Intro: First Internet Bank Reviews

In today’s fast-paced world, Internet banking makes managing your money significantly easier: you don’t have to worry about making it to a branch during business hours, and you get flexible options for earning interest or investing your dollars.

First Internet Bank is an Internet banking service that promises the conveniences of traditional banking with the added benefit of being able to access your funds anywhere, anytime.

Is opening an account with First Internet Bank right for you? We’re going to take a look at several First Internet Bank reviews to find out what others are saying about this new Internet banking experience.

Image Source: BigStock

Overview

Before we get started looking at the details of the services that First Internet Bank can offer, let’s take a look at its history. This company is still relatively new in comparison to the major players of traditional banking, having been founded in 1999. However, with less than twenty years’ experience, it has already accumulated quite a few awards:

- Best Bank to Work for by American Banker

- Top Workplace by Indianapolis Star

- Best Online Bank by GOBanking Rates

- Top Online Originator by Mortgage Technology

- #1 Online Bank by Gomez

Without the overhead costs of maintaining physical locations, its Internet banking service promises to offer competitive rates, as well as a variety of different account options for personal and business banking, and it offers loans throughout the United States.

First Internet Bank can help you to take out a new mortgage, refinance your existing home or purchase a new vehicle with a car loan. Plan for the future with its IRA accounts and CDs and manage your current needs with basic checking and savings accounts.

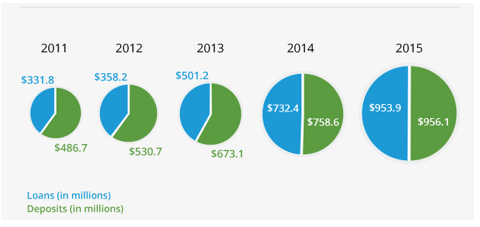

Image Source: FIB

As of just last year, the amount of money that First Internet Bank issued in loans was equal to the amount of money it received in customer deposits. Based on the history of customer deposits and loans, the six states that garner the most business for it are Indiana (its home state), California, Texas, Florida, New York, and Illinois.

First Internet Bank reviews are quick to point out that, even though it may not have locations on every corner, it is FDIC insured to protect your money. It was given four stars in its First Internet Bank review from Bauer Financial, a bank rating firm. Such a high rating demonstrates that it is profitable, good at managing loans, and keeps more than 1.5 times the amount of capital available that regulators would require.

The representatives at First Internet Bank are readily available to offer support when needed. It has banking specialists available through chat and phone Monday – Friday 7:00 AM – 9:00 PM EST and Saturday 9:00 AM – 3:00 PM EST. Customers can view the banks support page as well, to see commonly asked questions and answers, to possibly avoid having to make the call to customer service. If you are unable to find an answer to your question/concern, a First Internet Bank representative will be glad to take your call.

See Also: Top Banks in Georgia | Ranking | Top banks in Atlanta, Savannah, Augusta, and Across Georgia

First Internet Bank Savings Accounts

First Internet Bank offers several different types of savings accounts to help you manage your money and even collect interest on it. According to First Internet Bank reviews on Huffington Post, its interest rates (0.6 percent APY) are almost 7.5 times higher than the yield on an average traditional savings account at a physical bank. Let’s take a look at the different options available:

- Free Savings Account: Open an account with no monthly maintenance fee for as little as $25. This type of account is a good option but, understandably, doesn’t earn as much interest as the other savings account types.

- Regular Savings Account: Deposit $100 to open a regular savings account, where you’ll earn 0.6 percent APY on your money. The monthly fee is just $2, or you can maintain a $1,000 balance.

- Money Market Savings Account: A money market savings account will net you the highest interest rate (0.8 percent APY), with just a $5 monthly maintenance fee that can be waived if you can maintain a $4,000 balance. This is a great option for keeping your money readily available while still taking advantage of higher interest-bearing accounts.

All of the savings accounts give you access to free online and mobile banking, real-time fund transfers between accounts, free paperless account statements, and a debit card for accessing your money when you need to. With the regular savings account and money market savings account, you are also granted a $10 ATM surcharge rebate each month, just in case you do need access to your money quickly with your debit card.

A First Internet Bank review from Top Ten Reviews compared interest rates from First Internet Bank against other Internet banking companies and found that the interest rates are slightly lower than the average. However, its maintenance fees are relatively low and easy to waive.

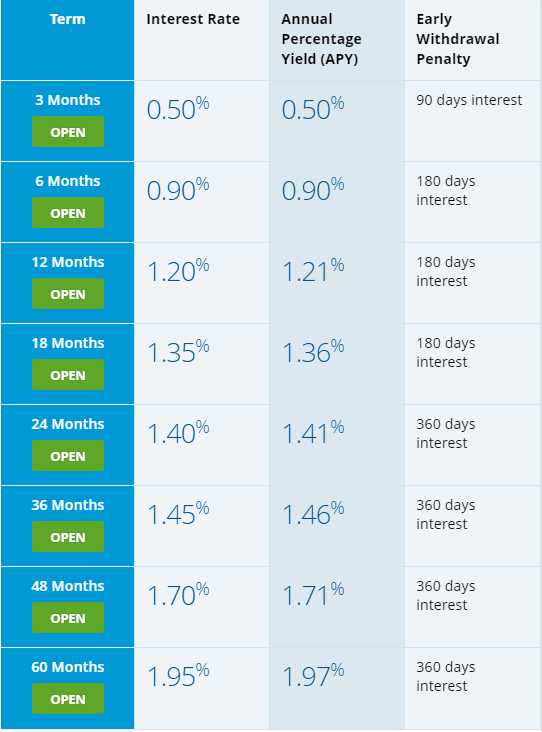

Image Source: FIB

The real draw of its savings program, according to First Internet Bank reviews, is the certificates of deposit (CDs). These can earn “competitive interest rates” and come with a variety of short and long-term investment options, depending on how accessible you prefer your funds to be. You can select from CDs with terms as low as three months all the way up to five years, with interest rates ranging from 0.5 percent for short-term CDs all the way to 1.95 percent for the longest term.

Don’t Miss: Best Banks in Florida (Ranking & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

First Internet Bank Checking Accounts

Choosing a checking account can be tricky. First Internet Bank gives you choices while offering some of the same basic features across the board. Any checking account gives you a debit card, access to free online and mobile banking as well as optional overdraft protection and free paperless statements. First Internet Bank offers two different types of basic checking accounts depending on your needs and preferences:

- Interest Checking: You can earn a 0.5% APY by opening one of its interest checking accounts. In order to receive this benefit, there is a $10 monthly fee or a required $500 balance, though you only need to deposit $100 in order to open the account.

- Free Checking: You can open an account with as little as $25 but your account will bear no interest. This is a good, basic option if you don’t plan on maintaining the $500 balance for the interest checking.

Online bank reviews from Wallet Hub give the checking account options at First Internet Bank an overall rating of 4.7 stars out of 5 across categories for customer service, clear disclosures, application process, and problem resolution.

First Internet Bank Review on Mortgages

Managing your mortgage can be a real hassle, so the appeal of applying for a new mortgage online and walking through the process from the comfort of your own home is understandable. Online bank reviews from Mortgage Technology awarded First Internet Bank with its Top Online Originator award in 2013. You can select from any number of mortgage loan programs, including:

- Fixed-rate and adjustable-rate mortgages

- FHA and VA loans

- USDA rural development loans

- HARP refinance programs

- Jumbo loans

If you aren’t certain which type of mortgage is right for your needs, First Internet Bank has loan specialists that can help you work through the details of what your family needs and what your potential new home requires.

First Internet Bank reviews seem to rave over the ease of the process. A First Internet Bank review from Mortgage Insider found the application process to be easy and user-friendly, with a standard application, the option of chatting with a live loan consultant, and the live rate watch. Bankrate, a leading site in allowing consumers to rate services that they receive, gave it an overall 4.6 stars out of 5 in its First Internet Bank review. The bank was rated on professionalism, knowledge, responsiveness, and level of service.

Zillow has over 400 reviews from users that have gone through First Internet Bank for their mortgage and refinancing needs. Overall, it was given a 4.6 star rating, which is very high considering the number of reviews factored into this.

Related: Amegy Bank (Zions Bancorp) (Ranking & Review)

First Internet Bank Reviews Concerns

Very few complaints have been lodged against the institution with the Better Business Bureau. In the last three years, only 8 complaints have been filed, and four of them were closed within the last calendar year. The bank maintains an A+ rating for the responses and few criticisms it has received.

If you’re satisfied with First Internet Bank for your personal banking needs, you might also want to consider its business banking options. It has very similar offerings in the way of checking and savings accounts for your company needs as well as the same high-interest CDs for investing your extra cash flow. Additionally, it can provide treasury management services and commercial deposit services.

Conclusion – First Internet Bank Review – Should You Use Them?

It’s understandable to be a little skeptical at first about an online bank that doesn’t have any physical locations where you can deal face to face with a representative. However, by examining online bank reviews, you can take some of the worry away from making your financial decisions.

First Internet Bank offers several ways to save your money with ease, from basic savings accounts to its high-interest certificates of deposit. You can opt for basic checking with easy, on-the-go mobile banking as well as jump right into the world of Internet banking by applying for a mortgage from your living room.

Overall, First Internet Bank reviews indicate that it is a trustworthy institution that offers basic services to meet your banking needs as well as a few more advanced options. Reach out to a specialist through its email messenger or customer service line to ask any questions you may still have before making First Internet Bank your go-to institution for Internet banking.

Popular Article: Ameris Bank Review | Ranking | What You Should Know Before Using Ameris

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.