repayment of loans range from 1.5 to 12 percent of your monthly amount. They offer two loan durations:

- Six month loan option

- Twelve month loan option

There are no fees or penalties for paying back a Kabbage loan early.

Popular Article: CreditRepair.com Reviews and Overview (Before You Sign-up) First Choice Capital Resources Review

OnDeck Review

Image Source: OnDeck

OnDeck is another company in the business of offering loans to small businesses. OnDeck launched in 2007, and since then they’ve loaned $4 billion to small businesses. OnDeck also boasts an A+ rating from the Better Business Bureau. They also earned a number 11 spot on Forbes’ list of the 100 most promising companies.

Their loan approval system is based on more than your personal credit score. It actually looks at the performance of your business. This means they have a higher loan approval rating than many competitors.

Key Factors that Enabled This Firm to Rank as a Top Financial Technology Startup

Below are some of the most significant reasons we selected OnDeck as one of this year’s top fintech startup firms.

Qualifying for a Loan

OnDeck requires two things before they’ll consider you for a loan:

- Your business must have been “in business” for at least a year

- Your business must generate a minimum of $100,000 in gross annual revenue

If your business meets those criteria, you’ll be able to apply online. The application process takes place in a short period of time. Users can apply online in five minutes or over the phone. Once you are approved, you can receive your funding from OnDeck in as little as 24 hours.

Loan Amounts and Use

There are two options when working with OnDeck. The first option is opening a line of credit:

For the line of credit, you will only be paying interest on the amount you draw. The second option is taking a business loan:

Your application is considered in minutes, and you could receive your money in as little as one business day. The terms for the line of credit and for the business loan span between 3 and 36 months. OnDeck has a mobile app, which you can access 24 hours a day and seven days a week to draw whenever you need it. OnDeck’s services also help you to build business credit. And finally, OnDeck offers reduced pricing and fees for repeat customers.

Read More: iContact Review – What You Should Know Before Using iContact

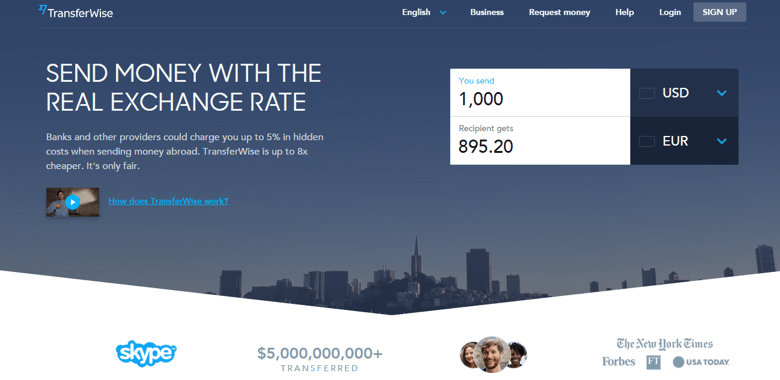

TransferWise Review

Image Source: TransferWise

TransferWise formed as a way to cheaply and transparently make international money transfers. Banks use their own fees, often hidden within exchange rates, to make money off of international monetary exchanges. TransferWise provides the same service at a fraction of the cost (up to 7x less expensive).

So far, they’ve serviced over one million customers since their founding in 2011. The creators of TransferWise were also some of the people who built Skype, the popular audio-visual call making software. In these past five years, this financial technology company has transferred over 5 billion dollars.

Key Factors That Enabled This Firm to Rank as a Top Fintech Startup

Below are some key features we used to rate TransferWise as one of this year’s best fintech startups.

Banks can easily hide fees behind “exchange rates” without you ever being the wiser. TransferWise cuts right through that practice and instead adopts one of utmost transparency.

Fairness, Transparency, and Savings

On their homepage, TransferWise hosts an exchange/fee calculator. You enter exactly the amount you plan on transferring, the two currencies involved, as well as the origin and destination of the money. The calculator does the rest, giving you your guaranteed rate, your TransferWise fee, and how much you save by not using another service.

TransferWise uses the transfer rate that you find on Google or through XE. It is the official mid-market rate.

Fees

TransferWise lists out all their fees on their FAQ page, as their fees for different currencies vary slightly. As an example, we’ll look at one of their more popular fee structures. This is used in U.S. Dollar transfers to currencies like the British Pound, the New Zealand Dollar, and the Hong Kong Dollar, among others.

- For transfers up to and including $300: fee of $3

- For transfers up to $5,000: fee of 1% (up to $50 total)

- For transfers exceeding $5,000: fee of 0.7% charged on everything past $5,000

As an example, let’s say you’re transferring $9,000 U.S. into New Zealand dollars. TransferWise charges you $50 for the first $5,000. For the remaining $4,000, they charge at 0.7%, which ends up being $28. That means a $9,000 USD transfer between those two currencies only costs you $78. Again, the pricing varies between certain currencies; check the FAQ to see if the currency you’re looking for is one of the 36 for which they currently offer transfers.

Transfer Limits and Expediency

- An individual using TransferWise can transfer up to $49,999 a day, with a cap of $200,000 a year

- A business can transfer up to $199,999 a day, with an annual cap of $1,000,000

Transfers can take as little as several hours. U.S. dollar transfers are typically received within one business day. Other currency transfers could take between one and four business days to process completely. For 22 hours a day and 365 days out of the year, TransferWise has support staff available to handle any issues you have. The FAQ is extensive, but if you need unique support, you can reach out via email, phone, or live chat.

Related: IdentityForce Reviews – What You Should Know Before Using Identity Force

WePay Review

Image Source: WePay

WePay was founded back in 2008. It is an online payment service provider. Whether it’s crowdfunding or online marketplaces, WePay can power the payment system.

In the WePay origin story, the founders envision an app that would let a group of friends pool their money for a joint trip or a big mutual purchase. Once these developers started to look beyond that idea, they eventually grew their financial technology to service crowdfunding sites (like GoFundMe) and e-commerce marketplaces.

Key Factors That Enabled This Firm to Rank as One of the Top Fintech Companies

Below are primary reasons we selected WePay to be rated as one of this year’s top financial technology companies.

Fees

WePay has a few fees in place in order to profit from providing their service:

- Credit card processing: 2.9% fee plus 30 cents per transaction

- ACH processing: 1% fee plus 30 cents per transaction

- Chargeback: $15 fee

That is all there is to their pricing structure. There aren’t any subscription fees or hidden payments; WePay quotes you a rate, and you pay that quoted rate regardless of what you charge your customers.

Security

Handling payments is no small task, and WePay is designed to let you focus on other things. The service offers state-of-the-art fraud protection, which is designed to catch fraud when it occurs and misidentify it less frequently than competing services. In the event that fraud does occur, WePay bears the full cost.

WePay also handles compliance issues with the appropriate parties. They take measures to ensure that government, bank, and card network compliance standards are met.

User Experience

In the interest of a streamlined experience, WePay offers its customers a highly customizable user interface. In addition to providing an online payment service, they go further by also providing other amenities:

- Easy “new user” sign-up

- Fast checkout

- Customizable sign-up

- Customizable checkout

- Customizable emails

Transparent rates, in-depth security measures, and vanguard payment technology updates all help make WePay a notable fintech company.

Conclusion – Top Six Fintech Startups

When it comes to comparing financial technology companies, it can end up being a bit like comparing apples and oranges. The past decade has seen an explosion of ideas occurring in the fintech sector. There are a lot of very useful, very exciting, very different services being offered under the broader umbrella of fintech services.

Despite the obvious differences in service offerings, many elements are shared across these top fintech companies. Transparency is a big one. Hidden fees go hand-in-hand with finance, or at least they used to. Most of these financial technology startups have ditched the smokescreen, and instead paint a very clear pricing picture for you.

Another shared element is that of affordability. Affordability goes effortlessly with transparency. These two elements both drive each other; it’s easy to be completely candid about your pricing when it is significantly cheaper than your brick and mortar (or online) competitors.

Ease of use, strong customer support, and streamlined user experiences, — all six of these top fintech startups showcase these traits alongside their niche-specific offerings. From investing in yourself to investing in your business to investing in a foreign crowdfund, these fintech startups have you covered.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.