Intro: 401K Withdrawal? Before You Do, Review the Limits, Penalty, and Early Withdrawal Facts

When you’ve been contributing to your retirement savings account for a while, it might become tempting to consider withdrawing some of those funds.

Maybe you’ve come on hard times, have expensive medical bills, or you just want to reallocate those funds to a down payment for your first home.

Unfortunately, withdrawing from 401k money can come with a cost. Do you know the 401k withdrawal penalty?

Image Source: BigStock

Here at AdvisoryHQ, we’ve noticed that a lot of consumers seem to be considering 401k withdrawals. However, many individuals are still researching whether this move might be right for them. A 401k early withdrawal comes with some clear disadvantages. We aim to break down the 401k early withdrawal penalty so that you can better understand what you might be losing in the long-term to gain in the short-term.

We will answer key questions, including:

- Why would you consider a 401k withdrawal?

- What is the 401k withdrawal penalty?

- How does the vesting schedule affect me when withdrawing from 401k?

If you need to know more about 401k early withdrawal, we hope you’ll dive right in with us as we explore 401k withdrawals.

See Also: Best Places to Retire in Florida (What You Should Know Before Choosing Florida)

Why Make a 401k Withdrawal?

Recent surveys have shown that in America, the average household has a median amount of approximately $30,000 tucked away in 401k and other thrift savings accounts. It’s only natural to assume that some individuals might want to or need to dip into those funds.

However, with a 401k withdrawal penalty, why do some feel the need to withdraw from these types of accounts?

CNBC recently studied the amount of money that is lost due to withdrawing from 401k accounts early. They came up with the top four reasons that most individuals will consider making a 401k withdrawal:

- Emergency finances: Under some conditions, you can make a 401k withdrawal without incurring the basic penalty from the IRS, and emergency financial need may fall into this category. If you’ve been unemployed or lost your job after the age of 55, you may very well be able to make a 401k withdrawal without the penalty.

- Medical reasons: If you’ve satisfied the eligibility requirements, you may be able to consider withdrawing from 401k accounts for medical expenses without incurring the 401k withdrawal penalty. Certain expenses can allow you a 401k early withdrawal without the penalty, as can becoming permanently and totally disabled.

- Home purchase: First-time homebuyers (or those who haven’t owned a home in the past two years) are allowed one 401k early withdrawal up to $10,000. Experts mostly agree that choosing to withdraw 401k funds for this purpose can be a good investment. After all, a home is not a depreciating asset but a long-term investment that can bring greater value over time.

- Education: In order to avoid being saddled with student loan debt, many individuals will considering early withdrawal from 401k accounts to cover with their own education or that of their spouse or children. Unfortunately, you do still incur a penalty on this type of 401k withdrawal, and experts say that it isn’t a wise investment. After all, there’s no such thing as a retirement loan.

While not all of the common reasons for removing funds from your 401k account can assist you in avoiding the 401k early withdrawal penalty, some of them certainly can. In a later section, we will dive further into a few common ways that some individuals are able to avoid incurring the 401k withdrawal penalty.

Basic 401k Withdrawal Penalty

There are several facets to consider when taking a look at the 401k withdrawal penalty. While some of them are very dependent on your unique situation, others are consistent across the board. Your vesting schedule and the income tax levied against your 401k early withdrawal will vary depending on your employer’s policies and the type of 401k account you have been investing in.

However, the first aspect of understanding fees associated with early withdrawal from 401k accounts is to grasp the basic tax issued by the IRS.

For the most part, individuals are not typically allowed to withdraw 401k funds until they reach the age of 59½ unless they are totally and permanently disabled, rendering them unable to work. As we already touched on, there are a few exceptions when the IRS will allow you to make a 401k withdrawal without incurring a 401k withdrawal penalty. These might include unemployment, medical expenses, or purchasing your first home.

If none of the extenuating circumstances that allow for an exception apply to you, you should figure on being hit with the 401k early withdrawal penalty issued by the IRS. Not only will you likely own income tax on this upcoming amount, but you will find yourself forking over a 10 percent fee on the distributions.

This would mean that making a $10,000 401k withdrawal would result in an even $1,000 401k early withdrawal penalty from the IRS. Bear in mind that this isn’t the only cost you will soon be subject to.

There are no 401k withdrawal limits on your account. You are 100 percent entitled to the funds that actually belong to you, a topic we will go into further detail in the next section. While there may not be any 401k withdrawal limits, you may not be entitled to as much as you imagined.

Vesting Schedule for 401k Early Withdrawal

The IRS may only hit you with a 10 percent fee on the distributions when you withdraw 401k funds, but there may be a few hidden fees you don’t initially see. You are always entitled to every contribution that you have personally made into your account. Experts would consider you to be 100 percent vested in your retirement savings accounts.

Your employer, on the other hand, may not be 100 percent vested. That means that you personally do not have access to the full balance of your 401k account. This might make a big difference in whether or not withdrawing from 401k accounts is a smart financial move for you and your family.

With employer-sponsored contributions made into your account, it is quite possible that there is a provision that requires your employment for a certain number of years prior to becoming 100 percent vested in the account. This can be calculated usually in two different ways:

- Cliff vesting: Employers who use cliff vesting require a certain number of years of service from an employee prior to granting them any ownership to the account. If this applies to your situation, it means that you would be able to make a 401k withdrawal from funds you personally contributed, but you will have no right to withdraw 401k funds added by an employer until you have worked there for the agreed-upon number of years.

- Graduated vesting: In this scenario, you have usually vested a certain percentage for each year you have been employed. In this case, you may consider withdrawing from 401k funds that have been added by your employer up to a certain percentage. Usually, as you remain loyal to the company and employed by them, your vesting percentage increases each year.

Asking your employer about the vesting schedule is a great idea because it allows you to know what your 401k early withdrawal options are. If your 401k withdrawal limits will be significantly lower due to the vesting schedule, you would want to know upfront.

Don’t Miss: How Much Should You Have Saved for Retirement by 30, 40, 50, or 60

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Income Tax on 401k Withdrawal

While the IRS already hit you with the 401k withdrawal penalty, how much more will you own the government at the end of the year? 401k withdrawal has the potential to significantly increase your annual gross earnings, especially if you were withdrawing a hefty sum to cover medical expenses or to help pay for a new home.

How do you know if your 401k withdrawal will be subject to income taxes?

The answer is fairly simple. You need to evaluate which type of 401k account you already have and figure out when the taxes are levied against those contributions. A traditional 401k account is funded through pretax contributions. This means that when you make 401k withdrawals, you will need to come up with the after-tax money. The amount of money you are withdrawing from 401k this year will end up in your taxable income at the end of the year.

Depending on which tax bracket you’re in, you could be losing another 10 to 40 percent in addition to the basic IRS 401k withdrawal penalty already collected.

A Roth 401k collects contributions on after-tax dollars, so no income tax is due when you make a 401k withdrawal.

The other thing to keep in mind is that income tax will be due on the money invested in a traditional 401k account even if your withdrawal is exempt from the 401k withdrawal penalty. It is still a part of your income for the year that you should account for, even if you can avoid the 10 percent basic fee imposed upon it.

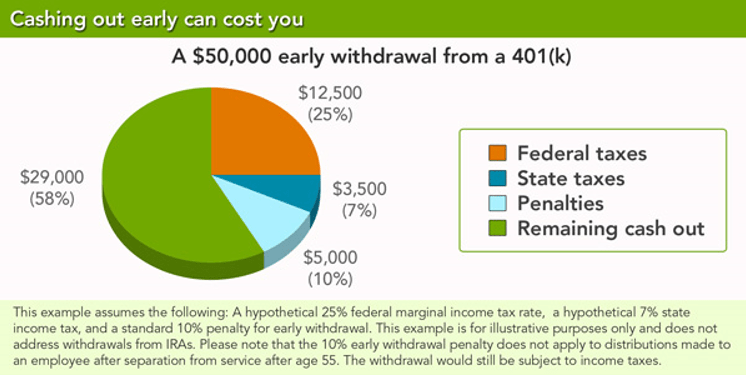

Image Source: Fidelity

This chart clearly shows how much money you lose through penalties and taxes when you make 401k withdrawals early.

Related: At What Age Can You Retire? Here is an Overview of How Soon You Can Retire

Avoiding the 401k Withdrawal Penalty

Under certain circumstances, you might be entitled to make an early withdrawal from 401k accounts without incurring the 401k withdrawal penalty. Situations like these are typically few and far between, but here is how to qualify:

- Medical expenses: Any medical expense that exceeds 10 percent of your adjusted gross income is considered tax-deductible, and you can consider withdrawing from 401k without the 401k withdrawal penalty.

- Court order: Divorce or separation may mean that you are court-ordered to turn over a portion of your 401k to a spouse. In these and similar circumstances, you can make an early withdrawal from 401k without penalties.

- Funeral expenses: Paying for the funeral or burial expenses of your spouse or dependents waives the 401k early withdrawal penalty.

- Housing: You may make a 401k withdrawal to help assist with the cost of purchasing a primary residence or to pay for certain repair costs on your home.

There are several circumstances under which you can avoid the 401k withdrawal penalty from the IRS. Most of these are related to circumstantial events and do not relate to purchasing new items or luxury items. Specifically mentioned in the IRS document regarding hardship is the purchase of a boat or television. Purchases such as these will not waive the 401k withdrawal penalty from withdrawing from 401k accounts and are generally considered unwise by experts.

You may also be able to make a 401k withdrawal under these circumstances:

- Disability: Being permanently and totally disabled allows you to make a 401k withdrawal without incurring a penalty.

- Retirement: If you choose to retire or leave your place of employment after the age of 55, you can avoid the 401k withdrawal penalty.

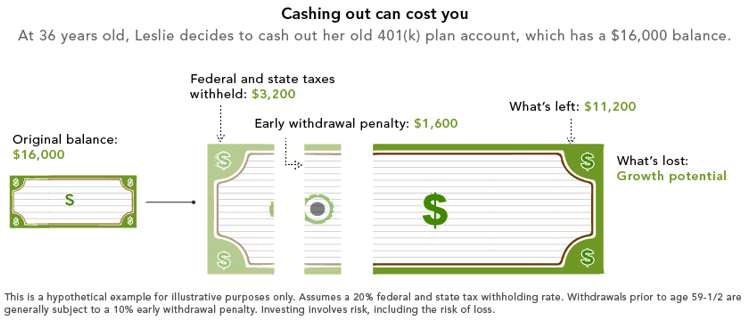

Image Source: Fidelity

Popular Article: Retirement Planning | Complete Guide to Help You Plan for Retirement

401k Loans

If you cash out your 401k account altogether, there are certainly no 401k withdrawal limits. You own and have access to all of the contributions you have made into your account. Sometimes, you may find yourself in need of just a portion of the funds within, and you need to make a small 401k withdrawal. Would it be better to consider a 401k loan instead of withdrawing from 401k accounts all the way?

Taking out a 401k loan will be dependent upon your employer’s policies. Specific reasons or circumstances may be required in order to justify a 401k loan, even if the same rules didn’t apply to withdrawing from 401k accounts. How does it work?

Well, you typically have a set period of time in which you must return the money you are withdrawing from 401k accounts. You will need to repay both the principal you withdraw along with the accrued interest, usually within five years. So long as those conditions are met, you won’t owe the 401k early withdrawal penalty and you will not be required to pay income tax on this amount.

What happens if you lose your job in the meantime? You must still repay your loan to the employer, usually within sixty days of the termination of your position.

Experts agree that withdrawing from 401k accounts for this purpose is still not recommended. Whenever money leaves your 401k amount, you are losing all of the potential growth that could have occurred while the money was safely tucked away within your retirement accounts. Your money can work much harder in long-term investment accounts such as 401ks than it can in your personal checking account.

Even when it comes to 401k loans, the amount that you borrow (even though it wasn’t a 401k withdrawal) won’t be able to grow nearly as much as it could have if you had allowed it to remain in the account.

Are 401k Withdrawals a Good Idea?

In the end, it’s easy to say that a 401k withdrawal likely isn’t the smartest or savviest financial decision you could choose to make. You automatically lose 10 percent of the money in your account to the basic IRS 401k withdrawal penalty in addition to potentially not being 100 percent vested in your 401k account as it is. While the income tax will be due on your 401k withdrawal at any age, you would qualify for a lower tax bracket when you hit retirement age.

There are many factors that directly impact the fees you pay for early withdrawal from 401k accounts. However, online calculators such as this one from Wells Fargo can help you to more accurately assess the cost.

Your 401k account is designed to help your money grow while you wait for retirement. By making a 401k withdrawal well in advance of that time period, you are losing out on quite a bit of extra potential earnings. You can choose to empty your 401k account since there are no 401k withdrawal limits, but you might be well advised to find other ways to meet your financial needs so you can have a heftier amount of money stored away for your inevitable retirement.

Read More: Saving For Retirement | What You Should Know about Saving for Retirement

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.