Overview: Is Credit Karma Accurate?

We all know it is important to monitor your credit. Doing so keeps you on top of your finances and helps you understand where your money is going and what debts you need to pay off.

Credit monitoring helps you identify fraudulent activity on your credit report, like someone trying to open an account in your name.

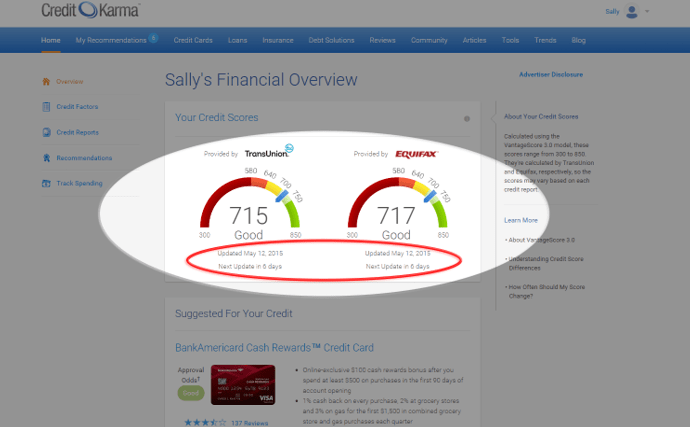

Credit Karma accurate credit monitoring can be a good tool to keep you abreast of your credit score and credit report.

But does Credit Karma give accurate scores that will help you keep track of and improve your credit?

Credit: Credit Karma

What Is Credit Karma?

You are likely reading this because you are a prospective customer considering signing up for Credit Karma. So, before answering the question, “Is my Credit Karma score accurate?” we are first going to explain Credit Karma and its services.

Credit Karma offers a free service for you to receive updates of your credit score and credit report. Credit Karma then uses the information provided to offer you recommendations of products or services that may improve your credit or financial needs, such as credit cards and loans.

Credit Karma updates your score and report once every week as long as you log in to the system. But is Credit Karma accurate if it only gives you updates weekly? Actually, weekly updates are very helpful. Most people only check their credit score and credit report once per year, which is not enough to catch fraudulent activity or monitor your debts and open loans.

A Credit Karma score accurate test can only be accomplished by understanding Credit Karma, what it offers, and how it works. Let’s take a look at the credit bureaus Credit Karma uses to pull your credit score and credit report, which will help us determine the answer to, “Is the credit score on Credit Karma accurate?”

See Also: Is Credit Karma Legit? Is It a Scam? What You Should Know About Credit Karma

What Credit Bureaus Does Credit Karma Use?

There are three major credit reporting bureaus: TransUnion, Equifax, and Experian. Each credit bureau calculates your credit score a bit differently using different algorithms according to your credit report information. What are the differences, and how does this affect the answer to, “Is the Credit Karma score accurate?” The two credit bureaus Credit Karma pulls its information from are TransUnion and Equifax, so let’s take a better look at both of these.

Your TransUnion credit score and your Equifax credit score can range between 300–850; the higher the score, the more creditworthiness you have. There are not significant differences between these two bureaus, but reported information can vary between them.

To research “Is Credit Karma accurate?” we need to understand the accuracy of the bureaus. Each creditor can decide what bureau or bureaus to report information to. Smaller banks, for example, may choose to report only to TransUnion or only to Equifax because it costs a fee to report to each bureau.

Each bureau also reports information in different ways, some of which can be easier or more difficult for one to understand. For example, Equifax separates your open and closed accounts from each other, making it easier to quickly pinpoint what you are looking for.

TransUnion provides a credit trending analysis based on your accounts that details behaviors in your spending. This can help you understand what you might need to do differently to pay down debt faster.

The credit bureaus can choose to use different credit scoring systems. A Credit Karma accurate credit score is the product of VantageScore 3.0, a fairly new credit score algorithm used by the three main credit bureaus. Credit Karma chooses to use this score rather than its rival, FICO, for several reasons. To better understand, “Is Credit Karma an accurate credit score indicator?” we will take a look at the differences between FICO and VantageScore 3.0.

What Are the Differences Between FICO and VantageScore 3.0?

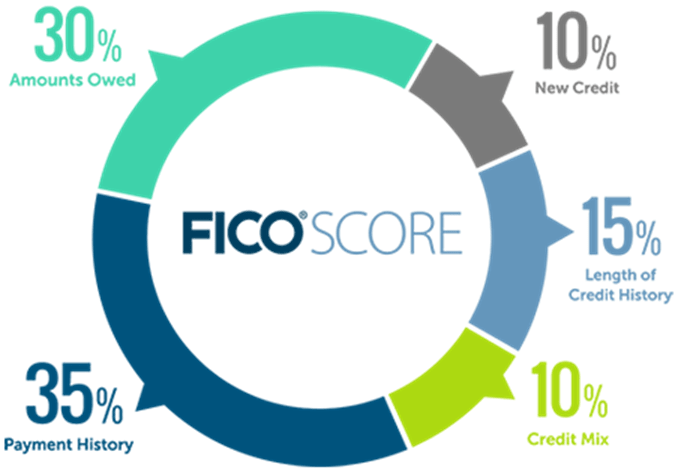

The Fair Isaac Corporation created the FICO credit score in 1956, making it the first official credit score. FICO predicts that 90% of lenders check your FICO credit score to understand your creditworthiness before lending you money. The three main credit bureaus use and update your FICO score.

Credit: My Fico

Your FICO score reflects both positive and negative information within your credit report, such as amounts owed, new credit lines opened, length of time each account has been opened, and payment history. Your payment history and amount you owe have the greatest impact on your FICO score. Basically, if you pay your bills on time and don’t carry high balances on the majority of your accounts, you should have a decent FICO credit score.

FICO seems to be the historical gold standard of credit scores. However, is the Credit Karma credit score on Credit Karma accurate since it uses VantageScore 3.0? Does Credit Karma give accurate scores without the use of FICO? Research shows that VantageScore 3.0 is also an accurate credit score tool.

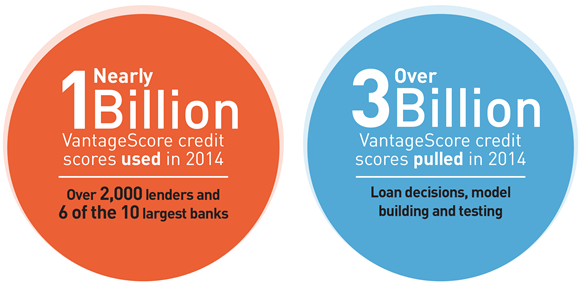

Credit: Credit.com

VantageScore 3.0, created in 2013, is a joint creation of Equifax, TransUnion, and Experian. The original VantageScore algorithm has been in place since 2006. VantageScore 3.0 is used with about 10% of lenders, usually large banks and lenders, which is a significant amount considering the difficulty competition sees in the credit score and reporting market.

Is the Credit Karma score accurate because of VantageScore 3.0? One of the biggest advantages of VantageScore 3.0 is that it is able to calculate scores for millions of people who were previously considered as not having enough credit history to score.

VantageScore 3.0 relies on only one month of credit history and less frequent credit report updates than FICO, which requires at least six months of credit history and recent credit updates. Therefore, it is possible that Credit Karma score accurate predictions are possible for those with little to no credit history, thanks to VantageScore 3.0.

VantageScore 3.0 offers other advantages FICO does not, such as credit relief for those affected by natural disasters and ignoring any paid or unpaid collections less than $250. So, your Credit Karma score with VantageScore 3.0 might actually be a little higher than your FICO score if these particular scenarios apply to you.

Is Credit Karma Accurate?

Now that we’ve discussed what the Credit Karma service does, what credit reporting bureaus it uses, and the VantageScore 3.0 credit score, we can answer the question, “Is the Credit Karma credit score accurate?”

We realize that the answer to the question, “Is Credit Karma accurate?” is subjective, so our goal is to objectively provide facts based on our research and the tools Credit Karma uses to provide Credit Karma score accurate predictions.

Related:Consumer Credit Counseling Service – What You Should Know Before Using Them

Credit Bureau Accuracy

First, let’s discuss the two credit bureaus that Credit Karma uses: Equifax and TransUnion. Since each credit bureau collects different information and uses it in various ways, it is a good sign of accuracy that Credit Karma chooses to use two of the three major credit reporting bureaus to calculate a Credit Karma accurate score.

Some advantages of using both of these credit reporting bureaus are:

- Your chances of having your most recent account information reflected are doubled

- Your credit score is combined, using Equifax and TransUnion, for a more accurate average of your score

- You will be able to see any discrepancies between the two bureaus so you can fix any errors you may find

VantageScore 3.0 Accuracy

How does VantageScore 3.0 help us answer the question, “Is Credit Karma accurate?” VantageScore 3.0 is the leading credit score resource next to FICO. The fact that VantageScore 3.0 is quickly on the rise in its use among large lenders and banks shows that it is a highly-respected credit score algorithm. Those who choose to use VantageScore 3.0 must see it as accurate for their purposes of checking credit history.

VantageScore 3.0 helps create Credit Karma score accurate predictions because it:

- Is able to score more people than FICO, like those with little to no credit history or those trying to rebuild their credit

- Uses the same score range of 300–850 as FICO, allowing more ability to produce an accurate and unlimited score

- Does not consider collections accounts that have been fully paid, so it accurately scores the progress you have made

- Heavily factors your payment history, age of credit, type of credit, and credit utilization percentage, which are all accurate predictors of how you manage your credit

- Does not place significant importance on your recent credit behavior or available credit; VantageScore 3.0 cares more about your history and how you use the credit you have

VantageScore 3.0 has several advantages over FICO and undoubtedly helps provide Credit Karma accurate credit scores.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Weekly Credit Score and Report Monitoring

To answer “Is my Credit Karma score accurate?” you might want to know how often Credit Karma updates your credit score and credit report information. As mentioned, Credit Karma provides free weekly updates of your credit score and credit report. Additionally, Credit Karma offers daily alerts when anything on your credit report changes.

Why is this important, and how does this affect Credit Karma score accurate results? A credit score last updated a year ago, six months ago or even one month ago would not be an accurate score. A lot can change in a month. You could open a new credit card account, pay off your car loan or refinance your mortgage – all things that can significantly affect your credit report.

Is the Credit Karma Score accurate because of weekly updates? No, but weekly updates help to ensure you are receiving the most accurate credit score and credit report information. If you choose to sign up for Credit Karma’s daily alert monitoring, you are staying proactive to keep a close eye on anything that could be fraudulent or inaccurate.

Verdict: Is My Credit Karma Score Accurate?

Although there will inevitably be discrepancies in your credit score and credit report when cross-checked with reports from other bureaus, Credit Karma does an excellent job to ensure that Credit Karma accurate results come from VantageScore 3.0, TransUnion, and Equifax combined. Credit Karma has millions of loyal customers who rely on Credit Karma to provide them with important financial information, and they proactively use that information to monitor their credit and keep it in good health.

Whether or not you question “Does Credit Karma give accurate scores?” one thing is for certain: actively monitoring your credit report and credit score is are good practices to keep your credit in good health and protect it from fraudulent activity. Credit Karma’s services help you do just that.

Popular Article: Credit Karma Complaints | What You Should Know Before Using the Site

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.