How to Pay Rent with a Credit Card Online

Paying with plastic can be quite tempting, especially when it comes to making large purchases or payments. The lure of paying bills with a credit card has been attracting the attention of renters who are looking to pay rent with a credit card.

The ability to pay rent online allows them a number of advantages, but is it worth the cost? Is there a method for how to pay rent with a credit card for free?

In this article, we will explore online rent payment options to help you determine whether you should pay rent with a credit card. Should I pay my rent online? By the end of the article, you’ll be able to confidently decide whether this is one of the best ways to pay rent for you.

Image Source: Pay Rent Online

Why Pay Rent with a Credit Card?

As consumers, we are accustomed to putting our purchases straight onto plastic whether we plan to use our credit card or debit card. Writing paper checks and even finding our checkbook for that matter are a thing of the past. More and more people are now starting to ask the question, “Should I pay my rent online with a credit card?” If you want to pay rent with credit card, you should first have a thorough understanding of the advantages:

- Rewards: Stacking up your rewards points is the one of the biggest reasons to pay rent online. With such a large purchase added straight to your account, your rewards points will increase almost exponentially. Depending on the type of rewards credit card you have, finding a way to pay rent online may even help you to qualify for rewards bonuses because of the sheer volume of spending you’re adding to your card.

- Convenience: If you work during normal business hours, as well as the representatives who run your leasing office, it makes it difficult to drop your payment by their office. You may need to consider other ways to pay rent, including online rent payment. If you pay rent online, you can make your payment whenever it’s convenient for you, whether that means at 5:01 pm or 2:00 am.

- Coverage: Most of us have had a month where we weren’t quite sure if we had enough to cover our expenses. These days, it would be a good time to ask, “Should I pay my rent online?” By paying rent with a credit card, you can let your card cover the bill for a few days until your next paycheck hits your account. If you pay rent with a credit card for this reason, you want to be sure that you can pay off your statement before the grace period is over though.

- Guarantee: Many third-party online rent payment services will offer a guarantee that your payment will reach the landlord by the due date. If your check comes in late, some services, like RadPad, will pay your late fee. If your check never arrives at all, it might even pay a full month’s rent plus the late fees that it incurred. The image below represents RadPad’s 100% Rent Guarantee, but other services will offer similar security for paying rent online.

Image from RadPad

Paying rent online can be a great tool to help you stack up some extra rewards or travel points on your credit card, make your life easier or help you to cover the gap in between your paychecks. Paying rent online can be one of the best ways to pay rent, but that isn’t always the case. In the next section, we will look at a few situations where you might not want to pay rent with a credit card.

Don’t Miss: What Is a Reverse Mortgage? – What You Need to Know (Pros & Cons, Disadvantages & Basics)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Pay Rent Online: Disadvantages of Using a Credit Card

If you’re looking to pay rent online or to pay rent with a credit card, you should be fully aware of the potential costs. Take these factors into consideration when asking yourself if you should pay rent online:

- Fees: Traditional ways to pay rent often come without a price tag, but that isn’t always the case with online rent payments. Online rent payment services typically charge a percentage-based processing fee while others may charge a flat rate. The percentage-based fee may negate all of the rewards points you would have earned and then some.

- Credit score: If you pay rent with a credit card, you want to keep a careful eye on what percentage of your credit limit you will be using. CardHub advises against using more than sixty percent of your credit limit overall. Given the high value of rent, paying rent with a credit card may push you over this figure and damage your credit score.

- Interest: You can pay rent online to help you cover the gap between paychecks, but if you aren’t sure whether you can pay it off, you might need to find other ways to pay rent. If the balance carries over into the next month, you will not only be behind in your rent, but you will begin to rack up significant interest depending on the terms of your credit card.

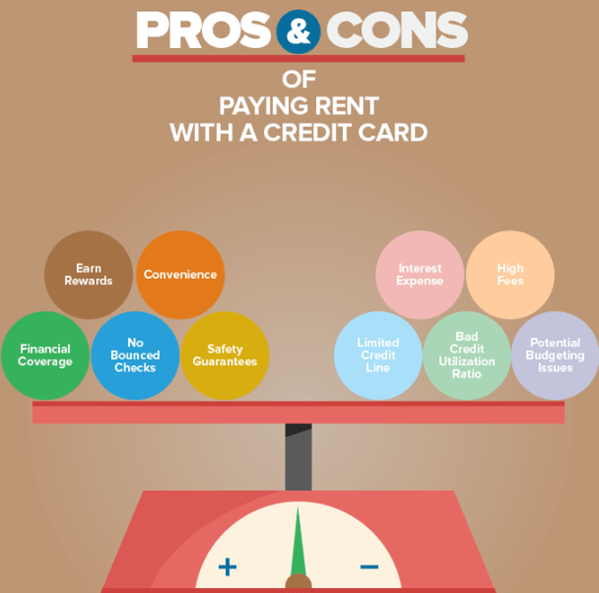

There is definitely a cost to the convenience of making an online rent payment. Wise renters know they need to closely examine whether the advantages will outweigh the disadvantages in their particular situation. Should you pay rent with a credit card? Only you can look at your personal finances and budget to determine if it’s the right choice for you. If it is, we will take a look at not only how to make an online rent payment but how to pay rent with a credit card for free.

Image from CardHub

Related: How to Get a Home Equity Loan with Bad Credit (What You Need to Know)

How to Pay Rent with a Credit Card

The easiest way to learn how to pay rent with a credit card is through a third-party app. In fact, learning how to pay rent with a credit card for free can be as simple as asking your landlord. Some property management companies or landlords are already set up to pay rent online and may even cover the fee. Through third-party apps, like Rent Track or ClickPayRent, you can pay rent online for their 2.95 percent fee, or your landlord can choose to pay the fee for you.

Many third-party apps that allow you to pay rent with a credit card require your landlord or property manager to have an account on the same app to accept online rent payment transactions. Rent Track, ClickPayRent, and RentPayment all require both parties to maintain accounts.

Does your landlord refuse to make an account? Do you need to know how to pay rent with a credit card, even if your landlord doesn’t allow it? Some services will take your credit card information to pay rent online and then issue a check on your behalf to the landlord. This does not require your landlord’s participation, and it still complies with the ways to pay rent that he/she offers you.

Of course, you can also choose to utilize more commonly-known services, like Venmo or Paypal. While these do require your landlord to have an account in order to pay rent online, many people already have this type of account for their personal use.

Online Rent Payment Apps

Once you’ve decided that paying rent with a credit card is the best choice, you need to decide how to pay rent with a credit card. If your landlord doesn’t accept credit cards directly, what service will you use? CardHub compiled a list of some of the most popular third-party apps available. We will take a closer look at the two apps that do not require your landlord’s participation to teach you how to pay rent with a credit card.

- RadPad: RadPad allows you to pay your rent with a debit card for no fee (for rent less than $5,000) and to pay rent with a credit card for 3.49 percent. In exchange for these fees, it will cut a paper check and mail it directly to your landlord, and you receive a guarantee that he/she will receive it on time. Business Insider reviewed the site and revealed that, with the average rent in the United States at $962, you would pay $31.27 in fees to RadPad each month.

- RentShare: RentShare offers a service for online rent payment very similar to that of RadPad. You can make a bank account payment for less than $2.00 in fees, but to pay rent with a credit card, you will pay 2.9 percent in processing fees. Admittedly, this rate is lower than that charged by RadPad for paying rent online. Wondering how to pay rent with a credit card and split your expenses between roommates? RentShare does allow you to divvy up the bills between you and your roommates at the beginning of the month.

On either site, you will simply register for a new account, provide your information, and set a date when you would like your rent payments to be due. The entire process should take only a few minutes depending on the speed of your Internet connection, and you can then set your account to automatically issue payments each month thereafter.

Of course, there are plenty of other ways to pay rent online and other services you can use for an online rent payment. The list of third-party apps available for online rent payment is lengthy, and the fees and participation required from your landlord will vary. RadPad and RentShare are great apps because they don’t require any consent from your landlord – perfect if you need to make a last-minute decision to pay rent with a credit card.

Popular Article: Wells Fargo Mortgage Reviews – Everything You Need to Know (Home Mortgage, Loans, Complaints, & Review)

Should I Pay My Rent Online?

Are you still on the fence about whether or not to pay rent online or to pay rent with a credit card? If so, you may want to consider NerdWallet’s advice in regard to paying rent with a credit card: It might be best for individuals who are sometimes late on making their rent payments. Apart from that circumstance, the fees for online rent payment may outweigh the possibility of stacking extra rewards, and you could be damaging your credit.

Take a look at your budget and finances to see if it makes sense to pay rent with a credit card. When your landlord doesn’t cover the fees for a third-party app, you may be racking up unnecessary expenses and bills for yourself. Especially in situations where you don’t need to pay rent with a credit card because you can afford to pay your rent in full, you might be better off using a debit card for a free transaction on RadPad or to simply pay with cash.

Of all the ways to pay rent, learning how to pay rent with a credit card can be easy, but it also comes with significant disadvantages. Take care of your credit and your finances by proceeding with caution when it comes to online rent payment services.

Read More: Cost to Build a Home – What You Might Be Missing! (Typical Closing Costs, Estimated & Average)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.