Overview: Advisory HQ’s Top Ten Tips to Find the Best Health Insurance Plans for Individuals & Small Business

Many of us have worried that getting an affordable plan from health care insurers was out of our reach. Plans offered by health care companies have been historically expensive, but the landscape is changing because of:

- ACA

- Medicaid

- Competitive marketplace

If you think that health care companies are too expensive, it will be important for you to read this article so that we can help you to find the best health insurance plans for you, your family or your business.

Image Source: Mediad

In this article we will unpack issues relating to the best health insurance available to you depending on your economic, social, and health situation. As well as discussing reviews of the top health insurance companies in the country, we will examine:

- The best health insurance plans for individuals

- How to get health insurance for small business

See Also: Northwestern Mutual Reviews | What you Need to know about Northwestern

Understand How the Landscape Has Changed for Health Care Insurers

Wheresident Obama introduced new health reform law in 2010, it changed the way the market that health care companies operate in compn Pletely. Until these reforms were put into place, the majority of Americans felt that they could not afford the best health insurance packages.

Image Source: Tracy Taguchi

Although there is still a lot of grumbling in some sectors about the health reform law, six years on, the positive change for people looking for the best health insurance plans for themselves, their families, and their businesses have more options available to them.

- Pre-existing conditions: As of 2014, health care companies can no longer charge more or deny cover for people with pre-existing health conditions or current health status.

- Preventative care: Health care insurers must offer a wide range of in-network preventative services without the burden of deductibles.

- Family policies: Even the top health insurance companies were cutting children and young adults off from family policies at 18 – 21 years. New regulations mean that health care companies must offer coverage for families until the “children” are 26 years old.

- Lifetime limits: Obamacare removed the limitations that were being put on people paying for the best health insurance. This means that health care insurers are no longer allowed to limit the number of days in hospital per year, for example.

- Profit watch: Health care insurers now have to submit proposals for high rate hikes for review and approval at federal level. Furthermore, if they are spending less than 80% of their income on health care, they must reimburse policyholders the difference.

- Cancellation: Before Obamacare, regardless of how much you had paid for your health insurance, even the top health insurance companies could cancel your policy or refuse to pay out on a claim for small mistakes made on application forms. Now, they can only cancel for fraud or non-payment.

Don’t Miss: New York Life Insurance Reviews | Is NY Life a Reliable Company? (Ratings, Pros & Cons)

Do You Think You Can’t Afford It? The Best Health Insurance Plans Are Available to You, Too!

All the changes to the healthcare landscape have been wonderful for those who already have the best health insurance plans. Their health care insurers are giving them more bang for their buck and they are more protected in terms of making claims, extended family plans, more preventative care options, and fewer limits.

Yet tens of millions of Americans remain uninsured. The problem is that the part of the population who do not have health care are still under the illusion that health care companies have nothing to offer them. Even if you think you cannot afford health insurance, there are options out there, and at Advisory HQ, we are here to help you find the best health insurance plans for you.

The US Department of Health and Human Services says that over half of uninsured Americans could qualify for health insurance through the marketplace but have just not looked into it. Let’s break it down for you.

Looking at the Affordable Care Act

We have already looked at how the Affordable Care Act has made a positive change to the health care market in America. But on a practical level, how can you access it? Now is a great time to find out because there is a brief window for enrollment just around the corner.

In order to find out about the best health insurance plans for individuals, you can enroll online, by phone, mail, or in person between November 1, 2016 and January 31, 2017. For more detail, visit usa.gov.

On the site you can:

- Sign up for health insurance

- Re-enroll for cover

- Change your existing cover

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Think of New Ways to Get the Best Health Insurance Plans

There are so many ways to get health insurance that you may never have thought of. Let’s have a look at some of the options in terms of the best health insurance plans for individuals.

- Group plans: If you or your spouse just got a new job, or if you have never spoken to human resources about the kind of health care benefits you might have with your job, now is the time! Many group plans are available through employers, and you and your spouse/dependents may be covered.

- Parents’ plan: As discussed above, family plans now cover young adults to the age of 26. So, if you thought you might be cut off from your parents’ plan after your 21st birthday, think again!

- Government programs: Some of the best health insurance plans for individuals may be available to you through a government program.

- Veteran services: There are plenty of options available to veterans looking for the best health insurance for themselves and their families – check out more here: Health Care Options for Veterans.

- State insurance plans: Some states work with health care companies to provide health insurance to different sectors or groups; for example, in North Carolina, there are state health insurance options for teachers and state employees.

- Marketplace: This can be a good place to start in terms of laying out all your options. Visit the U.S. Government site here: www.healthcare.gov for estimations on the best health insurance plans and enrollment.

Research the Factors Affecting the Best Health Insurance Plans for Individuals

It is difficult for Advisory HQ or any advisor to give a comprehensive list of the best health insurance plans for individuals because what defines the best health insurance plans for people and their spouse or family varies according to the health and economic situation of each applicant.

If you are looking for the best health insurance in terms of price, this will depend on:

- Age

- Location

- Gender

- Whether you are a smoker

- Qualifying life events

- Individual requirements

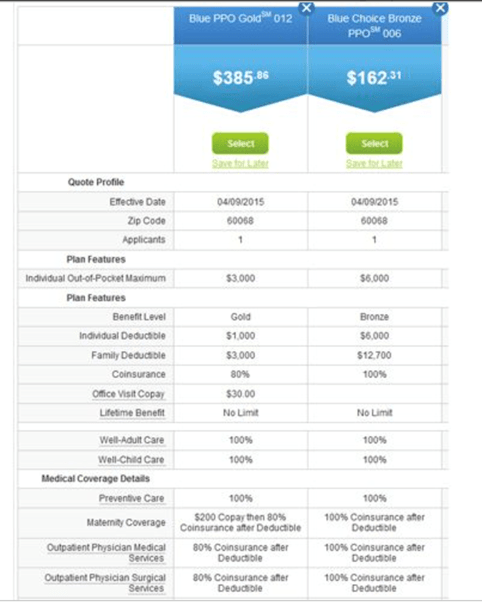

It is important to note that lower premiums does not necessarily equate to the best health insurance. Although the cheap monthly payments may seem attractive, you will have to consider the type of coverage the health care companies are offering and the deductibles that may apply.

The Term “Top Health Insurance Companies” Is Meaningless Unless They Can Provide the Right Coverage for You

Top Ten Reviews carried out a thorough review of the top health insurance companies in the country and awarded their Gold Award prize to Blue Cross Blue Shield. The basis on which they awarded this company the best health insurance was:

- A huge variety of plans (more than 20)

- Nationwide availability

- Good prices

- Wide range of options

- Discount programs

- Good website

- Online prescription manager

Image Source: Top Ten Reviews Blue Shield Blue Cross Review

As there are variations between states in terms of quality of service and incost according to your situation, this may not necessarily be the best health insurance company for your needs, but the factors above are important when it comes to considering the best health insurance companies for you.

Forbes also did an interesting breakdown of the top health insurance companies in America. Their list of health insurance companies was of the best health insurance companies in terms of size, with the top three coming down to:

- United Health Group: Market value – $112 billion

- Anthem: Market value – $41 billion

- Aetna: Market value – $38 billion

Another list of health insurance companies providing the best health insurance was tackled by Simple Dollar, which has examined the sector according to state and customer satisfaction. When it came to customer satisfaction, Blue Cross Blue Shield came out high, beaten only by Kaiser Permanente.

Government Options for Health Insurance for Small Business: Is SHOP a Flop?

According to the 2012 census, there are over 28 million small businesses in America. Although businesses with less than 50 employees are not legally obliged to provide health care to their employees, companies have found that it is hard to attract and keep skilled staff if they do not offer the best health insurance.

There was excitement around the prospects of health care reform leading to more options for health insurance for small business. The government health care plan does claim to offer health insurance for small business options through SHOP – Small Business Health Options Program.

Unfortunately, the SHOP initiative does not seem to have met needs when it comes to health insurance for small business in the United States. Critics of the plan, which promised affordable and accessible health insurance for small business, have been disappointed, citing the following as the failures of SHOP:

- Delay in enrollment

- Technical problems

- Limited options for businesses and employees

- Tax liabilities difficult to navigate

Although SHOP is still finding its feet, there are plenty of promising examples of how SHOP has been a helpful platform in providing health insurance for small business.

Related: Average Life Insurance Cost | Average Cost Of Whole Life and Term Life Insurance

Consider Other Options: Health Insurance for Small Business

If Obamacare’s options for health insurance for small business do not offer what you need, there are lots of other ways to cover your employees at work.

- Individual Health Insurance: Through these types of work schemes, employers offer to pay for (at least, in part) health insurance that employees take out themselves as individuals.

- Private Exchange: Similar to Individual Health Insurance described above, Private Exchange is slightly more limited, in that an employer will provide a list of health insurance companies with whom the employee can take out a plan. Through this plan, employers provide an agreed contribution toward the plan.

- Cooperative: When looking for health insurance for small business, businesses could think of going down an old-school route of joining a cooperative in order to leverage their group power and get discounted rates from health care insurers.

- Private Small Group Plan: If joining a cooperative is not an option, businesses can still work as a small group in order to get better deals from the best health insurance companies.

Questions To Ask About the Best Health Insurance Plans

When you are looking for the best health insurance plans for individuals or health insurance for small business, before you think about comparing prices, you need to ask the following questions about the plan:

- Which doctors, hospitals, clinics, and pharmacies can I use?

- Does this plan cover specialists?

- Does this plan cover special conditions?

- Does this plan cover nursing home/home care?

- Will this cover any costs of medicines?

- What are the deductibles?

- Are there any out-of-pocket expenses I should be aware of?

- How do customers settle disputes?

Do Your Research Into the Best Health Insurance Companies

As with almost every service out there, there are comparison sites and brokers that can produce a list of health insurance companies that meet your needs in terms of price and location. Some examples include:

You can also find out about the best health insurance available to you by visiting review sites that have up-to-date information on health care companies. If you are not sure where to start, you can look at:

However, when it comes to finding the best health insurance quotes, it is advisable to visit the individual websites of the top health insurance companies in order to get accurate information about the types of payments and deductibles that are associated with the health insurance plans.

Popular Article: Healthcare Consultants | Medical Consultant Job Description, Salary, and Function

Recommendations on Finding the Best Health Insurance

There are two main points to remember when you are looking for the best health insurance, be it the best health insurance plans for individuals or health insurance for small business.

Image Source: Florida MIG

Firstly, no matter what your financial situation is, whether you are unemployed, low income, or a student, the world of health insurance has changed, and if you do a bit of digging, you can find the best health insurance plans for you.

Secondly, there are lots of factors that go into defining what the best health insurance is. Cheap does not mean good if it does not cover you for the specific things you need. Think about the type of coverage that you and your family or employees need. For example, if you take a lot of medication, you might think about a plan that covers prescription costs.

When you are making decisions about health care insurers, do your research; make a list of health care insurance companies that cover you according to your location, age, or other factors; and then do some more research to see if you are happy with what they have to offer.

As with every agreement that you enter, read the small print to ensure that you understand what you are covered for and what extra costs there might be. The right health insurance plan is out there for you; you just need to find it!

Read More: The Best Top Healthcare Consulting Firms (Ranking and Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.