Introduction: How to Get a Successful 401(k) Loan and a Complete Guide to 401(k) Loan Rules

One of the most important financial responsibilities of every individual is planning for retirement.

After years of working steadily at a job, everyone should have the benefit of enjoying his or her “golden” years without having excess financial worries.

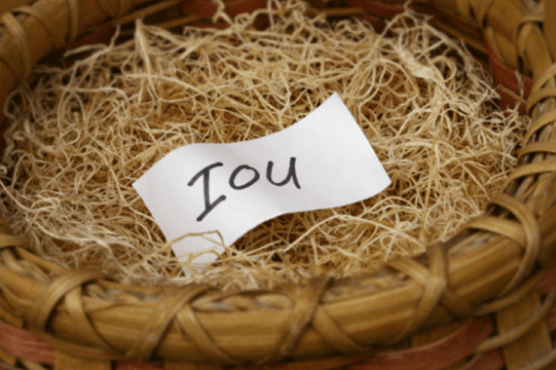

A 401(k) plan is one of the most common types of retirement plans provided by employers. While most people would hope to never touch that money until they retire, life is unpredictable and taking out a loan against your 401(k) might be a necessity during certain times of financial duress.

Taking out a 401(k) loan responsibly requires you to know all of the 401(k) loan rules. Understanding the 401(k) interest rate and the terms and conditions of the 401(k) loan will help you avoid defaulting on your loan, which would amount to a distribution that comes with heavy penalties and taxes.

In this brief article, AdvisoryHQ will look at all aspects of taking out a loan from a 401(k). We begin by explaining why it is possible to get a loan from a 401(k) or a loan against a 401(k) plan. We then look at the 401(k) loan interest rate so that you can decide whether or not a 401(k) loan is economically feasible for you.

Next, we offer advice on what you should consider before getting 401(k) loans and the potential benefits of getting a loan from your 401(k). Lastly, we look at the best 401(k) loan calculator to help you make a decision on whether to take out a 401(k) loan or not.

See Also: How to Roll Over 401k – Everything You Need to Know!

Is It Possible to Get a Loan from a 401(k) or a Loan Against a 401(k)?

The money that you save for retirement is yours. One of the biggest benefits of saving for retirement through a 401(k) plan is that your savings isn’t taxed until you eventually take out that money. If you take out that money before you reach retirement age, however, you will be taxed as if it were income and also receive a hefty 10% penalty.

There is a difference between a 401(k) loan and an early distribution on a 401(k) plan. According to the 401k Help Center “allowing loans within a 401k plan is allowed by law, but an employer is not required to do so. … If a participant has had no other plan loan in the 12 month period ending on the day before you apply for a loan, they are usually allowed to borrow up to 50% of their vested account balance to a maximum of $50,000.”

There are a number of 401(k) loan rules that we will explore below but the most important of the 401(k) loan rules is that if you don’t pay back your loan, you will be taxed for the amount unpaid and will also be required to pay a 10% early distribution fee.

401k Loan Rules

Nonetheless, if you are having a hard time finding a personal loan from the banks, a loan from 401(k) may very well be your best option. Additionally, depending on your personal financial situation, the 401(k) loan interest rate might be considerably better than what you could get through a private lender.

Don’t Miss: What Is a 401k? – (Understanding a 401(k) Plan Explained)

What Is the 401(k) Loan Interest Rate?

With any loan, one of the most important considerations is the interest rate you will get. Getting stuck with a loan where you are paying extremely high interest rates can cripple you financially and lead to long-term debt that can be close to impossible to escape from. With a 401(k) loan, you should always research the 401(k) loan interest rate that you qualify for.

While your credit score is the main factor determining what type of interest rate you will receive on a loan from a bank or other private lender, this isn’t the case with a loan from 401(k). Since the money you are borrowing is essentially yours, you can qualify for the prime rate on your 401(k) loan even if you have a sketchy credit history.

According to My Bank Tracker, “typically, according to most sources, a 401k loan will carry an interest rate based on the Prime Rate plus 1 or 2 percentage points. The prime rate is published every day by the Wall Street Journal, based on surveys of 30 banks’ lending rates. Currently it’s at 3.25% and hasn’t budged for a year.”

The 401(k) interest rate, in most cases, stands somewhere between 4 and 5%. Additionally, a loan from 401(k) can usually be taken out pretty quickly for urgent cash needs. Your loan from 401(k) won’t affect your credit score since you are not borrowing from a private lender.

Related: IRA vs Roth IRA vs 401K | IRA Comparison Guide

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Should You Consider Before Getting 401(k) Loans?

One of the most important things when thinking about 401(k) loans is to be well-informed on the 401(k) loan rules. Even if the 401(k) loan interest rate is significantly lower than what you might qualify for at the bank, if you don’t pay back your loan on time, you may end up paying much more through taxes and early distribution fees.

One of the most important 401(k) loan rules, then, is the amortization period. Most 401(k) loans have a 5-year amortization schedule, meaning that you have five years to pay back your loan without incurring any sort of penalty. Furthermore, 401(k) loan rules stipulate that if you are able to pay back your 401(k) loan beforehand, you won’t be charged any sort of prepayment fee.

How to Borrow from 401k?

Another of the 401(k) loan rules that is important to be aware of is related to the liquidation of your investments. Let’s say that you take out a 401(k) loan for two years. The money that you take out during that period will be liquidated from the investments of your 401(k) and you won’t be eligible to receive any sort of positive earnings. On the flip side, when you loan against a 401(k), you also would be able to avoid any investment losses.

If you foresee a potential downturn in the economy that might affect the return on investment on your 401(k), it might actually be a smart financial decision to loan from a 401(k) in order to avoid heavy losses on your investment.

Most 401(k) loan rules stipulate that you are allowed to take out up to 50% of your retirement plan balance or up to $50,000. Additionally, you will need to ask your employer if they allow you to take out a loan from your 401(k) for any reason or if you will be required to document what you plan to use the money for. Some plans allow you more flexibility and freedom related to how you plan to use the funds while others have stricter guidelines.

The Potential Benefits of a Loan from Your 401(k)

If you are having a hard time finding a loan from the bank, a loan from your 401(k) is most likely your best option.

Once you know the 401(k) rules, the process of getting a 401(k) loan is quite simple and can usually be done over the internet. You won’t have to deal with any sort of credit check or hefty loan origination fees.

Furthermore, since you are loaning your own money to yourself, you won’t owe any tax on your 401(k) loan until after retirement. Also, if you manage your loan from your 401(k) correctly, your retirement savings could even potentially benefit.

According to Investopedia, “if your 401(k) balance is invested in stocks, the real impact of short-term loans on your retirement progress will depend on the market environment. The impact should be modestly negative in strong up markets and it can be neutral, or even positive, in sideways or down markets.”

The ability to receive a loan and economically benefit from that loan is something you’d be hard pressed to find from a bank. If you dutifully pay your 401(k) loan back, the interest payments will accrue in your overall retirement balance, meaning that your retirement savings will actually increase.

Popular Article: All About 401K Contributions | How to Maximize 401K, Limits & Rules

The Best 401(k) Loan Calculator

One of the best ways to successfully manage your 401(k) loan is with the help of a 401(k) loan calculator. A 401(k) loan calculator is a simple, online tool that will help you factor how much you stand to lose on your 401(k) retirement plan through taking out a 401(k) loan.

Of course, these potential losses that are calculated by a 401(k) loan calculator are only estimates since the real losses (or gains) will depend on current market conditions. Nonetheless, a quality 401(k) loan calculator will help you understand the potential loss associated with a loan from 401(k).

Below, we review one of the best 401(k) calculators to help you determine if a 401(k) loan is right for you.

Bankrate 401(k) Loan Calculator: The Bankrate calculator asks you to input information for how much you plan to borrow, the expected 401(k) interest rate on your loan, the expected rate of return on your investments, the number of years until planned retirement, and the loan term.

With these numbers, the Bankrate calculator will calculate the possible losses if your loan is repaid on time. It will also calculate potential losses if you fail to repay your loan, including the 10% early distribution penalty.

Read More: Average Retirement Income in America | Retirement Income Planning

Conclusion – How a Well-Managed 401(k) Loan Can Financially Work for You

Saving for your retirement is an important financial goal that all of us have. While no one wants to touch their retirement savings, sometimes it may be necessary to do just that. Knowing the 401(k) loan rules is a necessary first step to make sure that you benefit from your 401(k) loan.

The beneficial 401(k) loan interest rate and the relative ease of getting a 401(k) loan make this option appealing to many people who are in need of a loan.

As long as you are responsible enough to pay back your loan on time, a loan from your 401(k) usually makes financial sense for short-term cash needs.

If you are considering taking out a 401(k) loan, consider using a 401(k) loan calculator to find out the cost associated with that loan. When responsibly well managed, a 401(k) loan might just be the best option for you.

Image Sources:

- https://www.nasdaq.com/articles/taking-a-401k-loan-and-hardship-withdrawal-rules-2010-07-21

- https://www.dummies.com/personal-finance/investing/retirement/how-to-borrow-from-your-401k/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.