Complete Guide to Retirement Planning

No one wants to work for the rest of their life, but it seems that many individuals have a shaky knowledge of what goes into retirement planning. Planning for retirement involves thinking ahead to your golden years, accounting for your future living expenses, and then making arrangements for preparing for retirement.

Do you know how to plan for retirement? What are you doing to plan for retirement right now?

Image Source: Complete Guide to Help You Plan for Retirement

Whether you happen to be in your twenties or your fifties, preparing for retirement is crucial. We will go over the basics of what you need to know and help you to sort through the retirement advice from the experts. After you finish, you’ll feel ready to begin preparing for retirement right away.

See Also: At What Age Can You Retire? Here is an Overview of How Soon You Can Retire

Basic Tips and Facts for Planning for Retirement

According to the United States Department of Labor, fewer than half of all Americans have calculated how much money they should store away during their retirement planning.

How long do you estimate that you will spend in retirement? When it comes to planning for retirement, the average American spends approximately twenty years in this state. What retirement advice should you follow when it comes to your retirement financial planning?

Consider some of these tips for how to plan for retirement from the Department of Labor:

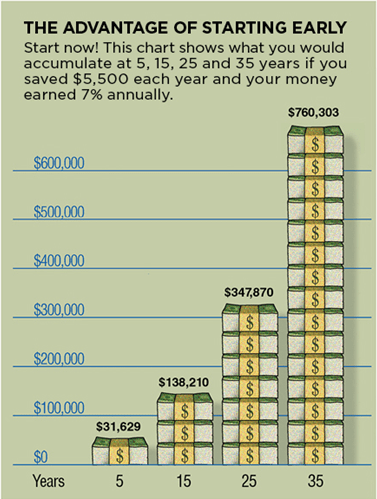

- Start saving. It’s important to take the first step when you begin preparing for retirement. Start putting money aside sooner rather than later.

- Make a plan. Retirement planning isn’t complete until you’ve calculated how much money you’ll need to set aside. Some of the best retirement advice is to plan for at least 70% of your preretirement income. Individuals and families who were low earners to begin with may want to shoot for retirement income planning of approximately 90% of their preretirement income.

- Make use of an employer’s retirement savings plan. If your company offers a plan to help employees preparing for retirement, make contributions and allow your employer to match what you contribute.

- Leave the money where it’s at. Some of the most well-known retirement planning advice centers on this principle. If you’ve already invested the money wisely, leave it where it’s at.

Image from the United States Department of Labor

Now that you have a basic grip on some retirement planning advice, we’re going to take an in-depth look at some of the more popular retirement investment account options and retirement income planning. We know that preparing for retirement can be overwhelming, so we’re going to break it down into manageable pieces.

Keep in mind that what is best for your own retirement planning might not be the ideal solution for someone else’s plan for preparing for retirement. You will have to figure out what works best for how to plan for retirement based on your own needs.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Social Security and Retirement Income Planning

If you are eligible for Social Security, the United States Department of Labor notes that you can expect to receive around 40% of your current income from Social Security benefits. Accounting for this type of retirement income planning can drastically lower the amount you need and change how to plan for retirement.

Not sure how much you can expect to receive from Social Security? In order to do some retirement income planning, you can take a look at their calculator on the Social Security website. When you have a good idea of what you can expect to receive on a regular basis, you may want to reconsider how to plan for retirement with a new strategy.

This retirement planning calculator from Kiplinger will help you estimate how much you should make each month in contributions toward preparing for retirement.

Don’t Miss: Ways You Can Retire Early (Detailed Early Retirement Planning Guide)

Planning for Retirement: 401(k)

What exactly is a 401(k) account? A lot of people reference this type of account when they begin discussing how to prepare for retirement. Employers frequently offer some type of retirement planning service for their employees, and they typically choose between 401(k) accounts and IRAs.

A 401(k) contribution withdraws money straight from your paycheck before taxes to put toward preparing for your retirement. This type of account does allow you to plan for larger contributions to your retirement planning than some other types of accounts. Each year, you can fund a 401(k) account up to $18,000. If you’re over the age of 50, the IRS’s catch-up provision allows you to make up for the lost time in preparing for retirement. You can then contribute up to $24,000 to your 401(k).

The best way to begin making use of a 401(k) is to check with your employer to see if they will help you with planning for retirement. You may find that they will do a company match up to a certain percentage. For example, you may contribute three percent of your paycheck into a 401(k) account, and your employer will add the same amount (either dollar for dollar or 50 cents to each dollar). Planning for retirement gets a lot easier when you have someone else helping you to save.

Do you get any say in your retirement planning, or does your employer dictate where the money goes? You typically get to choose the investments for your retirement financial planning based on several choices provided by your employer. The best retirement advice is to be proactive in your investments: know where your money is going and be aware of what the average rate of return is. You can’t fully flesh out your plan for preparing for retirement without understanding your investments.

Looking for some additional retirement planning advice? If you leave your employer that features a 401(k) contribution plan that you’ve been using while planning for retirement, you may want to consider rolling that plan over to an IRA (individual retirement savings account).

Retirement Income Planning: IRAs

Individual retirement savings accounts are a great way to begin planning for retirement. While some of these accounts are offered by your employer for the purposes of planning for retirement, you often set up your own with a bank or brokerage. The idea behind an IRA is to set aside your savings into investments where they grow tax-deferred.

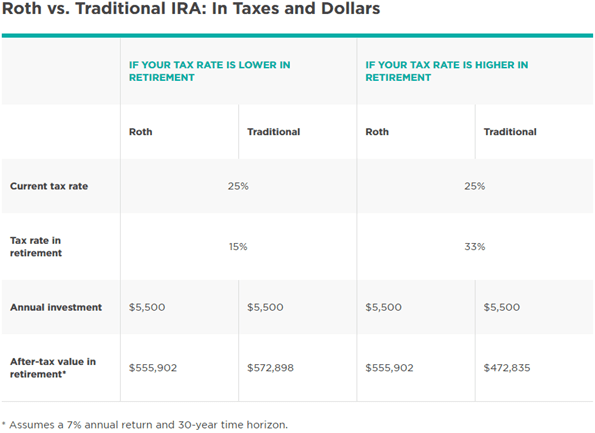

If you need to know how to plan for retirement, you should consider investigating the two major types of IRA accounts: traditional IRA and Roth IRA. Both accounts have a maximum retirement planning contribution of $5,500 per year with special catch-up provisions from the IRS for those over the age of 50.

Both types of accounts have advantages when it comes to retirement income planning, but it is often based on the income bracket you expect to be in for the future. A traditional IRA gives you a tax break in the here and now, while retirement planning with a Roth IRA reduces your future taxes.

You may also want to consider when you plan on withdrawing money from the account. If you withdraw money in advance of your retirement, your investment will take a hit either way. Compare the fees on both accounts to see which suits your retirement planning needs for the immediate future.

Chart from Nerd Wallet

Related: Do I Have Enough to Retire? Find out If You Have Enough Money for Retirement

Retirement Planning and Your Age

Planning for retirement will look different at every age. The sooner you can start preparing for retirement, the better off you will be in the long-run. The best retirement advice anyone can give is to start as soon as possible. TIME magazine compiled a list of tips and tricks for retirement planning at every age so you never have to wonder how to prepare for retirement based on your age. We’ll take a look at a few of them below.

If you’re in your twenties, you want to start paying down whatever debt you might have and begin to develop good savings habits. Planning for retirement requires you to contribute less each year if you can start earlier and gain a few extra years of savings. By your thirties, you’ve hit the “vital years for retirement planning,” when you need to start capitalizing on long-term investments for the maximum retirement income planning.

Once you hit your forties, planning for retirement becomes more conservative. You may want to consider shifting your portfolio from approximately 80 percent in stocks to 65 percent in stocks. Good retirement advice always leads you to decrease your risk as you age.

The fifties and sixties bring an opportunity for increased contributions to your retirement financial planning with catch-up provisions from the IRS. You will continue to shift your portfolio to more conservative investments. If you’re in your sixties and looking to access the funds in your retirement planning accounts, you will want to take a look at the market. If it’s a bear market, you run a 60 percent greater chance of running out of funds.

You may want to consider making a retirement income planning strategy with an emergency fund or a year or two of expenses set aside in case this happens to you shortly after your retirement.

Popular Article: How Much Should You Have Saved for Retirement by 30, 40, 50, or 60

Looking for Retirement Financial Planning

Need more retirement planning advice? Consider hiring a financial advisor that specializes in retirement planning and helping you learn how to plan for retirement. A financial planner can take a look at your current stage in life compared to when you are planning for retirement and see what steps would best serve you moving forward. Based on your long-term goals, they can help you figure out how much to stow away as well as how to plan for retirement.

You will want to look for someone who is a certified financial planner and fiduciary to make sure they will protect your best interests. Certified financial planners are required to complete coursework and continuing education to make sure they stay up to date on the best strategies, including retirement financial planning. Not everyone should issue retirement advice, so you may want to consider looking for an individual who has experience with retirement financial planning.

Retirement financial planning can provide a wealth of retirement planning advice from someone who has experience with the funds and account types available that would best suit your needs. Based on your current assets and savings coupled with your future needs, retirement planning advice from a certified financial planner would help you make informed decisions for your specific scenario.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

Retirement financial planning and preparing for retirement can be a daunting strategy to undertake. Begin with a basic understanding of the most popular methods for how to plan for retirement and then examine some of the best retirement advice from the experts. Keep in mind where you are in life, both in terms of age and current income level, to determine what you must do to begin preparing for retirement now.

Still at a loss for the best way to proceed in planning for retirement? Seeking the retirement advice of a certified financial planner can put you on the right path to preparing for retirement that will accommodate accurate living expenses and teach you exactly how to plan for retirement so you can live your golden years without worrying about money.

Read More: Best States to Retire in the U.S. (Review of the Top Retirement States)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.