fGuide on How to Get a Mortgage with Good or Bad Credit

When you purchase a home, you enter into a world full of stressful details that only come up a handful of times throughout your lifetime.

Where can you turn to for mortgage help? It seems that the professionals all offer cheap mortgages and various mortgage options, but you may not be able to tell what the best mortgage options are. You want to make the best decisions you can, but first you need to know how to get a mortgage.

AdvisoryHQ has noticed all the consumer interest surrounding tips for getting a mortgage—mortgages for bad credit and good credit abound. We’ll help you learn how to compare mortgage rates and give you the real mortgage help you’ve been searching for.

If you’re ready to uncover the secrets of how to get a mortgage that will work for you, let’s take a closer look at what you need to do.

See Also: We Buy Ugly Houses Reviews | What You Need to Know (Complaints, Pros & Cons)

Mortgage Options

First things first, you should have a crystal clear understanding of what the various types of mortgages are.

When your lender begins to spout off about fixed-rate mortgages, adjustable-rate mortgages, jumbo loans, FHA loans, VA loans, and any number of confusing terms or acronyms, you should understand exactly what you’re agreeing to.

We’re going to cover the basic mortgage options that cover a variety of needs. You’ll almost certainly find a loan that fits into one of these categories:

Fixed-Rate Mortgage

A fixed-rate mortgage is exactly what it sounds like—a loan that features one interest rate that will last throughout the duration of your loan term. That term could span any set period of time, typically ranging from ten years to thirty years. Most lenders will offer the two most popular options at fifteen- and thirty-year loan terms.

These are ideal for homeowners who want mortgage options that will give them one steady and consistent payment throughout the duration of their loan term. If you intend to stay in your home from now until your mortgage is paid in full, a fixed-rate mortgage gives you the best chance of security as long as you sign on the dotted line while mortgage rates are low.

Adjustable-Rate Mortgage

This is sometimes referred to as an ARM, and the interest rate does change, meaning that you will need to compare mortgage rates every so many years. Depending on the set up of your particular mortgage options, your rates will stay the same for a set introductory period ranging from three to ten years. After that, lenders will typically evaluate your rates on an annual basis.

This could be great if you don’t plan to stay in your home for a long period of time. Adjustable rate mortgages tend to offer the lowest interest rates when you start to compare mortgage rates side by side.

However, you’re taking a big gamble after your introductory period expires at the end of the term. It’s true that you could be getting a mortgage rate that is significantly lower at the end of your introductory period, but it could also rise beyond what you imagined.

Don’t Miss: How to Find a House to Buy | Guide on Finding Houses for Sale

Other Mortgage Options

From those basic two types of mortgages come a number of other programs that are helpful to certain segments of the population. If you’re in desperate need of mortgage help, one of these mortgage options might give you exactly the assistance you’ve been searching for.

- Jumbo loans: A jumbo loan is the option for homeowners seeking extremely expensive or high-end homes greater than $417,000 in value. You should expect to have stellar credit and the income necessary to afford such an extravagant home.

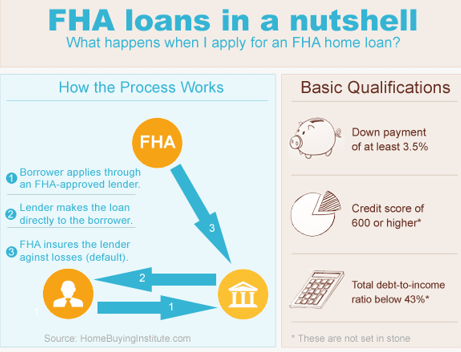

- FHA loans: Federal Housing Administration loans are far more commonly referred to as FHA loans. These are ideal options for first-time homebuyers because they allow a significantly lower-than-usual down payment. With introductory down payments starting as low as 3.5 percent, FHA loans are backed by the federal government and give lenders more access to lower rates and better deals that make purchasing a home more appealing.

Source:Mortgage Types

- VA loans: VA loans are mortgage options that are backed by the United States Department of Veterans Affairs. The VA loan program is an attractive option for eligible service members in the United States armed forces because of its no down payment requirements and the waived mortgage insurance.

- USDA loans: Designed to help very low- to moderate-income families make homeownership a reality, USDA loans are one of the best mortgage options for families who need assistance. Depending on which program you opt for through the USDA, you’ll find that getting a mortgage for a home in a developing and eligible rural area gives you the best choice among cheap mortgages. No down payment is required, though there are stringent guidelines regarding what type of house you purchase when getting a mortgage with this program.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Deliver on Your Down Payment

You probably already knew that getting a mortgage means handing over a large chunk of change to your lender before they’ll allow you to sign on the dotted line. Unfortunately, most people don’t have access to the kind of funds that they need to make their purchase unless they’ve been planning for quite some time. If you choose to go for a conventional mortgage versus one of the programs that feature no down payment or a low down payment, most lenders will want you to put down at least 20 percent.

If you think that you can get relatively close, it may be worth waiting until you can reach this magic number. At several financial institutions, you may find that when you offer up a larger down payment, they can offer a lower rate.

Compare mortgage rates based on the down payment that you plan to hand over to the bank in exchange for your initial mortgage. You may save a hefty amount of money of the length of your loan, especially if you are looking at longer loan terms like a thirty-year fixed-rate mortgage.

Additionally, putting down a full 20 percent for the down payment on your house is likely to give you lower monthly payments in more ways than one.

Lenders who issue conventional loans with down payments less than 20 percent will typically require private mortgage insurance which can add up quickly. Once you surpass this magic number, this additional monthly fee is often waived which allows you to receive more cheap mortgages.

Related: Top Navy Federal Credit Cards | Ranking | Best NFCU Secured, Rewards, Cash Back Credit Cards

Credit Scores Do Matter

There aren’t very many mortgages for bad credit available for individuals who haven’t exactly kept on top of their credit scores. With an investment as large as a house, lenders prefer to issue long-term loans to individuals and families who stay current with their financial obligations and who have a low debt-to-income ratio.

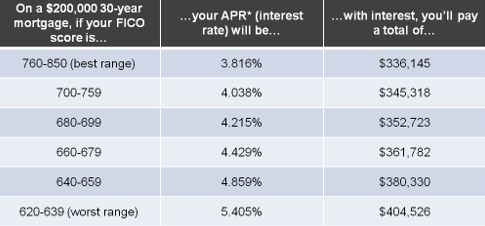

When you compare mortgage rates, you’re likely to find that applying with an excellent credit score (anything over 760) will typically give you the best mortgage rates around. When you start searching for a bad credit mortgage, there likely won’t be much to be found. Start today by polishing up your credit score even if you know that homeownership is a goal far in the future for you.

You can begin to keep tabs on your credit sore through free credit score sites like Credit Karma or Credit Sesame. Additionally, you may already have access to free credit reporting through any credit cards that you have. Some of these include offers that give you a free FICO credit sore on your monthly statement so many times each year. Get an idea of where you stand and then take the suggestions offered for ways to improve it.

Keep in mind that maxing out your credit cards isn’t going to help you figure out how to get a mortgage. In fact, burying yourself in debt makes a bad credit mortgage even less likely than it was before. Experts recommend keeping your credit cards at no more than 30 percent of their maximum line of credit for the best results.

At most, lenders will want to see a debt-to-income ratio of 43 percent including the projected cost of your new home. That means that your total financial obligations (think of your auto loans, student loans, and credit card debt) plus your new mortgage should make up 43 percent or less of your total income. Lowering your debt can certainly help to lower your rates and may allow you to get mortgages for bad credit while you work on polishing up your score.

Bad Credit Mortgage

If you do end up needing mortgages for bad credit, it is still possible to find mortgage help. Bear in mind that this attribute does make you a less desirable consumer for lenders and they may not be inclined to give you their best mortgage options. Mortgages for bad credit typically entail higher interest rates and more fees than your consumer counterpart who has stellar credit.

Source: Improve Credit Score

When you apply for mortgages for bad credit, many lenders may require you to go through some sort of financial counseling to ensure that you truly do understand the financial obligations of getting a mortgage. This homeownership counseling can generally be completed online from the comfort and convenience of your own home.

If you find a lender that makes this a requirement for a bad credit mortgage, try to look at the positives of it. The financial counseling could open your eyes to some of the unseen costs of homeownership to help you determine whether or not you can afford to keep up with your bad credit mortgage payments.

If your credit score needs to be polished, but the perfect opportunity arises for a bad credit mortgage in the here and now, you can always refinance in years to come. By making your payments in a timely manner over the course of the next few years, your credit score is likely to increase, and getting a mortgage with better rates should be easier when you refinance. This can be a great way to take advantage of homeownership now but qualify for better cheap mortgages in the near future.

Compare Mortgage Rates

It’s tempting to assume that all lenders offer identical rates and mortgage options, but that really isn’t the case. Your mortgage interest rate is critical to consider. After all, your interest payments really accumulate throughout the years, especially on a thirty-year fixed-rate mortgage. How do you know whether you’re getting a great deal if you don’t compare mortgage rates?

Interest rates can rise and fall on a day-to-day basis, even sometimes fluctuating throughout the course of the day. Lenders make adjustments based on economic indicators that show growth or slowdown in the economy, predictions about future shifts in the economy, the mortgage market, and even the money supply. Getting a mortgage rate from one company today likely won’t give you a fair comparison when you look at a separate company weeks in the future.

If you’re going to compare mortgage rates (and we highly advise that you do), it’s imperative to look at lenders in the same general timeframe. When possible, you should really compare mortgage rates in the same day or at least over the span of a few days. This will give you the most accurate insight into which lenders are offering the best rates, whether you’re looking at a bad credit mortgage or a good one.

Furthermore, keep in mind that the credit reporting agencies typically give you a 14-day window in which to compare mortgage rates. They won’t expect you to commit to the very first lender that you talk with. So go ahead and do a little window shopping to find the best mortgage rates and terms that you can find. You’ll be stuck with your loan for a long time, so getting a mortgage that you feel comfortable with is critical.

Cheap Mortgages

You feel fairly comfortable with the basics of what you need to do to get the best mortgage options available for your financial situation. You’ve worked hard to polish your credit score until it shines, pay down your debt, and scrape together a larger down payment. But now where can you go to start receiving mortgage help?

In the new digital age, many consumers are finding that online mortgage lenders present an excellent opportunity. They tend to offer lower interest rates than their brick-and-mortar financial institution counterparts because they lack the overhead expenses that these local branches must account for. Not to mention, time is money, and the convenience of performing all your mortgage requirements from the comfort of your couch at your convenience is highly appealing.

Companies such as Quicken Loans, Citi Mortgage, and PNC Bank have all begun to claim a share of the online lending market. They offer competitive interest rates and a variety of mortgage options to choose from, making them ideal for most individuals.

Source: Quicken Loans

For those individuals who prefer a more traditional face-to-face interaction when it comes to getting a mortgage, applying at your local credit union might be your best bet. Because they are non-profit lenders, a credit union can usually offer the lowest rates. They also may have more flexible terms and options, including for those who need a bad credit mortgage option. It’s a bonus if you already have a relationship with the lender that you’re approaching for a mortgage.

Read More: How to Sell Your House Fast in 30 to 60 Days | Guide on Selling Your House Fast

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

For those who are struggling to figure out how to get a mortgage, much less a bad credit mortgage, it helps just to know what all of the mortgage options are. Homeownership and the financing it requires can be a difficult field to navigate without the proper know-how and mortgage help.

You’ll need to evaluate where you are financially and what sort of improvements or changes you may need to make to qualify for the best mortgage options. With any luck, the best mortgage options will also be cheap mortgages. These tips and tricks should put you on the right path to getting a mortgage that will work for you for the long years ahead.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.