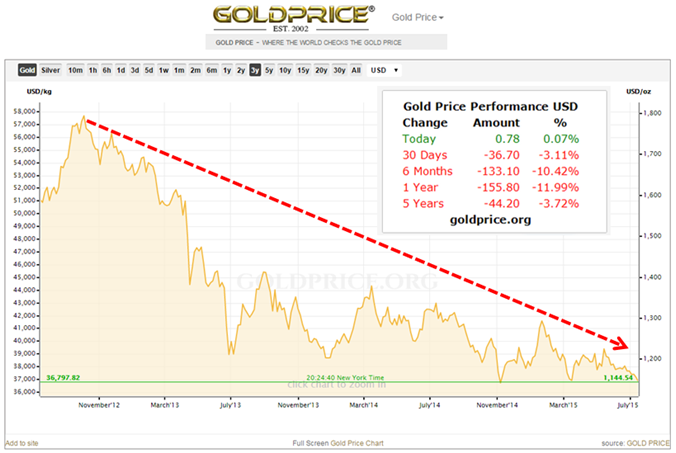

Overview: Gold Prices | 3-Year Chart

Source: Gold Price

Is Gold a Good Investment Right Now?

Over the last three years, as seen in the chart above, gold prices have declined sharply.

During this time, investors have asked themselves three key questions: Is gold a good investment right now? Is this a good time to be investing in gold? Should I buy or sell gold now?

To answer the above questions, we first need to take a step back and quickly review the key factors that institutional gold investors consider when deciding whether to invest in gold.

See Also: Are Bonds a Good Investment Now that the Fed Plans to Raise Rates?

Fed Interest Rate Hike Expected – Should Investors Buy or Sell Bonds?

Key Factors to Consider When Investing in Gold and Silver

Gold investors invest in gold when they need a “safe heaven.”

Silver is the closest precious metal that investors buy and sell if they don’t want to specifically buy or sell gold.

The prices of these two precious metal commodities normally move in lockstep.

When the US or global economies experience economic declines, investors rush into precious metal (gold or silver).

When financial markets freeze up, investors rush into precious metal investments.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Gold is the one asset that will always “exist” even if the world falls into an abyss, which nearly happened during the 2008–2010 financial crisis.

This was the same period when financial markets came crashing down across the world, credit markets froze, banks stopped lending, and the Dow Jones index plunged 778 points in a single day.

With each day came breaking news that another bank had become insolvent.

In the United States, firms, like Bear Stearns, Lehman Brothers, Freddie Mac, Fannie Mae, AIG, and Washington Mutual, either collapsed or needed to be bailed out by the US government.

In the UK and other countries, thousands of banks collapsed and needed taxpayer bailouts.

During this time, investors fled from stocks, bonds, and most other assets (mostly at a loss) and purchased gold.

Investing in gold became one of the highest trending topics.

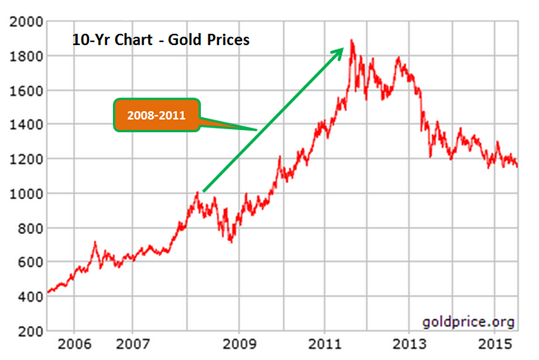

During this entire time, while the global economy teetered on the brink of depression, silver and gold prices surged.

Between 2007 and 2011, gold prices soared over 130% to a high of $1,921 an ounce.

Source: Gold Price

Things are much different now.

Economies around the world are experiencing improvements across various sectors.

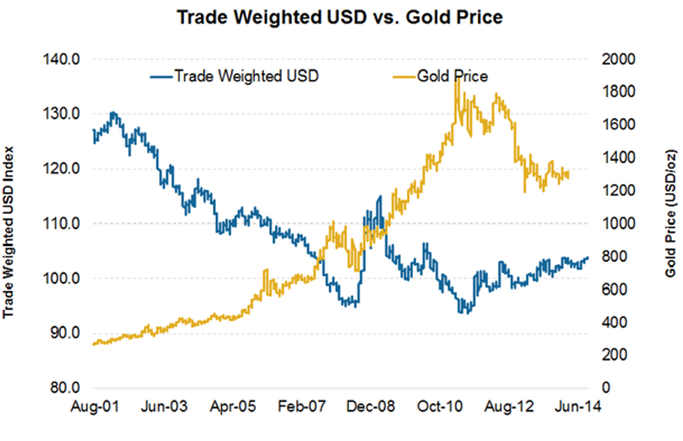

The U.S. dollar has become very strong relative to other currencies.

As such, as the dollar has increased in value (a sign of investors’ confidence in the US economy), the price of gold has fallen and continues to fall (the U.S. dollar has an inverse relationship with gold prices).

Below is an illustrative example of the inverse relationship between the USD and gold prices.

Image source: Finance.Yahoo.com

This brings us back to the question, “Is gold a good investment?”

Is Buying Gold a Good Investment Now?

The answer to this question depends on the following three factors.

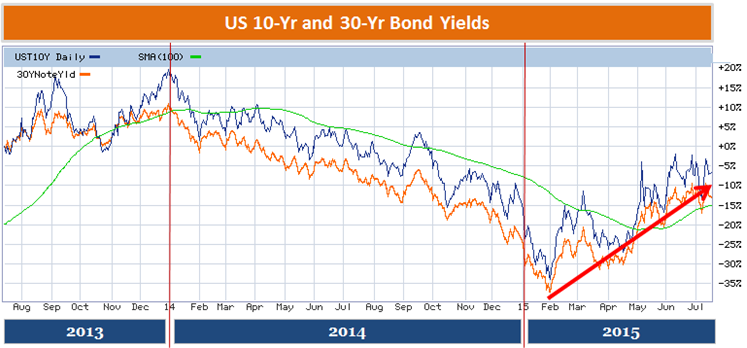

(1) Interest rates

On Wednesday, July 15, 2015, Janet Yellen, the US Fed Chair, told members of Congress that the Federal Reserve would be raising interest rates before the end of 2015.

A rise in a country’s interest rates is followed by an increase in investments in that country by global investors.

As global investors increase their investments in the US, they’ll need to convert from whatever currency these funds are into US dollars.

This process involves selling those other currencies and buying US dollars, which leads to the further strengthening of the dollar and weakening of other currencies.

The overall result of the scenario above is that gold prices will continue to decline. As mentioned above, gold prices drop when the dollar increases in value.

If you agree with the forecast above, then investing in gold right now might not be the optimal investing decision.

(2) The US/global economy experiences an economic shock

Another reason why investors invest in gold is to engage in “hedging.”

This basically means investing in gold not as a long-term investment, but rather to minimize the decline in your portfolio of assets in the event that the US or other global economies experience some kind of economic shock.

Image Source: Pexels.com

For example, a catastrophic terrorist attack that causes a temporary decline in economic growth – which happened shortly after the 9/11 terrorist attacks, or the US Fed rising rates too sharply, leading to a temporary slowdown in economic growth.

If your idea is to invest in gold as a hedging tactic, then investing in gold now would be a good investment.

(3) Long-term investment

Financial markets never go straight up, or even straight down.

There are always periods of economic contraction and periods of economic expansion.

So you can invest in gold or silver now, while these asset prices are relatively low, and then wait for the next economic contraction.

When that happens, gold and silver prices will surge, at which time you can sell your holdings and cash in on your buy & hold strategy.

The three points above are just a few examples of scenarios where buying gold would either be a good investment now or a very unwise decision.

Free Wealth & Finance Software - Get Yours Now ►

Other Scenarios for Investing in Gold and Silver

Other scenarios that could determine whether silver and gold could be good investments right now include:

- The Fed delaying interest rate hikes (which would lead to a decline in the US dollar)

- Renewed debt crisis

- Declining mining production that leads to a supply crunch

Investing in gold and silver as an inflation hedge is another reason why you would want to consider investing in these assets.

However, economic indicators show the possibility of little to no inflation in the near future, which is one reason why the Fed has been able to keep rates so low for such a long period of time.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.