Intro: First Financial

First Financial is an online financial institution that specializes in consumer loans. While a quick look online doesn’t show a lot of First Financial reviews, it is still possible to get an overall feel for their services based on the few reviews there are, plus information from the First Financial website.

So what is First Financial? According to a section of the low credit score page, First Financial describes itself as:

“First Financial’s use of the most cutting edge technology and automation not only saves borrowers money, it protects their privacy and time. The mobile accessibility we provide brings lenders right to your smartphone, tablet or laptop, ready to make their best deals to win your business. Operating now since 1996, we also guarantee the highest levels of banking security available in the United States!”

Image Source: BigStock

Image Source: BigStock

However, their disclosure page reveals that services such as credit cards, auto loans, cash advance, insurance, and investment services are only offered by independent third parties—not by First Financial themselves. This should be taken into consideration when reading First Financial reviews because they only act as a middleman to many of the services listed on their website.

See Also: Best Credit Unions in the US (Top Ranking List and Reviews)

First Financial Review of Personal Services

In the personal services category, First Financial offers:

- Auto loan

- Personal loan

- Mortgage loan

- Cash advance

However, in the personal services category they also include “low credit score” and “credit cards” sections. However, in the low credit score section, First Financial doesn’t offer a definitive way to fix a low credit score. Instead, they only offer the reader an article about the problem with having a low credit score and how a customer can increase their score by using any one of First Financial’s loan services.

First Financial Personal Loan Reviews for Credit Rating Categories

First Financial does offer a breakdown of the type of loan you qualify for if your credit score falls into certain ranges so potential consumers can estimate how much they’ll be eligible to receive. Here is a brief review of First Financial’s credit score categories:

- 700 and above: Great score. First Financial will have no problems giving loans to consumers in this category.

- 680-699: This places consumers in the “fair/good” credit score category. This is still a great score, and consumers shouldn’t have much trouble getting a loan with First Financial.

- 620-279: This is considered an “okay” credit score and is average for most consumers.

- 580-619: This score range puts consumers in the “poor credit” category. Loans will be tougher to receive, especially in larger amounts.

- 500-580: This is a bad credit rating. While loans are still possible, First Financial only says, “More information may be required” for consumers who fall into this category.

- 499-below: Very poor credit. Again, First Financial says they can still extend a consumer credit, but they will need to submit more information for credit approval.

As one reviews First Financial’s low credit page, they find this statement: “Let the Bad Credit Loan BUILD your credit score.” The theory is that as the customer pays off the loan, whether it’s for personal use or a car, their credit score will begin to creep upward until they have a good-to-excellent credit score. However, this is kind of ambiguous since they don’t give any specifics about the loans they offer.

Don’t Miss: Best Bank for Small Business Banking (Best Business Bank Accounts)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

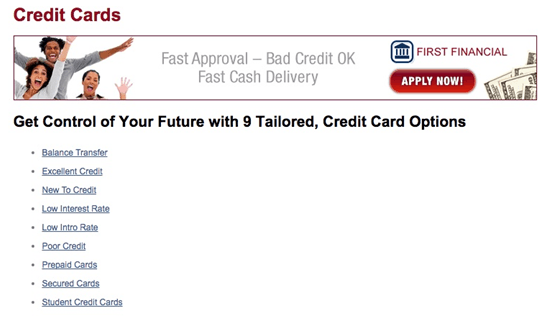

First Financial Review: Credit Cards

Since every lending institution is different, consumers should compare First Financial reviews with those of other lending companies to ensure they’re getting the best loan rates available. Further, keep in mind that First Financial only offers credit cards through independent third parties.

The credit card section offers a list of credit card types, such as low interest rates, low introductory rates, secured cards, student cards, etc. But it takes some studying the web page to understand that one must click on those individual links to apply for the card, rather than having one application button on the main credit card page

Image Source: First Financial

The page also specifies that First Financial reviews each type of credit card so they can offer the right type of card to each consumer. First Financial appears to take the opinion that since every consumer is different, and has different credit needs, a one-size-fits-all approach to credit only leads to problems down the road. However, it’s still important for potential customers to carefully review First Financial’s offerings, including a careful read of the fine print to avoid getting in over their head.

Cash Advance: First Financial Personal Loan Review

First Financial makes it clear on their cash advance page that they do extend this service to “students, bankruptcy filers and low-income applicants.” In fact, they say they will lend to someone with an income as little as $800 per month. This raises some red flags because those in the above categories do tend to default on loans at a higher rate than the average consumer with a steady income and a fairly good credit score. Aside from looking at First Financial loan reviews, prospective customers should review other lenders to see who offers the better deal.

A quick review of firstfinancial.com shows they offer:

- Instant approvals

- All credit scores

- Flexible terms

- Fast funding

Further, a closer review of First Financial’s cash advance page shows that they do offer several different choices to consumers – thus letting the consumer pick the right cash advance that will meet their needs. They also imply that there is no penalty for paying off a cash advance early. First Financial says:

“We make the cash advance options clear, so that you can choose the best offer for you. Able to pay off the loan sooner rather than later? We’re happy to oblige. With everything orchestrated online, you can apply, see the cash in your personal checking account and make a payment from that very source within a day or two of starting the process.”

First Financial touts that the consumer can manage their cash advance online; everything from applying for the advance to making payments. At least one First Financial review says that the company did not return any of her phone calls. While being able to manage your account online, there are times when a customer needs to talk to a real person to answer a question or solve a problem. This is why it’s so important to read all First Financial reviews online, as well as the reviews of other lenders.

Related: Best Banks in Australia (Ranking: Biggest Banks, Best Savings Accounts)

First Financial Review of Mortgage Loans

Like most financial lending institutions, First Financial offers mortgage loans to consumers. Their mortgage loan website says they offer better rates and options than the competition. Before deciding to get a mortgage with First Financial, reviews of other lenders should still be a priority.

First Financial only offers mortgage loans through a third-party. They don’t offer direct mortgage loans to consumers. Consumers who are thinking about taking out a mortgage loan with First Financial need to also review the company actually giving out the mortgage.

That said, reviewing First Financial’s mortgage page makes it clear that they will give you all the information you need to make an informed decision, without the high pressure sales tactics used by some mortgage lender sales departments. First Financial offer tools that will:

- Give negotiating tips to get the best mortgage possible.

- Break down mortgage offers into an easy-to-understand, digestible format.

- Show other customer reviews and ratings.

Finally, First Financial says they will offer the customer “at least five quotes within minutes of your application.” Again, all the quotes will be from third parties, not from First Financial. So consumers should read both First Financial reviews and reviews from the sources of the mortgage loans.

Popular Article: Top 5 Banks in Canada – Ranking | Best High Interest Savings Accounts – Canada

First Financial Reviews: What Customers Are Saying

Firstfinancial.com reviews are hard to come by since this is a relatively small organization. The problem is further compounded by the fact that many, many companies use “First Financial” as their name or part of their name.

But many First Financial reviews can be found in the review section of their Facebook page. Overall, the reviews are positive. Some of the complaints are that they are slow to respond to inquiries (or not at all).

Some confusion exists over, again over the name: a few reviewers received solicitations over the phone and were asked to pay an “insurance fee” to get qualified for a loan. First Financial maintains that they never solicit over the phone and those calls were from a different company. Again, the term “First Financial” is used by a lot of finance institutions, so it can be easy to for a customer to get confused.

Now, it’s time to see for yourself: read the First Financial reviews and information provided on their website. Keep in mind many of their services are actually provided by an independent third-party, but once you have all of the information about First Financial, you will be able to decide whether this company offers the right services for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.