Overview: How to Get the Best Home Equity Loans & Equity Line of Credit Rates

When you take out a loan, you want to be certain that you’re getting the best terms possible, and a home equity loan is no exception.

If you’ve been eyeing those glamorous kitchen remodels in magazines but are stuck with a kitchen from four decades ago, you’re probably interested in getting a home equity loan to help fund your remodel.

Of course, you only want to borrow a sum of money that large if you know that you’re getting the best home equity line of credit.

Image Source: HELOC Loans

Before you go about researching how to get home equity loan options, you need to know the basics of what the best home equity line of credit would look like. AdvisoryHQ wants to help you answer questions like:

- What is the difference between a home equity loan and a home equity line of credit (HELOC)?

- What are the requirements for a home equity loan?

- What sort of home equity loan terms should you expect from the best home equity loans?

If you’ve been considering reinvesting in your home to boost its value with a home equity loan, then join us as we dive into the details of what you might expect from the very best home equity loans.

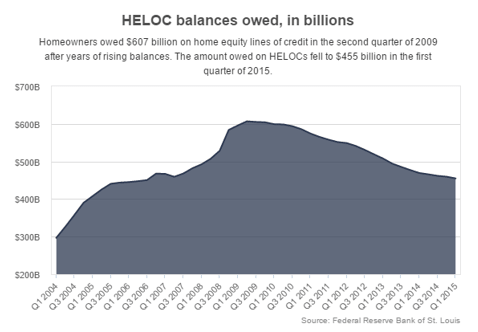

Image Source: HELOC Balances Owed

See Also: Can You Pay Rent Online? How to Pay Rent with a Credit Card Online

Home Equity Loan vs. HELOC

Many individuals use the terms “home equity loan” and “home equity line of credit” interchangeably, but they actually have quite different meanings. In order to make sure that you are getting the product that best suits your needs, it’s important to understand the distinct differences between these two methods of borrowing.

Both a home equity loan (sometimes referred to as a mortgage equity loan) and a home equity line of credit (HELOC) allow you to use the value that you have already invested into your home or property.

The amount you can borrow against that value will be determined by an individual lender, but it is usually based on your combined loan-to-value ratio. For example, if you have paid off 50 percent of your mortgage and your bank will allow you to finance 70 percent of the value of your home, your home equity loan would be for 20 percent of the value of your home.

A home equity loan or mortgage equity loan allows you to withdraw that 20 percent (or whatever amount your lender will issue) all in one lump sum. Oftentimes, you receive a set interest rate on this one-time withdrawal, which is why you may also sometimes hear it referred to as a fixed-rate home equity loan.

A home equity line of credit works slightly differently. Your lender will issue that 20 percent as an available line of credit for a specific time period. You may withdraw the amount that you need over multiple transactions, but you will only ever have to repay on the amount that you withdraw.

While this could lead to smaller monthly payments if you don’t use or need the full amount, it does have what some would consider a major disadvantage: a variable interest rate.

A mortgage equity loan and a HELOC both give you some flexibility with spending to accomplish major projects for your property.

However, the home equity loan terms will vary depending on whether you opt for the best home equity loan or the best home equity line of credit. With one, you will have set payments each month while the other may fluctuate.

Don’t Miss: Imortgage Reviews – What You Should Know (Complaints & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How to Get a Home Equity Loan

If you are interested in how to get a home equity loan, then it’s time to cover the requirements for a home equity loan. Each lender will have slightly different home equity loan requirements, but we will give you a few of the general guidelines to help you find the best home equity line of credit or home equity loan available.

The most important first step to see if you will meet the home equity loan requirements for the best home equity line of credit is to evaluate your current financial situation. Are you saddled with debt or are you struggling to cover your monthly mortgage payment?

Some experts recommend that your mortgage payment, insurance, private mortgage insurance, property taxes, and your new HELOC or home equity loan payment should total less than 28 percent of your gross income.

When combined with your other debt (credit card, student loans, auto loans), your total debt should account for only 36 percent of your income. Fannie Mae and Freddie Mac allow for your total debt to account for up to 45 percent of your monthly income to meet home equity loan requirements.

Of course, the second most important aspect of the home equity loan requirements is your FICO credit score. According to Bank Rate, the best home equity line of credit is available for individuals with a credit score as low as 660, but the higher your score is, the better chance you have of getting a home equity loan.

Scores of 700 or higher may qualify for more home equity loan options or more favorable home equity loan terms.

Related: Best Banks for Mortgages – A Complete Guide (Best Mortgage Rates & Reviews)

Home Equity Loan Rates

Knowing how to get a home equity loan or a HELOC is only a small portion of the information you should keep in mind when applying with different banks or lenders. Perhaps the most important thing to keep in mind in finding the best home equity loan is the rate the bank is offering you.

Interest rates are constantly changing as the prime rate changes. The prime rate is usually a good rule of thumb for rates on a home equity loan or HELOC. At the time of this writing, the prime rate issued by the Wall Street Journal was hovering around 3.5 percent. However, if your credit score is less than optimal, you may find that a lender requires a higher interest rate than the prime rate.

If you’re offered a great interest rate, there are a couple of things to consider. First, you want to see if you can make your loan into a fixed rate home equity loan or line of credit. Both of these would give you set payment amounts, which makes budgeting significantly easier.

If the interest rate you’re offered is less than stellar, you might consider getting a home equity loan now but allowing the interest rate to vary in hopes that it decreases over time.

On the best home equity line of credit, you should also be aware that you are sometimes offered an introductory interest rate. Similar to a promotion run by credit card companies, you might be offered an incredible interest rate only to find out that it doesn’t last the entire term of your loan or that it isn’t for a fixed rate home equity loan. Pay careful attention to the fine print when an offer for a home equity loan sounds too good to be true.

A good way to gauge the rates on the best home equity loans is to use a referral service like Lending Tree. By answering a short survey regarding the amount remaining on your mortgage, your property value, and your borrowing goals, they can match you with the best home equity loans for your needs.

With offers from several lenders available, you can quickly scan them to get a good feel for what sort of interest rate might be a good fit for you depending on your credit.

You can also get a quick glimpse of potential rates and home equity loan terms through the calculator available at U.S. Bank.

Home Equity Loan Terms

When you take out a mortgage equity loan, a fixed-rate equity loan, or the best home equity line of credit, you should be aware of some of the different terms available. Repayment options can vary depending on whether you are getting a home equity loan or home equity line of credit.

On a home equity loan, you typically receive a fixed-rate home equity loan that will create set payments for you with both principal and interest. While it will be similar to the way your mortgage payment is calculated, your fixed-rate home equity loan will be in addition to your usual monthly payment to your mortgage lender.

When it comes to the best home equity line of credit available, you can expect slightly different terms. Because you are only paying interest on the amount of money used from your available line of credit, you may find that your payments are interest-only during the set draw period. After this period ends, you are responsible for both interest and principal payment.

Home equity loan terms for HELOCs can also be term-limited. In essence, this means that your credit lines can mature over time, but the balance is due upon the end of your term. Whether it is five, ten, or fifteen years in the future, the balance of both your principal and interest will be due no later than the set date.

Of course, different lenders will have different terms and your credit score may determine which of the best home equity loan or line of credit options are available to you. These are provided just to give you a general overview of the main options and most popular home equity loan terms available on the market.

Popular Article: How to Get a Home Equity Loan with Bad Credit (What You Need to Know)

Potential Sources for the Best Home Equity Loan

There are a number of sources available to help you figure out how to get a home equity loan to complete the renovations you’ve been dreaming of. We’ve put together a short list of some potential lenders you may want to check with to see what sort of help they can provide to show you how to get home equity loan options.

You should check first with your mortgage lender. Because you are already doing business with them, they may have additional incentive to earn more of your business by offering you the best home equity loan or the best home equity line of credit right off the bat. Know where you stand with other lenders before approaching them by using referral sites such as Lending Tree to know what terms and rates you qualify for.

If you don’t feel that your primary mortgage lender offers you the best home equity line of credit available, Wall Street Journal recommends checking out credit unions because they tend to offer better interest rates than larger financial institutions or types of banks.

Still need a few other options? Take a look at some of these sources to try to find the best home equity line of credit:

- Bank of America: Bank of America is a fairly large financial institution that can provide you with plenty of know-how in how to get home equity loan options. In comparison to other lenders, they allow a higher loan to value ratio, according to Top Ten Reviews. You can also get custom rates quickly and easily without a full application.

- Citibank: At Citibank, you may meet the requirements for a home equity loan even if you have a large amount of debt in another area of your life. They accept higher debt-to-income ratios than some lenders do (43 percent versus 36 percent).

- Wells Fargo: Wells Fargo is very transparent with how to get a home equity loan or line of credit through their institution. You should be able to qualify for a home equity loan with a credit score as low as 621, but you will get the best home equity line of credit rates with a credit score above 760 and a debt-to-income ratio of 43 percent or less.

- TD Bank: TD Bank offers great interest rates, well in line with the other major players in the home equity loan field with home equity loan terms ranging from five to thirty years for plenty of flexibility with a $25,000 minimum home equity loan. You can also get one of the best home equity line of credit options through TD Bank with either a fixed rate or a variable rate. They also have a number of calculators you can use quickly for rates and terms.

Image Source: Home Equity Calculator

We could never provide you with an exhaustive list of all the places where you may find the best home equity line of credit or the best home equity loan for you and your family. However, we hope that this list is a great starting point as you begin the process of getting a home equity loan.

Read More: US Bank Mortgage Reviews – What You Should Know (Home Mortgage, Complaints & Loan Reviews)

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

So, how do you know what the best home equity line of credit or the best home equity loans are? It will mostly depend on your own personal preferences when it comes to borrowing money from lenders as well as your personal financial situation.

Would you prefer a fixed rate home equity loan, or are you searching for the best home equity line of credit? Even determining which of the two options better suits your borrowing needs is highly personal and situation-dependent.

Take a close look at your debt-to-income ratio, your current loan-to-value ratio, and your credit score to see if you would meet the minimum requirements for a home equity loan from any lender. After this, take a close look at several options before deciding on the one that offers the most attractive home equity loan terms available.

You will likely have your mortgage equity loan for years to come, so be sure that you are completely satisfied with the terms and length of the loan so you can comfortably repay the funds you withdraw for your next big project.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.