Intro – Huntington Bank Reviews

Opening a checking account, savings account or credit card with a new and unfamiliar bank can be scary.

You need to examine their programs, overdraft fees, and perhaps most importantly, their reviews. Huntington Bank has numerous programs and features to suit the usual needs, as well as several others that are a little more unique to their brand.

Let’s take a look at some Huntington Bank reviews to help answer some of the basic questions:

- What is Huntington Bancshares?

- What features does a Huntington Bank savings account offer?

- What is the Huntington online banking app?

We can answer all of these and more in this Huntington Bank review to give you the knowledge you need to decide if it’s the right fit for you.

See Also: Morgan Stanley Reviews – What Is Morgan Stanley? (About, Customer Reviews, & Review)

What is Huntington Bancshares?

Huntington Bancshares Incorporated is the new name for the former Huntington National Bank originally established back in 1866. The new name was created after the merger between Huntington and FirstMerit to create a stronger regional bank.

After the merger, based on their deposits, Huntington Bancshares became the largest bank in Ohio. They have $100 billion in assets and nearly 1,000 branches sprinkled across eight states.

LendingTree hosts Huntington Bank reviews from over 600 customers, and 77% have said they would recommend them as a lender.

Out of 5 stars, they scored a whopping 4.5, a huge feat given how large of a bank they are and how much more prone that makes them to negative publicity.

Don’t Miss: About RBS – What Is RBS? (Complaints, News & Reviews)

Huntington Bank Reviews: Savings

Huntington Bancshares offers several options for savings depending on the amount you plan to keep in your account. However, the Huntington Bank savings account program offers a few basic features that are inherent to all their programs:

Overdraft Protection

Avoid the Huntington Bank overdraft fees with free protection from your savings account. As long as you have enough money in the account to cover the amount you’ve overdrawn, they will automatically transfer the money with no additional fees.

They also give you a 24-hour grace period to correct your overdrawn status the following business day.

Mobile App

Access your Huntington Bank savings account anywhere, anytime with the Huntington online banking app.

All Day Deposits

If you have a savings account, you also have access to all day deposits with no cut off time.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

NerdWallet’s Huntington Bank review lists their “excellent variety of checking and savings account products” as one of Huntington Bancshares’ best features. They break up their savings accounts into three basic types:

Huntington Premier Savings Account

Our Huntington Bank review found that this account requires an average daily balance of $300 in order to waive their monthly fee. Another way to avoid the monthly fees is to link it to an Asterisk Free checking account.

This is a great savings option for someone who is just getting started. The monthly fee without those requirements is a mere $4.00 per month.

Relationship Savings Account

This account features a higher interest rate on deposits and free overdraft protection fees if you have a Huntington 5 checking account.

You also gain additional interest on your deposits if you have a Huntington 5 checking account. Monthly fees are $10 per month unless linked with a Huntington 5 or Huntington 25 account.

Huntington Relationship MMA

This money market account is best for those who average a $25,000 balance, maintain a Huntington 5 or Huntington 25 checking account, or pay the $25 monthly fee.

Although the requirements are higher, our Huntingon Bank review found that this Huntington Bancshares savings account does offer the best interest rates.

While their variety of savings accounts is large, the interest rates are only average.

If you maintain a large monthly balance and are more interested in getting higher returns, Huntington Bancshares may not be the place for you.

Huntington Bank Reviews for Checking Accounts

Huntington Bank reviews wouldn’t be complete without taking a look at the different checking account options available.

For most people, this is their biggest concern with a new bank: How will their basic checking accounts function to meet their most pressing daily needs?

All of Huntington Bank’s checking accounts have a few basic features:

- A grace period for Huntington Bank overdraft fees

- Huntington bank overdraft fee protection from savings accounts

- Monthly fees waived on savings accounts

- Free online bill pay and mobile banking

- Free alerts

- All-day deposits.

Below is a Huntington Bank review of their basic checking accounts:

Asterisk Free Checking

While you don’t get any interest accumulating on this type of account, it is a good basic starting point. It has no monthly fees, regardless of what balance you maintain.

Huntington 5

The Huntington 5 is the first tier of their interest-bearing checking accounts. You must pay the $5 monthly fee or maintain $5,000 in balances across your Huntington Bancshares accounts.

Huntington 25

The second and highest tier of their interest-bearing checking accounts, you get a 0.25% APY , a rate bump when you link your checking and savings, a 10% Huntington Bank credit card bonus, unlimited ATM withdrawals (even at non-Huntington Bank ATMs), and free checks.

Unfortunately, this is also the most costly of their accounts. Expect a $25 monthly maintenance fee or to maintain a $25,000 balance across your accounts.

The checking accounts can range from basic to more involved depending on your banking needs.

If you have a long history of overdrawing your accounts, Huntington Bancshares would be a good bank to consider because of its flexibility on overdraft fees.

Our Huntington Bank review found that you have several ways you can safeguard your accounts to avoid unnecessary fees.

Related: BMO Harris Bank Reviews -Everything You Need to Know (Credit Card Rewards, Private Banking & Review)

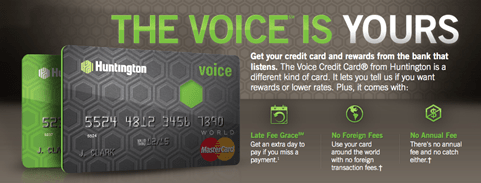

Huntington Voice Credit Card Review

Looking for a credit card that is going to give you flexibility to choose what you earn points on? This Huntington Voice credit card review will walk you through the details of what you need to know about their unique program.

Photo courtesy of: Huntington Bancshares

Huntington Bancshares offers their Voice credit card as a basic credit card with some premium features. There are no annual fees, no foreign transaction fees, and no penalty rates. Offering the ultimate flexibility, you get to choose which option you prefer:

Triple Rewards

Every purchase earns you a point per dollar, but you are allowed to select one category each quarter to earn triple points.

However, this reward is limited to $2,000 per quarter, which might not be much depending on which category you choose.

Lower Interest Rates

If you would rather have lower interest rates, choose this option instead of the triple rewards. It offers a 3% decrease in the purchase APR of the card.

If you choose to go with the rewards points options, you even have several options for how to use them. You can use them to shop for specific items directly from the Huntington website, use them to plan your next vacation, or just cash them in and use your money elsewhere.

The best feature, according to Huntington Voice credit card reviews, is the amount of flexibility you get with the rewards you accumulate based on your spending.

No matter which option you choose, one of the best features to include in the Huntington Voice credit card review is their late fee grace period.

You have one extra day to catch up if you miss a payment. This is great if you have a tendency to forget your due date or just have a full plate.

Huntington Online Banking App

Because Huntington Bancshares is a regional bank, their Huntington online banking app makes their services available to anyone anywhere.

Available for both iPhone and Android, you can have access to your Huntington Bank savings account and checking account 24/7.

Keep an eye on your account balances at any time to avoid a Huntington Bank overdraft fee or to pay your bills quickly and efficiently.

The Huntington online banking app gives you the power to:

- Access accounts

- Find locations near you

- Make deposits or transfer money

AppPicker claims that one of the best features of the Huntington online banking app is the ability to call customer service directly from within the app if you have any questions about your accounts.

Their Huntington Bank review found it to be an easy-to-use interface with convenient features, great for those on the go.

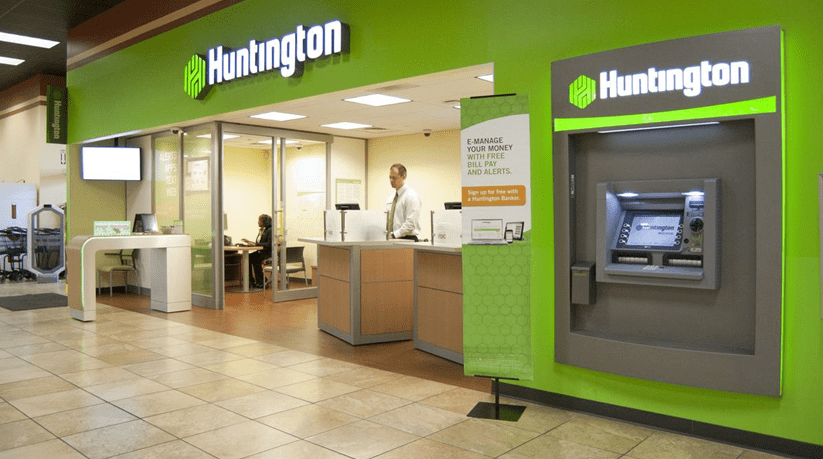

Photo courtesy of: Huntington Bancshares

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Is Huntington Bancshares Right for You?

Still on the fence about whether or not Huntington Bancshares is the bank for you, even after reading the Huntington Bank reviews? Take a look at this checklist to see if your banking needs line up with what Huntington can offer:

- Flexible savings and checking account options, depending on your financial status and willingness to pay monthly fees

- Accounts that help you to avoid Huntington Bank overdraft fees with grace periods and savings account protection

- An intuitive Huntington bank online mobile app for banking on the go

- A flexible credit card that gives you freedom to choose what is most important to you

Take a look at all the favorable Huntington Bank reviews and see that it offers great flexibility, tons of options, and unique features.

We’ve reviewed the history of the bank, taken a look at the Huntington Voice credit card reviews, and examined the Huntington Bank savings account options. Now it’s time to decide. Is Huntington Bancshares right for you?

Popular Article: Nationwide Bank Review – What You Need to Know! (Auto lending, Loan &Mortage Reviews)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.