Guide: Finding the Best Student Loan Companies

Finding the best student loan company to finance your college education should not have to be difficult, but it can be. After you figure out your school’s tuition requirements, you then have the responsibility to find a way to cover the costs.

Most college students do not have thousands of dollars readily available to finance their education, nor do their families. So, they are faced with finding a student loan company to help.

If you are one of the fortunate college students who can receive full tuition funding from the government, you may not need the help of private student loan companies. However, many new college students do not qualify for enough federal grants and loans to cover their full tuition.

Source: Simple Tuition

Similarly, those who graduated college or are seeking to further their education might want to find the best company to consolidate student loans to keep them from getting too far in debt.

It is no secret that a college education is pricey. Fortunately, this guide will help walk you through the process of finding some of the best student loan companies so you can fund your college education in a way you can afford.

This guide will discuss two top options for three categories: the best student loan consolidation companies, the best companies for student loans for new students, and the best private student loan companies to bridge the gap between federal grants and loans.

See Also: Student Loan Repayment & Forgiveness |Guide | What You Need to Know About Paying off Student Loans

Types of Student Loan Companies

Most of the best companies to consolidate student loans with have specialized their loans to help a particular type of college student. For example, company A might be the best place to consolidate student loans whereas company B is a student loan company that tailors its loans to new college students with little to no credit.

Private student loan companies do not come in the same shape and size, and neither do their loans. You should take this into account before you begin your search, especially if you are in the market for a particular type of student loan.

New college students will not want to look for student loan refinancing companies. However, recent graduates or those seeking a graduate degree will want to find the best place to consolidate student loans.

Some of the best student loan refinance companies will offer more than one type of student loan option. Wells Fargo, for example, is considered one of the best student loan companies for its versatile options. In addition to being one of the best student loan consolidation companies, it also offers both undergraduate and graduate student loan options.

What Makes a Good Student Loan Company?

The best student loan companies are usually those that offer versatility. The best company to consolidate student loans can also be the best student loan company for new students because of its low interest rate loan options.

Source: Consolidate Student Loans

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

However, even if a student loan company only focuses on a specific type of loan, its loan features could still make it one of the best companies for student loans. Here are a few of the features you should look for in student loan refinancing companies, undergraduate loan companies or best student loan companies in general:

- Low and fixed interest rates. The best private student loan companies are those with low interest rates that make your loan more affordable over time. College students usually lack a large amount of funds to be able to afford sky-high interest rates, and the best student loan company understands this.Also, look for fixed interest rates when searching for the best student loan companies. A fixed rate means your interest rate will be locked in and not subject to change over time. This is especially important when looking for student loan refinance companies so you can ensure you are staying on track with your financing goals.

- Low and transparent fees. The best company to consolidate student loans or provide new student loans will clearly outline its fees, if any, to prospective borrowers before applying. You will want to find the best student loan company that does not charge extra fees for paying early or for applying. If you cannot find information about a company’s loan fees, it may not be the best place to consolidate student loans or apply for a new loan.

- Additional benefits or discounts. Some student loan refinancing companies and new student loan companies offer additional benefits to their borrowers, like deferred payments while attending college and discounts for autopay.

Certain student loan refinance companies even offer very low interest rates if you choose a variable interest rate rather than fixed. While this is a gamble, it could give you the possibility to pay less interest over the life of your loan.

Don’t Miss: Top Best Credit Cards | Ranking & Reviews

Where to Find the Best Companies for Student Loans

Where can you find the best company to consolidate student loans or the best private student loan companies? There are two websites that help streamline the process of searching for the best student loan companies online.

Source: Credible

Credible is an excellent resource for finding the best companies to consolidate student loans or provide new loans. On its website, you can search for private student loans that meet your needs. Browse the website on your own or click “Get My Rates” to be provided with instant results for loans from private student loan companies.

Credible also has blog posts that lists its picks for the best company to consolidate student loans and best private student loan companies overall. You can compare each company by its brief information listed on Credible or click “Get Offers” to view further information about each company’s loans.

Source: Simple Tuition

Simple Tuition by LendingTree is another website that provides financial aid resources to college students. This website can help you find the best company to consolidate student loans or the best companies for student loans for new college students when you use its student loan comparison tool.

You can also use the “Student Loans” and “Refinance Student Loans” links at the top of the website to search for the best student loan companies to meet your needs and to learn more about each type of loan.

Related: How to Refinance Student Loans | Guide | Private & Federal Student Loans Refinancing

The Best Student Loan Companies for New College Students

The best student loan companies for new college students are those that offer specific benefits for undergraduates. Most undergraduate students are those fresh out of high school with little to no credit, which can make it difficult to qualify for a private student loan.

However, there are private student loan companies that cater their loan options toward undergraduate students who are entering college for the first time. The best student loan companies for new students understand what undergraduates have and what they need and provide options to meet those needs.

One of the biggest struggles new college students face is a lack of funds and income to repay a loan while attending school. Extra time for a job is something most college students do not have, and some private student loan companies understand this.

Sallie Mae and Wells Fargo are two of the best student loan companies for new college students because they provide low interest rate loan options for undergraduates and offer the chance to defer payments until after graduation.

Sallie Mae

Sallie Mae provides several student loan options for undergraduates, graduates, and parents to help their children afford college tuition. Undergraduates should consider Sallie Mae as one of the best companies for student loans because of its Smart Option Student Loan tailored for undergraduates.

Source: Sallie Mae

Sallie Mae is one of the few private student loan companies to offer different methods of repayment. You can choose to defer your payments until after graduation, pay a low payment of $25 per month while in school or pay interest only while attending to save you money on the life of your loan.

Additionally, Sallie Mae offers 100% financing of your college tuition should you not be eligible to financial aid. It is also a student loan company with some of the lowest interest rates available, and you can lower your interest rate further when you enroll in the Interest Repayment Option or automatic deduction payments.

Wells Fargo

Wells Fargo offers two types of loans for new college students: private student loans for those attending a 2-year community or non-traditional school and private student loans for undergraduates attending a traditional college or university. It is one of the few private student loan companies to tailor loan options for undergraduates.

Source: Wells Fargo

Due to its deferment policy, fee-less application and origination fees, and competitive interest rates with the possibility of interest rate discounts, Wells Fargo is one of the best student loan companies for new college students with low funds or low income.

Wells Fargo is also considered one of the best companies to consolidate student loans, which can be helpful if you decide to consolidate in the future. It is best to stay with one company when you finance because that company will know your payment history and can offer you better discounts and benefits in the future.

Popular Article: The Best Private Student Loans |Guide | How to Get Private Student Loans Without a Cosigner

The Best Companies to Consolidate Student Loans

When searching for the best student loan consolidation companies, it is important to know exactly how much student loan debt you have and from what sources. If you have both federal and private student loans, you should look for the best company to consolidate student loans from all sources.

The best companies to consolidate student loans will offer low interest rates to compete with your current rates, fixed-rate and variable-rate options for you to choose from, and a high cap for maximum loan amounts to consolidate. iHelp and CommonBond are two of the best student loan consolidation companies that fit these criteria.

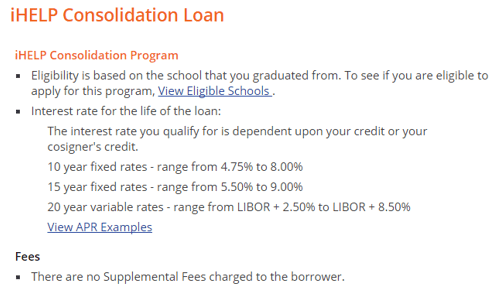

iHelp

iHelp is one of the best student loan refinance companies because of its low interest rates, ranging from LIBOR + 2.50% to 9.00%, depending on whether you choose fixed or variable. iHelp also gives its borrowers the option of 10, 15 or 20-year consolidation loans, allowing for more flexible options.

Source: iHelp

iHelp is also considered one of the best companies to consolidate student loans because it offers two ways to repay: interest-only payments for 24 months or graduated payments that increase over time until you pay full principal and interest payments.

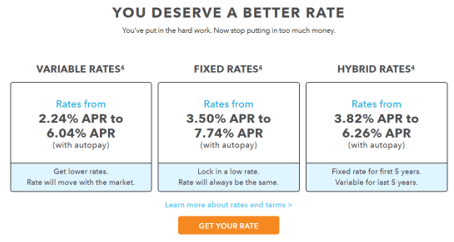

CommonBond

CommonBond offers something that makes it stand out as one of the best companies to consolidate student loans. In addition to extremely competitive interest rates, CommonBond offers variable, fixed, and hybrid interest rate options.

Source: CommonBond

A hybrid interest rate will give you a fixed rate for 5 years and then a variable rate for the next 5 years of your loan. This is an option most student loan refinancing companies do not give, but it can significantly help to decrease the interest you pay during the life of your loan. You are eligible for a hybrid interest rate with CommonBond if you sign up for automatic payments.

If you are not specifically looking for undergraduate loans or the best place to consolidate student loans, there are private student loan companies that are considered the best companies for student loans in general.

What makes a best student loan company in general? Citizen’s Bank and College Ave are two of the best student loan companies because they provide loan options customized to meet your specific needs.

Whether you are looking for the best company to consolidate student loans or private student loan companies with benefits for new students, these two loan companies are excellent places to start your search.

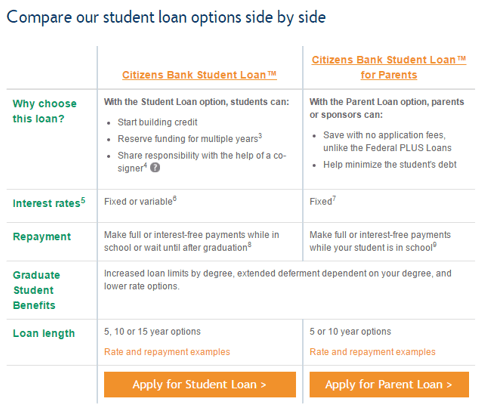

Citizen’s Bank

Citizen’s Bank offers loan options for both students and parents. It is considered one of the best student loan companies because of its flexible loan options with no fees and no prepayment penalties.

Source: Citizen’s Bank

Citizen’s Bank is also considered a best company to consolidate student loans even though it does not offer a specific consolidation loan. However, if you are a graduate no longer enrolled in school, have made timely payments on your current loans, and have at least $10,000 in student debt, you could be eligible for its refinancing options.

College Ave

College Ave is known as one of the best companies to consolidate student loans, configure new student loans, and learn about loan options in general. Its loan configuration tool allows you to personalize a student loan according to your needs – whether you need loans from student loan refinance companies or new student loan options.

Source: College Ave

Once you fill in your information, College Ave will bring you to your loan options. For example, you can choose to have a cosigner or not, make payments during college or after graduation or have a lower monthly budget but longer loan term. Its options make College Ave one of the most personalized private student loan companies to meet the needs of the majority of college students.

Read More: The Best Student Loans & Rates | Guide on the Best Private Student Loan Options

Conclusion

When looking for undergraduate student loan companies or student loan refinancing companies, consider the most important features of a loan.

Do you want the lowest interest rates, the option for low monthly payments or no payments until 6 months after you graduate? These factors will help you determine the type of student loan company you need.

While there are specifically companies to consolidate student loans and private student loan companies for undergraduate loans, some of the best student loan companies are those that offer customizable loan options to create the perfect loan for you.

Be diligent in searching for the top interest rates and repayment options to determine whether or not a company is the best company to consolidate student loans or provide new student loans for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.