Overview: FreeTaxUSA vs TurboTax – Review & Comparison (Alternatives & Reviews)

Of the 150 million U.S. tax returns submitted in a given year, the government reports that more than 90% are e-filed. In this article, we will review, compare, and contrast an up-and-coming tax preparation software program against an industry giant: FreeTaxUSA vs TurboTax.

In measuring the capabilities and features of FreeTaxUSA vs TurboTax, AdvisoryHQ will look at the below five key areas:

- Trustworthiness

- Pricing

- Features

- Ease of Use/Support

- Conveniences

Review of TurboTax

Let’s start the TurboTax vs FreeTaxUSA comparisons at square one: trust. Who is TurboTax?

TurboTax Trustworthiness

Legend has it TurboTax was developed in the mid-1980s by Chipsoft before Intuit acquired Chipsoft in 1993. Even if you are not familiar with Intuit, chances are, you know of or use at least one of the company’s flagship products:

- TurboTax, a moderately-priced suite of tax preparation products

- QuickBooks small business accounting software

- Mint, a web-based personal finance management app

Image Source: Pixabay

Image Source: Pixabay

Reviews.com listed 2016 TurboTax as one of the best online tax preparation software solutions on the market. TurboTax outperformed TaxSlayer, TaxAct, Jackson Hewitt and H&R Block in an early 2016 review by PCMag.com. ConsumerReports.org’s review of TurboTax Deluxe and H&R Block Deluxe – the two leading tax preparation products on the market – revealed advantages and challenges with both pieces of software.

See Also: Gift Card Granny Review – What You Might Want to Know! (Reviews & Complaints)

TurboTax Pricing

Pricing strategies for the two companies involved in the FreeTaxUSA vs TurboTax competition present two very different ideologies – simple and affordable vs competitive and elastic.

TurboTax ranges in price from its well-publicized Absolutely Zero-cost basic online edition (check out TurboTax’s SuperBowl commercial with Sir Anthony Hopkins) to $109.99 for software downloads or CD versions of its Home & Business Edition. For taxpayers filing Forms 1040 EZ or 1040 A, the basic version will usually suffice. For those with more complex tax preparation needs, Deluxe, Premier or Home & Business editions range in price from $54.99 to $109.99 with TurboTax state filing fees ranging from $29.99 to $44.99.

Pricing has been a significant point of contention for TurboTax customers in recent years with many TurboTax customers looking for comparable TurboTax alternatives. By far, TurboTax has some of the most expensive tax preparation software available to DIYers.

This is one area where TurboTax competitors can quickly and permanently get the advantage, especially when comparing TurboTax vs FreeTaxUSA.

In 2014, Intuit quietly downgraded TurboTax Deluxe without proactively notifying consumers, removing the Schedules C, D, and E, which would have allowed self-employed taxpayers, small business owners, and investors to continue using TurboTax Deluxe to file their taxes.

The change forced the self-employed and small business owners to upgrade to the Home & Business Edition, at nearly double the price of TurboTax Deluxe, while investors were forced to upgrade to TurboTax Premier.

Also, depending on what time of the year you happen to file your taxes, prices may change.

When PCMag.com ran its review of TurboTax Deluxe 2016 during the first few weeks of 2016, the price point was $34.99. Later in the year, submitting a federal tax filing using TurboTax Deluxe became $54.99 for the online version and $69.99 for the downloadable/physical software.

TurboTax Features

In our TurboTax vs FreeTaxUSA comparison, and with virtually any of the TurboTax competitors, the one clear advantage TurboTax has is its feature-rich product line.

TurboTax offers a plethora of learning resources, access to certified tax professionals, and technical features and conveniences packed into their software, website, and mobile app.

A few of the better features include:

- Automatically import data from your W-2 or 1099 by snapping a picture of the form and uploading it to TurboTax

- Import tax data from compatible mobile apps

- Your choice of web-based or downloadable software to allow you to skip the lines when buying physical software packages

- The ExplainWhy™ feature provides users with on-the-spot explanations to help them understand specific data affecting their tax return

TurboTax Ease of Use/Support

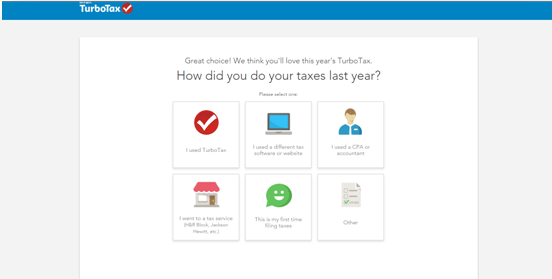

Another area where TurboTax wins in FreeTaxUSA vs TurboTax is ease of use. Where FreeTaxUSA’s design is mostly text, TurboTax’s streamlined, visual design uses a combination of text and graphics to make using the software easier, more intuitive, and more visually appealing.

Even the simplest questions get their own set of descriptive iconography. TurboTax comes out ahead here in our TurboTax vs FreeTaxUSA comparison.

Image Source: TurboTax

Availability of support is another key issue for tax filers. TurboTax support is accessible in several different ways:

- You can use the provided 1-800 number to get answers to technical/software-related questions. This feature is included with every edition of TurboTax.

- Use the SmartLook™ web form to get expert answers from certified tax professionals.

- Access an FAQ section directly from their TurboTax dashboard under Help.

For those in need of immediate tax advice, the Home & Business Edition comes with direct access to certified tax professionals who are available to answer your questions.

Another advantage TurboTax has in the FreeTaxUSA vs TurboTax match-up that gives this product the advantage over other TurboTax competitors is its lively online community. Answer Xchange is TurboTax’s online community/forum that users can access to get quick answers to their questions.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

TurboTax Conveniences

In addition to an active online community and ample product features, TurboTax offers several other conveniences to help time-pressed tax filers choose TurboTax vs FreeTaxUSA.

- TaxCaster ™: This free mobile app for iOS and Android uses the TurboTax calculator to help tax payers estimate their refund by entering some basic information.

- MyTaxRefund™: This free mobile app for iOS and Android tracks when you can expect your refund. Even if you efiled using another tax preparation service, MyTaxRefund™ can track it.

- TurboTax ItsDeductible™: This free mobile app for iOS helps you keep track of your charitable donations for the year. No more guessing donation values or trying to remember what and when you gave.

- Information Rollover: If you used TurboTax to do your taxes last tax season, TurboTax will autofill much of the data entry, giving you an opportunity to enter new information only for what’s changed. No tedious re-entering.

Related: Tips Before You Choose a Web Host

Review of FreeTaxUSA

In a full-fledged face-off of TurboTax vs FreeTaxUSA, which product deserves your trust? Billion-dollar branding aside, for all its fanfare and Forbes.com coverage, does TurboTax really surpass FreeTaxUSA in the key areas we’ve identified? Can you trust FreeTaxUSA with your sensitive tax information? Just who is FreeTaxUSA?

FreeTaxUSA Trustworthiness

While not as flashy as TurboTax, FreeTaxUSA is a nationally-recognized software company that has processed more than 14 million tax returns for U.S. tax payers, according to their homepage. TaxHawk, Inc., FreeTaxUSA’s owner, has a superb A+ Better Business Bureau rating. The company’s rating is not spotless, but TaxHawk, Inc. has a proven track record of addressing and resolving customer complaints.

In the David and Goliath battle of FreeTaxUSA vs TurboTax, perhaps the primary question anyone would have about submitting their social security numbers and financial information to an unknown website is security. FreeTaxUSA makes it clear that after millions of successful filings on the site, security is of the utmost importance.

Filers’ information is encrypted with Secure Sockets Layer (SSL), the industry standard for encryption technology. As well, FreeTaxUSA says the website exceeds the IRS encryption standards and that there is 24-hour monitoring of its physical servers.

FreeTaxUSA Pricing

On product pricing alone, FreeTaxUSA emerges as the clear winner in the FreeTaxUSA vs TurboTax battle. FreeTaxUSA has just two price points for federal tax filing: The Basic edition is free while Deluxe is just $6.99.

With Deluxe, you receive priority customer support with Live Chat, Audit Assist, and amended tax returns at no additional charge.

You can start using Deluxe for free and you only have to pay when you are ready to file your taxes. FreeTaxUSA claims:

Anyone filing a simple 1040 return would probably fare well using the free edition, which is the site’s more popular option. For an additional $12.95, tax payers can file a single state tax return. So, if you happen to have worked in multiple states during the previous tax year, the cost would be $12.95 per state in which you are required to file, which is significantly less than the TurboTax state filing fee, in any of its editions, free or paid.

FreeTaxUSA Features

FreeTaxUSA.com takes a no-frills approach to providing tax preparation service. The Basic Edition is 100% free and provides users with everything needed to complete and file their tax returns.

One of the benefits that may put FreeTaxUSA ahead in the FreeTaxUSA vs TurboTax rivalry is that FreeTaxUSA’s Free Edition gives users access to more than just the basic Form 1040.

With TurboTax, users who happen to own a home must upgrade from the Free Edition to the Deluxe Edition to complete their tax return. If they own a business, only the higher-priced Premier Edition offers access to the Schedule C tax payers would need to report small business income. Not so with FreeTaxUSA.

Intuit’s pricing strategy for TurboTax is one of the primary drivers for would-be TurboTax users to find TurboTax alternatives. It also provides an easy “in” for TurboTax competitors large and small to woo users away from the industry giant.

FreeTaxUSA keeps to its 100% FREE promise regardless of the tax payer’s personal or professional situation. So whether you own a home, own a business, generate investment income, or make HSA contributions, the price to complete and file your federal tax return is still zero dollars and zero cents.

The four upgrade features in the Deluxe version of FreeTaxUSA include amended tax returns, priority customer support, Live Chat, and Audit Assist.

- Amended Tax Returns: Should you complete and submit your tax but discover later on that you need to change it, as a Deluxe user you do not have to pay the $14.99 fee to file an amended return.

- Priority Customer Support: FreeTaxUSA offers the most basic customer support. Nevertheless, as a Deluxe user, you can skip to the top of the call-back list to get your emailed questions answered faster.

- Live Chat: As a Deluxe user, you can access FreeTaxUSA’s Live Chat feature, where you can message a credentialed professional who will do their best to answer your questions on the spot instead of waiting for someone to get back to your email.

- Audit Assist: In the event of an IRS audit, an Audit Assist specialist will help you understand and navigate the audit process, which includes writing a response to the IRS if you receive an audit notice and helping you understand your options throughout the process and with the outcome.

Popular Article: ownCloud Review – What is ownCloud & What You Should Know (Alternatives & Review)

FreeTaxUSA Ease of Use/Support

It’s often the case that smaller companies trump larger companies in at least one area – client services. In the case of TurboTax vs FreeTaxUSA, is this the case?

FreeTaxUSA has a straightforward, text-heavy user interface. The questions asked are clear and there is no accounting jargon to make you scratch your head. You can breeze through the questions, type or select your answer, and move seamlessly through the process of completing your tax returns – however simple, however complex – without the added worry of trying to understand tax codes.

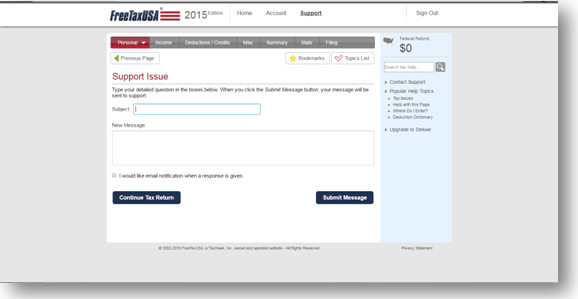

Image Source: FreeTaxUSA

The primary drawback is the availability of support. Typically, DIY tax filers spend hours or even days gathering the needed information to make tax filing a fluid process (logistically speaking, we can’t account for your frustration over your own record-keeping). With FreeTaxUSA, users have to submit an inquiry form and possibly wait an entire business day before getting an answer.

That said, being able to get faster support could be reason enough to forego the free version and pay the $6.99 for better support through Live Chat.

FreeTaxUSA Conveniences

FreeTaxUSA offers several really cool features which help it to hold its own against larger, more well-known brands like TurboTax and TurboTax competitors such as H&R Block and TaxAct.

- Information Rollover: Like TurboTax, FreeTaxUSA offers information rollover to reduce the amount of data entry you have to do the next time you sit down to file your taxes.

- Filing for Previous Years:

FreeTaxUSA gives you access to three years of tax forms at a time. You can access blank forms for 2013, 2014 and 2015 and file them all online for FREE using FreeTaxUSA’s tax preparation website. - Prior Year’s Returns: If you did file your taxes and need access to previous returns, access them through your Account menu.

Read More: Deloitte Reviews – What Is Deloitte? (Services & Deloitte Consulting Review)

Final Words

FreeTaxUSA offers a straightforward, 100% free, secure website for preparing and submitting taxes. The product outperforms TurboTax in price stability and transparency, offering all filers the chance to file their federal taxes for free and pay a small fee of $12.95 to file state taxes.

TurboTax, on the other hand, has taken a public beating on the review sites for lacking transparency in pricing and product offerings. Plus, the TurboTax state filing fee is more than double the cost of filing them with FreeTaxUSA — vs TurboTax, which specializes in adding the conveniences that save its users time for an additional financial investment.

In the end, consumers will take price, features, and support into consideration and align each product’s offering with their own needs. There isn’t a clear winner or loser in the TurboTax vs FreeTaxUSA battle.

Ultimately, it’s up to you which you need to keep more of — your time or your money. This decision will determine which product comes out on top in the FreeTaxUSA vs TurboTax match-up.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.