Guide: Roth IRA vs 401K vs IRA | Comparison Guide

It is favorable that we have so many options when it comes to investing in our futures. From IRA vs. 401k plans to mutual funds and pensions, our futures can be easily secured by making the right investment choices.

The problem is: How do you choose between the many options available? Some options seem very similar, and actually are, so it is important to learn the minute differences so you are not left wondering, “Is a 401k an IRA?”

Source: DailyWorth

The seemingly slight differences between retirement investment options can equate to significant differences during the life of your retirement plan and after you have retired. This article will guide you through the differences of some of the most popular investment options: Roth 401k vs. Roth IRA and traditional 401k vs. IRA plans.

When considering a Roth vs. 401k account, keep in mind what is important to you. Perhaps how taxes affect 401k vs. Roth 401k plans is an important factor in determining the type of retirement plan you want. Or, will the contribution limits between a Roth IRA or 401k be the deciding factor?

Create a plan for your retirement now so finding the right plan will be easier later. Outline your retirement goals: How much do you want, or can you afford, to contribute each month or year? How much do you want saved by the time you retire? Is that enough to live comfortably or provide for your family? These questions will help you determine whether an IRA vs. 401k is right for you.

See Also: Betterment IRA Review | Read Before Rolling Over Your 401(k), ROTH, or SEP IRA

Why Invest in Your Retirement?

We are faced with so many things we need to save for throughout our lives: College, our first home, a new baby, our children’s futures, and our retirements. Often, learning whether we should open a Roth IRA vs. Roth 401k is not a top concern, as we push off our own retirement savings to cover the finances for everything else.

However, the earlier you start contributing to a 401k or Roth IRA, the more significant your retirement income will be when you retire. In fact, each year you put off opening a Roth IRA or 401k, you risk losing potentially thousands of dollars in your retirement fund.

Source: Trading Academy

Even with this information, many people are choosing not to save for retirement. In fact, this year only 2 in 3 Americans have begun saving with a retirement fund, like a 401k or Roth IRA. 36% of Americans depend only on social security income because they do not have any, or enough, retirement funds saved. Social security income is usually not enough to be a fully sustainable income.

Whether you choose a Roth vs. 401k account does not specifically matter, as you will still be saving money toward your future. Instead, the decision between 401k vs. Roth 401k or 401k vs. IRA is based more on how you want your retirement funds to work regarding taxes, contributions, and distributions.

Comparison: Roth 401k vs. 401k

The difference between Roth 401k vs. 401k falls mainly with how your contributions and withdrawals are taxed. A Roth 401k taxes your income first, and your contributions to your account are made after.

A traditional 401k, however, makes contributions to your account before they have been taxed. Contributions in both the Roth 401k vs. 401k grow tax-free, but with a traditional 401k, you are taxed upon withdrawal of your funds. Since you already paid tax with your Roth 401k contributions, you are not taxed upon withdrawal.

So, consider your tax rate now when deciding between 401k Roth vs. 401k traditional accounts. If you expect your tax rate to be lower upon retirement than it is currently, you might want to opt for a traditional 401k vs. Roth 401k because you will pay lower taxes later on your withdrawals than you will currently on your contributions.

Don’t Miss: Sep IRA Rules| What You Need to Know about SEP Withdrawal, Contributions, and Plan Rules

Comparison: Roth IRA vs. Traditional IRA

Although IRA plans are different than 401k retirement plans, the Roth IRA vs. traditional IRA is similar to Roth 401k vs. 401k in the tax requirements.

When considering a Roth 401k vs Roth IRA, understand that they both work the same tax-wise. You will pay taxes upon your contributions, they will grow tax-free, and you will not be taxed upon withdrawal.

Source: USA Today

So, is a 401k an IRA comparable account in terms of taxes? Yes, they also work the same in regards to taxation, with your contributions remaining tax-free and growing tax-free, but then taxed upon withdrawal.

Therefore, you might consider a Roth IRA or 401k Roth account if you think your tax bracket may be higher upon retirement. Since you will pay less taxes on your contributions now and as your retirement plan grows, you will want to take advantage of that lower tax bracket now rather than having to pay higher taxes on withdrawals later.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Is a 401k an IRA? What Are the Similarities and Differences?

There are a lot of similarities between an IRA vs. 401k, and it can be difficult to pinpoint the differences to know which one is better for your retirement plan. The main reason people choose one over the other is dependent upon their employers and whether they choose to participate in a 401k program.

However, a Roth IRA vs. Roth 401k and their respective traditional plans also differ in maximum contribution amounts, the types of investments offered and required distributions. So, which should you choose: an IRA, Roth 401k, Roth IRA vs. 401k?

Many financial experts will actually advise you to have one of each option, such as a 401k vs. Roth IRA, if your employer participates in a 401k program. This is the best way to maximize your retirement benefits by combining the best of a 401k vs. IRA and can significantly boost your savings by retirement age.

So, if it is a possibility, have both a traditional or Roth IRA vs. Roth 401k. Allow your 401k to be the account for the majority of your contributions if your employer offers a good match, and use your leftover for your IRA. However, if your employer does not offer 401k, and you have to choose between your options, like a 401k vs. Roth IRA, consider the following differences between the plans.

Related: What Is a 401k?—What You Need to Know! (Understanding a 401(k) Plan Explained)

Income Guidelines for 401k vs. Roth IRA

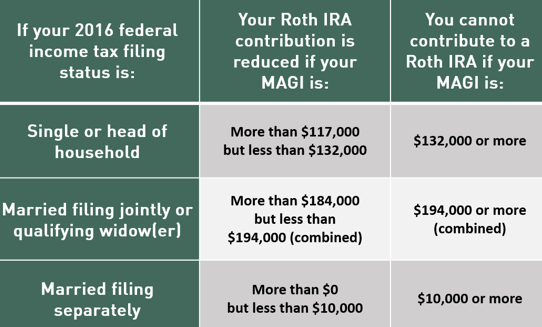

Roth IRA vs. 401k plans have important income guidelines to keep in mind before considering which option to choose. Between a Roth 401k vs. Roth IRA, the 401k plan will typically allow you to have a higher income than an IRA.

A Roth IRA vs. 401k requires a single tax return filer to have an income of less than $132,000 per year to be able to contribute to a Roth IRA. A 401k, on the other hand, does not have an income limit, so even high earners can contribute.

Source: Hardworking Capital

However, when comparing a 401k vs. Roth IRA, keep in mind that there is a rule for highly-compensated employees in 401k plans that limits the amount they can contribute each year to their plan. However, a highly-compensated employee’s higher earnings will not affect his ability to open and maintain a 401k account.

Taxation Differences between IRA vs 401k Plans

As previously mentioned, taxation is different between Roth 401k vs. IRA plans. Roth IRA vs. 401k Roth plans are taxed when contributions are made, but withdrawals are tax-free. Traditional IRA vs. 401k plan contributions are not taxed, but withdrawals are taxed.

But how do traditional or Roth 401k vs. Roth IRA and traditional plans differ in regard to taxes? The answer to this lies within the income guidelines of each type of plan. Since 401k plans do not have income restrictions as to how much income you can earn to open one, you are not limited to choosing between a traditional 401k vs. Roth 401k.

However, if you earn a higher income than a Roth IRA allows, you will have no choice but to choose a traditional IRA over a Roth IRA. Depending on the type of IRA you qualify for, your taxes will be different as outlined previously.

The 401k vs. Roth 401k plans do not have this income restriction, and you can therefore choose the plan with the taxation guidelines that works better for you. If you have high income and would rather have a Roth retirement account, a Roth 401k vs. IRA might be the better choice for you.

Maximum Contributions of 401k vs. IRA Plans

401k vs. IRA plans all have maximum contribution limits. How much you can and want to contribute will help you decide which retirement plan to choose to meet your retirement savings goals.

When considering an IRA vs. 401k, know that a 401k plan allows you to contribute a higher amount per year than an IRA. If you are under age 50, you can contribute up to $18,000 per year with a 401k vs. IRA limit of $5,500. If you are 50 or older, you can only contribute up to $6,500 with an IRA vs. 401k limit of $24,000.

Source: FedSmith

If you are a high earner and would like to contribute high amounts of your income per year, you should consider opening a 401k vs. Roth IRA to maximize your savings. However, if you will not be able to contribute nearly the maximum 401k amount, a Roth IRA vs. 401k could suit your needs.

Popular Article: How to Roll Over 401k—Everything You Need to Know! (Should I Roll Over My 401K & Advice)

Required Distributions of IRA, Roth 401k, 401k or Roth IRA

As maximum distributions of IRA vs. 401k plans differ, so do their required distributions, which are the withdrawals you are required to make by a specific age. Once you turn 59½, you are allowed to withdraw money penalty-free from your Roth IRA vs. 401k, which requires you to begin withdrawing money at age 70½.

Whereas a 401k vs. Roth IRA requires distributions by age 70½, your IRA will not require distributions for as long as you have your retirement plan. However, when you reach age 59½ and decide to withdraw money, an IRA will require you to have had your account for at least 5 years. A 401k does not have this restriction.

If you plan to need money prior to retirement, a Roth IRA vs. 401k could be a better option for you, as you can withdraw your money penalty-free. However, if you want to leave your money untouched until retirement age, a 401k is a good option.

Conclusion

Although the differences between 401k vs. IRA and their Roth counterparts seem small, they are important for those with certain incomes, taxation goals, and contribution abilities.

For those with higher incomes who wish to contribute more money, a 401k vs. Roth IRA could be the better option. If you have a lower income or an employer without a 401k plan, you might consider an IRA vs. 401k. Either way, you are taking a significant step toward saving for your future.

Read More: 401K Withdrawal | Before You Do | Limits, Penalty, Early Withdrawal Facts

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.