2017 Guide: The Best Mortgage Loan Calculators | Google vs. Trulia vs. Bank of America

Before selecting a mortgage, using a mortgage loan calculator is one of the smartest steps you can take.

This is especially true if you are somebody that finds it difficult visualizing what your loan agreement will look like as a monthly payment. Under these circumstances, a free mortgage calculator is very useful and beneficial.

Choosing to calculate mortgage payments before even signing up for the mortgage is a smart and proactive choice.

A mortgage loan calculator can help calculate mortgage payments in a comprehensive way that takes into consideration several variables such as interest rates, taxes, and amortization period.

Image source: Pixabay

Whether you choose a Google mortgage calculator, Bank of America mortgage calculator, or Trulia mortgage calculator, you can make adjustments that allow it to be a mortgage calculator with taxes or a mortgage amortization calculator.

This article will go over what you need to know about using a mortgage loan calculator. There are several variables that future mortgage-holders should take into consideration when using a free mortgage calculator, or any loan mortgage calculator for that matter.

When calculating your mortgage, you should understand what exactly it is you are paying for, which is why this article will look at factors such as the amortization period and the effect of taxes on your mortgage.

As a result, readers can move on to use a mortgage amortization calculator or mortgage calculator with taxes in a knowledgeable way.

Additionally, this article will compare the usefulness of different mortgage loan calculators including the Google mortgage calculator, Bank of America mortgage calculator, and the Trulia mortgage calculator.

See Also: Cost to Build a Home—What You Might Be Missing! (Typical Closing Costs, Estimated & Average)

Understanding the Usefulness of a Mortgage Loan Calculator—What Different Variables Are Factored When You Calculate Mortgage Payments?

There are a number of different variables that you have to take into consideration when deciding on a mortgage. It is not as simple as the amount of money you borrow for the house plus the interest rate. You may already be familiar with things like down payment, fixed term vs. variable term mortgage, or interest rate, so here are a few terms you should be familiar with before using a mortgage loan calculator.

Amortization Period: The amount of time it takes to pay off the loan using the fixed monthly payments you have agreed to with your lender.

Annual Percentage Rate (APR): This is the annual percentage rate that a bank or lender charges you for the loan. This is different from the interest rate because it also reflects other charges that are incorporated into the loan such as points or broker’s fees. Lenders are required to divulge the APR in addition to the monthly rate they may advertise.

A simple way to think of this when you calculate mortgage payments is to consider the interest rate as related to the monthly payments and the APR as related to the total cost of the loan.

Private Mortgage Insurance (PMI): Private mortgage insurance may be required by some lenders in order to mitigate the risk of lending to those considered risky borrowers. Borrowers with a down payment of less than 20 percent may be required to pay private mortgage insurance. You can calculate mortgage payments incorporating your PMI.

Don’t Miss: Getting an Interest-Only Mortgage This Year? What You Need to Know

Loan Mortgage Calculator Comparison: A Breakdown of the Google Mortgage Calculator

Google offers its calculators, including its Google mortgage calculator, in a unique fashion. Instead of a simple web page with a small area to input data, Google offers its loan mortgage calculator as a template in Google Sheets.

In fact, users can access a number of different calculators and templates for budgeting and personal finance on Google Sheets. The beauty of spreadsheet programs such as Sheets or Excel is that they are built in charts, graphs, and of course, calculators.

As a result, companies can build in templates that allow them to calculate timesheets at the end of the week, make their budgets, or calculate mortgage payments per month.

Users can browse templates created by either people or companies. There is a free mortgage calculator template available on Google Sheets with five stars. This mortgage calculator template comes ready-made with all the necessary spreadsheet formulas, allowing you to easily type in the necessary variables. This Google mortgage payment calculator is easily labelled as well with a helpful piece of text telling the user to input their information in the green cells.

While that kind of instruction may sound painfully obvious to some, that kind of information makes the Google mortgage payment calculator template easy to navigate for those who are unfamiliar with Google Sheets or any kind of spreadsheet program.

Using the Google Mortgage Payment Calculator Template

Using the Google mortgage calculator is very straightforward, especially if you have experience using spreadsheets. At the top of the Google mortgage payment calculator is a section that allows to input your variables: loan amount, interest rate, and loan terms.

Let’s say you take out a home loan for $250,000 with an interest rate of 4.75 percent and with a loan term of 25 years. After inputting this data into your Google mortgage calculator, it would tell you that your minimum monthly payment would come to $1,425.29. The Google mortgage payment calculator will also calculate mortgage interest. After 25 years, you will have paid $177,588.91 in interest.

As a result, you can use the Google mortgage calculator to play with the variables and calculate mortgage payments based on different amounts of financing (if you want to see how much you can afford to decrease or increase your down payment), the interest rate, and the amortization period. As a result, this free mortgage calculator is also a mortgage amortization calculator.

Another attractive feature of the Google mortgage calculator is the ability to save your calculations so that you can print them off or refer to them later in Google Sheets. You can calculate mortgage payments with several different variables and save each sheet to make comparisons after the fact.

Cons of the Google Mortgage Calculator

While the Google mortgage calculator is very useful for straightforward mortgage calculations, it is limited in its ability to take in other variables relevant to a monthly mortgage payment.

In fairness, Google Sheets allows users to modify the template to add additional formulas, but if you do not have any experience with spreadsheet formulas this may be difficult. Additionally, you may not have the time to create this kind of mortgage amortization calculator or mortgage calculator with taxes on your own.

Related: Guaranteed Rate Reviews—What You Need to Know! (Mortgage, Complaints & Review)

Loan Mortgage Calculator Comparison: A Breakdown of the Bank of America Mortgage Calculator

Image source: Bigstock

Bank of America offers a Bank of America mortgage calculator. Customers or interested individuals can quickly calculate mortgage fees and see which options are most affordable for them.

This particular mortgage calculator is more geared toward helping customers find relevant rates. The Bank of America mortgage calculator is not about playing around with variables but instead finding interest rates that match the home price you are considering, the down payment you might put down, and the zip code you are looking to buy in.

Let’s say we are hoping to buy a home for $320,000. We are going to put down 20 percent, and we are looking for property in Mableton, Georgia.

So we enter all of this information into the Bank of America mortgage calculator including our zip code for the Mableton area, 30126, to see the kinds of rates that are available to us.

The Bank of America website will then proceed to show the rates available to us in conjunction with different loan terms.

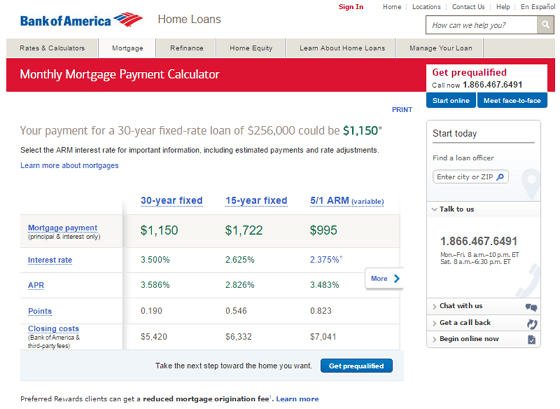

Source: BoA Mortgage Payment Calculator Computation

So the Bank of America mortgage calculator found the following rates for each type of mortgage: $1,150 monthly payment for a 30-year fixed mortgage, $1,722 for a 15-year fixed mortgage, and an estimated $995 for an adjustable-rate mortgage (ARM). Of course, these are all estimates, subject to change, and could be contingent upon factors like your credit score.

This results page after using the Bank of America mortgage calculator breaks down the different things that are incorporated into the cost of your loan (and monthly payment). This includes the interest rate, the annual percentage rate (APR), points, and closing costs.

Pros and Cons of the Bank of America Mortgage Calculator

The benefits of the Bank of America mortgage calculator is its ability to facilitate “shopping around.” Other free mortgage calculators make the assumption that you already have an idea of the interest rate you will be paying and simply want an idea of your monthly payment.

This tool allows you to see what interest rates and loan conditions are available to you based on the type of home you want to buy and the area you live in.

Of course, this tool only shows users the Bank of America rates that are available. So while the Bank of America mortgage calculator is great for getting started and understanding your options, it only does so within the context of Bank of America rates. Comparison is a bit more difficult with this tool, which is understandable considering Bank of America is trying to convert your use of their tool into eventually signing up for a mortgage with them.

Popular Article: How to Buy a House with No Money Down | Guide | Buying a Home with No Down Payment

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Loan Mortgage Calculator Comparison: A Breakdown of the Trulia Mortgage Calculator

Trulia is a mobile app and online resource that makes finding property, either to buy or rent, easier. It offers a number of resources related to real estate, so it is only natural that they would have a Trulia mortgage calculator for their customers to use.

Trulia visitors can either use the simple Trulia mortgage calculator or their more comprehensive free mortgage calculator.

Using the straightforward Trulia mortgage calculator you can enter your property price, down payment, and APR.

With the more comprehensive Trulia mortgage calculator, you can calculate mortgage payments with a number of different variables including the zip code, home price, down payment, interest rate, and loan type.

Let us imagine again that we are buying a home in Mableton, Georgia (so our zip code is 30126). We will say that the home price is $320,000, our down payment is 20 percent, the interest rate is 4.75 percent, and the loan type is a 30-year fixed mortgage. We can enter all of this information into the Trulia mortgage calculator to calculate mortgage monthly payments.

With these variables, you would have an estimated monthly mortgage payment of $1,428 per month according to the Trulia mortgage calculator. This free mortgage calculator also allows you to see how much you would be paying roughly for principal and interest, property taxes, home insurance, and other fees.

At the bottom of the comprehensive Trulia mortgage calculator is an option to expand it into an even more sophisticated free mortgage calculator by clicking on “Advanced.” With this calculator you can input the amount of property tax you are paying (effectively turning it into a mortgage calculator with taxes), enter the home insurance, HOA dues, and any other variables that you are interested in factoring in.

Pros of Using the Trulia Mortgage Calculator

There are not many downsides to the Trulia mortgage calculator, although the simplified Trulia mortgage calculator can be glitchy. The comprehensive free mortgage calculator offered by Trulia is very helpful and user-friendly. Additionally, the interface is visually pleasing, which makes the process of calculating pesky property taxes and interest rates a little less dreary.

The advanced features on the Trulia mortgage calculator makes it a one-stop shop for all of your mortgage calculating needs. Anybody who is interested on the effect of property taxes or HOA dues on their monthly mortgage payment can have their questions answered using this easy free mortgage calculator offered by Trulia.

In addition to their helpful Trulia mortgage calculator, Trulia also offers a lot of other helpful information about mortgages underneath their simplified mortgage calculator. Visitors to the site can find answers to commonly asked questions like, “How much can I afford?”, “Should I refinance my mortgage?”, and “What are the tax savings generated by my mortgage?”

Trulia Mortgage Calculator vs. Bank of America Mortgage Calculator vs. Google Mortgage Calculator

In a match-up between the free mortgage calculators offered by Google, Bank of America, and Trulia, the Trulia mortgage calculator comes out on top. The site and the calculator were designed with one purpose in mind: helping users find helpful information on real estate.

While the other calculators do serve their purpose, they are arguably afterthoughts to other agendas (collaboration for Google Sheets and templates and selling financial products for Bank of America).

Bonus Free Mortgage Calculator: US Mortgage Calculator

The US mortgage calculator is a great bonus mortgage calculator that is worth pointing out. It is a very simple, yet comprehensive tool to calculate mortgage monthly payments with numerous variables.

The US mortgage calculator allows you to enter the home value, down payment, mortgage amount, and interest rate, much like other free mortgage calculators. But it also allows for the entry of other variables that can make a difference when you calculate mortgage monthly payments.

Consumers can also enter their private mortgage insurance for the year, their amortization period, payment frequency (monthly or bi-weekly), their start date, and even their homeowner expenses including property taxes, home insurance, HOA fees, and one-time expenses.

The US mortgage calculator is definitely a useful tool to consider using in addition to the others mentioned in this article.

Read More: How to Get a Home Equity Loan with Bad Credit (What You Need to Know)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.