Finding the Best Money Market Rates and Accounts With High Rates

When searching for the best money market account (MMA) rates, consumers generally ask the below questions:

- Which bank offers the best money market rates?

- How do I find the best money market deposit account that matches my needs?

- Where can I compare money market savings rates?

Finding the best money market savings account that matches your specific banking needs is extremely important as it’ll determine how much earnings you can generate from your money market account.

Image source: Pixabay

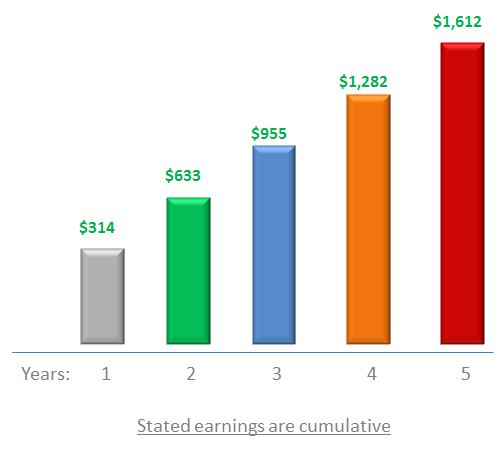

Below is an example of how much savings you could earn from depositing $25,000 in a high-interest money market account.

Potential Savings

Assume you were to deposit $25,000 into an MMA that pays a high yield (APY) of 1.25% and has no money market monthly account fees.

Your total savings on this high yield money market account would be $1,612.33 over a five year period with daily rate compounding.

Benefits of Money Market Accounts

Most money market accounts require that you hold a higher minimum balance than high yield savings and checking accounts.

The upside is that by complying with the minimum balance requirements, the money market interest rate can earn higher returns on your cash balances – sometimes significantly so – than with a regular checking account.

Additionally, in the event that you need to quickly withdraw the money in your account, you wouldn’t have to pay stiff penalties or forego interest earned as you would on a high-interest certificate of deposit account.

Some money market accounts also allow you to perform a limited number of regular banking transactions, such as ATM withdrawals and bill payments.

In addition, there are some high yielding money market accounts (included on our list) that do not mandate a minimum balance.

Best Money Market Rates

This AdvisoryHQ article presents a comparison review of the best money market savings accounts with the highest interest rates and yields.

We also provide an additional overview of the banks offering these high-interest money market accounts.

The top money market rates presented in this article include:

- EverBank (1.11%–1.73%)

- iGObanking Money Market Savings Account (1.10%)

- Sallie Mae Money Market Account (1.07%)

- ableBanking (1.00%)

- Ally Bank Money Market Account (0.85%)

- Synchrony Money Market Account (0.85%)

- First Internet Bank (0.80%)

- Discover Money Market Account (0.75%–0.80%)<

- Bank of Internet USA (0.75%)

- NASB Money Market Checking (0.70%–0.90%)

- Nationwide (0.60%)

- Mutual of Omaha Bank Online Money Market (0.10%–0.85%)

- Northeast Bank (0.10%–0.35%)

- State Farm Money Market Savings (0.00%–0.25%)

See the table below for a detailed comparison of these accounts.

What Is a Money Market Account?

So what exactly is a money market account? Similar in nature to most savings and checking accounts, a money market account (MMA) is a federally-insured (by the FDIC) money-saving vehicle. It requires you to hold a higher account balance than a regular checking account, but it also pays higher interest on balances held.

Minimum Balance vs. Minimum Opening Balance

Each institution/bank maintains its own policy regarding how much money an account holder should initially deposit in order to open appropriate money market accounts.

That minimum amount is referred to as the “minimum opening balance” or “min. opening balance.”

However, most institutions will also stipulate a minimum average daily balance that the account must hold in order to remain eligible for earning the best money market rates or remain exempt from either monthly account maintenance/administration or transaction fees.

That balance is referred to as the “minimum balance.”

Top Money Market Rates Comparison

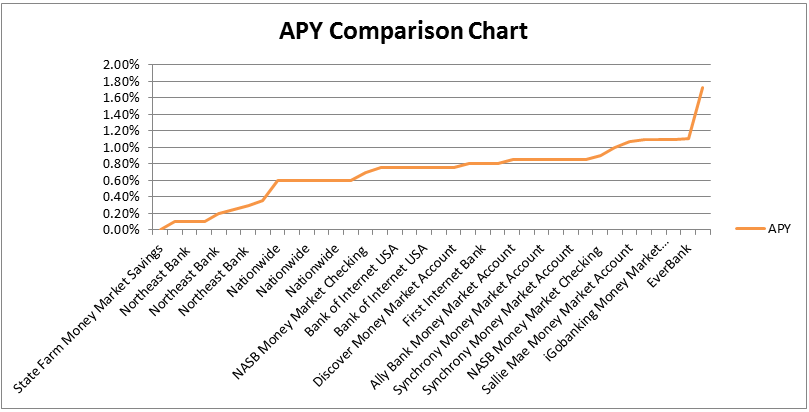

Below is a comparison review of some of the best MMA rates and APYs (annual percentage yields) that are currently offered by banks and financial institutions around the country.

Note: Some banks offer multiple APY rates based on account balances.

Sorted by APY (highest to lowest)

| Banks | APY | Balance (From) | Balance (To) | Min. Opening Deposit |

| EverBank | 1.73% | $150,000.01 | $10,000,000 | $1,500 |

| EverBank | 1.11% | $0.00 | $150,000 | $1,500 |

| iGObanking Money Market Savings Account | 1.10% | $25,000 | $74,999 | $25,000 |

| iGObanking Money Market Savings Account | 1.10% | $75,000 | $99,999.99 | $25,000 |

| iGObanking Money Market Savings Account | 1.10% | $100,000 | > $100,000 | $25,000 |

| Sallie Mae Money Market Account | 1.07% | $0.01 | > $0.01 | $0 |

| Able Banking | 1.00% | $0.01 | > $0.01 | $250 |

| NASB Money Market Checking | 0.90% | $50,000 | > $50,000 | $1,000 |

| Ally Bank Money Market Account | 0.85% | $0.01 | >$0.01 | $1 |

| Mutual of Omaha Bank Online Money Market | 0.85% | $1,000 | $1,000,000 | $1,000 |

| Synchrony Money Market Account | 0.85% | $0.01 | $4,999 | $30 |

| Synchrony Money Market Account | 0.85% | $5,000 | $9,999 | $30 |

| Synchrony Money Market Account | 0.85% | $10,000 | $24,999 | $30 |

| Synchrony Money Market Account | 0.85% | $25,000 | > $25,000 | $30 |

| Discover Bank Money Market Account | 0.80% | $100,000 | > $100,000 | $2,500 |

| First Internet Bank | 0.80% | $100 | >$4,000 | $100 |

| NASB Money Market Checking | 0.80% | $25,000 | $49,999.99 | $1,000 |

| Bank of Internet USA | 0.75% | $1.00 | $9,999 | $100 |

| Bank of Internet USA | 0.75% | $10,000 | $24,999 | $100 |

| Bank of Internet USA | 0.75% | $25,000 | $49,999 | $100 |

| Bank of Internet USA | 0.75% | $50,000 | $99,999 | $100 |

| Bank of Internet USA | 0.75% | $100,000 | > $100,000 | $100 |

| Discover Bank Money Market Account | 0.75% | $1.00 | $99,999 | $2,500 |

| NASB Money Market Checking | 0.70% | $0.01 | $24,999.99 | $1,000 |

| Nationwide | 0.60% | $0.01 | $999.99 | $1,000 |

| Nationwide | 0.60% | $1,000 | $9,999.99 | $1,000 |

| Nationwide | 0.60% | $10,000 | $24,999.99 | $1,000 |

| Nationwide | 0.60% | $25,000 | $49,999.99 | $1,000 |

| Nationwide | 0.60% | $50,000 | $99,999.99 | $1,000 |

| Nationwide | 0.60% | $100,000 | > $100,000 | $1,000 |

| Northeast Bank | 0.35% | $75,000.01 | > $100,000 | $100 |

| Northeast Bank | 0.30% | $75,000 | $99,999.99 | $100 |

| State Farm Money Market Savings | 0.25% | $2,499.99 | > $2,500 | $1,000 |

| Northeast Bank | 0.20% | $15,000 | $74,999.99 | $100 |

| Mutual of Omaha Bank Online Money Market | 0.10% | $1,000,000.01 | > $1,000,000.01 | $1,000 |

| Northeast Bank | 0.10% | $0.01 | $9,999.99 | $100 |

| Northeast Bank | 0.10% | $10,000 | $24,999.99 | $100 |

| State Farm Money Market Savings | 0.00% | $0.01 | $2,499 | $1,000 |

The data in the table above is presented in the chart below.

Click here (Best MMA Accounts) for additional information and features on these banks.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Can I Use a Money Market Account and Close My Regular Checking Account?

That depends.

Federal law restricts the number of banking transactions that an account holder can do using an MMA.

Additionally, in some instances, money deposited into a money market account isn’t immediately available for withdrawal.

There might be a longer “hold” period for such funds compared to a checking account.

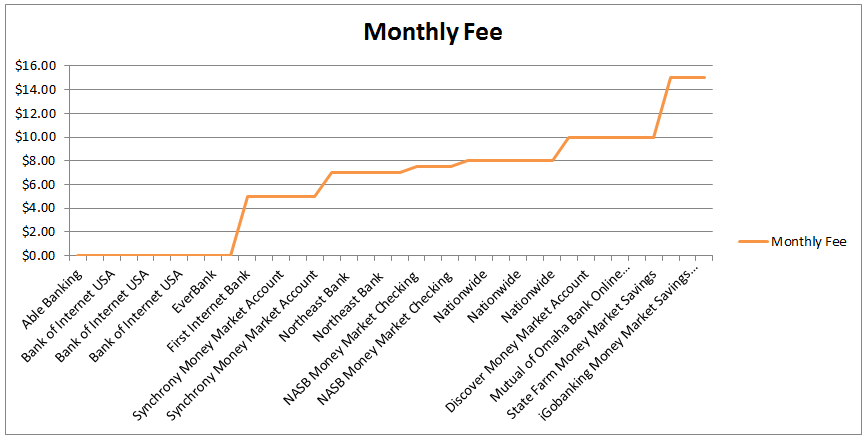

Money Market Rates – Monthly Fees and Additional Comparison

Before deciding on one of the money market deposit accounts presented in this article, you’ll also want to consider the stated MMA monthly fees or minimum balance requirements.

See the table below for a list of money market account monthly fees.

Sorted by highest to lowest money market monthly fees

| Banking Firms | Monthly Fee |

| iGObanking Money Market Savings Account | $15 |

| Discover Bank Money Market Account | $10 |

| Mutual of Omaha Bank Online Money Market | $10 |

| State Farm Money Market Savings | $10 |

| Nationwide | $8 |

| NASB Money Market Checking | $7.50 |

| Northeast Bank | $7 |

| First Internet Bank | $5 |

| Synchrony Money Market Account | $5 |

| Able Banking | $0 |

| Ally Bank Money Market Account | $0 |

| Bank of Internet USA | $0 |

| EverBank | $0 |

| Sallie Mae Money Market Account | $0 |

MMA Monthly Fee Breakdown Chart

Click here (Best MMA Accounts) for additional information and features on these banks.

Minimum Balance – Top MMAs

Below is a list of minimum balances required to maintain the listed money market accounts.

Some of these MMAs do not require a monthly minimum.

| Banking Firms | Minimum Balance |

| iGObanking Money Market Savings Account | $25,000 |

| EverBank | $5,000 |

| First Internet Bank | $4,000 |

| Discover Bank Money Market Account | $2,500 |

| Northeast Bank | $2,500 |

| Mutual of Omaha Bank Online Money Market | $1,000 |

| Nationwide | $1,000 |

| NASB Money Market Checking | $1,000 |

| State Farm Money Market Savings | $500 |

| Synchrony Money Market Account | $30 |

| Able Banking | No min. balance |

| Ally Bank Money Market Account | No min. balance |

| Bank of Internet USA | No min. balance |

| Sallie Mae Money Market Account | No min. balance |

Are Money Market Accounts and Money Market Funds Synonymous?No! Money market accounts are deposit accounts that are insured by the FDIC.

Money market funds, on the other hand, are mutual funds that invest in short-term debt. These funds are not insured by the FDIC, and, despite their low-risk nature, your invested funds are not protected.

Why Open a Money Market Account?

You should consider opening a money market account if you frequently have “spare” cash available because:

- It takes you some time (a month or two) to decide on where to invest recurring cash flows.

- The nature of your business (or personal financial situation) is such that you need to periodically hold significant cash balances for some time before disbursing the cash towards predetermined obligations (a personal/business loan repayment, regular student debt servicing, etc.).

- You need to maintain a high cash balance (perhaps several thousand dollars) indefinitely, which you might need access to quickly in an emergency or a crisis situation.

If either of these situations describes your own predicament, then you likely do not want to hold that cash in your regular checking account.

The outcome of that is your cash balance will earn you little to zero interest – and may even erode over time because of inflation!

If you are confident that you won’t need access to that money in a hurry over the foreseeable future (several months to many years), then you could deposit the funds in one of the MMAs presented in this article.

Other alternatives would be to deposit the funds in a high-interest rate CD, high yield checking account or in a savings account that pays a high-interest rate.

Can I Maintain a Money Market Account as Well as a Checking Account Simultaneously?

Yes! Ideally, if you have excess cash available, you should consider parking it in a money market account, while doing your day-to-day banking using your regular checking account.

Some institutions also allow you to “link” your MMA to your checking account, allowing additional overdraft protection.

Additional Information and Features

State Farm Bank

State Farm Bank is one of the nation’s most renowned insurance companies. It offers money market savings accounts where depositors can safely park their excess funds and earn comparatively higher returns.

Account holders can get started by opening an account with as little as $1000, and if you maintain a $500 average daily balance, you will not have to pay a minimum balance fee.

Key features of a State Farm Bank Money Market Savings Account:

- You can open your account with an initial deposit of as little as $1,000.

- Any balance of $100 or more will earn you interest.

- Interest on your MMAs is compounded daily and credited to your account on a monthly basis.

- This account is insured by the FDIC.

- If you use State Farm Bank ATMs, you are not charged a fee for such transactions.

- Online banking and bill payment are offered as a complimentary service.

- Flexible withdrawal options are available – via ATM, online transfer, mail, or telephone.

Anyone with a valid Social Security number (SSN), Tax Identification Number (TIN) or Individual Taxpayer Identification Number (ITIN) can open a money market account with State Farm Bank. While joint or primary account holders may be as young as 13 years of age, at least one account holder must be 18 or older.

Northeast Bank

In business since 1872, Northeast Bank is a full-service community bank that serves western, central, and southern Maine as well as customers along seacoast New Hampshire.

Key features of Northeast Bank’s Money Market Account:

- The bank offers two flavors of money market accounts, including an IRA-eligible account called a Pearl Money Market.

- The minimum daily balance to earn one of the best MMA rates (APY) starts as low as $0.01.

- The bank’s graduating APY scale makes it more attractive for individuals to save more since the APY rates rise along with their balances.

- Accounts can be opened with a minimum deposit of $100.

- You have great flexibility in accessing your money, including via pre-authorized, automatic, telephone, and online transfers or by check or debit card.

While not applicable to the bank’s existing clients, there is also a promotional rate that the bank offers to new clients who open a Pearl Money Market Account.

Mutual of Omaha Bank

While synonymous with the long-running nature TV show, Mutual of Omaha’s Wild Kingdom, the Omaha Bank has a legacy that dates back over a century – as far back as 1909 when it was founded. The company maintains a strong balance sheet, which gives it stability that is envied by many of its peers, signaling that it will be around for a long time to come.

Key features of Mutual of Omaha Bank’s Money Market Account:

- FREE access is given to a nationwide network of 22,000 ATMs.

- FREE online banking and e-statements are included.

- FREE online bill pay and account-to-account transfer are available.

- Money market deposit account funding is available through ACH or check.

- Unlimited deposits and withdrawals are possible at a community bank or bank ATM.

- You are provided with 24/7 online access to your money.

While the bank does impose a monthly maintenance fee, this charge can be avoided by maintaining an average collected balance of as little as $1,000.

Discover Bank

Already one of the nation’s leaders in the credit card arena, Discover Bank has earned a great reputation for its money market savings accounts. The bank consistently scores high on customer privacy protection through its proactive fraud monitoring, bill pay protection and $0 liability protection initiatives.

Image source: Pixabay

Discover Bank has also been featured among the best banks with high yield accounts in America by AdvisoryHQ.

Key features of Discover Bank’s Money Market Account:

- Access your money via a massive 60,000-strong network of ATMs nationwide.

- Enjoy one of the best money market rates/highest APYs offered for comparative accounts (depending on minimum balances held).

- Flexible mobile banking applications make it a breeze to move, transfer or deposit money from anywhere.

- View account balances and account activity 24/7 using any mobile device.

- Get access to Discover’s online bill payment service to pay your bills promptly and avoid late fees/surcharges.

All of Discover’s Money Market Account deposits are insured to the maximum value allowed by the FDIC.

First Internet Bank

Contrary to many who may believe otherwise, First Internet Bank has shown that a high-tech financial institution can indeed deliver highly personalized banking experiences to its customers. And that’s exactly what this bank has been doing since its founding in 1999.

Key features of First Internet Bank Money Market Account:

- Open an MMA with as little as $100.

- When applicable, the bank only charges a low monthly maintenance fee of $5.

- Maintain an average daily balance of $4,000 in your money market deposit account, and you’ll avoid the monthly maintenance fee.

- Each money market account comes with a free ATM card.

- The bank offers an ATM surcharge rebate of up to $10 per month.

Since its founding, the bank has extended its reach and now operates in all 50 states nationwide.

It was recently named a “Best Online Bank” by industry watcher GOBankingRates and has surpassed the $1 billion savings milestone.

North American Savings Bank (NASB)

NASB has been on the banking scene since 1927 and offers its clients a range of banking, savings and lending products – from money market accounts, checking accounts, and retail banking to residential and commercial lending, construction lending, and IRA-related real estate loans.

Key features of NASB’s Money Market Checking Account:

- Money Market Account and checking accounts are “blended” into a single product.

- The more you save, the higher the interest you will earn on your balance.

- Current interest rates are guaranteed until the end of next year (Dec 2016).

- Account holders get free access to Internet banking and receive free e-statements.

- You get access to a wide range of free financial management tools.

- The bank allows direct deposit for quick funds deposits into your money market savings account.

Rarely seen in the industry, NASB’s Money Market Account is a great opportunity for retail clients to take advantage of the features of a checking account while allowing their savings to grow like an MMA.

EverBank

The bank offers a great incentive to continue amassing your savings using its YieldPledge® Money Market Account. If you hold a balance of $150,000 or more, you will be rewarded with a bonus interest rate of 1.60% for the first 6 months on your first $150,000.

EverBank is also another bank that been featured by AdvisoryHQ as a top bank in America.

Key features of EverBank’s Money Market Account:

- You can open an account with as little as $1,500.

- The bank’s technology enables you to deposit checks using secure mobile banking apps.

- The bank’s money market account is IRA-eligible.

- If you maintain a minimum balance of $5,000, your ATM fees will be reimbursed 100% – regardless of which ATM network you use.

While the national average APY is calculated at being around 0.09%, EverBank’s first year APY for balances up to $150,000 works out to be 1.11%. This is a great incentive for savers to use the bank’s money market account and start saving.

iGObanking

With a highly competitive APY of similarly positioned money market products currently available, iGObanking is a great place to park your money if you have a modest cash balance on hand.

iGObanking is also featured as one of this year’s best banks to bank with by AdvisoryHQ.

Key features of iGObanking’s Money Market Savings Account:

- As an iGObanking Money Market Account holder, you’ll enjoy the yield of a CD with convenient checking account-type access to your money.

- If you have all of the relevant information on hand (Social Security number, driver’s license, passport, beneficiary, etc.), the online money market account opening process takes less than 10 minutes to complete.

- The minimum balance to earn interest is a modest $25,000 (unlike the $100,000 threshold many peers have set for account holders to earn comparative interest rates).

- Maintaining the minimum balance means that you won’t have to pay any fees to maintain your account.

- As an account holder, you will receive a free debit card.

In addition to the above features, you will have access to online banking and will receive automatic balance alerts to notify you if your balance is nearing the minimum level. Additionally, you can set up automatic transfers from your checking account to go directly into your iGObanking Money Market Account.

ableBanking

A division of Northeast Bank (featured earlier in this review), ableBanking is part of the family of a Maine-based institution that was established in 1872 and currently employs 200+ professionals.

While the bank and its subsidiary entities operate 10 brick and mortar branches throughout 7 counties in Maine, ableBanking believes that customers don’t always need brick and mortar branches – given the technology available to support modern-day savings and banking initiatives.

Key features of Able Banking’s Money Market Savings Account:

- A low minimum opening deposit of $250 is required to start a money market account.

- Your money market account will earn you an APY that’s comparatively higher than the national average money market rates as well as compared to that earned when saving with traditional banks.

- You’ll earn the stated APY on a balance as low as $0.01 – which means that every penny of your savings is potentially eligible to earn you a return.

- You’ll have regular and convenient access to your money.

- You can withdraw funds up to 6 times from your money market savings account.

- Your money is insured by the FDIC up to the maximum allowable limit of $250,000.

To put these features into perspective, while an account with a traditional bank will earn you $9.00 on a $10,000 balance for a year, ableBanking’s money market accounts will earn your as much as $100 during the year.

Sallie Mae

If you are looking for some of the best money market rates and an exceptionally high APR (up to 13 times the national average) to park free cash for a limited duration (180 days or more), then you should take a closer look at the MMA offered by Sallie Mae.

Sallie Mae has also previously been featured among the best banks in America by AdvisoryHQ.

Key features of Sallie Mae’s Money Market Account:

- With a Sallie Mae Money Market Account, you’ll receive an APY that’s 13 times higher than the national average.

- You can write checks from your MMA.

- You don’t have to maintain any minimum balances.

- There are no account-related fees applicable to your MMA.

- You are eligible for free electronic transfers.

The 1.24% initial APY (for the first 180 days) means that your money will grow rapidly during that time. You’ll also get 24/7 access to your balance using the bank’s easy online account management tools.

Plus, your savings are FDIC-protected to the maximum amount applicable under federal law.

Bank of Internet USA

With a money market account from Bank of Internet USA, you’ll not only get one of the best money market rates (higher than what a conventional checking account offers), but you’ll also be able to do much more than simply “save.”

Bank of Internet USA has also previously been featured among the best banks in America by AdvisoryHQ.

Key features of Bank of Internet USA’s Money Market Account:

- You can open a money market savings account with an initial deposit of as little as $100.

- Along with a highly competitive APY, your interest grows through daily compounding.

- There are no monthly maintenance fees and no minimum monthly balances to maintain.

- You get limited check writing for free and get a starter kit of free checks if you order them when you open your account.

- Deposit checks online for free.

- You will receive a Free Visa® Debit card.

In addition, when you open your money market account, you’ll be able to do free online banking, pay your bills for free, receive text and messaging alerts, and save on postage with free postage-paid envelopes when sending communications/deposits related to your account.

You’ll also be able to use Free FinanceWorks™ to track all of your financial accounts – even those at other institutions.

Ally Bank

With a money market deposit account from Ally Bank, you’ll get a whole array of great advantages, including secure online and mobile banking services, a debit card, standard checks, and postage-paid deposit envelopes.

Most of these features are provided at no extra charge.

Ally Bank was included in this year’s list of the best banks in America by AdvisoryHQ News.

Key features of Ally Bank’s Money Market Account:

- You get to earn a comparatively higher rate than most similar MMAs.

- There is no minimum deposit to open an Ally Bank MMA.

- You are not charged any monthly maintenance fees.

- You can conveniently deposit checks remotely using the bank’s Ally eCheck Deposit℠ system.

- Your deposits are insured by the FDIC up to the maximum allowed by law.

With the offered by Ally Bank, your money will grow quicker than any conventional checking account with daily interest compounding. You also get to make unlimited deposits and ATM withdrawals and up to 6 additional transactions.

Synchrony

Synchrony Bank offers MMA holders great features that include a low minimum balance and the convenience of accessing your money quickly and easily.

Similar to Ally Bank, Synchrony Bank was also included in this year’s list of the best banks with high yield savings accounts by AdvisoryHQ.

Key features of Synchrony’s Money Market Account:

- It offers you some of the highest rates available.

- Easily make withdrawals online, over the phone, by check or with an ATM card.

- Use the bank’s online banking portal or seek assistance from a banking representative to control and manage your money.

- There is no monthly charge if you keep a $30 minimum balance.

- An account is FDIC-insured up to $250,000.

To put things into perspective, your $4,000 deposit could grow to $4,017 in just 6 months, while a 60-month deposit of the same amount will grow to $4,174.

Nationwide

Nationwide offers its money market account holders access to one of the nation’s largest ATM networks, which makes accessing your MMA funds extremely convenient.

Key features of Nationwide’s Money Market Account:

- You just need a minimum balance of $1,000 to open a money market savings account.

- There is no monthly maintenance fee if you maintain a $1,000 minimum daily balance.

- You can make up to 6 preauthorized withdrawals each month (during a monthly statement cycle), and these include using telephone or electronic transfers and checks or point-of-sale transactions.

- Your transaction limit does not apply to the number of withdrawals you can make at an ATM, by mail or at a nationwide bank branch.

- You get surcharge-free access to a network of over 77,000 ATMs.

All of your deposits, up to a maximum of $250,000, are FDIC-insured. In addition, you can conduct free online and mobile banking and, optionally, you can also link your MMA to your checking account to receive overdraft protection.

Disclaimer:

- The rates/APYs, minimum balance requirements, and other financial data presented on this page are those that have been identified by AdvisoryHQ based on a detailed level of research and due diligence.

- AdvisoryHQ’s proprietary money market account selection methodology focuses on identifying MMAs that offer the best savings value to retail customers and which are open to the broadest range of consumers.

- Most of these types of rates are those offered by online US banks that are available to any US resident, irrespective of the city, state or domicile.

- The above lists of MMAs and rates do not include every MMA rate imaginable. Please do not consider these lists as “comprehensive.”

- The above rates also reflect the minimum deposited amounts. Some banks offer higher MMA rates for higher deposits.

- Please consult each bank’s website for information on the most updated MMA rates and product offerings.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.