Guide to Finding the Best Affordable Health Insurance Plans & Companies

A common topic that many households are often concerned about is how to find affordable health insurance.

Premiums have been on the rise both prior to and following the Affordable Health Care Act (also known as Obamacare) being enacted.

It can be somewhat confusing to know where to look for affordable health insurance plans due to changing regulations and the fact that affordable medical insurance carriers can differ from state to state.

Affordable Health Insurance

According to a CNNMoney article, in August, affordable health care became even harder to find as costs rose the most in one month than it had in the last 32 years.

A recent Kaiser Family Foundation Employer Health Benefits Survey found that premiums for employer-sponsored affordable family health insurance reached $18,142 this year, up 3 percent over last year.

However, there are still some resources you can use to find the most affordable health care plans for your family. In this year’s guide, How to Find Affordable Health Insurance Plans, we will review the different options you have for locating affordable health insurance companies through employer-offered affordable health plans, alternate methods such as affordable health credit cards, affordable individual health insurance, and options you can use to get affordable health insurance quotes.

After reading our guide, you should have a better idea of how to find affordable health care insurance for you and your family and exactly where you can find the best affordable health insurance companies and plans.

See Also: Northwestern Mutual Reviews | What You Need to Know About Northwestern

Affordable Health Insurance | Health Care Options

It’s important to understand the different options you have for affordable health care so you can evaluate and compare each type to see which may be the best affordable health plans for your family.

Not all employers offer affordable individual health insurance, so you’ll want to know alternative options that will cover your medical expenses as well as understand the differences between different affordable health insurance quotes and plans.

Affordable Medical Insurance

Major Medical Affordable Health Types: Major medical is the main type of affordable medical insurance that people are most familiar with.

All plans that are compliant with the Affordable Health Care Act are major medical, which covers a wide range of both inpatient and outpatient health services.

Types of major medical affordable family health insurance include:

- Obamacare for individuals and families

- Employer-offered health plans

- Union-offered affordable health care insurance

- Qualified Health Plans under Obamacare that are subsidized

- Catastrophic health plans, usually for those under 30

- Government-sponsored affordable health care insurance, like Medicare and Medicaid

Non-Major Medical Affordable Health Care Plans: These types of plans are not qualified as major medical because they don’t offer the same type of coverage that is considered as “minimum essential coverage” and thus are not Obamacare-qualified affordable health plans.

Types of affordable medical insurance that are not major medical include:

- Short-term/temporary health insurance

- Gap insurance, typically a supplemental plan to cover out-of-pocket costs

- Vision or dental-only plansCancer insurance or disease-specific plans

Health Savings Account Affordable Health Plans: A health savings account is a medical savings that is tax advantaged, and you can use it to contribute to certain medical expenses tax-free. They can’t be used to pay health insurance premiums but can be used for out-of-pocket expenses and with qualifying high deductible affordable health plans.

Credit Cards for Affordable Health Care: Due to the long-term rise in premiums that are unaffordable to a growing number of Americans, the health care credit card has been increasing in popularity. While this is not the same thing as affordable health insurance, these cards do offer a way to pay for immediate medical needs and typically have a no-interest period.

Don’t Miss: Top Best Credit Card Balance Transfer Offers & Deals | Ranking | Interest-Free Credit Card Transfers

What to Look for When Comparing Affordable Health Insurance Plans

Affordable Health Insurance Plans

When you are trying to find the most affordable medical insurance for your family, there are several items that you will want to compare to get a complete picture of the difference between each of the affordable health insurance companies and what they are offering. One company may offer the lowest monthly premium, but it may come at the cost of a high deductible or more initial out-of-pocket expenses. So, you’ll want to be sure to look at all the combined expenses and benefits when choosing affordable family health insurance.

Things to compare between affordable health care plans:

- Monthly premium

- Deductible

- Copayments

- Coinsurance percentage

- Out-of-pocket maximum

- The size of your in-network providers

- If your current doctors are included in their provider network

- Costs for visiting an out-of-network provider

- Types of medical and hospital coverage offered

- Prescription drug coverage

- Whether the plan qualifies under the Affordable Health Care Act

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Affordable Health Insurance | Searching the Marketplaces

A source where you can find a number of affordable health insurance quotes in one place is at one of the affordable health insurance plan marketplaces, also known as health exchanges. Healthcare.gov is the most well known of these, but there are other private marketplaces as well that you can use when looking for affordable medical insurance.

Using an affordable health marketplace can save you time when searching on your own for affordable individual health insurance because it sources information from multiple companies in each state to provide you with a number of quotes from qualified providers.

Marketplaces that help find affordable health insurance include:

Certain states also run their own affordable health care marketplaces while others rely on the federally-facilitated marketplace. You can find a full listing of which states use state-based or federally-facilitated marketplaces for affordable health insurance at the Kaiser Family Foundation.

If you live in one of the states below, you’ll want to visit its site in your search for affordable medical insurance.

- California

- Colorado

- Connecticut

- District of Columbia

- Idaho

- Maryland

- Massachusetts

- Minnesota

- Mississippi

- New Mexico

- New York

- Rhode Island

- Utah

- Vermont

- Washington

Related: Top Best Life Insurance Companies | Ranking | Term Life & Whole Life Insurance Comparison

Finding Affordable Health Plans | Affordable Health Insurance Companies

Another source that you may find helpful when searching for affordable health care plans is to check out the insurance company sites directly.

You might already have a relationship with one of the more affordable health insurance companies, and reviewing the options available can reveal savings if you decide to move to a different plan.

Affordable Health Care Plans

You may also want to stay with an affordable health provider that you know your doctor accepts, so it can pay to shop for an approved provider to seek out deals for affordable individual health insurance in case there is a better plan out there.

Below are a few of the larger affordable health insurance companies. You can also find a larger listing on Wikipedia.

Aetna – Aetna was founded in 1853 and is headquartered in Hartford, Connecticut. It offers major medical and other affordable medical insurance options for individuals and families.

Alfac – Aflac was founded in 1955 and is headquartered in Columbus, Georgia. It offers supplemental affordable health care plans, such as cancer insurance, critical illness insurance, and hospital insurance.

BlueCross BlueShield – BlueCross BlueShield was founded in 1929 and is headquartered in Chicago, Illinois. It offers major medical and other affordable family health insurance options.

Cigna – Cigna was founded in 1982 and is headquartered in Bloomfield, Connecticut. It offers major medical, Cigna Medicare, and supplemental affordable health plans.

Kaiser Permanente – Kaiser Permanente was founded in 1945 and is headquartered in Rockville, Maryland. It offers a number of major medical options for families as well as affordable individual health insurance.

UnitedHealthcare – UnitedHealthcare was founded in 1977 and is headquartered in Minnetonka, Minnesota. It provides a number of affordable health care plans, including major medical, short-term health, Medicare, and Medicaid.

Affordable Health Insurance | Best Company Lists

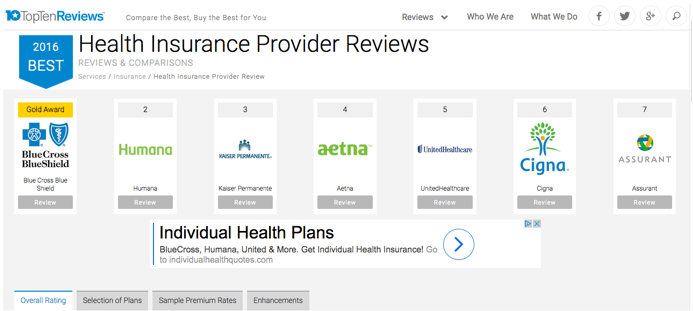

When looking for affordable health care insurance and a company that you can trust, you will also want to look through reviews and best company lists that may help you find affordable health care at a company that you weren’t familiar with before.

It’s always a good idea to read what others are saying about any option you’re considering for affordable family health insurance so you can learn about the company’s track record of provider service.

It’s important to know a company’s reputation before signing up for an affordable medical insurance plan in case you find information on rate increases, refused claims or other red flags that may cause you to choose a different provider.

You should also pay attention to whether it is qualified in the affordable health care marketplace so you don’t end up paying a penalty with the IRS at tax time.

Best company lists and reviews for affordable health insurance companies:

- TheTopTens Best Health Insurance Companies

- HealthInsurancezoom.com List of Top Insurance Companies Comparison

- Consumer Affairs Top 10 Best Rated Health Insurance Companies

- TopTenReviews Health Insurance Provider Reviews

- TheSimpleDollar Best Health Insurance Companies in 2017

- LifeHealthPro Consumers Vote: Best and Worst Health Insurance Carriers

Popular Article: Best Life Insurance Rates & Charts | Tips to Get the Best Life, Term, and Whole Life Rates

Affordable Family Health Insurance | Tax Penalty Information

When the Affordable Care Act (Obamacare) was signed into law in 2010, included within it was a penalty for those who do not carry qualified health insurance or those who did not meet exemption requirements. For the tax year 2017, the penalty will increase to 2.5% of an individual’s total household adjusted gross income.

Some of the tax penalty exemptions include:

- If the lowest priced health plans offered are more than 8.13% of your household income

- If you don’t have to file a tax return due to income level

- If you have a hardship exemption

- If you were uninsured for no more than 2 consecutive months of the year

- If you’re a member of a federally recognized tribe or if you are eligible for services through an Indian Health Services provider

- If you’re a member of a recognized health care sharing ministry

- If you’re a U.S. citizen living abroad or a certain type of non-citizen

You will want to make sure when reviewing affordable health insurance quotes that you know whether the plans you’re considering qualify under Obamacare. You can find a listing of examples of qualifying health coverage at healthcare.gov.

Guide on Finding Affordable Health Care Recap

While it may seem harder each year to find affordable health plans, there are several options available regarding various alternatives. The healthcare marketplaces, whether public or private, give you the chance to seek out affordable health insurance quotes from several insurance providers at once to compare and contrast their premiums, deductibles, and coverage options.

You can also research each company individually for affordable health insurance plans to see what they have to offer on their websites.

There may be some choices for supplemental health care insurance plans regarding short-term disability, disease-specific coverage or hospital stays that you that you didn’t realize were available.

We hope that this review on finding affordable health insurance plans and companies will prove to be a helpful tool for you while navigating the different types of affordable health coverage for families, individual health insurance, and supplemental insurance options.

By doing your homework on the companies, plans, and rules for healthcare coverage, you will have a better chance of coming out ahead and securing the affordable health insurance you need for your family.

Read More: Top Best Corporate Credit Cards | Ranking | Compare the Best Company, Corporate, and Business Cards

Image Sources:

- https://pixabay.com/en/doctor-patient-hospital-child-899037/

- https://pixabay.com/photos/elderly-corridor-doctor-1461424/

- https://www.healthcare.gov/

- https://www.toptenreviews.com/best-health-insurance-providers

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.