Overview: FreeTaxUSA

While no one likes paying income taxes, paying someone to tell you how much you owe is even worse. FreeTaxUSA can’t keep you from owing taxes, but the name implies that it can keep you from paying a middleman. FreeTaxUSA customer reviews indicate that the average person can file a federal return with FreeTaxUSA and pay no fees.

Image Source: Pixabay

FreeTaxUSA Reviews: Free Tax Preparation

The IRS Free File program offers free tax preparation software by many of the major tax preparation firms. If you access that software from the IRS website and have an income under $62,000, you can choose from a variety of software to prepare your return at no cost.

FreeTaxUSA offers free federal tax preparation to all users and charges only $12.95 for state returns, but users who earn over $62,000 per year will need to access the software from FreeTaxUSA’s website.

Like other tax preparation software, FreeTaxUSA reviews the answers users give to interview questions and uses those answers to generate tax returns.

FreeTaxUSA Reviews: Preparing Your Taxes with FreeTaxUSA

When considering FreeTaxUSA reviews, potential buyers may want to know what is involved in preparing taxes with FreeTaxUSA. To prepare taxes with FreeTaxUSA, users first need to gather their tax documents, including W-2s, 1099s, K-9s, and any other documents showing income earned for the tax year. They also need documentation of deductions, including receipts from charities, mortgage interest statements, and documentation of medical expenses.

Users do not need to know ahead of time exactly what documents will be needed as the software will ask for them; however, having the basic documents handy will make the tax preparation chore go more smoothly. Users will then:

- Create an account

- Respond to interview questions

- Review lists of types of income and deductions to select the ones applicable to them

- Review the prepared return

- E-file it or print and mail it.

See Also: Can Capital Reviews – Get All the Facts Before Using Can Capital

FreeTaxUSA Reviews: The FreeTaxUSA Interface

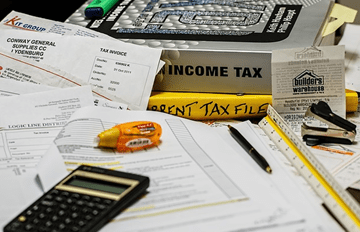

FreeTaxUSA’s interface shows tabs across the top for Personal, Income, Deductions/Credits, Misc., Summary, State and Filing. Each tab has a number of pages under it. For example, the first page of the Personal tab asks for name, address, Social Security Number, and date of birth. Some FreeTaxUSA.com reviews indicate that users find competitors’ interfaces to be more sophisticated, but some prefer the simplicity used by FreeTaxUSA.

Image Source: FreeTaxUSA

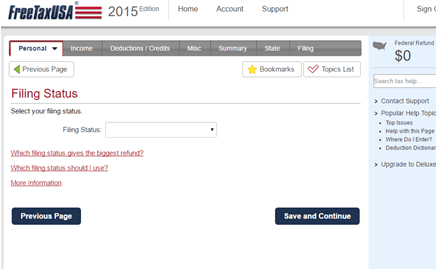

Regarding income, FreeTaxUSA includes a long list of types of income; users select the ones that apply to them, and the proper questions are asked. The same is true of deductions. Once users are finished entering deductions, FreeTaxUSA reviews the data and a deductions summary is prepared that compares the user’s deductions with the standard deduction and asks which the user prefers to use.

Image Source: FreeTaxUSA

After the deductions, credits are addressed. The more common ones — childcare, post-secondary tuition and energy-efficient improvements — are covered individually; then a list of other available credits is given from which the taxpayer can choose as applicable.

The Misc. tab is next and includes more forms. While some other software works via “if-then” questions and answers, FreeTaxUSA requires users to select the things they need from lists.

Once the taxpayer deems the return complete, FreeTaxUSA offers the use of the “Refund Maximizer” in which FreeTaxUSA uses information on the return to ask additional questions to find anything the taxpayer missed. A return for a single adult, age 55, who had a salary but no investment income could ask about claiming a live-in partner as a dependent or deductions for IRAs or moving for a job that might otherwise be missed.

For our review, we created a sample simple return for a single adult, age 55, with a salary and no investment income in less than fifteen minutes. Adding a few 1099s would not have added significant time to the process. As with any other method of tax preparation, the more complex the person’s finances, the longer it takes to complete the return.

Don’t Miss: CuraDebt Customer Reviews – Get all the Facts before Starting with CuraDebt

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

FreeTaxUSA Reviews: What Forms Does FreeTaxUSA Support?

When reading FreeTaxUSA.com reviews questions that comes to mind are:

- Are the forms needed by the taxpayer supported by FreeTaxUSA?

- Does FreeTaxUSA remain free when the forms a taxpayer needs are used?

Image Source: Pixabay

Many types of “free” tax preparation software are not free once forms beyond the very basic are used, and the software does not disclose that until after significant time has been spent entering data and responding to interview questions. FreeTaxUSA supports most IRS forms; the few it does not are not forms used by those who would likely be preparing their own taxes. Further, FreeTaxUSA never charges for preparing or filing a federal return, which is something that gets positive mention in more than one FreeTaxUSA review.

FreeTaxUSA Reviews: What Forms Does FreeTaxUSA NOT Support?

Forms that are NOT supported by FreeTaxUSA are listed below:

- Foreign employment income (Form 2555)

- Nonresident alien returns (Form 1040NR)

- At-risk limitations (Form 6198)

- Installment sales (Form 6252)

- Tax for children with more than $2,100 in investment income (Form 8615)

- Prior year minimum tax credit (Form 8801)

- Archer MSAs (Form 8853)

FreeTaxUSA customer reviews do not indicate that the lack of these forms is a problem.

Related: OptionsHouse Review – Fees, App, Commission, Services, Speed, Trading

FreeTaxUSA Reviews: How Does FreeTaxUSA Make Money?

If something seems too good to be true, it probably is. In order to stay in business and continue to provide useful products and services, companies have to make money. A FreeTaxUSA review would be remiss if it did not look at how FreeTaxUSA makes money. Unlike many “free” tax preparation software companies, FreeTaxUSA does not start users with a free form, and then, when the data is all entered, tell them they have to purchase additional forms in order to complete the return.

FreeTaxUSA charges $12.95 for a state return. They offer a Deluxe Edition for $6.99 that gives users priority support and assistance if an audit happens, as well as free amended returns. If something happened and a user missed filing a return sometime between 2010 and 2014, FreeTaxUSA will charge $14.99 to file a state return for those years, but the federal return remains free. For those who do not purchase the Deluxe Edition, amended returns are $14.99 and priority customer support is $5.99.

While not many FreeTaxUSA reviews mention these add-on fees, they are below average in the industry, and having the ability to complete past-year returns is a real plus.

What Do Customers Like About FreeTaxUSA?

Reading a FreeTaxUSA.com review, or a series of FreeTaxUSA reviews, gives the reader an idea of the strengths and weaknesses of the product. FreeTaxUSA.com reviews are available on their website.

The main strength of FreeTaxUSA.com is its price. Filing a federal and state return using the Deluxe edition of FreeTaxUSA.com will cost a taxpayer $19.94. Other than for taxpayers filing very simple returns, the major competitors will cost more. Further, FreeTaxUSA.com states its price up-front; some of the competitors add charges for forms that the software determines the taxpayer needs, and the final cost is not visible until the return is complete. FreeTaxUSA.com reviews show that customers hate that type of bait-and-switch and appreciate that FreeTaxUSA.com does not engage in it.

Users find the FreeTaxUSA interface to be clean and easy to use. For repeat users, last year’s data is available for this year’s return. Also, those who used other software and have a PDF of their return can import those as well, though FreeTaxUSA cautions that the feature is new and still in beta.

FreeTaxUSA generates immediate alerts if the data entered appears to be incorrect or incomplete. Other software may not do this until the entire return is finished.

What Problems Do Customers Report with FreeTaxUSA?

As with any other product, FreeTaxUSA customer reviews, taken as a group, will point out the weaknesses in the product.

While other software products offer the ability to import much of the data needed (in fact, some W-9s even promote one of FreeTaxUSA’s competitors, saying on the W-9 that the data can be imported), those who use FreeTaxUSA will have to type the data from their forms into the program. While those with one job, few investments, and only one mortgage may not find this to be a problem, at least one FreeTaxUSA.com review indicated that those with a large number of such forms, particularly if they are not used to data entry, may find this to be a tedious, error-prone process.

FreeTaxUSA does not offer live support unless you purchase the Deluxe Edition. Even so, the live support is via computer chat, not via phone. According to some FreeTaxUSA customer reviews, people who are not comfortable searching help files, waiting for an email response or using a computer chat function may find this to be a deal-breaker.

In some FreeTaxUSA reviews, consumers complain about difficulty accessing their account if they forget their username and password. FreeTaxUSA considers this to be a strength, not a weakness; unfortunately, in order for a site that contains personal, financial, and often banking information to be secure, it has to be difficult to access.

Popular Article: CreditRepair.com Reviews and Overview (Before You Sign-up)

Is FreeTaxUSA.com for Me?

FreeTaxUSA customer reviews show that those who are happiest with FreeTaxUSA are customers who either have relatively simple returns with few forms or those who are savvy enough about taxes to not need telephone support.

According to FreeTaxUSA.com reviews, users who have a lot of forms to enter may wish to consider whether the higher prices charged by companies with import features are worth the time savings. Customers who are not comfortable with computer chat or who otherwise want telephone support will need another product.

Some customers will appreciate FreeTaxUSA’s lists of types of income and types of deductions to other products’ long lists of questions all requiring answers (even when the answers are all “no”). FreeTaxUSA reviews paint a picture of a product that does a good job for a low price (free federal returns, $12.95 state returns) for most people.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.