2017 RANKING & REVIEWS

TOP RANKING BEST BANKS IN SYDNEY, AUSTRALIA

Intro: Finding the Top Banks in Sydney (New South Wales)

Sydney is the most populated city in Australia and is the capital of New South Wales. With a population of more than four million people, Sydney is a hub for commerce. The hustle and bustle of this city makes it no surprise that there are a large number of banks in Sydney, Australia, serving the needs of consumers and businesses.

The sheer number of Sydney banks available to choose from can make it difficult to figure out the best deal. While there are many top banks in Sydney, we have managed to narrow it down to the ten absolute best banks in Sydney using our stringent selection methodology.

Whether you are looking to open an online savings account or secure a loan, there is a top bank in Sydney for you on our list. Our comprehensive review of each of these banks in Sydney provides you with the opportunity to compare features such as monthly service fees and account accessibility.

Award Emblem: Best Banks in Sydney, Australia

There is much to be considered when selecting a bank in Sydney. While all of the Sydney banks on this list are among the best banks in Sydney, there can be significant differences in the products and services offered from one Sydney bank to another.

As you read the comprehensive reviews contained in this article, it is important to focus on the banks in Sydney that offer the right financial products and services for your individual financial needs. The bank that is best suited to meet your financial needs will be the best bank in Sydney for you.

See Also: Best Mutual Banks & Building Societies in Australia | Sydney, Melbourne, and Adelaide, AU

AdvisoryHQ’s List of the Top 10 Banks in Sydney

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that bank):

- ANZ

- Bank of Queensland (BOQ)

- Commonwealth Bank of Australia

- Credit Suisse Group

- HSBC Bank Australia

- Macquarie

- National Australia Bank

- St. George Bank

- UBS Bank Australia

- Westpac

Click here for 2016’s Top 10 Best Banks in Sydney

Top 10 Best Banks in Sydney | Brief Comparison

Sydney Banks | Highlighted Features |

| ANZ | ANZ Business Ready |

| Bank of Queensland | Mortgage Offset Account |

| Commonwealth Bank of Australia | Everyday Smart Access Account |

| Credit Suisse | Private Banking |

| HSBC Australia | Flexi Saver |

| Macquarie | Owners Advisory Service |

| National Australia Bank | NAB Startup Program |

| St. George Bank | Incentive Saver |

| UBS Australia | Asset Management for Individuals |

| Westpac | Reward Saver Account |

Table: Top 10 Best Banks in Sydney | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Sydney Banks

Below, please find the detailed review of each firm on our list of top banks in Sydney, Australia.

We have highlighted some of the factors that allowed these best banks in Sydney to score so highly in our selection ranking.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

ANZ Review

First opened in 1835 in Sydney as the Bank of Australasia, ANZ has a history in the banking industry that spans more than 180 years. They are a global bank with operations in 34 global markets, including Australia, New Zealand, Asia, the Pacific, Europe, America, and the Middle East.

This top bank in Sydney is ranked among the top four banks in Australia and is the largest bank group in New Zealand and the Pacific. The Sydney bank is also ranked among the top 50 banks in the world.

Headquartered in Melbourne, Australia, this top bank in Sydney serves more than ten million retail, commercial, and institutional customers. This impressive bank in Sydney, Australia, boasts more than $889 billion in assets.

Key Factors That Enabled This Bank to Rank as a Best Bank in Sydney

Below are key factors that enabled ANZ to be rated as one of this year’s top banks in Sydney.

ANZ Online Saver Account

An ANZ Online Saver Account is a free, high-yield, online savings account. There is no monthly account fee and no minimum balance requirement for the Online Saver Account.

This impressive savings account offered by this top Sydney bank offers customers an easy and flexible way to save and earn. Funds in the account are easily accessed via customers’ linked ANZ everyday banking account. Savings in this account may be accessed at any time and can be used to pay bills via bill pay or direct debit.

This easy savings account offered by this top bank in Sydney features an impressive interest earning rate of 1.25% p.a., but on top of that already great rate customers who open a new Online Savers Account also receive a bonus 1.40% p.a. for the first three months.

This means that if the variable rate of 1.25% p.a. stays the same for the first three months, new account holders will earn an amazing 2.65% p.a. for the first three months.

With such a high-yield interest rate plus bonus interest for the first three months and easy access to funds, this Sydney bank’s Online Savers Account is hard to beat.

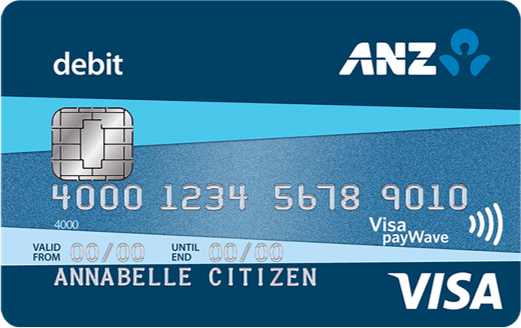

ANZ Access Advantage Account

Image Source: ANZ Access Advantage

An ANZ Access Advantage account offers everything customers need in an everyday transaction account. This top notch account offered by this best bank in Sydney provides customers with flexibility and easy access to their funds as well as the convenience of the latest technology.

Features of this everyday transaction account are:

- $5 monthly service fee can be avoided by depositing at least $2,000 a month; fee is waived for those under 25

- ANZ Access debit card can be used to make purchases wherever Visa is accepted

- Unlimited ANZ transactions

- Apple Pay, Android Pay, and ANZ Mobile Pay allow convenient and secure transactions with mobile phone

- ANZ Falcon provides around-the-clock monitoring for suspicious activities for added peace of mind

ANZ Business Ready

ANZ is a bank in Sydney that knows a thing or two about starting a business. They have helped millions of businesses achieve their dreams of success and know what it takes to get a business up and running. That is why they offer their ANZ Business Ready program to help business owners set up their small businesses online in just one day.

ANZ Business Ready is powered by Honcho and guides business owners step by step on how to apply for an ABN, register their business name, set up a website, establish email addresses, and organize their business accounts.

All of this is done with ANZ Business Ready without having to visit multiple websites or contact multiple suppliers. The program offered by this top bank in Sydney also offers a range of other services such as document storage, marketing, and invoicing, all at a market-leading discounted price.

Small Business Lending

When starting a small business, one of the first steps is securing financing. ANZ has pledged $2 billion dollars to lending for small businesses. Thousands of small businesses have already benefited from this lending pledge, and ANZ remains dedicated to lending to more.

Thousands of small businesses have benefited from this commitment by this Sydney bank. In 2014 alone, this bank in Sydney approved 74% of loan applications.

Don’t Miss: Bank Australia Review and Ranking

Bank of Queensland (BOQ) Review

The Bank of Queensland is a financial organization with a bank branch in every Australian state and territory. This Sydney bank works differently from most large banks in that their branches are run by local Owner-Managers, meaning the branch managers actually own the branches and run them themselves locally.

The Owner-Managers of these top banks in Sydney live locally, take the time to get to know their customers personally, and have an active interest in the communities that they serve. This impressive bank in Sydney is comprised of three lines of business: banking, finance, and insurance.

BOQ operates with a goal to be the real alternative in Australian financial services. They strive to achieve that goal by offering value and service to their customers, looking after their staff, rewarding their shareholders, and partnering with the communities that they serve.

Key Factors That Enabled This Bank to Rank as a Best Bank in Sydney

Below are key factors that enabled the Bank of Queensland to be rated as one of this year’s top banks in Sydney.

BOQ Money

BOQ Money is a program offered by this top bank in Sydney to help both customers and non-customers take control of their finances. The program helps consumers determine where money is being spent and lets them set up income and spending targets.

Users can view history and trends and can also create hypothetical spending and income scenarios to determine how an income change or big purchase will impact their finances. The program is user-friendly and has automated features that take the hassle out of budgeting.

BOQ Money is offered for free to both customers of the Sydney bank and non-customers. This program is a great tool for getting spending under control and building savings.

Mortgage Offset Account

A Mortgage Offset account from this top notch bank in Sydney can help customers pay off their home loan faster while putting away money for a rainy day. The account is a savings account that gives at-call access to the funds in the account while allowing 100% offset against a BOQ home loan.

To aid customers in paying off their home loan faster, the interest on this savings account is calculated at the same rate as the interest charged on the linked home loan. Then, the interest credited on the funds in the account is offset against the monthly interest charged on the balance on of the home loan. This helps reduce the unpaid balance on the customer’s home loan each month and allows the customer to earn greater interest rates on their funds that are matched to their home loan rate.

Benefits of a BOQ Mortgage Offset account at this top Sydney bank are:

- Funds available at-call

- 100% of interest earned is offset against BOQ mortgage interest

- Easy access to funds via internet banking, phone banking, in-branch, checks

- No minimum balance required in bank account to participate

- Available on a variety of home loan products

Business Banking

BOQ considers themselves to be a relationship bank as well as a transaction bank. That means that they always try to put their customers and business clients first. The large bank in Sydney employs dedicated relationship managers and experienced business and industry specialists to provide customers and clients with tailored financial solutions.

With their unique Owner-Manager branch set up, BOQ has a unique understanding of what it takes to run a business as many branch managers are business owners themselves.

BOQ offers a comprehensive range of financial products for businesses, including solutions for agribusiness, small to medium business, corporate and property, financial market, and private banking.

Business solutions and products offered by this best bank in Sydney are:

- Business loans

- Transaction accounts

- Investment accounts

- Specialized accounts

- Self-managed super funds

- Vehicle and equipment finance

- Payments and merchants

- Financial markets international

- Inventory and dealer finance

- Insurance options

Commonwealth Bank of Australia Review

The Commonwealth Bank of Australia has been doing business in the banking industry since 1912. Today the top bank in Sydney offers a full range of financial services to help all Australians build and manage their finances. The Commonwealth Bank has more than 800,000 shareholders and employs 52,000 people.

This top bank in Sydney, Australia, holds itself up to be Australia’s top provider of integrated financial services, including retail, premium, business and institutional banking, funds management, superannuation, insurance, investment, and share-broking products and services. The Commonwealth Bank Group is one of the largest listed companies on the Australian Securities Exchange and is included in the Morgan Capital Global Index.

Image Source: Best Sydney Banks

The Sydney bank has more than $933 million in assets and operates more than 1,100 branches nationally. They were the first bank in Australia to go real time, 24/7, and they were one of the first in the world to offer an online banking platform and currently boast more than 4.6 million customers using it.

Key Factors That Enabled This Bank to Rank as One of the Best Sydney Banks

Below are key factors that enabled the Commonwealth Bank of Australia to be rated as one of this year’s top banks in Sydney.

Everyday Smart Access Account

With their Everyday Smart Access account, the Commonwealth Bank offers their customers a no-nonsense, everyday transaction account. To make taking advantage of this account even easier, this simple transaction account can be opened online in just five minutes.

Customers of this Sydney bank who choose to take advantage of their Everyday Smart Access account enjoy these great benefits:

- Access to over 4,000 ATMs and 950 branches

- Tap & Pay capability with a debit Mastercard

- Online banking with Netbank

- The ability to pay friends with the CommBank app

- $4 monthly fee waived when $2,000 or more is deposited

- Unlimited free electronic transactions

Personal Loans

Commonwealth Bank helps its customers take control of the next step toward their goal by offering personal loan options to help get them where they want to be. Whether a customer is interested in buying a new car, making home improvements, or consolidating debt, this top bank in Sydney can help them finance it.

This best bank in Sydney offers three personal options for customers to choose from: a variable rate loan, a fixed rate loan, and a secured car loan.

Benefits of a Variable Rate Loan from this best bank in Sydney are:

- Flexibility to make extra repayments without a fee

- Redraw additional repayments you’ve already made

- Borrow from $5,000 to $50,000

A Fixed Rate Loan from this Sydney bank also has many benefits:

- Customers can stay in control with a fixed interest rate and fixed repayments for the life of the loan

- May make up to $1,000 additional payments per year without a fee

- Borrow from $5,000 to $50,000

For those customers interested in purchasing a car, a Secured Car Loan from this top bank in Sydney can help:

- Pay a lower interest rate by using the car as security

- Stay in control with a fixed interest rate and repayments for the life of the loan

- Make up to $1,000 in extra repayments per year without a fee

International Products and Services

Sydney enjoys a booming economy and is home to many large businesses and corporations. There are a good number of expats living in Sydney who have moved there from their country of origin in need of the best Sydney banks. It is common for consumers to look for a bank in Sydney that makes it easy to send money overseas to friends and relatives, and the Commonwealth Bank is one such bank.

With their international money transfers, customers of this Sydney bank are able to send money quickly, easily, and safely to more than 200 countries using over 30 different currencies. The transfer is made through the international banking system into the recipient’s bank account, ensuring that the funds stay secure.

To make the process even easier, international transfers from this top bank in Sydney can be made online in NetBank, with the CommBank app, or at any branch location.

For those customers who regularly send money overseas or need to hold savings in another currency, this best bank in Sydney offers a Foreign Currency Account. With this special account, customers can choose to hold funds in any major global currency and may convert them when it suits them.

Commonwealth Bank also offers foreign cheques and drafts as a safe and convenient way for customers to pay for goods and services bought overseas.

Related: Beyond Bank Australia Review and Ranking

Credit Suisse Group Review

Credit Suisse Group was founded in 1856 and today enjoys a global reach with operations in more than 50 countries and over 48,000 employees from 150 different nations. Headquartered in Zurich, Switzerland, the Credit Suisse Group holds more than $1214 billion in assets.

The company is organized with four divisions: Investment Banking, Private Banking, Asset Management, and Shared Services. The Shared Services Group provides marketing and support to the other three divisions. For those looking for a bank in Sydney that provides investment and lending advice, Credit Suisse Group may be a good fit.

Key Factors That Enabled This Bank to Rank as One of the Best Sydney Banks

Below are key factors that enabled the Credit Suisse Group to be rated as one of this year’s top banks in Sydney.

Investment Banking

Credit Suisse Group offers a comprehensive list of investment banking products and services managed by accomplished professionals who are dedicated to their clients’ success. Those who want to work with a Sydney bank that can help them invest and grow their money will find what they need in Credit Suisse Group. Their investment professionals have advised many of the world’s preeminent institutions, businesses, asset managers, hedge funds, and governments.

Their investment banking division specializes in:

- Advanced execution services

- Capital markets

- Convertibles

- Corporate insights

- Emerging markets

- Equity derivatives

- Equity sales and training

- Financial sponsors

- Fixed income

- Fund linked products

- Industry experience

- Mergers and acquisitions

- Prime services

- Private placements

Private Banking

Credit Suisse is a Swiss company, but they also have strong roots in Australia. They have been providing private banking services in Australia since the 1960s. Every private banking customer who chooses Credit Suisse as their Sydney bank has a dedicated Relationship Manager assigned to them.

Private banking clients are advised using research-driven investment solutions drawn from in-depth analysis across the globe. Credit Suisse offers a montage of private banking services capable of addressing even the most complex financial needs:

- Portfolio management

- Wealth planning

- Lending advice

- Research

- Private investor banking

- Significant investor visa portfolios

Asset Management

Credit Suisse provides a wide range of asset management services across a range of specialist investment classes including hedge funds, credit, private equity, and commodities.

For those in search of a top bank in Sydney with a far reach, Credit Suisse’s asset management businesses in Australia work in close collaboration with their Private Banking and Investment Banking divisions. This gives customers a broad spectrum of investment solutions as well as the strength of an independent global bank with a strong financial foundation.

Solutions and capabilities offered by the Asset Management division are:

- Equities

- Real estate

- Fixed income

- Index solutions

- Commodities

- Multi-asset class solutions

- Private equity

- Hedge funds

HSBC Bank Australia Review

HSBC is one of the world’s largest banking and financial services organizations. They currently serve more than 45 million customers worldwide, and their network covers 71 countries and territories in Europe, Asia, the Middle East, Africa, North America, and Latin America. They operate around 4,400 offices worldwide and are easily accessible as a bank in Sydney.

The financial giant began operations in Australia in 1965 and was awarded a commercial banking license in 1986. As a Sydney bank, HSBC has a strong presence in the community. They are the official banking partner of the Wallabies rugby team and participate in many community outreach programs, including partnering with the Australian Indigenous Education Foundation, YWCA NSW to deliver a Money Savvy financial literacy program, and Youth off the Street, which helps homeless teenagers in Sydney.

Key Factors That Enabled This Bank to Rank as One of the Best Sydney Banks

Below are key factors that enabled the HSBC Bank Australia to be rated as one of this year’s top banks in Sydney.

Flexi Saver Account

HSBC’s Flexi Saver account is a savings account that rewards customers for being diligent about building their savings. Account holders of this grade A savings account at this top Sydney bank receive bonus interest monthly when they stay on track with their savings.

The Flexi Saver monthly bonus interest can help customers of this best bank in Sydney reach their savings goal faster.

The account comes with a competitive standard variable interest rate of 1.50% p.a., and customers can earn a bonus variable rate of 0.50% p.a.

Image Source: Pexels

Details of how this savings account works are:

- Earn 0.50% p.a. bonus rate by ensuring the balance on the last business day of the month is at least $300 higher than it was on the first business day of the month

- The variable 0.50% p.a. monthly bonus is applied the following month and is calculated from the first business day of that month

- Interest is calculated daily and paid monthly

- If eligibility for the bonus rate is not met one month, the standard interest rate of variable 1.50% p.a. is applied and the customer can try again the next month as the monthly bonus resets each month

Day to Day Account

HSBC’s Day to Day account gives customers of this top bank in Sydney everything they need in an everyday transaction account without the hassles that come with many banks. This account comes with no monthly account fee and is designed to provide the flexibility customers need in today’s fast-paced society.

Features of the Day to Day account offered by this bank in Sydney are:

- No monthly account fee

- No minimum deposit

- Access to over 3,000 ATMs

- HSBC Visa debit card

- 24/7 access with internet and mobile banking

HSBC’s Day to Day account received the 2016 Mozo Experts Choice Award for Best Overall Value in a bank account.

Financial Planning

HSBC is a Sydney bank that wants to help customers achieve their financial goals. To help with this, they offer financial planning services to help customers with everything from saving for a big vacation to planning for retirement.

This top bank in Sydney has financial planners on staff to provide customers with financial advice on a wide range of topics that can affect the way they plan their life today in order to have the future they want tomorrow.

An HSBC financial planner can advise customers of this bank in Sydney in the areas of:

Popular Article: Greater Bank Review and Ranking

Macquarie Review

Macquarie opened their doors as a Sydney bank in 1969 with just three staff members and a hope to provide international advisory and investment banking services to the Australian market. Today, they have achieved that goal as a global business operating across 28 countries.

Macquarie is among the top banks in Sydney and specializes in the areas of resources, agriculture and commodities, energy and infrastructure, and a specialty knowledge of the Asia-Pacific region.

With over $356 billion assets under management, Macquarie is Australia’s largest investment bank and is the top ranked mergers and acquisitions advisor in Australia.

Key Factors That Enabled This Bank to Rank as One of the Best Sydney Banks

Below are key factors that enabled Macquarie to be rated as one of this year’s top banks in Sydney.

Owners Advisory Service

As self-directed investing becomes more popular, more and more consumers are utilizing robo-advisors. For those who are seeking a bank in Sydney that offers a robo-advice service, they don’t need to look any further than Macquarie’s Owners Advisory service.

This top Sydney bank offers a powerful robo-advice service that provides professional-grade financial guidance, expertise, and knowledge to help power up their customers’ investment decision-making.

This award-winning online investment advice program is a FinTech Awards 2016 winner for Innovation in Wealth Management.

Features of this robo-advisor service are:

- Fixed monthly subscription fee of $45/month

- Recommendations as to which specific stocks or funds to buy or sell

- No need to liquidate investments and move them

- Connected with Macquarie Online Trading for convenience

- Up-to-date information and insights from the Macquarie investment team

Home Loans

Macquarie is a bank in Sydney with an array of home loan options to help customers’ dreams of home ownership come true. With competitive fixed rates, customers can enjoy the peace of mind of knowing exactly how much their payment will be each month.

Available home loan options from this best bank in Sydney are:

- Basic Home Loan: a low rate with no application fee

- Offset Home Loan Package: a home loan with a transactional offset account

- Line of Credit Home Loan Package: home loan that allows customers to access the equity in their property

- SMSF Property Loan: property loan solution that allows customers’ SMSF to purchase residential investment property

- Offset Flyer Home Loan Package: complete home loan package to help customers do all of their banking in one place and pay off their home loan faster while earning Qantas Points

- Line of Credit Flyer Home Loan Package: home loan that lets customers access the equity in their home, do all their banking in one place, and earn Qantas Points

- Accommodation Bond Loan: helps retirement aged customers fund the move into aged care

- Reverse Mortgage: allows customer to access the equity in the family home to cover their retirement needs

Business Services

Macquarie offers business services and solutions to aid business owners in every stage of their business’s lifecycle. This Sydney bank offers tailor-made banking solutions to help businesses build, grow, and evolve.

Business services offered are:

- Accounts

- Payments

- Working capital financing

- Future growth financing

- Property financing

- Vehicles, technology, and equipment financing

- Invoice express

- Business intelligence

- Debtor management

Free Wealth & Finance Software - Get Yours Now ►

National Australia Bank (NAB) Review

One of the four largest financial institutions in Australia in terms of market capitalization and customers, National Australia Bank was ranked as the 21st-largest bank in the world in terms of market capitalization in 2014.

The National Australia Bank was founded in 1982 with the merger of National Bank of Australia and the Commercial Banking Company of Sydney. Since then, the Sydney bank has experienced massive growth and now operates 1,590 branches and service centers across Australia, New Zealand, and Asia. The impressive bank in Sydney serves 12.7 million customers with banking and financial services.

Key Factors That Enabled This Bank to Rank as One of the Best Sydney Banks

Below are key factors that enabled the National Australia Bank to be rated as one of this year’s top banks in Sydney.

NAB Classic Banking

NAB offers their NAB Classic Banking account so that their customers can concentrate on saving money and spending better without having to worry about costly account fees.

Benefits of this everyday transaction account offered by this top bank in Sydney are:

- No monthly account fees ever

- NAB mobile app is available to pay people or receive payments

- Balance can be tracked with NAB Quick Balance on mobile or through NAB internet banking

- Comes with an NAB Visa debit card that can be used to take advantage of Visa Entertainment offers

Personal Loans

NAB is the 2016 Australian Lending Awards winner for Best Unsecured Personal Loan Lender, and they know what they are doing when it comes to personal loans. Customers of this best bank in Sydney can utilize a personal loan to get the car they want, consolidate debt, or for something fun such as a new motorbike or boat.

Benefits of a personal loan from this top bank in Sydney, Australia are:

- Available with a fixed or variable rate

- Loan documents can be quickly accepted online

- Same day funds are available when approved in-store by 2 pm

- Redraw available with variable rate loans

- No exit fee if loan is paid off early

Small Business Banking

NAB offers a wide range of services tailor-made especially for small business owners. This large bank in Sydney knows that many small businesses have big ambitions, and they provide the tools to help them get to where they want to go.

On their small business page, NAB offers ample resource material to help small business owners succeed, including information on:

- Starting a business

- Cash flow, planning, and tax

- Choosing business finance

- Expanding locally and globally

- Marketing and online presence

The Sydney bank also offers their NAB Startup program to help business owners who are just getting started with everything from registering an ABN to getting a domain name.

Financial products offered for small businesses are:

Read More: Banks in Melbourne | Ranking | Review of the Best Melbourne Banks

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

St. George Bank Review

A part of Westpac Group, St. George Bank is one of Australia’s leading retail and business banking brands. A true Sydney bank, St. George Bank was founded in the southern Sydney suburbs in 1937. Throughout the years that followed, St. George built a reputation as Australia’s foremost building society before achieving full banking status in 1992.

Headquartered in Sydney, St. George Bank has a large number of branches and ATMs across Australia. At the time of the bank in Sydney, Australia’s acquisition by Westpac Group in 2008, it was the fifth-largest bank operating in Australia.

Key Factors That Enabled This Bank to Rank as One of the Best Sydney Banks

Below are key factors that enabled St. George Bank to be rated as one of this year’s top banks in Sydney.

Incentive Saver

Incentive Saver is a savings account offered by this top bank in Sydney that rewards customers with bonus interest for saving. With the monthly bonus interest, account holders can earn up to 1.75% p.a. on their funds.

While many banks make their customers jump through impossible hoops to earn a bonus, St. George Bank keeps it simple by only requiring that one deposit be made during the month to qualify for the bonus interest.

Benefits of this savings account offered by this best bank in Sydney are:

- Earn bonus interest every month during which at least one deposit is made with no withdrawals

- No account service fees

- No minimum monthly balance requirement

- Earn a competitive rate up to 1.75% p.a.

- 1 free withdrawal every month, but forfeits bonus interest if utilized

- Easy access to funds through internet banking, phone banking, and in-branch

The Incentive Saver account is a great way for customers to stay encouraged to save and earn more on their funds.

Credit Cards

St. George Bank offers several categories of credit cards to suit all of their customers’ credit needs. A credit card from this top bank in Sydney provides a flexible and secure way for customers to make purchases on the go.

Credit card types available from St. George Bank are:

- Low Rate Cards: this Sydney bank’s Vertigo and Vertigo Platinum cards offer a low rate and low annual fee with the added bonus of 0% p.a. for an introductory period

- Rewards Cards: St. George’s Amplify cards give customers the choice of two great rewards programs, Amplify Rewards or Amplify Qantas, along with a low introductory rate or no annual fee for the first year

- No Annual Fee Card: this Visa card is perfect for those customers who don’t want the burden of an annual fee and comes with a low introductory rate offer

Freedom Business Account

The Freedom Business Account is St. George Bank’s most popular everyday business account, and it’s not hard to see why. This account is ideal for those starting a new business. It offers the essentials that businesses need in an everyday transaction account while allowing for the flexibility and freedom that new businesses need as they grow.

This top notch business account offered by this bank in Sydney features:

- Separate personal and business transactions

- Unlimited fee-free electronic transactions

- 20 free over-the-counter deposits or withdrawals monthly

- 20 free cheque deposits or merchant envelopes monthly

- Business Visa debit card can be linked to account

- Access to funds anytime via online, mobile, branch, ATM, and more

Free Wealth Management for AdvisoryHQ Readers

UBS Bank Australia Review

UBS Bank has a history in the banking industry that spans more than 150 years. Today, UBS is considered to be the world’s largest manager of private wealth assets and is a leading provider of retail and commercial banking services in Switzerland, where they are headquartered.

USB is a global financial institution and has main offices in Chicago, Frankfurt, Hartford, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich. USB Bank is a Sydney bank with a solid financial foundation and a global reach.

Key Factors That Enabled This Bank to Rank as One of the Best Sydney Banks

Below are key factors that enabled USB Bank Australia to be rated as one of this year’s top banks in Sydney.

Asset Management for Individuals

While many global banks focus their asset management divisions solely on large businesses and corporations, USB Bank Australia is a bank in Sydney that has an Asset Management division tailored for individuals.

UBS Asset Management pairs investors with investment capabilities and investment styles across all major traditional and alternative asset classes. This Sydney bank’s investment strategy includes combining their financial strength with their reputation for security, stability, and innovation that embraces change.

Asset management services include:

- Australian large cap equity funds

- Australian small cap equity funds

- Fixed income and cash funds

- International equity funds

- Exchange traded funds

- Global real estate

- Multi-asset funds

- Property funds

- Significant investor visa

Investment Banking

UBS Bank Australia’s investment banking program has won such awards as Best Investment Bank in Australia, Leading Corporate Advisor in Australia M&A transactions, and Best Australian Equity House by many highly regarded industry magazines including FinanceAsia, AsiaMoney, CFO Magazine, and IFR Asia Magazine.

The bank in Sydney’s investment banking services is organized around two client groups: corporate client solutions and investor client services.

Their Corporate Client Solutions includes all advisory and solutions businesses, origination, structuring and execution, and financing solutions that involve corporate, financial institutions, and sponsor clients.

Their Investor Client Services include execution, distribution, and trading for institutional investors. Services offered to investor clients at this top bank in Sydney include equities, fixed income, and bond indices.

Investment Capabilities and Services

As a primarily investment bank, UBS Bank Australia has a wide range of investment capabilities and offers a comprehensive list of investment services to both individuals and corporations.

Investment services offered by this Sydney bank are:

- Equities

- Fixed income

- Structured Beta and indexing

- Multi-asset

- O’Connor

- A&Q Hedge fund solutions

- Global real estate

- Infrastructure and private equity

Free Money Management Software

Westpac Review

Westpac operates as a part of the Westpac Group’s consumer bank division. This Sydney bank has a long and proud history as Australia’s first and oldest bank. Established in 1817 as the Bank of New South Wales, the bank in Sydney changed its name to Westpac in 1982.

Westpac is one of Australia’s top four banks, and it is Australia’s second largest bank by assets.

Westpac currently serves more than 13 million customers and is Australia’s largest branch network with 1,429 branches across Australia.

Key Factors That Enabled This Bank to Rank as One of the Best Sydney Banks

Below are key factors that enabled Westpac to be rated as one of this year’s top banks in Sydney.

Westpac Choice Account

The Westpac Choice account is this Sydney bank’s most popular bank account. This everyday account provides everything customers need to manage their everyday banking needs while providing multiple ways to access their funds.

This flexible everyday account features:

- No monthly account fee if at least $2,000 is deposited monthly

- Westpac debit MasterCard

- Westpac online and mobile banking provide constant access to funds, even when overseas

Reward Saver Account

A Reward Saver account from this best bank in Sydney makes it easy for customers to be rewarded for saving. Account holders are rewarded with bonus interest each month they make a deposit of $50 or more and have no withdrawals.

This top Sydney bank makes it easy to put money away for a rainy day and earn more while doing it.

Benefits of this savings account are:

- Bonus interest earned by making no withdrawals and depositing at least $50 a month

- No monthly service fee

- No minimum balance to open account

- Savings can be monitored via PC, mobile, tablet, or telephone

- Safe online banking

This rewarding savings account is also available as a separate account for kids under the age of 12 and those aged 12 – 21.

Term Deposits

At Westpac, customers can open a new term deposit that earns an impressive 2.50% p.a. for 12 months. Customers of this bank in Sydney can apply for this special deposit rate term certificate online in just 5 to 10 minutes.

Term options for this special rate range from 12 to 36 months with interest paid at maturity or annually.

Features of a term deposit from this top bank in Sydney, Australia, are:

- Can be opened with $5,000 or more

- No set-up, monthly service, or management fees

- Choose fixed terms from 1 month to 5 years

- Term deposit can be managed online

- Interest payable at maturity, annually, or monthly depending on term

- Flexible payment options at maturity

- Range of options to reinvest all or part of the term deposit at maturity

- Principal is protected up to $250,000 under the Australian Government Deposit Guarantee

Related: Top Australia Banks | Ranking | Biggest Australia Banks & Best Banks in Australia

Conclusion – Top 10 Banks in Sydney

While there is certainly no shortage of banks in Sydney to choose from, this article should give you a good starting point on your search for the best bank in Sydney for you. All of the Sydney banks on this list have decades of experience in the Sydney financial services market and are built upon solid financial foundations.

Many of the banks on our list of the best Sydney banks have a global reach, allowing for more opportunity for growth for those who wish to utilize their investment services. There is also a wide range of traditional banking products offered by most of these top banks in Sydney, including everyday transaction accounts, savings accounts, and term deposits.

While services and products offered may vary, each bank in Sydney, Australia, on our list has earned a stellar reputation for the services that they offer – with many of them being award winning. In addition, almost every Sydney bank on our list offers foreign currency accounts or programs for those who wish to keep money reserved in another currency or frequently send money overseas.

When choosing a top bank in Sydney, it is important to compare products and services to ensure that you are getting the best deal for you. Factors to consider when researching a bank in Sydney is whether they offer any specialty accounts you may need such as business accounts or specialized savings accounts, what their fees and monthly requirements are, and if their interest rates on loans and savings products are competitive when compared with the other best banks in Sydney.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.