2017 Guide to Finding the Best High Yield Savings Accounts Online or Local

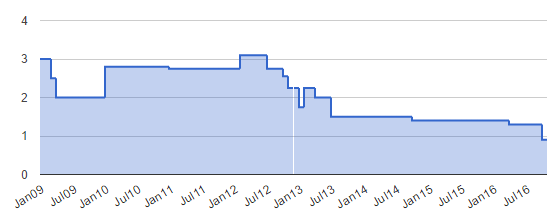

Low interest savings accounts got you down? You’re not alone. Interest rates on savings accounts have been steadily declining since 2014 and have seen as much as a 12% difference since 1990.

This steep decline has forced people to search for the highest paying savings accounts that will meet their financial needs.

Image Source: Swanlowpark.co.uk

Why the significant drop in interest rates for savings accounts? Mostly because mortgage interest rates have lowered to 3–4%.

If a bank gave customers a 5% interest rate for its savings accounts with only a 4% return on mortgages, the bank would lose money. Therefore, banks with the highest savings interest rates probably charge more interest for mortgages and other loans.

As housing prices fluctuate, so does the need for loans.

If a bank hands out more mortgage loans with low interest rates during a specific time period, chances are it will not be offering savings accounts with high interest rates.

So, how can you find the highest interest rate for a savings account so you can feel satisfied with its return on investment?

This article will provide six useful tips to lead you to some of the best high yield savings accounts available. But first, what are high yield savings accounts, and how do these accounts differ from other savings accounts?

See Also: Best Money Market Rates | Money Market Accounts with High Rates

What Does High Yield Savings Mean?

A highest yield savings account or high interest savings account is as it sounds: a type of savings account with a competitive interest rate.

However, the definition for highest yield savings varies from year to year and with one’s perspective. Not everyone will have the same expectations when they hear the term “high interest savings.”

Image Source: Magnifymoney.com

For the year 2016, the best high yield savings rates hover around 1%. How does this add up for you? It depends on whether your savings account uses simple or compound interest.

- Simple interest is calculated using the principal investment. For example, if your savings account highest interest rate is set at 1% simple interest and you have $10,000 in your account, you will accrue $100 in interest by the end of the year. Even with a high yield savings rate of 1%, that is not significant interest.

- Compound interest calculates interest using the principal amount and already-earned interest, usually daily or monthly. Compound interest has the potential to provide the highest interest rate savings accounts for you because the interest keeps stacking upon itself.

Regardless of your interest rate and type of interest on the savings account you choose, keep in mind that the only way to make interest work for you is by making regular deposits to your savings account.

Without deposits, even high interest savings accounts will seem stagnant.

How to Handle a High Interest Rate Savings Account

To prevent your high interest rate savings account from going to waste, make it a point to save regularly. To set your savings goals on track, consider the following tips to make your high interest rate savings account work for you:

- Set aside a portion of each paycheck. Whether you get paid weekly or bi-weekly, try to set aside a certain percentage or a specific amount from each paycheck for savings. This can be a small amount, like $5, if that is all you can afford. Some savings is better than no savings at all, and you will be surprised how fast it can add up when gaining compound interest on the highest paying savings accounts.

- Set up auto payments. Once you decide on an amount you want to set aside from each paycheck, set up an auto transfer between your checking and high interest rate savings account. The money will be transferred automatically so you do not have to worry about forgetting, and you will get used to managing your finances without that amount readily available.

- Consider an online high interest savings account. Or at least set up an online account to view your savings account information. An online high interest savings account allows you to instantly view your information so you can visually keep track of your savings. Check at least once per month so you can see how much interest you have accrued, which will keep you motivated to keep saving.

Banks with the highest savings interest rates are available both online and at brick-and-mortar locations. Most large banks have websites where you can complete online banking transactions and view account information.

The type of bank you choose depends on your personal needs.

Some banks are Internet-only banks. Although this is not an issue for most people, if you prefer to speak with your bank representatives in person, opening an online high interest savings account may not be the best choice for you. Internet-only banks often have special ATM locators on their websites to help you find free ATMs should you need one.

Don’t Miss: Best Financial Goals to Set in This Year (Examples of Short & Long-Term Financial Goals)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How can you find the best high yield savings account? Here are six tips to help you in your search.

Tip #1: Use Your Current Bank

The best way to do this is for them to offer added value to what they already have, often in the form of bundling products or offering added benefits for new accounts.

For example, your bank might offer rewards, like lower loan interest rates and savings accounts with high interest rates, to stand out against competitors. This is known as a loyalty reward for remaining a loyal customer. The longer you are with a particular bank and handle your account responsibly, the more rewards you may qualify for.

Image Source: CapitalOne360.com

Using your own bank can also make access to your money more simplified. For example, Capital One 360 provides online banking that allows you to transfer money between your Capital One 360 accounts instantly.

You can even set up automatic transfers from your checking account to your high yield savings account.

The best way to find your bank’s reward offers is to speak with a representative. If you are honest and tell the representative the options you are considering for banks with highest savings interest rates, he or she could find you a better deal at your own bank.

Related: Best Money Management Tips (What You Need to Know About Money Management)

Tip #2: Look for Rates of at Least 1%

The highest paying savings accounts in 2016 are those with high yield savings interest rates of 1% or more. With the national savings account interest rate nearing new lows for 2016, the highest yield savings accounts are those with rates closest to or over 1%.

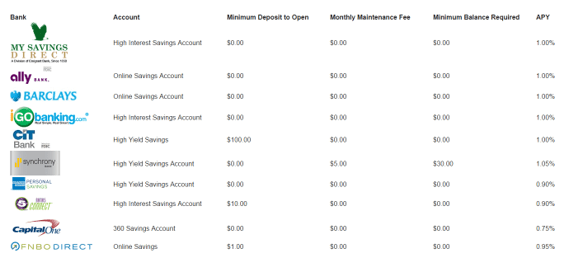

Image Source: Huffingtonpost.com

Although the first thing you will want to check for prospective highest interest rate savings accounts is the current APY, there are several other things you will want to keep in mind regarding their benefits, like:

- ATM access

- Withdrawal policies

- Maintenance fees

- Minimum deposit amount

- Minimum balance

- FDIC insurance

Finding the highest interest rate for a savings account is extremely important in meeting your financial goals, but it is not the only important part of a savings account. To make the most of your high interest savings, research more information about the bank and its savings accounts. This will help you find the best high yield savings account all-around.

Tip #3: Compare Highest Interest Rate Savings Accounts Online

To best compare high interest savings accounts, you should use the power of the Internet. There is a wealth of information on the web that you can use to compare the best high yield savings accounts quickly, taking into consideration pertinent information about each account.

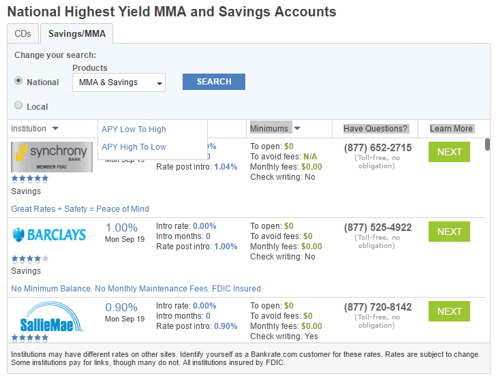

Image Source: Bankrate

Many websites that compare high yield savings accounts use tables to conveniently compare each account and what it offers. Bankrate, for example, offers a table with several savings account options to help you narrow down your search. You can filter by high yield savings rates, minimum deposit, monthly fees, and more.

Once you narrow down your search and have decided on a few of the best high yield savings accounts, you can choose to call each bank or check its website for more information. The Internet is a good place to start looking through your choices.

Popular Article: Complete Guide | How to Budget Money This Year (Tips, Details, Online Budgeting Tools)

Tip #4: Search for Savings Accounts with High Interest Rates and Added Benefits

Even the highest paying savings accounts are useless if they come with drawbacks, like large minimum deposits or hefty monthly maintenance fees. You should not only avoid savings accounts that won’t make the most of your savings, but you should also search for accounts that will help you reach your savings goals faster by offering added benefits in addition to high interest savings.

For example, some savings accounts require you to hold your money in the account for a certain period of time before it is available for withdrawal. Other high interest rate savings accounts allow you to withdraw money when you need it, much like a checking account. If having your money readily available to you is important, you should find a high yield savings account with no withdrawal restrictions.

Image Source: Bankingsense.com

You can find other benefits specific to certain banks. For example, Bank of America offers a program called Keep the Change.

When you link your checking account with your high interest savings account and make a purchase with your debit card, your purchase amount is rounded to the next dollar. The difference is automatically transferred to your high yield savings account as a deposit you do not even have to think about.

Tip #5: Research All Possible Fees from High Interest Savings Accounts

What seems like the best high yield savings account may not always be the best choice. Does it have monthly maintenance fees? Or fees for not maintaining a certain balance each month? Some banks impose fees as a way to make extra money from your account. You should always check the fine print of a savings account to see what fees, if any, you will be responsible for.

A bank has a right to charge a monthly maintenance fee without any stipulations. These fees can be a few dollars or more each month.

Your account may have a high interest savings rate, but you lose money every month to the maintenance fee. Some banks only impose the monthly maintenance fee if your account drops below a minimum amount.

If you would rather not have to worry about money being taken from your high yield savings account, look for accounts with no minimum balance fee or maintenance fee.

Tip #6: Take Your Time and Become a Valued Customer

Finding the best high yield savings account can take time but will be worth it in the end. Do not expect your bank to offer you great deals on a savings account if you just opened a checking account two months ago.

Banks may offer rewards to their most valued, responsible customers after a proven history of financial responsibility.

Make sure your current account gets used frequently and responsibly. Do not allow overdrafts or bounced checks.

When your bank sees you as a customer who values his or her finances consistently, you will be more apt to receive rewards from the bank. Proving yourself as a valued customer can lead you to better high interest savings accounts and rewards from your bank.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Best High Yield Savings Guide

The best high yield savings accounts can take time to find, but do not rush the process.

Saving money is an important financial step, and your choice of savings accounts with high interest rates can affect how much money you have saved in one, five or ten years.

Search wisely on the Internet to find accounts that offer helpful rewards and convenient access to your money while having no fees or minimums.

Read More: How to Budget Your Money – Top Budgeting Tips

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.