Kabbage Reviews – What You Need to Know Before Getting a Loan from Kabbage.com

There is a wide range of Kabbage reviews available online. Some Kabbage reviews include Kabbage complaints while others are from raving customers who really love the company and the services provided on kabbage.com.

AdvisoryHQ has performed a detailed review of kabbage.com and presents the Kabbage review article below to help you decide whether Kabbage’s loan requirements, fees, funding, interest rates, and business loans can help you meet your business needs.

Kabbage Review (What Is Kabbage?)

Kabbage is an online leader in small business financing. Since its inception in 2009, Kabbage’s name has become synonymous with flexibility in small business loans that is nearly unparalleled in traditional loan servicing.

Combined with Kabbage’s offshoot projects – Karrot Loans and Kabbage Platform – it appears as if the company is poised to grow its market share quite considerably in the immediate future.

But how exactly does Kabbage work? What unique value does it bring to the world of small business loans? What are professional reviewers and former Kabbage customers saying about what they know concerning the company and its practices?

Find out in our comprehensive Kabbage review below.

Image Source: Kabbage

Kabbage History & Growth

Based out of Atlanta, Georgia, Kabbage was formed by Rob Frohwein, Marc Gorlin, and Kathryn Petralia in 2009. By May of 2011, the company had launched its first phase of small business lending to the public. From there, Kabbage has grown rapidly while showing no signs of slowing.

One short year later, in 2012, the company opened its first expansion offices in San Francisco and took the big step of appointing a chief marketing officer. By early 2013, Kabbage had grown overseas, with a reach that stretched all the way to the United Kingdom. Exactly two years after its first international expansion, Kabbage grew by leaps and bounds yet again, establishing a partnership with Kikka Capital in Australia.

Concurrent with its global reach, in early 2014, Kabbage began opening up its products and services to include both online businesses as well as location-based, brick-and-mortar organizations. To go along with its multiple levels of expansion, Kabbage grew its customer base by upping its working lines of credit from $50,000 to $100,000 – positioning itself to service a greater share of the small business lending market.

By March 2015, Kabbage had innovated the small business loan industry by establishing a platform lending agreement with Kikka Capital in Australia. Not only would Kabbage continue underwriting loans for small business owners, but with the help of Kabbage Platform, it would be able to help other companies enter the arena of small business lending through the use of Kabbage’s patented platform technology.

In May of that same year, Kabbage built platform-lending partnerships with none other than Sage Payment Solutions, MasterCard, and Experian Information Solutions. These partnerships mean that Kabbage and its industry-leading platform software now performs the onboarding, underwriting, and real-time monitoring for the above companies, leaving these businesses free to control their daily operations, marketing, and lending.

By its own metrics, Kabbage estimates that it has funded loans totaling more than $1 billion.

Image Source: Kabbage

Not only that, but Kabbage has seen its reach extend to over 50,000 small businesses in as little as 4 years. The company also estimates that it has streamlined the loan request process down to a 7-minute average, with at least 95% of its customers experiencing a 100% automated transaction.

As of its last round of funding, Kabbage has an estimated worth in excess of $1 billion.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Kabbage Loan Process

While Kabbage’s influence and impact on small business loan servicing has grown tremendously, it hasn’t forgotten its roots – namely the actual real-world servicing of small business loans.

Kabbage loans are issued by Celtic Bank in Salt Lake City, Utah, but the loan request process itself is conducted entirely online. Users are greeted with a streamline, intuitive interface that simplifies a loan request down to three simple steps.

Step One: First, small business owners will need to enter basic information regarding their businesses, such as name, business structure, industry, and tax ID to name a few.

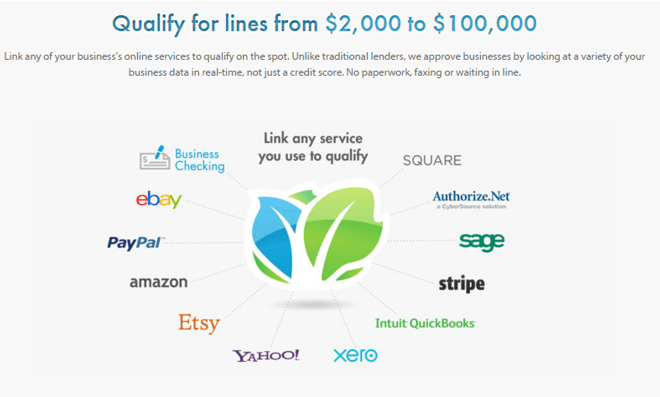

Step Two: From there, Kabbage’s approach to loan approval takes a unique and interesting turn. Rather than rely solely on traditional verification criteria, such as cash flow and credit score, Kabbage also determines a business’s health and loan qualification by means of the business’s online presence, both in social media and financial accounts.

What this means is that if a small business has a presence on Facebook, eBay, Amazon, Etsy or the like, Kabbage will research those links to see if the health of the business warrants a loan. For instance, businesses with QuickBooks accounts will submit their accounts for review to help Kabbage determine if they have adequate cash flow for a loan and if so, for how much. This is a radical departure from how traditional lenders evaluate the creditworthiness of their borrowers.

Step Three: The borrower is notified within minutes whether or not he/she is approved for a small business loan. At that time, the terms of the loan are made clear, and the borrower has the choice to accept or decline Kabbage’s offer.

The loan amount is deposited into the borrower’s bank account typically within one day after approval of the loan. Repayments are deducted automatically at the same time every month, making it more convenient for the borrower to stay ahead of his/her payments.

Requirements for Kabbage Small Business Loans

With a few exceptions, Kabbage competitors offer loans whose fine print more closely resembles traditional lending. Kabbage loan requirements, on the other hand, are relatively simple, less strict, and set Kabbage apart from other online small business lenders. According to Kabbage, borrowers qualify for a loan if:

- they have been in business for at least 1 year

- their business has made no less than $50,000 in revenue

- the borrower has a personal credit score of 550

These restrictions have given Kabbage a reputation among reviewers and users as being more flexible and small business-friendly than what is typically found among traditional financial institutions. Although small business owners with fair to below-average credit might not have qualified for a loan at all in the past, they find in Kabbage a lender much more willing to loan them the money they need.

Loan Terms

With a focus exclusively on small business loans, Kabbage has demonstrated an understanding of small business owners and their changing needs.

To that end, Kabbage offers loans from $2,000 to $100,000. This flexibility helps the business owner who wants a small amount of cash but who would often be forced into taking out more money than necessary when working with a traditional lender. Conversely, business owners with a more sizable financial need will find Kabbage more open to establishing a line of credit that is immediately available.

Repayment schedules range from 1 month to 6 months, allowing small business owners to get their cash without getting bogged down in a prolonged contract. In further contrast to traditional loans, a Kabbage loan comes with no prepayment penalties, and borrowers are required to repay only what they have used.

Personal guarantees are not required with Kabbage loans. However, it may place a lien on a borrower’s business assets for any loan over $20,000.

Some Kabbage reviews have specified that while Kabbage is a good resource for most small business owners, Kabbage will not service loans to non-profits, title loan companies, and insurance businesses.

Kabbage Interest Rates, APR, and Factor Rates

Several Kabbage reviews indicated that it does not disclose a specific interest rate or APR to borrowers. Instead, kabbage.com emphasizes factor rates.

A factor rate is the dollar amount that the borrower will repay over the duration of a loan. For instance, if a loan has a factor rate of 1.2, it means that the borrower will have to repay 1.2 times the loan amount. To put this in concrete numbers, a loan of $50,000 with a factor rate of 1.2 translates into a principal of $50,000 and fees/interest totaling $10,000.

Kabbage has said that it will charge 1% to 12% in fees for the first two months of a loan, with a possible addition of 1.5% applied by certain third-party partners. After the first two months, a 1% fee rate will apply for the remaining four months.

Likewise, assuming that the total loan amount has been used, borrowers will be required to repay 1/6 of the loan each month plus additional Kabbage fees. This has led many professional reviews to estimate Kabbage’s effective APR as anywhere from 34% to 102%.

Due to this, both professional and user reviews have cautioned future customers to be prepared for larger-than-expected monthly payment amounts. They have warned that the ease of loan procurement might be offset by the steep burden of loan repayment.

In a blog post on kabbage.com, the company admits that Kabbage interest rates are higher than traditional bank rates. However, it is quick to point out that the convenience and flexibility of its loan process will often be more important to customers who want to keep their businesses moving and growing. In that same vein, it stresses that traditional bank loans can take weeks or months to gain approval.

Kabbage customer reviewers have advised anyone thinking of taking out a small business loan to account for the above factors when considering Kabbage. They noted that alternative lenders (Kabbage competitors) might give a lower APR, thereby lessening the strain on borrowers’ monthly finances, even if that means not obtaining the money as quickly as they would with Kabbage.

Loan Types and Applications

There are no restrictions on how Kabbage loans may be used. In fact, kabbage.com dedicates an entire page to the many industries, professions, and ways in which its loans may be applied.

Image Source: BigStock

Image Source: BigStock

For example, Kabbage believes its loans to be a good fit for:

- retailers

- restaurants

- construction businesses

- auto repair shops

- truck drivers

- beauty salons

- wholesalers

- private practice doctors and dentists

Kabbage also encourages easy access to loan amounts so that owners can use them for such business-related expenses like:

- inventory

- supplies

- equipment

- staffing

- marketing

- website development

- any other pressing needs a small business owner may have

Karrot Loans

Kabbage has found a way to branch out from its small business lending niche into personal loans by way of its Karrot brand.

With Karrot, borrowers can obtain an unsecured line of credit from $2,000 to $35,000. Repayment terms start at 36 months and are capped at 60 months. APR is fixed and begins at 8.99% and can go all the way to 21.18%, taking into account the loan origination fee.

As with most APRs, Karrot APRs are variable depending on data such as the borrower’s credit score and income. Borrowers must earn a pre-tax minimum of $10,000 and be at least 18 years of age (except in Alabama and Nebraska, where the minimum age is 19).

Like Kabbage business loans, Karrot personal loans come with no hidden fees and no prepayment penalties.

Free Wealth & Finance Software - Get Yours Now ►

Kabbage Platform

One of the more unique and pioneering aspects of the Kabbage business model is Kabbage Platform.

Kabbage Platform includes the patented, streamlined technology that helps Kabbage’s loan servicing run so efficiently while maintaining an automated, user-friendly interface. Kabbage lends this platform for use in other companies’ loan servicing processes, handling the underwriting, onboarding, and monitoring aspects of platform integration.

By making Kabbage Platform available in this way, Kabbage benefits its partners significantly by:

- helping them set up their small business financing more quickly

- providing immediate underwriting and effective risk management

- giving them a proven, scalable platform that can aid in domestic and international expansion

- offering real-time data monitoring

- speeding up customer onboarding

- venturing into new markets

- controlling a tested network that requires minimal implementation

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Kabbage Products

To make it easier on small business owners, Kabbage introduced the Kabbage Card in 2015. This tool enables borrowers to swipe their cards at the point of sale and purchase needed supplies, equipment or other resources just as they would with a standard credit card. Many online Kabbage reviews cited the ease with which the Kabbage card allowed them to access their lines of credit and keep their businesses operating smoothly.

Since Kabbage understands that business owners are busy people, it has made a phone and tablet app available to its users. With the Kabbage app, small business owners can check their account balances, access their cash for purchases, and make repayments on the go.

Awards and Accolades

Kabbage has been given several awards throughout the years.

Most notably, Fast Company rated Kabbage as one of the “Most Innovating Companies in Finance” in 2013. Kabbage has also been listed as one of “America’s 100 Most Promising Companies” by Forbes for two years in a row (2014 and 2015). Inc. put Kabbage on its 2015 list of the fastest-growing companies in America.

Free Money Management Software

Kabbage Conclusion

All told, reviews seem to indicate that Kabbage is a solid choice for a small business loan, especially if the borrower cannot obtain a traditional loan.

Most reviews highlight the simplified interface and smooth, three-step process. They tend to give the company a good-to-great score, and the majority of former users would recommend Kabbage services to other small business owners.

However, a lot of Kabbage reviews advised people to do their homework about APRs. Indeed, there seemed to be a sizable minority of former customers who were happy to have instant access to their cash but were, nonetheless, still displeased with their rates. These users were split on whether they would recommend Kabbage to other borrowers.

There were also many users who spoke of overwhelmingly poor experiences with Kabbage. Complaints of this nature focused once again on high repayments, with the users arguing that such practices were counterproductive to why they took out a small business loan in the first place. Additionally, many users claimed that their high payments only added to the stress of taking out a loan.

If a potential borrower has average credit and is not prepared to pay more each month than what he/she has budgeted, Kabbage might not be the right choice. The same appears to hold true for borrowers who need a higher loan amount.

However, borrowers with good or excellent credit can probably take advantage of Kabbage’s unique approach to loan servicing and help their businesses grow in the end.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.