Guide to Finding The Best Remortgage Deals

If your current mortgage rates are higher than the average, you might want to consider looking for remortgage deals to get a better rate. After all, rates are subject to change frequently during the life of your original mortgage, which can be 15, 20, or even 30 years.

But, in the face of remortgaging, you might have several questions. What does remortgage mean? How does remortgage work for the average homeowner? How easy is it to remortgage your home? And where can you find the best remortgage rates?

Source: Check A Contract

You may even wonder how to find different types of remortgages, like an interest-only remortgage. Regardless of how much you know about remortgaging or what, specifically, you are looking for, this remortgaging guide will help you walk through the process.

This article will explain the process to remortgage a house, help you learn how to look for an excellent remortgage for your home, explain how to remortgage with bad credit, and compare remortgage rates from popular lenders. We will also include our picks for some of the best remortgage lenders on the current market.

See Also: Top Answers to “How Much Can I Afford For a House” Questions

What Does Remortgage Mean?

Before learning about the best remortgage lenders and rates, just what does remortgage mean?

When you remortgage your home, you are essentially entering into a new mortgage agreement that will replace your current mortgage. Homeowners remortgage a house to take advantage of the best remortgage deals currently available if they are better than their current rates.

Most homeowners tend to remortgage their homes when the introductory rate on their mortgage expires, which is usually a few years after signing for the loan. After that, a mortgage switches to a variable rate, which can significantly change the monthly payment for a mortgage. Remortgage deals can, therefore, help owners continue to have steady, affordable monthly payments.

How Does Remortgage Work?

If you are considering a remortgage for your home, you might want to know “How does remortgage work?” The process can be fairly straight-forward, especially when you do your research to compare the rates of remortgages.

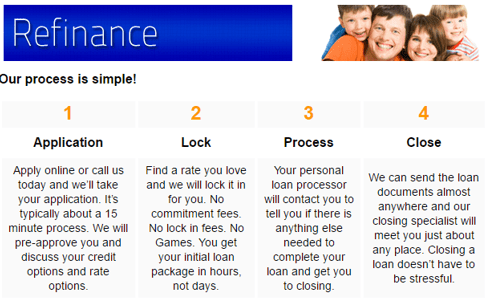

The process to remortgage a house is usually much quicker than buying the home and qualifying for your original mortgage. Once you find the best remortgage options for you, you can speak to the lender to discuss the requirements to qualify for the remortgage.

Source: Total Mortgage Network

For most remortgage deals, the application process usually requires income information, current mortgage information, details about your home, and a record of your expenses. The remortgage company will want to know your debt-to-income ratio so it can better understand your ability to repay your remortgage.

After the application process for the best remortgage rates, your lender will assess your submitted information and your credit information. Depending on the lender, you may also be required to have a home appraisal so your new lender can ensure the home is worth the cost of the remortgage.

Once the assessment is complete, your lender will allow you to compare remortgage rates from them. The rates may or may not be what you are hoping for. At this point, if the lender cannot match the best remortgage deals for you, you should consider starting the process over through another lender.

Don’t Miss: Private Mortgage Insurance: What You Need to Know About PMI Insurance

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Easy Is It to Remortgage?

Applying and qualifying for an original mortgage is usually a lengthy process and requires a lot of paperwork. But how easy is it to remortgage your home?

The process is usually much shorter than the process for your original mortgage. Make sure you compare remortgage rates and terms with your current mortgage rates and terms to ensure that the remortgage rates you found are the best remortgage rates for you.

Doing a remortgage comparison with your current mortgage can also clue you in on how easy or difficult your remortgage process will be. If your mortgage has an early redemption fee (ERC) or an exit fee, you will be required to complete necessary paperwork and pay the fees before switching to your remortgage.

Also, check the fine print of what seem to be the best remortgage deals to find out if there are legal fees or any other fees associated with the remortgage. Fees can not only make the process take longer, but they can also set you back financially for more than you intended.

The best remortgage process is one that gets you your remortgage quickly and without hassle. To streamline the process, make sure you have all necessary paperwork ready for the lender to review and thoroughly read through the terms of the lender’s best remortgage deals so there are no surprises later.

Is It Possible to Remortgage with Bad Credit?

Those who want to remortgage with bad credit should not feel like remortgaging is impossible. In fact, it is quite common for people with bad credit to remortgage to put themselves in a better financial situation. Sometimes, a remortgage with bad credit is the only option to dig out of debt.

If you had bad credit when you applied for your original mortgage, remember that you were still able to qualify for that mortgage. A remortgage is no different, and you may still qualify for some of the best remortgage deals.

Or, if your credit has declined since your original mortgage due to a job loss, emergency, or other financial situation, you can still remortgage with bad credit. And sometimes, the best remortgage rates can help you climb out of debt faster than you could have if you stuck with your original loan.

Source: Doctors Mortgages Online

Some remortgages allow you to bundle the amount you owe on your home with other debts. This may be the best remortgage rates option for those with bad credit because it lets you consolidate debt to achieve lower rates and payments each month.

Unfortunately, if your credit score falls below 600, you may find it difficult to qualify for the best remortgage. Lenders could quote you much higher rates than you were expecting or they can require a co-signer. Complete a thorough remortgage comparison against your current mortgage to make sure the remortgage makes sense for you long-term.

Related: Redfin Reviews | What You Should Know about Redfin (Real Estate)

How to Find the Best Remortgage Rates and Deals

Homeowners should typically talk to their current lenders first to see what, if any, remortgage rates are available through them. Have an idea of the best remortgage rates you have in mind and the monthly payment you want.

If your lender cannot match your needs, it is time to look for other lenders. An independent mortgage advisor can be helpful for finding the best remortgage deals and explaining the different types of remortgages, like an interest-only mortgage.

Independent mortgage advisors work for you rather than with a specific lender, so they are unbiased for or against lenders. They simply work to help you compare remortgage rates to find one that is best for you. Independent mortgage advisors often have close relationships with lenders, though, so they can more easily negotiate the best mortgage rates.

However, if you cannot afford the extra cost of an independent mortgage advisor, you can search the internet for a remortgage comparison of the best remortgage deals. Websites like Bankrate allow you to plug in some information, like the loan amount, down payment, and your credit score.

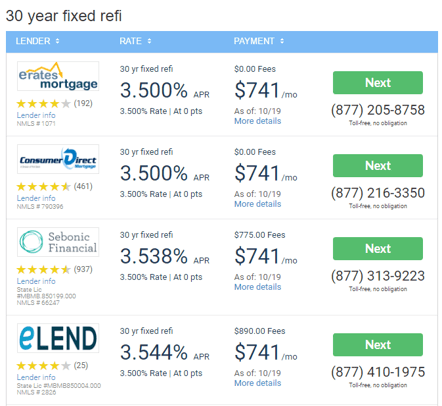

Source: Bankrate

Then, you can view the best remortgage deals for a fixed, ARM, or interest-only remortgage. The easy-to-understand table shows the APR, payment amount, fees, and more to compare remortgage lenders in your area.

From here, find out more about the lenders you are interested in. Sometimes, the best remortgage rates do not equal the best remortgage fine print. Check each lender’s website to find out more about their fixed, ARM, or interest only remortgages and rates to ensure they have a remortgage that is best for you.

How to Compare Remortgage Rates

When you use a remortgage comparison website like Bankrate, you can easily find the basic information for each remortgage and lender. But, how can you compare the best remortgage deals that you find to make sure they fit within your budget now and long-term?

Fortunately, there are several free calculators on the web that will help you compare remortgage rates by using the details of a remortgage.

Mortgage Calculator provides an excellent, free remortgage calculator that helps you compare the best remortgage deals with your current mortgage.

First, plug in your current loan amount, interest rate, number of months left, number of months paid, and other important mortgage information. Then, add the interest rate and the length of the remortgage you are considering to compare remortgage with your current mortgage.

The results from the calculator show your current mortgage information compared to the best remortgage rates you inputted to compare. You will see the difference in monthly payments, tax savings, total interest paid, and more.

NerdWallet also offers a detailed table with today’s current best remortgage rates, simplified for easy viewing and understanding. This is a handy tool that you can check daily, as rates vary frequently, so you never miss the best remortgage deals.

Popular Article: How to Get a Home Equity Loan with Bad Credit – This Year’s Tips

Remortgage a House with the Best Remortgage Deals

If you want to remortgage a house, you want the best remortgage rates to do so. Now that we have answered the questions, “How does remortgage work?” and “How easy is it to remortgage?” we will introduce you to two of our top picks for remortgages.

eLend

eLend is a go-to place for some of the best remortgage rates to reduce your monthly payments and pay less over the life of your loan. It also allows you to get a Cash Out remortgage so you can cover other debts or home repairs with your remortgage by rolling your debt or repair costs into your remortgage.

Source: eLend

eRates Mortgage

eRates Mortgage is another lender with super-low interest rates available to those who qualify – between 1%-2% lower than other lenders. eRates Mortgage offers to lock you into the best remortgage rates you can find within a few hours. This lender also gives you the option of rolling up your other debts into your remortgage to save money every month and over the life of your loans.

Source: eRates Mortgage

Both lenders are among the top-rated remortgage lenders because of their excellent remortgage deals and rates. Additionally, they boast some of the lowest remortgage fees compared to their competitors.

Conclusion

Remortgaging is an excellent option for those who want to get the best rates on their mortgage, have lower monthly payments, or consolidate their current debts into their remortgage.

Those with bad credit can still qualify for a remortgage and may find that they are making a smart long-term financial decision when they remortgage a house.

The best remortgage deals are those with low interest rates, fixed rates for several years, low remortgage fees, and the ability to consolidate other debts by rolling them into the remortgage.

To find the best current remortgage deals, first check with your current lender. If no deals are available, search the internet to find and compare the best remortgage rates.

Remember to read the fine print of any remortgage terms to ensure that your new remortgage will save you money long-term over your current mortgage.

Read More: Can You Pay Rent Online? How to Pay Rent with a Credit Card Online

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.