2017 RANKING & REVIEWS

TOP RANKING BANKS IN AUSTRALIA

Overview – Ranking of the Top Banks in Australia and Australian Banks with the Highest Yielding Savings Accounts

Australia is a large and diverse country, and their available banking and financial institutions are varied. This article presents a detailed review of two different types of top Australia banks, although there is some overlap.

This review includes:

- The biggest banks in Australia

- Best banks in Australia with the best high-yield accounts

Source: Australiance

The first Australian banks reviewed in this article are the biggest banks in Australia. This covers the type and scope of services, the number of branches, and factors such as international presence and growth through the years.

The second part of this review includes banks in Australia with the best high-yield accounts. Some of the names on this list overlap, so you may find that one of Australia’s largest banks also has one of the best high-yield accounts.

As well, some of the largest banks in Australia may not be on the list of the best high-yield accounts at all. For example, National Australia Bank is one of the largest banks in Australia, but is not included in our ranking of specific accounts.

The reason for the differentiation is simple. While some of the largest banks in Australia have a significant presence throughout the country, those Australian banks may not offer things like the lowest banking fees or the highest interest rates on accounts.

Award Emblem: Best Banks in Australia

AdvisoryHQ’s Lists of the Top Banks in Australia

Each list is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that bank).

The Biggest Banks in Australia

- Australia and New Zealand Banking Group (ANZ)

- Commonwealth Bank (CBA)

- National Australia Bank (NAB)

- Westpac Bank

Top Yielding Accounts (Best Banks in Australia to Bank with)

- ANZ-Online Saver Account

- BankSA-Maxi Saver Account

- ING Direct-Savings Maximiser

- RaboDirect-High Interest Savings Account

- St. George-MaxiSaver Account

- Westpac-eSaver Account

Click here for 2016’s Top Banks in Australia

Largest Banks in Australia | Brief Comparison

Australia Banks | Total Asset Size |

| Commonwealth Bank | $933,078,000,000 |

| ANZ | $914,900,000,000 |

| Westpac | $839,202,000,000 |

| NAB | $777,622,000,000 |

Table: Top and Largest Banks in Australia | Above list is sorted by asset size

Best Banks in Australia for High Interest Savings Accounts | Brief Comparison

Australian Bank | Account Name |

| ANZ | Online Saver Account |

| BankSA | Maxi Saver Account |

| ING Direct | Savings Maximiser |

| RaboDirect | High Interest Savings Account |

| St. George | MaxiSaver Account |

| Westpac | eSaver Account |

Table: Best Australian Banks for High Interest Savings Accounts | Above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Methodology for Selecting Banks and Accounts in Australia

When AdvisoryHQ began reviewing and ranking the major banks in Australia, the process was two-fold. To rank the largest banks in Australia, we looked at easily measurable data.

- National Australia Bank (NAB)

- Commonwealth Bank

- Australia and New Zealand Banking Group (ANZ)

- Westpac (WBC)

The Big Four Banks are the largest banks in Australia based on asset size.

Then, once we determined the largest banks in Australia, we moved on to conduct our own in-depth research to find the banks with the best accounts in terms of the interest rate offered to consumers. Many of these accounts not only carry the highest yield levels but also have low fees to maintain these accounts.

Detailed Review— Top Banks in Australia by Size

Below, please find the detailed review of each firm on our list of the largest banks in Australia. We have highlighted some of the features of the best and biggest Australian banks.

See Also: Best Mutual Banks & Building Societies in Australia | Sydney, Melbourne, and Adelaide, AU

Commonwealth Bank Review

The Commonwealth Bank of Australia, also called the Commonwealth Bank or CBA, provides financial services that range from personal retail banking for individuals to business banking, funds management, and investment services. The Australian government founded the Commonwealth Bank in 1911, and it is recognised as one of the Big Four Banks in Australia.

CBA was listed on the Australian Stock Exchange in 1991, and the bank was fully privatised by 1996. The headquarters of CBA are located in the State Savings Bank in Sydney. CBA is one of the largest companies on the Australian Securities Exchange and is part of the Morgan Stanley Capital Global Index.

Key Highlights of Commonwealth Bank, One of the Largest Banks in Australia

International Presence

The Commonwealth Bank Group is not only one of the Big Four banks in Australia, but it also has an increasingly significant presence throughout the world.

This presence includes the following:

- Retail banks in New Zealand under the name ASB

- Retail banks in Indonesia, called Commonwealth Bank Indonesia

- Investments in China and Vietnam, including 20 percent stakes in Qilu Bank, Bank of Hangzhou, and Vietnam International Bank

- Life insurance operations in New Zealand, Indonesia, and a joint venture in China

- Banking branches in London, New York, Tokyo, Hong Kong, Shanghai, Beijing, Singapore, Auckland, Ho Chi Minh City, and Mumbai

Networks and Alliances

Commonwealth Bank has a widespread distribution network that allows this Australian bank to expand its reach, which is created through a partnership with Australia Post. This banking group also provides customers 24-hour access to banking services through telephone banking and the most extensive network of EFTPOS and ATM networks in Australia.

The Commonwealth Bank Group is also a leading provider of online financial services. Online financial service offerings include NetBank, which is the Internet banking site, as well as CommSec, which is the most popular online broker in the country.

As well as these services and offerings from this Australian bank, the Commonwealth Bank Group also features independent financial advisement distribution, provided by licensed investment advisers.

Structure

The structure of the Commonwealth Bank includes five primary business divisions, each of which is designed to offer the highest level of service and product development. These segmentations include the following:

- Retail Banking Services: This is where CBA delivers customised services for personal and small business customers. The focus is on the delivery of products and services that are convenient and affordable.

- Business and Private Banking: This is designed to facilitate relationship management with small-medium enterprise customers. This includes regional and agribusiness customers. Also, this is the branch of banking business that includes online trading and premium personal clients.

- Institutional Banking and Markets: The focus here is on the management of bank relationships with major corporate and governmental clients, as well as institutional investors.

- Wealth Management: At CBA, wealth management includes management of manufacturing and distribution. This division also includes the brands of Colonial First State Global Asset Management, Colonial FirstState, and CommInsure.

Also part of the business structure are Financial Services, Risk Management, Enterprise Services, Human Resources, and Group Corporate Affairs.

Vision and Financial Information

The vision of Commonwealth is defined as striving to excel at “securing and enhancing the financial wellbeing of people, businesses, and communities.”

Key financial information includes the following:

- The shareholder base is more than 800,000.

- About 81.3 percent of Australian staff members are also shareholders.

- The net after-tax profit on a statutory basis for the half year that ended on December 31, 2016 was $4,895 million. That’s a two percent increase as compared to the prior year.

- The Group, as a whole, has more than $971,719 million in assets as of December 31, 2016.

- The Commonwealth Bank operates the largest financial services distribution network in Australia, with the most points of access available to customers.

- There are more than 4.6 million active online customers.

Don’t Miss: Banks in Melbourne | Ranking | Review of the Best Melbourne Banks

Australia and New Zealand Banking Group Review

Australia and New Zealand Banking Group (ANZ) is one of the largest banks in Australia based on market capitalisation, with Australian operations making up the majority of operations. ANZ not only has a large Big Four presence in Australia. It’s also ranked as the biggest bank in New Zealand. ANZ has a history spanning more than 180 years, and it originally opened as the Bank of Australasia in 1835 in Sydney.

From there, the bank expanded into Melbourne. In 1951, the Bank of Australasia merged with the Union Bank of Australia, and ANZ was formed. ANZ was also part of one of the largest mergers in Australian banking history, when it merged with the English, Scottish, and Australian Bank Limited to form the present organisation.

Key Highlights of ANZ, One of the Largest Banks in Australia

Business Structure

The business structure of ANZ is laid out in the following way:

- Australian Division: ANZ’s retail and commercial branch.

- New Zealand Division: The New Zealand division is similar to the Australian in that products and services are geared toward the needs of retail, commercial, and wealth management customers.

- Institutional: This regional-based division offers products and services for global business clients and institutional clients.

- Corporate Centre: The ANZ Corporate Centre operates as the area of the business that serves the needs of international organisations and clients.

Another separate division within ANZ is Technology, Services, and Operations.

Scope

As one of the leading banks in Australia, ANZ is not just one of the four largest banks in Australia but is also ranked as one of the top 25 largest banks in the world based on capitalisation. This Australian bank has a staff of over 50,000, and a global presence in 34 countries.

ANZ is listed on the Australian Stock Exchange, and it also has a secondary listing on the New Zealand Stock Exchange.

There are more than 10 million customers served by ANZ. This includes retail, commercial, and institutional customers.

Business Strategy

The goal of ANZ and everything done as part of their overall business strategy is to become a super-regional bank. This means the focus of the strategy at ANZ is on building a presence in the Asia-Pacific Region.

Last year, ANZ set a goal to source 25-30% of all earnings from the Asia-Pacific, Europe, and American divisions by 2017, while keeping the focus on domestic business in Australia and New Zealand as well. The strategy to achieve these goals includes:

- Geographic: Balances exposure to Asian growth with regional connectivity and strength in domestic markets.

- Building super regional capabilities: This includes technology operations hubs, the cultivation of a core global brand, governance and risk management, and the construction of leading product capability.

- Customer focus: Relies on a thorough understanding of client needs, including resources, agribusiness, and infrastructure, as well as trade and investment flows, and migration/people flows/education.

Related: Banks in Sydney | Rankings | Comparison of the Best Sydney Banks

Westpac Review

Westpac Banking Corporation, simply known as Westpac, is a leading Australian bank and financial services provider. Westpac’s headquarters is in Sydney, and as with the previous three, this Australian bank is among the Big Four in the country. Westpac serves around 13 million customers.

Westpac holds the distinction of being Australia’s oldest bank, having been established in 1817 as the Bank of New South Wales. In October 1982, the name was changed to Westpac Banking Corporation after the acquisition of the Commercial Bank of Australia. The first employee of the bank was Joseph Hyde Potts, a porter and a servant.

Key Highlights of Westpac, One of the Largest Banks in Australia

Global Locations

The reach of Westpac goes well beyond Australia and even New Zealand. The following are details of this Australian bank’s international reach and expansion, including places where the bank has a strong presence:

- Asia: Some offices support customers in nearly every aspect of the business including Corporate, Institution, Private and Premium customers.

- Westpac New Zealand: This international division includes retail and commercial banking, as well as wealth management products and services.

- Westpac in the Pacific: The bank has representation in seven Pacific Island nations.

- Westpac Institutional Bank: There are branches and representative offices in the main worldwide markets including London, New York, and throughout Asia.

- Westpac in the United Kingdom: This includes corporate, institutional, and premium banking sectors.

Portfolio and Investor Information

Westpac has grown to become one of the strongest, most stable, and largest financial institutions in the world with millions of customers and a significant presence in key markets.

This top Australian bank, which is nearly 200 years old, continues to evolve with the changing world and financial markets while relying on the models of business operations and customer services that have allowed them to remain a thriving institution.

Below is an infographic representing the portfolio, size, and scope of Westpac, presently:

Five-Year Summary

To become recognized as a top Australian bank and a biggest bank in Australia, it’s important to have strong assets and financials. Westpac releases regular summaries highlighting details such as cash earnings, balance sheets, total assets, Tier 1 capital ratio, and information regarding total equity to total assets as a percentage.

Products and Services

The primary service areas of this top Australian bank are divided into three broad categories: Personal, Business, and Corporate.

Below are details of the specific services offered under each larger umbrella:

- Personal: Personal banking services and solutions from Westpac include bank accounts, credit cards, travel money cards, superannuation, home loans, personal loans, insurance, shares, and investing.

- Business: Business banking includes bank and savings accounts, international trade, merchant services, credit cards, business loans, and equipment financing.

- Corporate: Corporate clients have access to products and services that include corporate and institutional banking, corporate and structured finance, financial markets, transactional banking, and trade and supply chain finance.

National Australia Bank (NAB) Review

National Australia Bank (NAB), is guided by the principle that a bank in Australia or elsewhere has a special responsibility. This is why they’re committed to “creating more of what matters to people, communities, and the economy.”

The majority of financial services provided by NAB are based in Australia and New Zealand, but the bank does also provide some level of service in Asia, the UK, and the US. The relationships between this top bank in Australia and its customers are based on helping, guiding, and advising individuals to achieve better financial outcomes.

This Australian bank includes full-service offerings, such as both personal and business banking, and specialist-level expertise in industries including health, government, and education.

Key Highlights of National Australia Bank, One of the Biggest Banks in Australia

Transaction Accounts

One of the primary services offered by this large Australian bank is transaction accounts, designed to give customers a convenient and straightforward way to access their money on their terms.

Everyday bank accounts from NAB include no monthly account fees. In addition, transaction account holders receive a NAB Visa Debit card with payWave at no additional charge, there are no minimum deposits or ongoing balance requirements, and fraud protection is offered with NAB Defence.

Specific transaction accounts available from this top Australian bank include NAB Classic Banking and the NAB Retirement Account.

Highlights from Recent Annual Report

In their recent annual report, National Australia Bank outlined its refreshed strategy for becoming the most respected bank in Australia and New Zealand. At the center of this strategy are three core objectives that are meant to serve as way to guide the actions of this Australian bank:

- Customers are advocates

- People are engaged

- Shareholder return on equity (ROE) is improved

This Australian bank also identified other objectives they wanted to focus on in the upcoming financial year including a focus on strengthening their foundations.

Notable pieces of information from their Annual Review:

- Net interest income increased by 3.8 percent (about $468 million)

- Net profit that is attributable to NAB owneres decreased by 94.4 percent (about $5,986 million)

- Net investment and insurance income decreased by 7.7 percent (about $54 million)

Loans

This Australian bank offers lending products for its customers, including home loans and personal loans. There are home loan products available for a number of situations including buying a first home, or renovating or upgrading an existing home.

If you’re considering a home loan from NAB, this Australian bank also offers useful tools, including calculators to estimate how much you may be eligible to borrow, the ability to inquire online and speak with home loan experts, and options to have mobile bankers visit you to discuss your home loan options.

Other calculators include a loan repayments calculator, stamp duty calculator, and a calculator that helps would-be borrowers decide whether renting or buying is best for their financial situation.

Global Scope

NAB has 800 locations in Australia, New Zealand, and around the world serving with 35,000 employees serving 10 million customers.

Popular Article: NAB Review – Review of the Largest Bank in Australia – What Is NAB? Complaints, Fees, Reviews

Detailed Review—Banks in Australia with the High Interest Savings Accounts

As mentioned above, while an Australian bank may be considered a pick for the biggest bank in Australia, that doesn’t necessarily mean it’s also a selection for the best bank in Australia.

The above banks represented the largest banks in Australia, while the following list represents some of the top Australian banks based on their availability of competitive high-yield accounts. Some of the Australian banks from our first list will be found on this list as well.

Free Wealth & Finance Software - Get Yours Now ►

ANZ—Online Saver Review

The ANZ Online Saver account delivers monthly interest earnings on deposits and available funds. This account from this Australian bank features a bonus interest rate for new customers on top of an existing competitive interest rate.

Key Factors That Led to Our Ranking of This as an Australian Bank with the Best High-Yield Account

Below are reasons ANZ’s Online Saver account was included on this list of banks in Australia with the best interest-earning accounts.

Bonus Interest Rate

As mentioned above, when you’re an ANZ customer who opens a new Online Saver account, you become eligible for a bonus introductory interest rate of 1.40% p.a., which is added on top of the standard variable interest rate, which is currently at 1.15% p.a. This introductory bonus rate is added to your standard rate for a period of three months after opening a new Online Saver account.

This means that if the standard variable interest rate remained unchanged, account holders would earn a total interest rate of 2.55% p.a. for three months.

Source: ANZ

Fees and Charges

As well as a leading competitive interest rate on deposits, the ANZ Saver Online Account also carries no minimum balance, no fixed terms, and no monthly account service fees.

Transactions included each month with this Australian bank account and/or a linked ANZ Everyday Banking Account include unlimited ANZ goMoney, phone banking, and Internet Banking transactions.

Linked Everyday Accounts

Online Saver is an Australian bank account designed to make money accessible through the option to link it with a variety of ANZ everyday bank accounts. One of these is the ANZ Access Advantage account, which offers freedom to use money online and overseas with the flexible and convenient ANZ Access Visa Debit Card.

ANZ goMoney App

To provide account holders with visibility and control of their finances, this top bank in Australia offers the goMoney mobile app. It can be used in conjunction with the Online Saver account as well as the accompanying linked transaction account so users can manage their money on the go.

This banking app from this top Australian bank is designed for both Android and Apple smartphones.

Features of the app include the ability to check balances rapidly, transfer money between linked accounts, pay bills quickly, and pay friends and family members using just their mobile phone number.

Read More: Bank Australia Review and Ranking

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

BankSA Maxi Saver Review

As one of the best banks in Australia, BankSA also offers an excellent high-yield savings account, called Maxi Saver. Detailed below are key reasons Maxi Saver was included in this ranking of the banks in Australia with the best high-earning savings accounts.

Key Factors That Led to Our Ranking of This as an Australian Bank with the Best High-Yield Account

Below are reasons BankSA’s MaxiSaver account was included on this list of banks in Australia with the best interest-earning accounts.

Interest Rate

When you open a Maxi Saver account with this top Australian bank, it comes with an introductory 2.75% p.a. interest rate for three months. This rate includes a bonus 1.75% p.a. for new customers opening a Maxi Saver account.

While providing the opportunity to earn a competitive interest rate, this account from this bank account in Australia also includes no monthly service fee, so you can focus exclusively on meeting your savings goals.

Other Fees and Charges

As well as being an account with no monthly service fee, there are other perks associated with this account from this top bank in Australia. Internet banking and phone transactions are free to account holders, and if there is a need for a staff assisted transactions, the fee is only $2.50.

Users can check their account balances and manage their funds via not only the Internet but also mobile banking, and there is no minimum monthly balance or deposit required to have this account.

Online Application

If you want to apply to open the Maxi Saver account at this top Australian bank, it’s a very easy process. Anyone who’s at least 14 years old and an Australian Permanent Resident can apply. It takes only five minutes to fill out the online application, and this time period is even less for existing customers of BankSA. The application process is secure, but new customers do need to complete an online ID check.

As part of the process, you will also register for Internet Banking.

If you don’t prefer to apply for the Maxi Saver account online, you can do so by visiting a branch of this leading Australian bank.

Mobile Banking

If you do open a Maxi Saver account with BankSA, you can use mobile banking to manage your account. Some of the features of this modern mobile banking app include the following:

- Find forgotten account details online by logging in and following the prompts

- Make direct payments from your eligible BankSA account to another person’s external bank account using their mobile number with the Pay to Mobile feature

- Check balances quickly without logging in

- Log in using your fingerprint on some devices

- Use Cardless Cash

- Receive customized notifications including low balance, withdrawal, deposit, dishonour, high balance, daily balance, and credit card reminders

Free Wealth Management for AdvisoryHQ Readers

ING Direct—Savings Maximiser Review

After completing the comprehensive review of the top banks in Australia, and more specifically the best high-yield savings accounts, we offer below the reasons why the ING Direct Savings Maximiser was included in this ranking.

Key Factors That Led to Our Ranking of This as an Australian Bank with the Best High-Yield Account

Below are reasons ING Direct’s Savings Maximiser account was included on this list of banks in Australia with the best interest-earning accounts.

High Variable Rate

Customers with an Orange Everyday bank account and deposit pay amounting to $1,000 a month are eligible for a 3.00% p.a. variable rate. This offer is also available for single account holders who have an account balance of $100,000 or over. The standard variable rate for this account is 1.60% p.a.

No Fees

The high-yield savings account from this top Australian bank includes no ING Direct fees. That means you aren’t spending money to save your own money, so you can watch your savings grow more quickly.

This account from this bank in Australia includes other benefits as well, including the ability to make withdrawals and deposits from a linked external account or an Orange Everyday Account, and there are no minimum deposit requirements.

Australian residents aged 13 and older are eligible to apply for the Savings Maximiser Account.

Savings Plans

As well as competitive variable interest rates, when consumers open a Maximiser Account with this leading Australian bank, they have the opportunity to set up a savings plan. Customers can set up a system that automatically moves a portion of their salary to their savings account each pay day so that they can save money with ease.

This allows customers to literally maximize their earnings by making money through the variable interest rate. This top bank in Australia makes it simple to set things up:

- Calculate how much money you can afford to set aside from your pay each pay period

- Provide the pay office at your job with your Savings Maximiser account number and ING Direct’s BSB along with instructions for how much money should be taken

- Payments can be automatically credited to your ING Savings Maximiser

Customers can take things a step further and boost their earning potential by having dividends from investments, tax refunds, rental income, and more go directly to their Savings Maximiser account.

Related: Beyond Bank Australia Review and Ranking

Free Money Management Software

RaboDirect—High-Interest Savings Account Review

When ranking the Australian banks with the best high-interest savings accounts, below are key reasons the RaboDirect High-Interest Savings Account was included in this ranking.

Key Factors That Led to Our Ranking of This as an Australian Bank with the Best High-Yield Account

Below are reasons RaboDirect’s High Interest Savings account was included on this list of banks in Australia with the best interest-earning accounts.

Bonus P.A.

The High-Interest Saving Account from this top Australian bank offers many valuable features and benefits. One of those is an introductory 3.05% p.a. rate for the first four months after you open your account on the first $250,000.

This introductory rate offered by this high interest Australian bank account is a combination of the standard variable rate (2.00%) and the 4-month additional variable rate (1.05%).

Tiered Interest

The High-Interest Savings Account operates with tiered interest rates based on the account balance:

Balances up to $250,000 earn a standard variable interest rate of 2.00% p.a.

Balances between $250,001 and $1 million earn a standard variable interest rate of 1.75% p.a.

Balances over $1 million also earn a standard variable interest rate of 1.75% p.a.

Features and Benefits

Along with high yields to help account holders earn money on their savings more quickly and competitively, this account also has the following features and benefits:

- There are no account keeping or maintenance fees

- Interest is paid on a monthly basis

- Your first $250,000 in deposits is protected by a guarantee from the Australian Government

- There is no minimum balance requirement

- This account includes access to online and mobile banking services

Savings Bank

One of the unique reasons RaboDirect is not just a great place to have a high-yield account, but also a pick for one of the best banks in Australia is that they focus almost exclusively on savings accounts.

From short- to long-term goals, all of the products and services offered here are designed to help customers achieve their savings goals, and there is a broad range of products to suit vastly varied needs.

RaboDirect is also an online-only bank, so there is lower overhead, which is how they can provide competitive earnings rates without account keeping fees.

St. George Bank—Maxi Saver Account Review

The Maxi Saver Account from St. George Bank is a no-fee online savings account that helps account holders effortlessly earn interest on their deposits. Not only are you earning interest on your deposits, but the rate is highly competitive.

Detailed below are some of the pivotal reasons St. George Bank is ranked as one of the best banks in Australia with an excellent high-yield savings account option available to customers called the Maxi Saver.

Key Factors That Led to Our Ranking of This as an Australian Bank with the Best High-Yield Account

Below are reasons St. George Bank’s Maxi Saver account was included on this list of banks in Australia with the best interest-earning accounts.

Account Features

The Maxi Saver account is designed to provide new account holders with rewards through a bonus introductory interest rate. You earn interest on the entire balance of your account, regardless of how big or small it is. There are no limits on the amount of interest you can earn based on the size of your deposit.

The rates are competitive and include an introductory three-month variable rate of 2.75% p.a. This includes a fixed bonus rate of 1.75% for new Maxi Saver customers. After the first three months, account holders then earn the standard variable rate.

No Monthly Fees

Account holders of this high-yield account from this top bank in Australia can watch their money grow quickly because, in addition to a bonus interest rate and a competitive standard variable interest rate, there is no monthly service fee.

Convenience Features

As one of the leading banks in Australia, St. George offers many technological and convenience-based feature and benefits to customers. Some of these apply to Maxi Saver account holdings.

These include:

- Quick Balance: This feature lets Maxi Saver account holders see exactly how much money they have in their account at a glance using their smartphone or smartwatch.

- Fingerprint Login: Fingerprint login demonstrates the highest level of security, as comparable to other mobile banking login options, but it’s also fast and easy. Fingerprint login also includes fraud protection features.

- Mobile and Internet Banking: You can access your Maxi Saver funds and account information as well as your linked St. George transaction accounts anytime using mobile and internet banking.

Security

Listed below are some of the security features St. George Bank puts in place to protect Maxi Saver customers:

- St. George Savings accounts are protected accounts under the Financial Claims Scheme from the Australian Government.

- If you’re banking in-person, online, or over the phone, St. George utilizes the most stringent security measures throughout.

- The Fraud Money Back Guarantee says savings account holders at St. George will be reimbursed for any losses resulting from unauthorised transactions, as long as it’s reported promptly and the account holder hasn’t contributed to the loss.

Westpac—eSaver Account Review

The Westpac eSaver Account is specifically designed to offer an easy, convenient way to save money with 24/7 funds access and competitive interest rates on deposits. Below are particular details of why Westpac, one of the largest banks in Australia, made it onto our list of the banks in Australia with the best high-yield savings options.

Key Factors That Led to Our Ranking of This as an Australian Bank with the Best High-Yield Account

Below are reasons Westpac’s e-Saver account was included on this list of banks in Australia with the best interest-earning accounts.

Benefits

The list below highlights some of the advantages and reasons a consumer might consider opening an eSaver account from this top bank in Australia.

- Competitive interest rates so you can earn more on your savings and put idle money to work

- No monthly service fee

- Unlimited access to your account via a Westpac Choice account

- No minimum deposit or monthly balance requirement

- Safe online banking, which includes the Westpac security guarantee

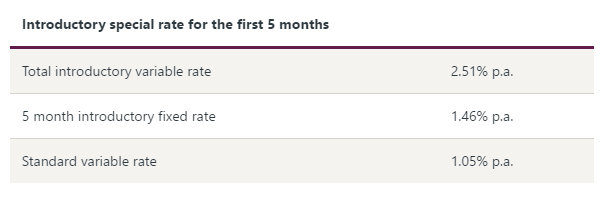

Bonus Rate

When you open a new eSaver account at Westpac, one of the biggest banks in Australia, you also receive an introductory fixed bonus rate, which is added in addition to the standard variable rate. New account holders receive this bonus for the first five months after opening a new account, which is one of the longest terms to earn a bonus compared to the other accounts ranked on this list of the top Australian banks with high-yield account options.

The breakdown of the interest rates is as follows:

Source: Westpac

Features

Some of the available features that make the Westpac eSaver account a standout among Australian high-yield savings options include the following:

- Account holders can quickly and easily manage everything online, including depositing money by transferring funds between an eSaver and Westpac Choice account.

- There is no fee when money is transferred between an eSaver and Westpac Choice account.

- Account holders have access to the award-winning online banking services offered by this top Australian bank.

Online Banking is backed by the Westpac Security Guarantee.

Westpac Choice

To open an eSaver account, customers are required to have a Westpac Choice account, which is an award-winning transaction account. If you already have one you can link it to a new eSaver account in the application.

The Westpac Choice account has benefits including no monthly service fee when at least $2,000 a month is deposited, the inclusion of a Westpac Debit MasterCard if requested, and no ATM withdrawal fee at more than 3,000 Westpac Group ATMs in Australia and New Zealand.

There are no ongoing monthly service fees for the eSaver account and no fees assessed for online banking or automated telephone banking transactions between a Westpac eSaver and Westpac linked account in the same name.

Conclusion—Largest Banks in Australia and the Top Yielding Accounts

We approached our review from two angles. First, we looked at the biggest banks in Australia and compared each of these financial institutions, primarily regarding their network of services and their international presence.

When you’re looking at the largest banks in Australia, you’re going to find that while they may be known globally and they may offer the widest range of services, that doesn’t necessarily mean they’re the best banks in Australia or that they offer the most monetary advantages for customers.

For that reason, this ranking also included the banks in Australia with the top high-yield savings accounts, which are one of the simplest ways for consumers to earn money on their existing deposits. While only a couple of banks were included on both lists, you likely noticed there were some names that were ranked as both the largest banks in Australia and banks in Australia with the best high-yield accounts.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.