Hargreaves Lansdown Review | Fees, Competitors, Stocks and Shares ISA. What You Need to Know

Have you been considering jumping on the bandwagon of robo advisers that are surging in popularity throughout the UK?

You can choose from any number of portfolios, whether you are interested in a ready-made option or a do-it-yourself collection of stocks, funds, bonds, and trusts.

Options for opening an ISA are almost endless, but most individuals have likely already heard of the Hargreaves Lansdown ISA. Hargreaves Lansdown asset management has been around for close to four decades, earning the title of the top “investment supermarket” with private investors.

There are more than £61.7 billion in Hargreaves Lansdown funds for more than 800,000 Vantage clients. The Hargreaves Lansdown stocks and shares ISA maintains a completely UK presence instead of spreading itself thin globally.

Image Source: Hargreaves Lansdown

Their relatively new robo advice section of services still maintains true to their original slogan: “best information, best services, and best prices.”

Hargreaves Lansdown has been around for a number of years and is fighting to prove a viable alternative to Nutmeg, a company that quickly gained leadership in the robo investment field from the beginning.

Do the Hargreaves Lansdown reviews have what it takes to earn your business and investment plans?

AdvisoryHQ wants to help you weigh the pros and cons of using the Hargreaves Lansdown ISA before deciding if this firm is for you.

Our Hargreaves Lansdown review includes details of the fee structure, the success of the program, and the usability of the platform. We aim to create a Hargreaves Lansdown review that gives you the fullest picture of what you will receive with the Hargreaves Lansdown ISA.

Don’t Miss: Top Rated UK Robo-Advisers | Ranking | Top Automated Investment Firms in the UK

Understanding the Hargreaves Lansdown ISA

If you’ve never heard of an ISA, it might be difficult to understand the services that are offered through the Hargreaves Lansdown stocks and shares ISA. An individual savings account, or ISA, is an incredibly tax-efficient way to set aside money for investments.

As Hargreaves Lansdown describes it, an ISA is a “wrapper” that holds your savings and investments and protects them from capital gains tax and UK tax on income and interest.

With the Hargreaves Lansdown stocks and shares ISA, the funds within your account can be used to purchase various funds, shares, and bonds with tax-free gains.

According to the Hargreaves Lansdown reviews on their page from May 2016, 97 percent of their clients rated this type of ISA as good, very good, or excellent, with more than 1,000 respondents.

You have two main options for the Hargreaves Lansdown asset management and stocks and shares ISA:

- Robo advisor: You are free to take advantage of one of their six premade portfolios that cover a variety of risk levels and savings goals. Hargreaves Lansdown reviews the daily fluctuations and variations present among the Hargreaves Lansdown ISA choices in this selection. Their top fund managers’ careful attention gives them the opportunity to regularly rebalance and reinvest your funds to increase the performance and return on investments.

- Do-it-yourself: If you’re a seasoned investor or just want to try your hand at building your own Hargreaves Lansdown ISA, you can always choose from your top picks of funds, shares, bonds, ETFs, and trusts. You can select from more than 2,500 Hargreaves Lansdown funds with no charge for buying or selling and only minimal cost for reinvestments. Alternatively, you can also purchase various shares for £11.95 per trade (£5.95 for frequent traders).

In several Hargreaves Lansdown reviews, they have won awards for both choices. In 2014, they were named both the Best Self-Select ISA Provider by Investors Chronicle as well as the Best ISA Provider by Money Week in separate Hargreaves Lansdown reviews.

See Also: Robo Advisors (UK)—Everything You Should Know! (Investment Help & Advice)

Hargreaves Lansdown Fees

One of the biggest concerns to address before selecting a potential robo advisor is the fees. What do the Hargreaves Lansdown fees or the Hargreaves Lansdown charges to your account look like?

First, the Hargreaves Lansdown ISA requires a very small minimum deposit to begin. When compared to Hargreaves Lansdown competitors that require a £500 deposit or more, they only require a £100 deposit or a monthly debit of £25. With the minimum deposit so high with robo investing platforms such as Nutmeg, this low deposit is a critical feature to note in a Hargreaves Lansdown review because it makes it an appealing alternative to Nutmeg.

As with many of the Hargreaves Lansdown competitors, the fees are issued on a tiered system depending on the account balance within your Hargreaves Lansdown ISA.

On the first £250,000, you should expect to pay 0.45 percent annually. In the next tier, from £250,000 to £1 million, you will see a significant decrease to a 0.25 percent annual rate. Wealthier investors making their mark on Hargreaves Lansdown funds can expect to pay just 0.1 percent on funds between £1 million and £2 million and no Hargreaves Lansdown fees at all on funds in excess of £2 million.

Don’t Miss: How Robo Investing & Algorithmic Trading Is Disrupting Wall Street

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Hargreaves Lansdown Fees Breakdown

Hargreaves Account Balance | Hargreaves Lansdown Fees |

Up to £250,000 | 0.45% |

£250,000 to £1m | 0.25% |

£1m to £2m | 0.1% |

More than £2m | No charge |

Table: Hargreaves Lansdown Fees

Many Hargreaves Lansdown reviews remark that it is priced very competitively when compared to the other Hargreaves Lansdown competitors.

A Hargreaves Lansdown review would be remiss not to consider it as one of the least expensive platforms available for robo advice or the Hargreaves Lansdown ISA.

Hargreaves Lansdown is great for individuals interested in a service that can provide plenty of financial advice and extra features, including access to the Hargreaves Lansdown app. While the Hargreaves Lansdown charges may not be the lowest around, the company often argues in Hargreaves Lansdown reviews that clients should expect to pay more for their premium service. Their reputation, the Hargreaves Lansdown app, and the quality of their research, tools, and platform all contribute to the slightly higher Hargreaves Lansdown charges.

One important detail that many of the Hargreaves Lansdown reviews forget to include is the ability to negotiate for a lower cost on your account. Individuals who have larger portfolios can request that the Hargreaves Lansdown fees be lowered on their account. Hargreaves Lansdown reviews large accounts, and it sometimes is open to negotiation for lower fees and charges associated with your account.

Critical Features

One Hargreaves Lansdown review playfully calls the firm a “big gun of DIY investing,” and for good reason. The features and portfolio management tools that are offered through the firm are a critical reason why it is set apart from the Hargreaves Lansdown competitors and set it out as an excellent alternative to Nutmeg.

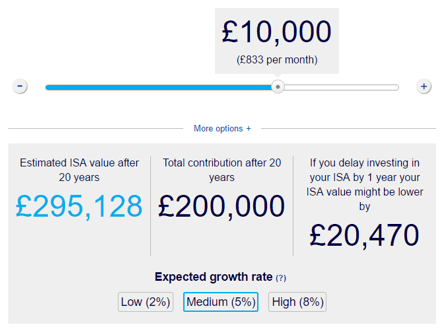

For those just entering into the investment world and dabbling with a Hargreaves Lansdown ISA, they feature a calculator that demonstrates how much your account could be worth in the future based on the various growth rates (supposing those would correspond with a low, medium, and high risk portfolio). Even better, it shows you how much money you would be losing if you delayed opening your Hargreaves Lansdown ISA by just one year.

Source: Investment Services – Hargreaves Lansdown

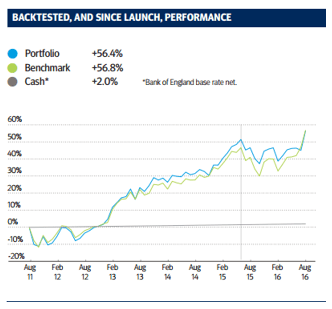

The ready-made portfolios can give you a great idea of what growth you may see from those Hargreaves Lansdown funds. Hargreaves Lansdown reviews the information regarding their ready-made portfolios and compiles it into handy factsheets that are readily accessible for every one of their categories.

You can see from the chart below (included in the factsheet for their aggressive growth portfolio) that they have a history of overall success with their Hargreaves Lansdown ISA.

Source: Tools – Hargreaves Lansdown

If you are new to the world of investments, you may find the education centre and tools a helpful addition to the other services that are offered through Hargreaves Lansdown. This is significant to mention in a Hargreaves Lansdown review.

You can find an entire section filled with helpful guides for how to select Hargreaves Lansdown funds, how the Hargreaves Lansdown ISA works, and how to save for retirement in one convenient location.

You may also find their calculator section useful. Apart from just the Hargreaves Lansdown ISA calculator discussed previously, you can find calculators for all of the following options as well:

- Inflation

- Household budget

- Pension tax relief

- Income tax

- Drawdown

- Annuity delay

- Emergency tax

- Longevity

The additional tools and education centres are compelling items to consider in an objective Hargreaves Lansdown review.

These are beneficial even to the most seasoned professionals who may be able to take advantage of a quick calculation or need to brush up on the finer details of a specific investment strategy.

Popular Article: WiseBanyan Review | Robo Comparison (WiseBanyan vs. Betterment)

Hargreaves Lansdown App

With most of the world moving quickly to mobile, a Hargreaves Lansdown review would be remiss not to include the Hargreaves Lansdown app in the list of services and tools that the company has to offer.

The app features live investment trading with detailed information regarding updated news and financial information concerning your investments. From the Hargreaves Lansdown app, you can monitor and manage all of the money you have under Hargreaves Lansdown asset management.

You can enjoy interactive graphs and a customizable dashboard so you can view the information that is pertinent to you quickly and easily with just a few taps on the screen.

The Hargreaves Lansdown app was the first share and funding app in the UK back in 2011. Perhaps the most important feature of an app designed to help you manage your money and investments more adequately is the security.

Your information in the Hargreaves Lansdown app is stored within the app, to be deleted upon your logout.

The information you enter (never any sensitive information after the initial set up) is not stored on your device. If you let your tablet sit out for too long, the Hargreaves Lansdown app will automatically sign you out.

In 2014, the iPad app known as HL Live won the Best Financial Services Campaign in a Hargreaves Lansdown review at the MOMA awards sponsored by The Drum magazine.

Perhaps one of the best features of the mobile app that is important to note in a Hargreaves Lansdown review would be the cost of the app. If you are interested in monitoring all of your investments on the go with Hargreaves Lansdown, the good news is that their app is absolutely free. You can utilize their services with convenience without the cost of investing in their annual Hargreaves Lansdown charges as well as their app.

Conclusion: Is a Hargreaves Lansdown ISA for You?

Good features abound with the Hargreaves Lansdown ISA or the Hargreaves Lansdown stocks and shares ISA. It takes only a few minutes to set up your account and fund it with the low minimum deposit, and you can take advantage of any number of wonderful investment tools, calculators, and successful Hargreaves Lansdown funds.

The Hargreaves Lansdown fees are relatively low in comparison to their competitors, making them a viable alternative to Nutmeg and other popular robo advisors in the UK. For a transparent robo investing platform that includes fancy features and a sizeable education centre, you can’t seem to go wrong with using this firm or their educational features.

Take advantage of their premade portfolios or choose to invest and self-select your own Hargreaves Lansdown funds for a custom Hargreaves Lansdown ISA that suits your investment needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.