Guide to Average Home Insurance Costs

The purchase of a new home can come with a slew of unexpected costs. The homeowner’s insurance cost can be confusing to calculate for both new homeowners and experienced homeowners alike.

The cost of home insurance can vary significantly depending on many factors, including your location, the coverage you desire for your home, the value of your home, and any additional features present inside the home. Do you know the average home insurance cost?

Image Source: Cost of Homeowners Insurance

AdvisoryHQ wants to assist homeowners in calculating the homeowner’s insurance average cost so you know what to expect.

The average home insurance cost might fluctuate depending on a number of factors, but we’re going to cover what is typically included in the average cost of homeowner’s insurance.

So if you’ve been feeling puzzled over what the cost of home insurance should be, this article will help you ensure you get a great deal with your insurance company. How much should home insurance cost? Let’s find out!

See Also: Mortgage Broker Salary – Full Details on How Much Mortgage Brokers Make

What Does Homeowner’s Insurance Do?

How much should home insurance cost? The answer depends pretty heavily on what your homeowner’s insurance actually does.

In short, this type of insurance is designed to protect homeowners and shield them from the financial damage that can ensue from certain types of disasters. This may include coverage for theft or burglary, intense storms, hail, or all-consuming fires.

Beyond those basic elements, your house insurance cost generally also covers you in the event that someone is seriously injured while on your property. For the cost of homeowner’s insurance, your company can cover the cost of your legal fee if and when this type of situation arises.

Certain events cause more damage to homes than others. The most frequently filed claims relate to property damage come from wind and hail, water damage and freezing, theft, and fire, lightening, or debris.

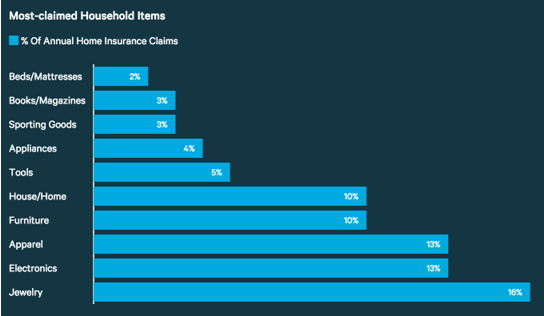

When it comes to filing claims on property damage, the most claimed household items are typically jewelry, electronics, apparel, furniture, and damage to the home itself. Homeowner’s insurance can help to shelter you from some of these costs.

Image Source: Average Homeowner Insurance Cost

Note that the average home insurance cost does not include flood insurance. In many instances, this must be purchased separately through a different company.

Depending on the area you live in, your home may not be at risk for flooding and you can opt for the additional coverage or save money on your annual premium. Homeowner’s insurance costs specific to floods tends to be minimal in comparison to the annual premium cost of home insurance.

Each individual’s policy likely covers a different number of items prioritized by what matters most to you. As a result, homeowner insurance cost varies greatly based on these factors. In the upcoming sections, we will be covering the various factors that can influence the average homeowner’s insurance cost.

Don’t Miss: CPA Fees | How Much a CPA Costs (Prices, Rates Per Hour, Fee Schedule)

Average Home Insurance Cost

We know that the cost of homeowner’s insurance can vary significantly around the country, but do you know how much home insurance should cost on average?

The national average home insurance cost in the United States comes in at $952. Most individuals are paying anywhere from $300 to $1,000 each year for their average house insurance cost, according to the Federal Reserve Bureau.

Where do those numbers come from?

If you’re attempting to estimate coverage for your homeowner’s insurance cost on a new home or on your existing home, experts recommend projecting costs based on $3.50 per $1,000 of the value of the home. By that logic, someone who owns a $500,000 home could expect approximately $1,750 in homeowner’s insurance cost each year.

If you’re more concerned about the monthly cost, Zillow makes it even easier to calculate what your homeowner’s insurance cost could be. They recommend estimating that the average home insurance cost is roughly $35 per $100,000 of the value of the home each month. For a house valued around $250,000, you could expect to pay $87.50 each month average home insurance cost.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Location Matters

One of the biggest contributing factors to the average home insurance cost is the location of your home. In areas that are prone to natural disasters such as hurricanes, floods, earthquakes, or tornados, homeowners can expect the house insurance cost to rise tremendously compared to states that are relatively safe by these standards. This can cause a significant difference in annual premiums.

The five most expensive states when it comes to the cost of home insurance are Florida, Louisiana, Texas, Mississippi, and Oklahoma. The first four tend to fall directly along the path of major hurricanes while the last has a long reputation for being home to the most tornados each year. The average house insurance cost among these five states ranges from $1,991 to $1,428.

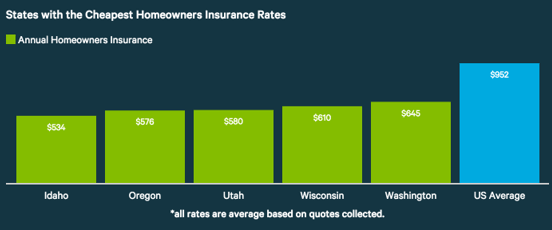

States that are considered low risk not only boast security but also low figures when it comes to their homeowners insurance average cost. Idaho, Oregon, Utah, Wisconsin, and Washington are great places to consider living if you want to save money on the cost of home insurance. Their prices range from $534 to $645.

Image Source: Average Cost of Homeowners Insurance

When compared to the annual premiums among those in the states posing the highest risk of natural disaster, the low states have an average home insurance cost that could be as little as one-third of Florida’s expected average house insurance cost.

Related: Accountant Fees for Small Businesses | Average Bookkeeping Services Fees

Property Factors Affecting Cost

It’s been shown that having certain attributes and features in your home can increase your cost of homeowner’s insurance. While these features may be included in the home at the time of purchase, if they aren’t, you may want to reconsider adding them when you learn the homeowner’s insurance average cost they add. Here are the top items on your property that can push the average homeowner’s insurance cost even higher:

- Pool: Maintaining a pool on your property puts you at risk for a lot more claims, whether from personal injury or from overflowing water in a heavy rain storm. The home insurance cost for homes with pools may not be worth it to you.

- Dog breeds: Considering buying a new puppy for your kids? Check what the average cost of homeowner’s insurance will be before you bring him home. The home insurance cost for families with certain breeds of dogs is on the rise.

- Age: Has your property been around for a century, or was it just granted a certificate of occupancy last week? The age of the home plays a big role in determining homeowner’s insurance cost. The older your home is, the more you will see your homeowner insurance cost rise.

Of course, there are a few factors that are well within your control that can either raise or lower the average home insurance cost. Two of the biggest factors are your deductible and your claim history.

Deductible

Your deductible is the easiest factor to adjust and see quick results to the homeowner insurance cost of your home. A lower deductible usually results in a higher average home insurance cost, while a higher deductible does the opposite. Be sure that you could actually afford to shell out for the higher deductible in the event that something does happen to your home. If you know that reaching the minimum deductible is far out of your reach, you may want to opt for the lower deductible and higher monthly homeowner’s insurance cost.

Experts claim that making a switch from a deductible of $500 to a deductible of $1,000 can save you as much as 25 percent each year. In years where you make no claims, you can come out significantly ahead on the average home insurance cost. In years where you do find yourself needing to file a claim, the extra $500 isn’t so steep that it is out of your reach.

Claim History

Claim history is considered heavily when companies are determining the house insurance cost. Homeowners who file more claims are considered a greater level of risk for the company and can expect the cost of homeowner’s insurance to rise. For filing just one claim, some claim that the average house insurance cost increases by nine percent. For a second offense, the homeowner’s insurance average cost can increase by as much as twenty percent.

Consider carefully if the increase in the cost of home insurance is worth it before you file a claim. Especially if there isn’t extensive damage to your home or property, it may be worth paying to repair the damage out of pocket in order to keep your homeowner’s insurance cost down on a monthly or annual basis.

Ask for a Discount

How much should home insurance cost? Well, it might cost significantly less if you’re comfortable asking for a discount on the average cost of homeowner’s insurance. Many companies are willing to dole out discounts in exchange for loyalty, increased business, or decreasing the risk to your home. If you’re searching for ways to lower the average homeowner’s insurance cost, take a look at these top items that insurance companies look for:

- Buy your insurance all in one place. For customers who bundle their home and auto insurance, they could find discounts as high as 15 percent. Of course, make sure that the rates are competitive with those offered by other companies instead of examining just the homeowner’s insurance cost.

- Remain loyal to the company. The longer you maintain one insurance company, the more likely you are to receive a discount for the extended business you’ve done with them. The Insurance Information Institute claims that some insurers will issue a five percent discount on your homeowner’s insurance cost for doing business with them for three years or more and a ten percent discount for customers remaining six years or longer.

- Weatherproof your home. Homeowners who weatherproof their homes, including installing storm windows, can see a decrease in their average house insurance cost. When your home poses less of a risk to the insurance company during a natural disaster, you can face discounts that reflect this on your home insurance cost.

- Install a security system. Insurance companies are extremely likely to offer at least a small discount on the cost of home insurance for those who opt to have security systems or sprinkler systems installed. Even placing deadbolt locks on the doors and new smoke detectors can sometimes lower your premiums or your average home insurance cost. Insurance companies will sometimes issue a five percent discount on the cost of home insurance for these items.

Shop Around

Don’t forget that every company is likely to offer you a different homeowner’s insurance cost. The various companies on the market each have a slightly different formula to determine home insurance cost. They may place emphasis on different factors than another company does or offer steeper discounts on your homeowner’s insurance cost for some of the features that you already have in place.

No matter where you decide to go for quotes on the cost of home insurance, make sure you are comparing the policies apples to apples. It isn’t a better deal if you are paying less but receiving significantly less coverage.

How much coverage do you need? Coverage also plays a huge role in the average home insurance cost. Experts recommend making sure that the payout of your policy could cover the cost of rebuilding your entire home if it was necessary. Many people do not have this extent of coverage on their primary residence, which may lower their average home insurance cost but will leave them struggling financially in case of a disaster.

There are several tools online to estimate the average home insurance cost as well as to determine the amount of coverage that you need. Consider taking a look at a few of these calculators to help you determine what would work best for your family’s needs in terms of coverage and what you can expect from the average home insurance cost:

- Esurance Home Insurance Calculator

- Liberty Mutual Home Insurance Cost Calculator

- Home Insurance Calculator from Home Insurance

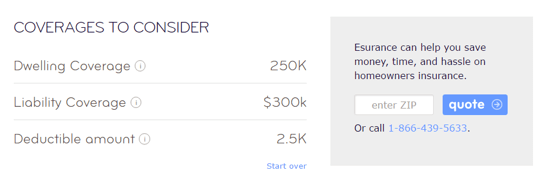

On the Esurance Home Insurance Calculator, it takes only a few seconds to fill out all of the requested information on your home before offering a suggested amount of coverage. From there, it can gather the cost of house insurance using your zip code and location.

Image Source: Home Insurance Calculator

Popular Article: Average Income Tax Preparation Fees | Full Details on Tax Service Fees

Conclusion

Having the appropriate coverage on your home is important, but understanding what that coverage should cost compared to the average home insurance cost is equally significant.

Homeowner’s insurance cost can fluctuate drastically depending on the features of your specific property, the precautions you take with your home, and your geographical location.

It’s undeniable that all of these factors can result in a higher average cost of homeowner’s insurance or in steep discounts for your property.

Be sure to weigh all of your options before committing to homeowner’s insurance cost with any one company.

Protecting your most valuable asset, your home, should be taken seriously. You don’t want to pay more than the homeowner’s insurance average cost if you don’t have to.

Consider what protection and deductible would make you feel most comfortable financially and then weigh the various costs of homeowner’s insurance that are available in your area.

Read More: Lawyer Retainer Cost | How Much Do Retainers Cost? Full Details

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.